“Massive 997 BTC Transfer Sparks Fears: Are Whales Manipulating the Market?”

Bitcoin whale activity, cryptocurrency market trends, large Bitcoin transfers

—————–

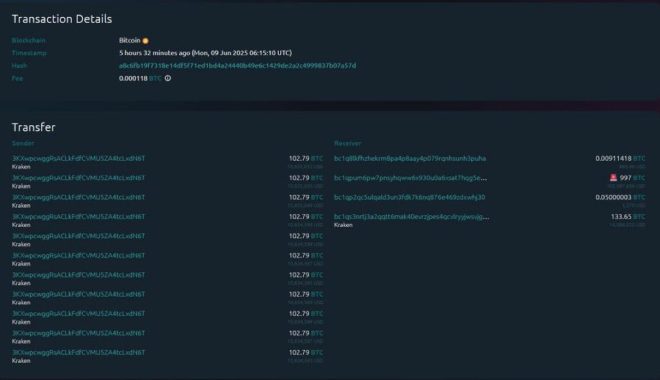

Major Bitcoin Transfer: 997 BTC Worth $105.1 Million Moves from Kraken to Unknown Wallet

In a significant event within the cryptocurrency market, a staggering 997 BTC (Bitcoin) valued at approximately $105.1 million has recently been transferred from the cryptocurrency exchange Kraken to an unidentified wallet. This massive transaction has caught the attention of crypto enthusiasts and analysts alike, as it signals potential market movements and the activities of cryptocurrency "whales"—those who hold large amounts of digital currency.

Understanding the Context of the Transfer

The transfer occurred on June 9, 2025, and was highlighted by prominent crypto analyst Crypto Rover via Twitter. The tweet not only reported the transaction but also expressed excitement about the implications of such a large transfer, suggesting that "whales are loading up!" This phrase indicates that large investors may be accumulating Bitcoin in anticipation of future price increases.

What Does This Transfer Mean for the Market?

Transfers of this magnitude can have several implications for the cryptocurrency market:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Market Sentiment: Large transactions can indicate bullish sentiment among large investors. If whales are accumulating Bitcoin, it might signal that they expect future price increases, encouraging smaller investors to follow suit.

- Price Volatility: Significant movements of Bitcoin can lead to increased volatility in the market. As news of such transactions spreads, it can influence buying and selling behavior, potentially leading to price fluctuations.

- Security of Funds: Transferring such a large amount of Bitcoin to an unknown wallet raises questions about security and the intentions behind the move. It could suggest that the owner is looking to hold the Bitcoin long-term or perhaps move it to a more secure storage option.

- Regulatory Implications: Large transfers can also attract the attention of regulatory bodies. Authorities may scrutinize such transactions, especially if they suspect illicit activities or money laundering.

The Role of Kraken in the Cryptocurrency Ecosystem

Kraken is one of the leading cryptocurrency exchanges globally. Established in 2011, it has built a reputation for security and reliability. The exchange offers a wide range of cryptocurrencies for trading and has a significant user base. The recent transfer of nearly 1,000 BTC from Kraken underscores the exchange’s role as a significant player in the cryptocurrency ecosystem.

The Importance of Whale Activity

Whales—individuals or entities that hold large quantities of Bitcoin—play a crucial role in the cryptocurrency market. Their buying and selling actions can significantly impact market prices. Here’s why their activity matters:

- Market Influence: Whales can influence market prices with their trading volumes. A sudden sell-off by a whale can lead to rapid price drops, while large purchases can drive prices up.

- Long-Term Trends: The accumulation of Bitcoin by whales can indicate long-term bullish trends. If whales are consistently buying, it suggests a belief in the future value of Bitcoin.

- Liquidity: Whale activity can also impact the liquidity of the market. Large transactions can either provide liquidity or temporarily drain it, affecting how easily other investors can buy or sell Bitcoin.

Analyzing the Current Market Conditions

As of June 2025, the cryptocurrency market has been experiencing increased interest from institutional investors, coupled with heightened regulatory discussions worldwide. This environment creates a unique backdrop for such large transactions.

- Institutional Investment: The influx of institutional capital has led to a more stable market, but it has also increased the scrutiny of large transactions. Institutions often engage in large trades, and their movements can impact market sentiment.

- Regulatory Landscape: With governments around the world tightening regulations on cryptocurrencies, investors are becoming more cautious. Large transfers may prompt regulatory inquiries, affecting market dynamics.

- Technological Developments: Innovations in blockchain technology and the growing acceptance of cryptocurrencies in mainstream finance continue to influence investor behavior. This backdrop can encourage whales to accumulate more Bitcoin as they anticipate future adoption.

Conclusion: What’s Next for Bitcoin?

The transfer of 997 BTC from Kraken to an unknown wallet is a clear indicator of ongoing interest in Bitcoin, particularly from major investors. As the market continues to evolve, the actions of these whales will likely play a pivotal role in shaping the future of cryptocurrency trading.

Investors and enthusiasts should monitor the market closely, as large transactions like this one can signal shifts in sentiment and potential price movements. Whether this is a sign of bullish trends or a precursor to increased volatility remains to be seen.

In summary, the cryptocurrency landscape is constantly changing, and large transactions such as the recent transfer of 997 BTC highlight the dynamic nature of the market. As more investors enter the space and institutional interest grows, the implications of such whale activity will continue to be a critical factor in understanding Bitcoin’s trajectory.

BREAKING:

997 BTC worth 105.1M moved from Kraken to unknown wallet.

Whales are loading up! pic.twitter.com/mQED7RarCx

— Crypto Rover (@rovercrc) June 9, 2025

BREAKING:

In an eye-popping development in the world of cryptocurrency, a staggering 997 BTC worth 105.1M has been transferred from Kraken to an unknown wallet. This massive movement of Bitcoin has caught the attention of crypto enthusiasts and investors alike, signaling a potential shift in market dynamics. Many are speculating that “whales” — individuals or entities holding large amounts of cryptocurrency — are gearing up for significant market actions. If you’re as intrigued as I am about what this means for the crypto landscape, let’s dive deeper.

What Does This Transfer Mean?

The transfer of 997 BTC is not just a random occurrence; it’s a clear indicator of market sentiment. When such a large amount of Bitcoin is moved, it generally suggests that the holder is either looking to buy or sell at opportune moments, or perhaps they’re simply diversifying their holdings into different wallets for security reasons. Whatever the motivation, the action certainly raises eyebrows.

Understanding the Whale Phenomenon

Whales have a significant influence on the crypto market. They can manipulate prices by buying or selling large amounts of cryptocurrency at once. When we see movements like the one reported, it often triggers a wave of reactions from smaller investors. If whales are loading up on Bitcoin, it might indicate they are bullish on its future price. This could lead to increased buying pressure from retail investors, further driving up the price. So, what does it mean when it’s reported that “whales are loading up”? It’s a sign to pay attention!

The Role of Kraken in the Crypto Ecosystem

Kraken is one of the largest and most reputable cryptocurrency exchanges globally. Founded in 2011, it has built a solid reputation for reliability and security. The fact that such a significant amount of Bitcoin was moved from Kraken adds weight to the news. Kraken is known for its robust security measures, making it a preferred choice for many crypto investors. So, when a significant transfer occurs from this platform, it’s worth noting.

Market Implications of Large Transfers

Large transfers of Bitcoin can have various implications for the market. For one, it can create volatility. If the recipient of the 997 BTC decides to sell a portion of it, it could flood the market and cause prices to drop. Conversely, if they hold onto it, it might indicate scarcity, which can drive prices up. Investors often monitor these movements closely to gauge market sentiment and adjust their strategies accordingly. It’s a dance of supply and demand that can change in an instant.

Why Are Whales Moving Their Assets?

There are several reasons why whales might move their assets. One reason could be the anticipation of regulatory changes or market shifts. If they believe that Bitcoin is about to enter a bullish phase, they might consolidate their holdings to maximize profits. Alternatively, some whales might see this as a chance to diversify into other cryptocurrencies or investments. The crypto market is always in flux, and these movements reflect the ongoing strategy adjustments by large holders.

The Importance of Tracking Whale Activity

For everyday investors, keeping an eye on whale activity can provide valuable insights. Many platforms track these large transactions and offer real-time alerts. Being aware of these moves can help investors make informed decisions about their own trading strategies. It’s like having a sneak peek into the minds of the big players in the market.

What to Expect Next in the Crypto Market?

With the news of this 997 BTC transfer, many are speculating about what’s next for Bitcoin. Will prices surge as retail investors jump in, or will there be a pullback as the market digests this information? The nature of the crypto market is unpredictable, but one thing is for sure: movements like this can set the stage for significant price action. Investors will need to stay vigilant and ready to adapt as the situation unfolds.

Potential Risks and Rewards

Investing in cryptocurrencies comes with its own set of risks and rewards. While the potential for high returns is enticing, the volatility of the market can lead to substantial losses. Movements like the one reported can heighten this volatility. It’s crucial for investors to do their own research and consider their risk tolerance before diving into the market. Understanding the motivations behind large transactions can help in making more informed decisions.

The Broader Impact of Bitcoin Movements

The transfer of 997 BTC from Kraken to an unknown wallet isn’t just a singular event; it reflects broader trends in the cryptocurrency space. As more institutions and individuals enter the market, the dynamics are changing. Increased adoption can lead to more stability, but it can also mean more volatility as new players bring their strategies and behaviors into the mix. The ripple effects of such transactions can be felt across the market.

Conclusion

The recent news of 997 BTC being moved to an unknown wallet is a compelling reminder of the fluid nature of the cryptocurrency market. As whales load up, it raises questions about future price movements and market sentiment. Whether you’re a seasoned investor or new to the crypto space, keeping an eye on these developments can provide valuable insights. So, stay informed, stay alert, and most importantly, enjoy the ride as the crypto world continues to evolve!

For more updates on cryptocurrency movements and market trends, check out the original tweet from Crypto Rover.