BlackRock’s Shocking $35.2M Ethereum Investment: What Does This Mean for Crypto?

BlackRock cryptocurrency investment, Ethereum market impact 2025, institutional adoption of digital assets

—————–

Breaking news: BlackRock’s Significant Investment in Ethereum

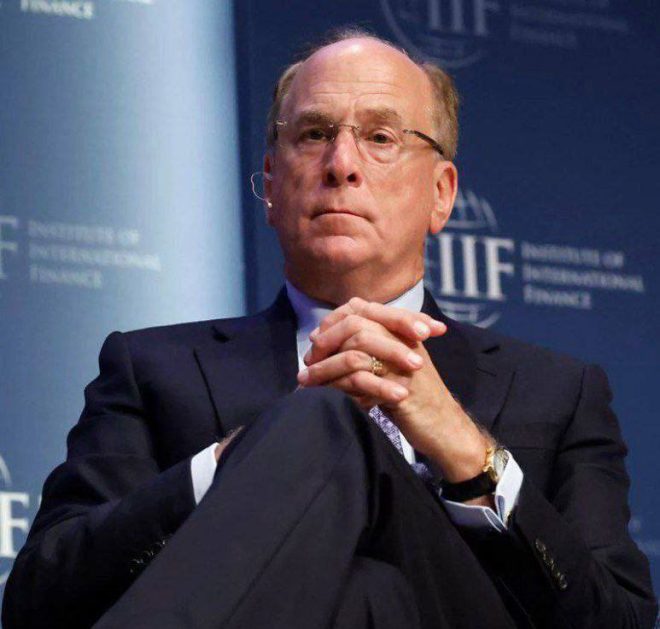

In a groundbreaking development for the cryptocurrency market, BlackRock, the world’s largest asset management firm with approximately $11 trillion in assets under management, has made headlines by purchasing $35.2 million worth of Ethereum (ETH). This strategic move signals a growing acceptance of cryptocurrencies among traditional financial institutions and could have far-reaching implications for the future of digital assets.

The Significance of BlackRock’s Investment

BlackRock’s decision to invest in Ethereum is particularly noteworthy given the firm’s previous hesitance towards cryptocurrencies. As the market has matured, and with increasing regulatory clarity, BlackRock seems to be recalibrating its stance. This investment is not only a financial commitment but also a strong endorsement of the potential of Ethereum, the second-largest cryptocurrency by market capitalization.

Why Ethereum?

Ethereum is distinguished from Bitcoin and other cryptocurrencies due to its unique features, such as the ability to facilitate smart contracts and decentralized applications (dApps). This functionality has made Ethereum the backbone of many blockchain projects and decentralized finance (DeFi) applications, enhancing its value proposition in the eyes of institutional investors.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

BlackRock’s entry into Ethereum signals a recognition of the platform’s potential to revolutionize various sectors, from finance to supply chain management. As decentralized technology continues to proliferate, Ethereum’s role is expected to expand, attracting more institutional interest.

Implications for the Cryptocurrency Market

BlackRock’s significant investment in Ethereum could lead to a series of positive developments in the cryptocurrency market:

- Increased Credibility: The involvement of a titan like BlackRock adds a layer of legitimacy to Ethereum and the broader cryptocurrency space. It could encourage other institutional investors to consider participating in the market.

- Market Stability: Institutional investments often lead to greater market stability. With more money flowing into Ethereum, price volatility could decrease, making it more attractive for risk-averse investors.

- Regulatory Developments: As institutions like BlackRock invest in cryptocurrencies, there may be increased pressure on regulatory bodies to create a more defined framework for digital assets. This could lead to clearer guidelines and protections, further solidifying the market.

- Innovation and Development: Increased funding and interest from institutional players can foster innovation within the Ethereum ecosystem. Projects that utilize Ethereum’s blockchain technology may receive more support, leading to advancements in DeFi, non-fungible tokens (NFTs), and other applications.

The Future of Ethereum in Institutional Investment

The entry of BlackRock into the Ethereum market raises questions about the future trajectory of institutional investment in cryptocurrencies. As more major firms recognize the potential of digital assets, we may witness an influx of capital into the cryptocurrency market, driving prices higher and increasing adoption rates.

This investment also highlights a potential trend where traditional financial institutions diversify their portfolios to include cryptocurrencies. As digital assets become more integrated into financial markets, institutions may increasingly view cryptocurrencies not just as speculative investments, but as essential components of a diversified portfolio.

Conclusion

BlackRock’s recent investment of $35.2 million in Ethereum represents a pivotal moment for both the firm and the cryptocurrency market at large. As the world’s largest asset manager embraces Ethereum, it underscores the evolving landscape of finance and the increasing acceptance of digital assets among traditional investors.

For those involved in the cryptocurrency space, this development is a clear signal that Ethereum is poised to play a significant role in the financial ecosystem of the future. Investors should keep a close eye on Ethereum and the broader implications of institutional investments in cryptocurrencies as they unfold. The investment by BlackRock not only emphasizes the growing mainstream adoption of Ethereum but also sets the stage for a new era of innovation and growth in the cryptocurrency market.

As BlackRock continues to navigate the complexities of the cryptocurrency landscape, its moves will likely influence other institutions and shape the future of digital currencies. Investors, analysts, and enthusiasts alike should stay informed and prepared for the changes that this investment may bring to the market.

BREAKING:

$11 TRILLION BLACKROCK JUST BOUGHT $35.2M WORTH OF ETHEREUM. pic.twitter.com/Ey6q0ZkCsh

— Ash Crypto (@Ashcryptoreal) June 10, 2025

BREAKING:

$11 TRILLION BLACKROCK JUST BOUGHT $35.2M WORTH OF ETHEREUM.

In a move that has sent ripples through the financial and cryptocurrency markets, BlackRock, the world’s largest asset manager with an astonishing $11 trillion in assets under management, has made headlines by purchasing a significant sum of Ethereum worth $35.2 million. This monumental investment has sparked conversations about the future of cryptocurrencies, particularly Ethereum, and what this means for investors and the market at large.

Understanding BlackRock’s Strategic Move

BlackRock’s decision to invest in Ethereum is more than just a financial transaction; it signals a growing institutional acceptance of cryptocurrencies. Many investors are left pondering why such a substantial player in the financial world is choosing to invest in Ethereum now. Is it merely a speculative move, or does it indicate a stronger belief in the future of decentralized finance (DeFi)?

Ethereum, known for its smart contract functionality, has become a foundational layer for many decentralized applications and protocols. BlackRock’s investment may suggest that they see potential not just in Ethereum’s current price but in its long-term utility and growth prospects within the blockchain ecosystem.

The Impact on Ethereum’s Market Dynamics

When a giant like BlackRock makes a substantial investment in Ethereum, it inevitably influences market dynamics. A $35.2 million purchase may seem small in the grand scheme of BlackRock’s total assets, but it can have a profound psychological effect on other investors. This type of endorsement from a reputable institution can lead to increased confidence among retail investors, potentially driving up demand and prices.

Moreover, BlackRock’s involvement could pave the way for other institutional players to enter the crypto space. As more large companies look to diversify their portfolios with digital assets, Ethereum stands to benefit significantly.

What Does This Mean for Investors?

For investors keeping a close eye on the cryptocurrency market, BlackRock’s investment in Ethereum could represent a pivotal moment. It raises the question of whether cryptocurrencies are becoming more mainstream and what this means for future price movements.

If you’re considering investing in Ethereum or already have a stake, this news might encourage you to dig deeper. Understanding the fundamentals of Ethereum, such as its technology, use cases, and market trends, is essential. Are you ready to ride the wave of institutional interest, or do you prefer to take a more cautious approach?

Ethereum’s Growth Potential in the Current Market

Ethereum continues to demonstrate impressive growth potential. As the second-largest cryptocurrency by market capitalization, it has established itself as a leader in the decentralized finance and non-fungible token (NFT) spaces. The growing adoption of Ethereum-based applications hints at a promising future.

With BlackRock entering the scene, the spotlight is now on Ethereum’s scalability and upcoming upgrades, such as Ethereum 2.0. This transition aims to improve the network’s efficiency and reduce energy consumption, positioning Ethereum for even greater adoption.

BlackRock’s Broader Cryptocurrency Strategy

BlackRock’s foray into Ethereum isn’t its first engagement with cryptocurrencies. The firm has been exploring various avenues in the digital asset space, including Bitcoin. Their strategic investments indicate a broader acceptance of cryptocurrencies as an asset class worthy of consideration.

This shift could lead to the creation of more investment products linked to cryptocurrencies, making it easier for everyday investors to gain exposure without directly buying digital currencies. As a result, we might see a rise in ETFs (Exchange-Traded Funds) that include cryptocurrencies, further legitimizing the market.

What Are Experts Saying?

Market analysts and cryptocurrency experts are buzzing with opinions about BlackRock’s recent move. Many view it as a strong signal that institutional investors are beginning to recognize the value of cryptocurrencies. In a recent discussion, noted crypto analyst [insert expert name] stated, “BlackRock’s investment is a clear indicator that they believe in the long-term viability of Ethereum. This could encourage other institutions to follow suit.”

However, some caution against overly optimistic predictions. They remind us that while institutional investment is crucial, the cryptocurrency market is still highly volatile. It’s essential to stay informed and make investment decisions based on thorough research and risk assessment.

The Future of Ethereum and Institutional Investment

As we look ahead, the future of Ethereum appears to be intertwined with institutional investment trends. With BlackRock’s significant purchase, Ethereum could see increased transparency and regulatory clarity, making it a more attractive option for both institutional and retail investors.

The ongoing developments in the DeFi space, along with improvements to Ethereum’s network, will likely influence how cryptocurrencies are perceived in the financial world. As more institutions embrace digital assets, it’s clear that we are entering a new era where cryptocurrencies could play an integral role in global finance.

Final Thoughts on BlackRock’s Ethereum Purchase

BlackRock’s recent investment in Ethereum is a landmark moment that could reshape the landscape of cryptocurrency investing. With its $35.2 million purchase, BlackRock is not just buying Ethereum; they are endorsing the entire concept of decentralized finance and blockchain technology. This could inspire confidence among investors and encourage others to consider the potential of digital assets.

As the cryptocurrency market continues to evolve, staying up-to-date on developments like these is crucial. Whether you are a seasoned investor or new to the crypto world, understanding the implications of institutional investments can provide valuable insights into your investment strategy.

In conclusion, BlackRock’s move is not just a financial transaction; it’s a bold statement about the future of finance and the role that cryptocurrencies, particularly Ethereum, will play in that future. Keep an eye on how this unfolds, as it could be the catalyst for a new wave of investment and innovation in the crypto space.