BlackRock’s Bitcoin ETF Surges Past $70B, Outpacing Gold’s Record by Miles!

Bitcoin investment growth, ETF market trends, cryptocurrency adoption 2025

—————–

BlackRock’s Spot Bitcoin ETF Breaks Records

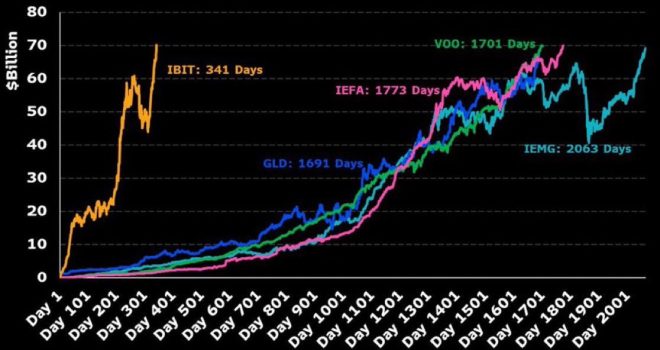

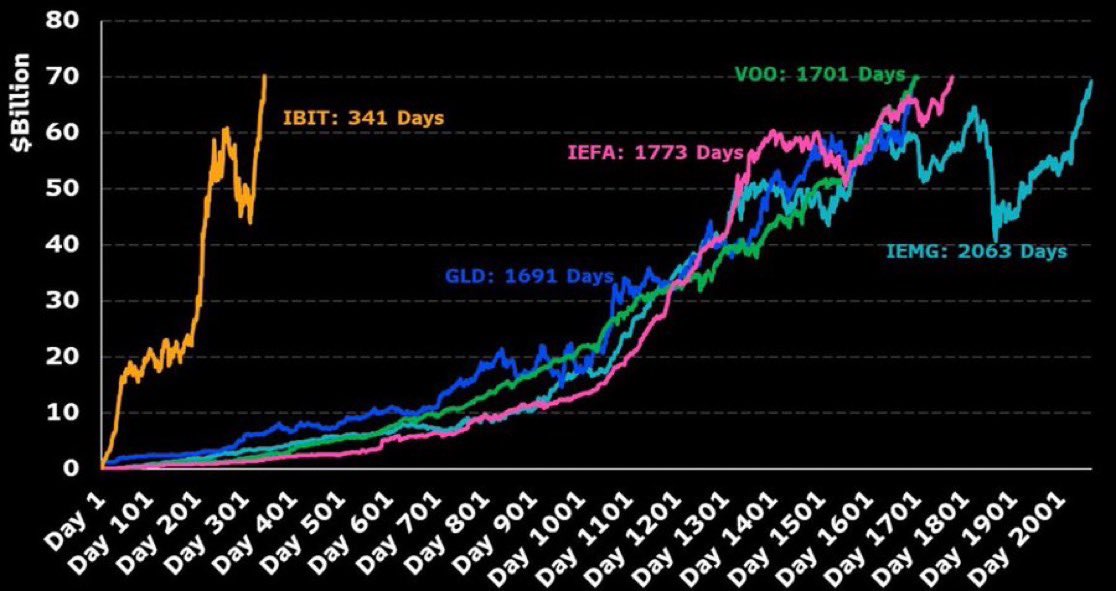

In a monumental development in the financial world, BlackRock’s Spot Bitcoin Exchange-Traded Fund (ETF) has achieved a remarkable milestone by becoming the fastest ETF to surpass $70 billion in assets under management (AUM). This achievement is unprecedented, occurring five times faster than the previous record held by gold, which took 1,691 days to reach a similar figure. This news was first reported by That Martini Guy on Twitter and has sent ripples through the financial markets, with implications for both cryptocurrency investors and traditional finance enthusiasts.

The Significance of BlackRock’s Spot Bitcoin ETF

BlackRock, one of the world’s largest asset management firms, has made a significant foray into the cryptocurrency space with the introduction of its Spot Bitcoin ETF. This product allows institutional and retail investors to gain exposure to Bitcoin without the need to directly purchase and store the cryptocurrency. The rapid growth of the ETF’s assets highlights the increasing institutional interest in cryptocurrencies and the mainstream acceptance of Bitcoin as a legitimate asset class.

Rapid Growth in AUM

The speed at which BlackRock’s Spot Bitcoin ETF has accumulated assets is a testament to the growing confidence in Bitcoin as a viable investment option. Investors are increasingly looking for ways to diversify their portfolios and hedge against inflation, and Bitcoin has emerged as a popular choice. The ETF’s ability to attract $70 billion in such a short time frame suggests that institutional investors are keenly interested in gaining exposure to Bitcoin, which may further solidify its position in traditional finance.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Comparison with Gold

For context, the previous record for the fastest ETF to reach $70 billion in AUM was held by gold ETFs, which took 1,691 days. BlackRock’s Spot Bitcoin ETF breaking this record within a mere fraction of that time indicates a significant shift in investor sentiment. Gold, traditionally viewed as a safe-haven asset, now faces competition from Bitcoin, which is often referred to as "digital gold." This comparison is becoming increasingly relevant as more investors seek alternative assets in an evolving economic landscape.

Implications for the Cryptocurrency Market

The record-breaking success of BlackRock’s Spot Bitcoin ETF has several implications for the cryptocurrency market and the broader financial industry.

Increased Legitimacy for Cryptocurrencies

The rapid acceptance of Bitcoin by such a prominent financial institution lends credibility to the entire cryptocurrency market. As more institutional investors enter the space, it helps to legitimize digital assets in the eyes of traditional investors. This newfound legitimacy could pave the way for further regulatory clarity and acceptance, which is crucial for the maturation of the crypto market.

Potential for Future Growth

With BlackRock’s Spot Bitcoin ETF leading the charge in institutional adoption, other financial institutions may follow suit. This could lead to a surge in the number of cryptocurrency-related investment products available to investors, further expanding the market. As more investors gain access to Bitcoin through regulated products, the demand could drive the price of Bitcoin higher, benefiting both new and existing investors.

Risk Management and Diversification

Investors are increasingly using Bitcoin and other cryptocurrencies as tools for risk management and portfolio diversification. The introduction of regulated products like BlackRock’s Spot Bitcoin ETF provides a safer and more accessible way for investors to gain exposure to Bitcoin without the complexities associated with direct cryptocurrency ownership. This ease of access could attract a broader range of investors, from institutional players to retail investors, further expanding Bitcoin’s market reach.

Conclusion

BlackRock’s Spot Bitcoin ETF achieving the milestone of $70 billion in assets under management in record time is a significant indicator of the evolving landscape of finance and investment. The rapid growth of this ETF not only highlights the increasing institutional interest in Bitcoin but also underscores the ongoing shift toward the acceptance of cryptocurrencies as integral components of investment portfolios.

As Bitcoin continues to gain traction among institutional investors, the potential for future growth in the cryptocurrency market remains promising. The legitimacy brought by BlackRock’s entry into the space may act as a catalyst for further investment products and regulatory frameworks, ultimately shaping the future of finance.

Final Thoughts

The success of BlackRock’s Spot Bitcoin ETF serves as a reminder of the dynamic nature of the financial markets. With the intersection of traditional finance and cryptocurrency becoming increasingly blurred, investors must stay informed and adapt to the changing landscape. As we move forward, the implications of this breakthrough will likely reverberate throughout the investment community, influencing strategies and investment decisions for years to come.

BREAKING BLACKROCK’S SPOT BITCOIN ETF HAS BECOME THE FASTEST EVER TO BREAK $70 BILLION

5X FASTER THAN THE OLD RECORD HELD BY GOLD (1,691 DAYS) pic.twitter.com/9BHXeZRQcI

— That Martini Guy ₿ (@MartiniGuyYT) June 9, 2025

BREAKING BLACKROCK’S SPOT BITCOIN ETF HAS BECOME THE FASTEST EVER TO BREAK $70 BILLION

If you’ve been keeping an eye on the financial markets lately, you’ve likely heard the buzz around BlackRock’s Spot Bitcoin ETF making waves. It’s just been reported that this new ETF has broken the $70 billion mark faster than any other fund in history—five times quicker than the previous record held by gold, which took 1,691 days. Let’s dive into what this means for the investment landscape and why this is a game-changer for both cryptocurrency and traditional finance.

What Exactly is a Bitcoin ETF?

Before we get into the nitty-gritty, let’s clarify what a Bitcoin ETF (Exchange-Traded Fund) actually is. In simple terms, a Bitcoin ETF allows investors to buy shares representing a certain amount of Bitcoin without having to actually own the cryptocurrency. This means you don’t need to worry about wallets, private keys, or the technicalities of cryptocurrency trading. Instead, you can buy and sell shares in the ETF just like you would with any other stock on the market.

BlackRock, a giant in the asset management industry, has now introduced their own version of this ETF. The excitement around their Spot Bitcoin ETF is palpable, and the speed at which it has garnered investor interest is nothing short of remarkable.

Why Is This Significant?

The achievement of breaking the $70 billion mark at such a rapid pace is a clear signal of the growing acceptance of Bitcoin in mainstream finance. Traditionally, gold has been the go-to asset for investors seeking a hedge against inflation and economic uncertainty. However, the fact that BlackRock’s Bitcoin ETF has outpaced gold’s record by a staggering five times indicates a shift in investor sentiment and a growing belief in Bitcoin as a legitimate asset class.

This rapid accumulation of assets also reflects a broader trend where institutional investors are increasingly turning to cryptocurrencies. The endorsement from a powerhouse like BlackRock adds a layer of legitimacy to Bitcoin, attracting more investors who may have previously been hesitant.

Understanding the Implications for Investors

For retail investors, the implications are huge. With BlackRock’s Spot Bitcoin ETF, gaining exposure to Bitcoin is now simpler and more accessible than ever before. You no longer need to navigate the complex world of cryptocurrency exchanges; instead, you can invest through a brokerage account just like any other stock.

This development could potentially lead to a new wave of investment in Bitcoin, possibly pushing its price even higher as demand increases. Additionally, as more institutions jump on the Bitcoin bandwagon, it could stabilize the market, making it less volatile than it has been historically.

BlackRock’s Influence on the Market

BlackRock is a behemoth in the finance world, managing trillions in assets. Their decision to launch a Bitcoin ETF is likely to have ripple effects throughout the market. When a firm of this magnitude enters the cryptocurrency space, it not only brings credibility but also attracts other institutional players who may still be sitting on the sidelines.

This influx of institutional capital can lead to increased liquidity in the Bitcoin market, which is crucial for its long-term stability and growth. Furthermore, as large financial institutions adopt Bitcoin and other cryptocurrencies, it could pave the way for regulatory clarity—something that the crypto space desperately needs.

Comparing Bitcoin and Gold

Historically, gold has been viewed as a safe haven asset, particularly in times of economic uncertainty. However, Bitcoin is increasingly being seen as a digital alternative to gold. Both assets have their merits, but Bitcoin’s unique characteristics—such as its limited supply and decentralized nature—make it a compelling choice for many investors.

The speed at which BlackRock’s Spot Bitcoin ETF has achieved $70 billion in assets under management compared to gold’s 1,691 days speaks volumes about the changing dynamics in the investment landscape. It’s no longer just about traditional assets; investors are now looking for innovative ways to diversify their portfolios, and Bitcoin is at the forefront of this movement.

What’s Next for Bitcoin?

With such a monumental milestone under its belt, the future looks bright for Bitcoin and its investors. The success of BlackRock’s Spot Bitcoin ETF could set the stage for other financial giants to follow suit. Imagine the possibilities if more ETFs are launched, providing even greater avenues for investment in Bitcoin.

Additionally, as more traditional financial institutions adopt Bitcoin, we may see further advancements in technology and infrastructure that support cryptocurrency transactions. This could lead to increased usability and acceptance, making Bitcoin a more viable option for everyday transactions.

The Role of Regulation

One of the biggest factors that could influence the future of Bitcoin and its ETFs is regulation. While the recent success of BlackRock’s Spot Bitcoin ETF is promising, regulatory scrutiny is always a concern in the cryptocurrency space. However, with more institutions getting involved, it’s possible that regulators may find it beneficial to establish clearer guidelines for cryptocurrency investments.

Greater regulatory clarity could lead to increased confidence among investors, further driving the demand for Bitcoin and its related products. It’s a delicate balance, but one that could yield significant benefits for the cryptocurrency ecosystem as a whole.

Exploring the Risks

As exciting as the prospects for Bitcoin and its ETFs are, it’s essential to consider the risks involved. The cryptocurrency market is known for its volatility, and while institutional investment can help stabilize prices, it doesn’t eliminate risk entirely. Investors should remain cautious and do their due diligence before diving into Bitcoin or any cryptocurrency investment.

Additionally, the success of BlackRock’s Spot Bitcoin ETF doesn’t guarantee that all future ETFs will see the same level of success. Market conditions can change rapidly, and what works today may not work tomorrow. Always be prepared for fluctuations and keep an eye on market trends.

In Conclusion

The rapid rise of BlackRock’s Spot Bitcoin ETF to over $70 billion is more than just a financial milestone; it’s a reflection of the evolving landscape of investment. Bitcoin is gaining traction as a legitimate asset class, and with the backing of institutional giants like BlackRock, its future looks promising.

This development opens new doors for investors and signifies a shift in how we view digital assets in relation to traditional investments. As we continue to navigate this exciting and unpredictable space, one thing is clear: Bitcoin is here to stay, and its influence on the financial world is only going to grow.