“Crypto Controversy: $308M Bitcoin Bet Sparks Debate on Market Manipulation!”

cryptocurrency market trends, high-leverage trading strategies, Bitcoin investment analysis

—————–

Breaking news: A Crypto Whale Takes a Massive Bet on Bitcoin

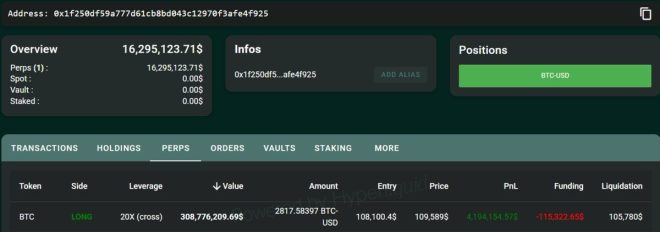

In the ever-evolving landscape of cryptocurrency, significant movements often create ripples that capture the attention of traders and investors alike. Recently, a notable event has emerged from the world of Bitcoin that has set the crypto community abuzz. A prominent crypto whale has opened a substantial long position on Bitcoin, totaling an impressive $308 million with an aggressive leverage of 20x. This development not only highlights the whale’s confidence in Bitcoin’s price trajectory but also raises questions about market dynamics and potential implications for other investors.

Understanding the Scale of the Investment

To comprehend the impact of this $308 million long position, it is crucial to understand what it means to trade with leverage. In this case, the whale is utilizing 20x leverage, which means that for every dollar of their own capital invested, they are borrowing an additional $19 to amplify their position. Such a strategy can lead to significant gains if the market moves favorably, but it also carries substantial risks, as losses can be equally magnified.

With Bitcoin’s recent volatility, a move of just a few percentage points could lead to massive profits or losses for the whale. The decision to open such a large position suggests that they possess a strong conviction that Bitcoin’s price will rise, potentially driven by market trends, macroeconomic factors, or other catalysts.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Implications for the Cryptocurrency Market

The actions of major players, often referred to as "whales," can significantly influence market sentiment. When a whale makes a move of this magnitude, it can spark interest and speculation among retail investors and traders. Many may interpret this long position as a bullish signal, leading them to consider entering the market themselves. Consequently, this could result in increased trading volume and price volatility as participants react to the news.

Moreover, the use of leverage in this context introduces an additional layer of complexity. High leverage can lead to cascading liquidations should the market move against the whale’s position. If Bitcoin’s price were to drop significantly, it could trigger a wave of margin calls and forced selling, potentially exacerbating downward price movements. Conversely, if the market rallies, it could lead to a buying frenzy, further driving up the price of Bitcoin.

What This Means for Bitcoin’s Future

The fact that a crypto whale has chosen to make such a significant investment in Bitcoin underscores the ongoing interest in the cryptocurrency, despite the market’s ups and downs. Many analysts believe that Bitcoin is still in a long-term bullish trend, with institutional adoption and increasing mainstream acceptance fueling demand. The whale’s bet could be seen as a vote of confidence in Bitcoin’s future performance, suggesting that they believe in its potential as a store of value and a hedge against inflation.

Furthermore, the timing of this investment is worth considering. With global economic uncertainty, many investors are looking for alternative assets that can provide protection against traditional market risks. Bitcoin, often dubbed "digital gold," has attracted attention as a potential hedge due to its limited supply and decentralized nature.

Monitoring Market Reactions

As the news of this $308 million long position circulates, market participants will be keenly observing Bitcoin’s price movements. Traders will likely analyze technical indicators and market sentiment to gauge whether this whale’s investment will lead to a bullish breakout or if it could trigger a bearish response.

Social media platforms, cryptocurrency forums, and trading communities are likely to be buzzing with discussions and analyses surrounding this development. Traders will be looking for opportunities to capitalize on potential price swings, while others may choose to adopt a wait-and-see approach.

Conclusion

The decision by a crypto whale to open a $308 million long position in Bitcoin with 20x leverage is a significant event that warrants attention from all corners of the cryptocurrency market. This move reflects a strong belief in Bitcoin’s potential for growth, which could inspire other investors to reconsider their positions in the market.

As the cryptocurrency landscape continues to evolve, it is essential for traders and investors to stay informed about such developments. Whether this whale’s bet will lead to bullish momentum or contribute to market volatility remains to be seen. However, one thing is clear: the world of cryptocurrency is never short of surprises, and the actions of whales can have far-reaching consequences for the entire market.

For those looking to navigate the complexities of cryptocurrency trading, understanding the dynamics of whale movements, market sentiment, and leveraging strategies is crucial. As always, due diligence and risk management are paramount in this high-stakes environment, where fortunes can be made or lost in an instant.

Stay tuned for more updates as the situation develops, and keep an eye on Bitcoin’s price action in the coming days. The cryptocurrency market is full of potential and opportunities, and the movements of influential players can provide valuable insights for traders at all levels.

BREAKING

A CRYPTO WHALE OPENED A $308 MILLION BITCOIN LONG WITH 20X LEVERAGE https://t.co/rE1RnQ4fxs

BREAKING

A CRYPTO WHALE OPENED A $308 MILLION BITCOIN LONG WITH 20X LEVERAGE

In an extraordinary move that has sent ripples through the cryptocurrency community, a significant crypto whale has just opened a staggering $308 million Bitcoin long position with a jaw-dropping 20x leverage. This bold maneuver underscores the volatile and unpredictable nature of the crypto market, sparking conversations about price movements, market dynamics, and the potential implications for average investors.

BREAKING

A CRYPTO WHALE OPENED A $308 MILLION BITCOIN LONG WITH 20X LEVERAGE

So, what does it mean when we refer to a “crypto whale”? In the world of cryptocurrencies, a whale is someone who holds a significant amount of a particular digital asset. These individuals or entities often have the power to influence market trends with their trading activities. This latest move by the whale showcases not only their confidence in Bitcoin’s future price but also highlights the high-stakes nature of trading with leverage.

BREAKING

A CRYPTO WHALE OPENED A $308 MILLION BITCOIN LONG WITH 20X LEVERAGE

Leveraged trading allows traders to borrow funds to increase their position size beyond what they could afford with their own capital. In this case, leveraging at 20x means that for every dollar the whale has, they are able to control $20 worth of Bitcoin. This can lead to substantial profits if the market moves in their favor, but it also comes with significant risks. A small price decrease could wipe out their investment in a flash.

BREAKING

A CRYPTO WHALE OPENED A $308 MILLION BITCOIN LONG WITH 20X LEVERAGE

Understanding the mechanics behind this whale’s decision requires a peek into market sentiment. Many traders and analysts are watching the current trends and predictions for Bitcoin. With recent fluctuations and a general bullish sentiment emerging, this whale’s bet could signal a turning point in the market. Could we be on the brink of a significant upward trend?

BREAKING

A CRYPTO WHALE OPENED A $308 MILLION BITCOIN LONG WITH 20X LEVERAGE

But not everyone is convinced. Critics argue that such large leveraged positions can destabilize the market, leading to increased volatility. When whales make big moves, they can trigger a chain reaction of profit-taking or panic selling among smaller traders. This ebb and flow can create turbulence, making it essential for everyday investors to stay informed and cautious.

BREAKING

A CRYPTO WHALE OPENED A $308 MILLION BITCOIN LONG WITH 20X LEVERAGE

Additionally, it’s important to consider the broader economic environment. Bitcoin doesn’t exist in a vacuum; various factors, including regulatory news, macroeconomic indicators, and institutional interest, can all impact its price. For instance, the recent discussions around Bitcoin ETFs and institutional adoption have generated buzz, and this whale’s long position might be a response to such developments.

BREAKING

A CRYPTO WHALE OPENED A $308 MILLION BITCOIN LONG WITH 20X LEVERAGE

As we analyze this situation, we can’t overlook the psychological factors at play. The actions of large traders and whales often serve as a barometer for market sentiment. When a whale takes a massive position, it can create a sense of fear of missing out (FOMO) among smaller traders, prompting them to jump on the bandwagon. This phenomenon can amplify price movements, leading to further volatility.

BREAKING

A CRYPTO WHALE OPENED A $308 MILLION BITCOIN LONG WITH 20X LEVERAGE

What does this mean for you, the average investor? If you’re considering entering the market or adjusting your current positions, it’s essential to do your research. Look at Bitcoin’s historical performance, understand the risks of leveraging, and consider your own financial situation. Always remember that while whales can influence the market, they don’t dictate it entirely.

BREAKING

A CRYPTO WHALE OPENED A $308 MILLION BITCOIN LONG WITH 20X LEVERAGE

Furthermore, keep an eye on the technical analysis and key resistance levels that experts are talking about. Understanding the charts and trends will help you make informed decisions rather than relying solely on market speculation.

BREAKING

A CRYPTO WHALE OPENED A $308 MILLION BITCOIN LONG WITH 20X LEVERAGE

Moreover, engaging with the community—whether through social media platforms, forums, or dedicated crypto channels—can provide you with varied perspectives. Many traders share their insights and analyses, which can be invaluable as you navigate the sometimes murky waters of cryptocurrency trading.

BREAKING

A CRYPTO WHALE OPENED A $308 MILLION BITCOIN LONG WITH 20X LEVERAGE

It’s also worth considering the ethical implications of whale activities. When they make such massive trades, it can lead to a sense of inequality in the market. Smaller traders often feel at a disadvantage, unable to match the resources or information that whales may possess. This disparity can lead to distrust and skepticism within the crypto community.

BREAKING

A CRYPTO WHALE OPENED A $308 MILLION BITCOIN LONG WITH 20X LEVERAGE

In summary, this whale’s $308 million Bitcoin long position with 20x leverage is a significant event in the ever-evolving crypto market. It serves as a reminder of the risks and rewards associated with leveraged trading. As you stay informed and engaged, remember to keep your emotions in check and make decisions based on thorough research rather than hysteria.

BREAKING

A CRYPTO WHALE OPENED A $308 MILLION BITCOIN LONG WITH 20X LEVERAGE

Whether you’re a seasoned trader or just dipping your toes into the world of cryptocurrency, this event is a crucial moment to watch. The cryptocurrency landscape is continually shifting, and staying updated on these significant transactions can help you navigate the ups and downs of this exciting market.