Bitcoin Surges to $107K: Is This the Start of a New Financial Revolution?

Bitcoin price surge, cryptocurrency market trends, digital asset investment strategies

—————–

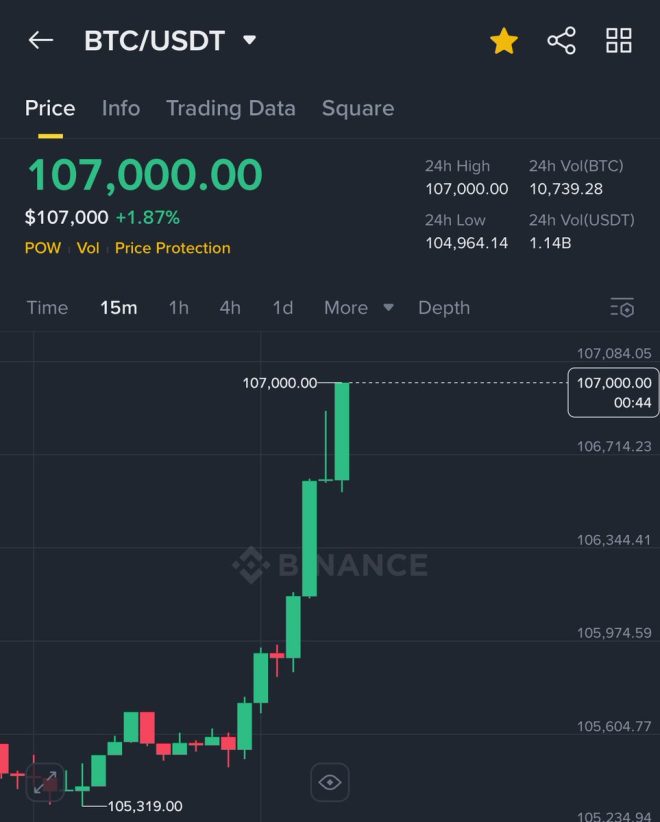

Bitcoin Surges to New Heights: Hits $107,000

In a groundbreaking announcement that has sent shockwaves through the cryptocurrency community, Bitcoin has officially reached a staggering price of $107,000. This milestone was reported by renowned crypto influencer Ash Crypto on June 9, 2025, marking a significant moment in the history of digital currencies. The tweet, which featured a captivating image, quickly garnered attention and sparked discussions across various social media platforms.

Understanding Bitcoin’s Rise

Bitcoin, the first and most prominent cryptocurrency, has experienced a meteoric rise in value since its inception in 2009. The digital currency is often seen as a store of value, akin to gold, and its increasing adoption by businesses and financial institutions has contributed to its surging price. Analysts attribute the recent spike to several factors, including institutional investments, regulatory developments, and a growing acceptance of cryptocurrencies as a legitimate form of payment.

Factors Contributing to Bitcoin’s Surge

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Institutional Adoption: Over the past few years, more institutional investors have entered the crypto market, viewing Bitcoin as a hedge against inflation and economic uncertainty. Companies like Tesla, MicroStrategy, and Square have invested heavily in Bitcoin, further legitimizing its status as an asset class.

- Regulatory Clarity: As governments around the world begin to establish clearer regulations for cryptocurrencies, investor confidence has been bolstered. Regulatory clarity can attract more institutional and retail investors, leading to increased demand for Bitcoin.

- Mainstream Acceptance: Major retailers and payment processors are increasingly accepting Bitcoin as a form of payment. This adoption by mainstream businesses not only increases demand but also enhances Bitcoin’s legitimacy as a currency.

- Market Sentiment: The overall sentiment in the crypto market plays a crucial role in Bitcoin’s price movements. Positive news, such as endorsements from influential figures and favorable market trends, can lead to a surge in buying activity, pushing the price higher.

The Impact of Bitcoin’s Price Surge

The recent price surge to $107,000 has significant implications for various stakeholders in the cryptocurrency space:

- Investors: For existing Bitcoin holders, this price increase translates to substantial gains. Many early adopters who bought Bitcoin at lower prices are now reaping the rewards of their investment, leading to increased wealth and financial freedom.

- Miners: Bitcoin miners, who validate transactions and secure the network, benefit from higher prices as it increases their profitability. However, they also face challenges, such as rising energy costs and regulatory scrutiny.

- Developers: The cryptocurrency ecosystem relies heavily on developers who create and maintain blockchain technology. A higher Bitcoin price can lead to increased funding for innovative projects and initiatives within the crypto space.

- Regulators: As Bitcoin’s price continues to rise, regulators are keenly watching the market. They seek to implement policies that protect investors while fostering innovation in the cryptocurrency sector.

What Lies Ahead for Bitcoin?

As Bitcoin reaches this new price milestone, many experts are analyzing what the future holds for the digital currency. Here are some predictions and insights:

- Volatility: Bitcoin is known for its price volatility. While the recent surge is impressive, market corrections are a natural part of the cryptocurrency landscape. Investors should be prepared for fluctuations in price.

- Technological Advancements: The Bitcoin network continues to evolve with technological advancements. Innovations such as the Lightning Network aim to improve transaction speed and reduce costs, potentially enhancing Bitcoin’s usability and adoption.

- Global Economic Factors: The broader economic environment plays a significant role in Bitcoin’s price movements. Economic uncertainty, inflation rates, and geopolitical events can all influence investor sentiment and demand for Bitcoin.

- Increased Competition: While Bitcoin remains the dominant cryptocurrency, competition from other digital assets, such as Ethereum and newer altcoins, is on the rise. These competitors may offer unique features and use cases that could impact Bitcoin’s market share.

- Institutional Investment Trends: The trend of institutional investment in Bitcoin is likely to continue. As more hedge funds, pension funds, and family offices allocate a portion of their portfolios to cryptocurrency, the demand for Bitcoin could further drive its price up.

Conclusion

The recent announcement of Bitcoin hitting $107,000 marks a pivotal moment in the cryptocurrency world. This achievement reflects the growing acceptance of Bitcoin as a legitimate asset class and its potential to reshape the financial landscape. As the market continues to evolve, investors and enthusiasts alike will be closely monitoring Bitcoin’s journey. With its volatile nature and the myriad of factors influencing its price, Bitcoin’s future remains both exciting and uncertain.

For those interested in the cryptocurrency space, staying informed about market trends, regulatory developments, and technological advancements is crucial. As Bitcoin’s story unfolds, it will undoubtedly continue to capture the attention of investors, analysts, and the media, solidifying its status as a transformative force in finance.

BREAKING

BITCOIN JUST HIT $107,000 pic.twitter.com/ir3QkcdPwv

— Ash Crypto (@Ashcryptoreal) June 9, 2025

BREAKING

In a jaw-dropping moment for crypto enthusiasts and investors alike, BITCOIN JUST HIT $107,000 . This remarkable surge has many people buzzing, and not just in financial circles but across social media platforms as well. As the digital currency reaches new heights, let’s dive into what this means for the future of Bitcoin and the cryptocurrency market as a whole.

The Rise to $107,000

Bitcoin’s trajectory has been anything but linear. From its humble beginnings, it has seen its fair share of ups and downs. However, the recent spike to $107,000 is indicative of a larger trend in the cryptocurrency market. Most analysts attribute this surge to several factors, including increased institutional adoption, growing interest from retail investors, and a general shift towards digital assets as a hedge against inflation. If you’re curious about the specifics behind Bitcoin’s rise, you can check out detailed analyses from reputable sources like Forbes.

Why the Surge?

So, what exactly led to this incredible spike? First off, the narrative around Bitcoin has changed significantly. Gone are the days when it was seen merely as a speculative asset. Today, it’s being viewed as a legitimate store of value, akin to gold. This perception shift is crucial for attracting institutional investors, who often prefer assets seen as stable and trustworthy. Major players in the finance world have started to allocate portions of their portfolios to Bitcoin, which has undoubtedly contributed to the price surge.

Additionally, advancements in technology and infrastructure around Bitcoin trading have made it easier than ever for individuals to invest. Platforms such as Coinbase and Binance have streamlined the buying process, allowing more people to jump on the Bitcoin bandwagon. Plus, with the increasing availability of Bitcoin ETFs, even traditional investors are finding it easier to get involved without having to hold the asset directly.

Market Reactions

As Bitcoin hit $107,000, social media exploded with reactions. Twitter accounts like @Ashcryptoreal were among the first to break the news, and their posts quickly went viral. The excitement surrounding this milestone is palpable, and it’s not just about the money. For many, Bitcoin represents a shift in power dynamics, challenging traditional banking systems and financial institutions.

What Does This Mean for Investors?

If you’re an investor, this moment presents both opportunities and risks. On one hand, the surge to $107,000 could signify a new era for Bitcoin, encouraging more people to invest. On the other hand, the volatility that often accompanies such dramatic price increases can be a double-edged sword. Many seasoned investors recommend a cautious approach: diversify your portfolio and only invest what you can afford to lose.

For those looking to enter the market, consider dollar-cost averaging. This strategy involves investing a fixed amount at regular intervals, which can mitigate the impact of volatility and help you avoid making emotional decisions based on price swings. If you want a deeper understanding of investment strategies, resources like Investopedia offer a wealth of information.

The Future of Bitcoin

As Bitcoin continues to gain traction, many are left wondering what its future holds. Will it continue to increase in value? Will it stabilize? Experts are divided on these questions. Some believe Bitcoin could reach even higher prices, potentially exceeding $150,000 by the end of 2025. Others caution that regulatory challenges and technological hurdles could impede growth.

Regardless of the outcome, one thing is clear: Bitcoin is here to stay. Its impact on the financial landscape is undeniable, and it has prompted a broader conversation about the nature of money, investments, and trust in financial systems. If you’re interested in forecasts and expert opinions, platforms like CoinDesk provide ongoing updates and insights.

Staying Informed

In the fast-paced world of cryptocurrency, staying informed is key. Following credible sources on social media, subscribing to newsletters, and engaging in community discussions can provide valuable insights. Whether you’re a seasoned investor or a newcomer, educating yourself about market trends, risks, and opportunities is essential.

Don’t forget to check out live price trackers and market analysis tools, which can help you keep an eye on Bitcoin’s performance in real-time. Websites like CoinMarketCap are invaluable for this purpose.

Final Thoughts

As we celebrate this milestone of Bitcoin hitting $107,000, it’s essential to approach this news with both excitement and caution. The world of cryptocurrency is dynamic and ever-evolving, and while the potential for profit is significant, the risks are equally present. Stay informed, make educated decisions, and remember that this journey into the world of digital assets is as much about learning as it is about investing.

Whether you’re planning to invest in Bitcoin or simply want to stay updated on the latest news, this moment marks a pivotal point in the cryptocurrency narrative. As always, do your research and engage with the community to navigate this thrilling landscape. Happy investing!