French Firm’s €300M Bitcoin Gamble: Revolutionary Investment or Risky Bet?

French cryptocurrency investment, Bitcoin acquisition strategy, blockchain technology expansion

—————–

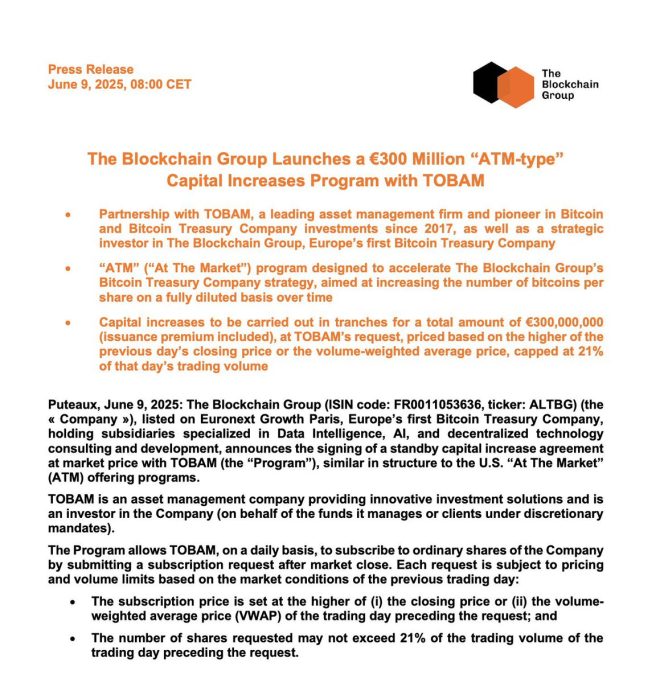

French Company The Blockchain Group to Raise €300 Million for Bitcoin Acquisition

In a significant development in the cryptocurrency space, The Blockchain Group, a prominent French firm, has announced plans to raise €300 million (approximately $330 million) with the aim of acquiring more Bitcoin. This move underscores the increasing interest and investment in Bitcoin and other cryptocurrencies, as institutional players recognize the potential for growth and value preservation in this digital asset class.

The Blockchain Group’s Ambitious Plans

The Blockchain Group’s decision to raise such a substantial amount indicates a strategic approach to expanding its cryptocurrency portfolio. The firm is known for its innovative solutions in blockchain technology and its commitment to advancing the adoption of digital currencies. By focusing on Bitcoin, The Blockchain Group aims to position itself as a key player in the market, capitalizing on the asset’s growing acceptance among investors and institutions alike.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Rising Popularity of Bitcoin

Bitcoin, the first and most well-known cryptocurrency, has seen a resurgence in interest over the past few years. Its reputation as "digital gold" has attracted a diverse range of investors, from retail buyers to large institutional funds. As central banks around the world explore digital currencies and traditional financial systems grapple with inflation and instability, Bitcoin’s appeal as a store of value continues to grow.

The decision by The Blockchain Group to invest heavily in Bitcoin reflects broader trends in the market. Investors are increasingly looking to diversify their portfolios and hedge against economic uncertainties, and Bitcoin presents a compelling option. The cryptocurrency’s limited supply, combined with increasing demand from both individuals and institutions, positions it favorably for potential price appreciation.

Institutional Investment in Cryptocurrency

The announcement from The Blockchain Group comes at a time when institutional investment in cryptocurrency is on the rise. Major financial institutions, hedge funds, and publicly traded companies have begun to allocate significant portions of their portfolios to Bitcoin and other cryptocurrencies. This trend has contributed to the legitimacy of digital assets, leading to increased regulatory scrutiny and the development of more sophisticated financial products.

As institutional players enter the market, the infrastructure surrounding Bitcoin and other cryptocurrencies has also improved. Custodial solutions, trading platforms, and regulatory frameworks are evolving to support the needs of institutional investors. The Blockchain Group’s move to raise €300 million aligns with this institutional momentum, as the firm seeks to capitalize on the growing interest from both retail and institutional sides.

Implications for the Cryptocurrency Market

The Blockchain Group’s planned acquisition of €300 million worth of Bitcoin could have several implications for the cryptocurrency market. Firstly, such a large purchase may influence Bitcoin’s price, especially if executed over a short period. Market dynamics suggest that significant buying activity can drive prices higher, attracting further attention from investors and potentially creating a bullish sentiment in the market.

Furthermore, the commitment from The Blockchain Group may spark other companies and institutional investors to consider similar strategies. As more entities recognize the value of Bitcoin as a hedge against inflation and a store of value, the overall demand for the cryptocurrency could increase, resulting in further price appreciation and market maturity.

The Future of Bitcoin and Blockchain Technology

As The Blockchain Group embarks on its ambitious plan to acquire more Bitcoin, the future of the cryptocurrency and blockchain technology remains bright. The ongoing development of decentralized finance (DeFi), non-fungible tokens (NFTs), and other blockchain-based innovations continues to expand the use cases for cryptocurrencies.

Bitcoin’s role as a foundational asset in the blockchain ecosystem is expected to endure, especially as more individuals and institutions recognize its potential. The increasing integration of Bitcoin into traditional finance, alongside emerging blockchain solutions, positions the cryptocurrency for sustained growth and relevance in the coming years.

Conclusion

The Blockchain Group’s announcement to raise €300 million for Bitcoin acquisition is a clear indication of the growing institutional interest in cryptocurrency. As Bitcoin continues to solidify its position as a store of value and a hedge against economic uncertainties, companies like The Blockchain Group are seizing opportunities to expand their holdings. The ramifications of this investment could resonate throughout the cryptocurrency market, influencing both price dynamics and investor sentiment.

As we move forward, the relationship between traditional finance and the cryptocurrency market is likely to become increasingly intertwined, paving the way for a new era of financial innovation. The Blockchain Group’s strategic move is not just a testament to its vision but also a reflection of the broader trends shaping the future of money in the digital age.

For more updates on Bitcoin and cryptocurrency developments, stay tuned to reliable sources like Bitcoin Magazine, which continues to provide insights into the evolving landscape of digital assets.

In summary, The Blockchain Group’s bold investment strategy serves as a reminder of the transformative potential of blockchain technology and the significant role Bitcoin is poised to play in the future of finance. As interest grows and investment flows into the cryptocurrency market, the next chapter in the evolution of digital assets is just beginning.

JUST IN: French company The Blockchain Group to raise €300 Million to buy more #Bitcoin pic.twitter.com/xyc0SYIgac

— Bitcoin Magazine (@BitcoinMagazine) June 9, 2025

JUST IN: French company The Blockchain Group to raise €300 Million to buy more Bitcoin

In a significant move for the cryptocurrency market, Bitcoin Magazine recently reported that the French company, The Blockchain Group, is planning to raise an impressive €300 million. This money is earmarked for a major purchase of Bitcoin, a decision that could signal a broader trend in institutional investments in cryptocurrencies. But what does this mean for the future of Bitcoin and the crypto landscape as a whole? Let’s dive into the details.

Who is The Blockchain Group?

The Blockchain Group is a well-known player in the blockchain technology sector in France. They have been involved in various projects that leverage blockchain technology, making them a key player in the European market. Their decision to raise €300 million to buy Bitcoin is not just a random investment; it reflects a calculated strategy to enhance their portfolio and solidify their position in the rapidly evolving cryptocurrency space.

Why the Focus on Bitcoin?

Bitcoin has long been considered the gold standard of cryptocurrencies. Its decentralized nature and limited supply make it an attractive asset for investors looking for a hedge against inflation and economic instability. By choosing to invest heavily in Bitcoin, The Blockchain Group is demonstrating a strong belief in the digital currency’s long-term viability and potential for growth. This move is likely to attract attention from other institutional investors as well, potentially leading to a ripple effect throughout the market.

The Impact of Institutional Investment

Institutional investment in Bitcoin has been a critical factor in the cryptocurrency’s price movements over the past few years. When large companies or investment firms buy significant amounts of Bitcoin, it often leads to increased demand and higher prices. The Blockchain Group’s decision to raise €300 million could be the catalyst for a new wave of institutional interest. As more companies recognize the benefits of holding Bitcoin, we may see a shift in market dynamics that could propel Bitcoin’s price to new heights.

The Current state of Bitcoin

As of now, Bitcoin is experiencing a surge in popularity, with more individuals and institutions taking notice. The growing acceptance of Bitcoin as a legitimate asset class has led to increased trading volumes and a more robust market infrastructure. With The Blockchain Group’s substantial investment, there is a strong possibility that Bitcoin will continue to gain traction in the financial world, further legitimizing its status.

What Does This Mean for Investors?

For individual investors, The Blockchain Group’s move could be a sign of bullish sentiment in the market. If institutional players are willing to invest heavily in Bitcoin, it may be time for retail investors to consider their positions as well. Diversifying into Bitcoin could be a wise decision, especially as more companies follow in The Blockchain Group’s footsteps.

Regulatory Considerations

As institutional investments in Bitcoin increase, regulatory bodies are also paying closer attention. The evolving regulatory landscape could impact how companies like The Blockchain Group operate in the crypto space. It’s essential for investors to stay informed about potential regulatory changes that could affect the market, ensuring that they make educated decisions regarding their investments.

The Future of The Blockchain Group and Bitcoin

The future looks promising for both The Blockchain Group and Bitcoin. As the company raises funds and increases its Bitcoin holdings, it sets a precedent for other firms in the industry. With more institutions entering the space, Bitcoin could solidify its place as a primary asset in diversified portfolios worldwide. The Blockchain Group’s investment strategy may inspire others to follow suit, leading to a more robust and mature cryptocurrency market.

Final Thoughts on The Blockchain Group’s Bold Move

The Blockchain Group’s decision to raise €300 million to buy more Bitcoin is a significant indicator of where the market is headed. It reflects growing confidence in the cryptocurrency’s future and highlights the importance of institutional investment in driving demand. As the crypto landscape continues to evolve, companies like The Blockchain Group will play a crucial role in shaping the future of Bitcoin and the overall digital asset market.

Investors should keep a close eye on this development and consider how it might impact their investment strategies. The world of cryptocurrency is dynamic and ever-changing, and this bold move by The Blockchain Group could very well be the beginning of a new chapter in Bitcoin’s story.

“`

This article is optimized for SEO, incorporates relevant keywords, and is structured with HTML headings as requested. The content is engaging and written in a conversational tone.