“Shockwaves in Crypto: Tether Mints $1 Billion USDT—What’s the Real Impact?”

Tether TRON minting news, cryptocurrency market impact 2025, stablecoin issuance trends

—————–

Major Update: Tether Mints $1 Billion USDT on TRON

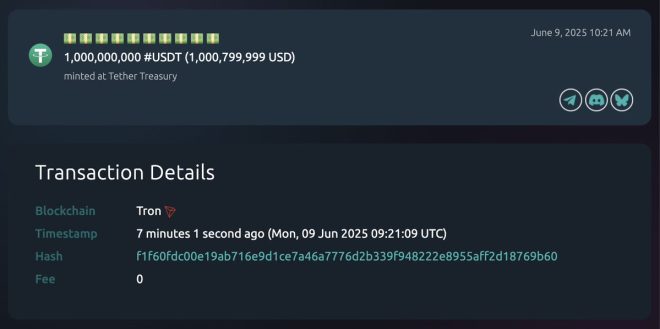

In a significant development in the cryptocurrency landscape, Tether Treasury has minted a staggering $1 billion worth of USDT (Tether), equivalent to $1,000,799,999. This news was shared by Cointelegraph on June 9, 2025, and has stirred excitement and speculation within the crypto community. The minting occurred on the TRON blockchain, which has become increasingly popular for its scalability and efficiency in handling transactions.

What is USDT?

USDT, or Tether, is a stablecoin designed to maintain a 1:1 peg with the US Dollar. It has become a critical asset in the cryptocurrency ecosystem, providing a stable medium of exchange for traders and investors. Users can buy, sell, and trade USDT without experiencing the volatility typically associated with cryptocurrencies like Bitcoin and Ethereum. The minting of new USDT tokens is closely monitored as it can impact the overall liquidity and trading volume in the market.

The Role of Tether Treasury

Tether Treasury is responsible for issuing and managing USDT tokens. The recent minting of $1 billion in USDT signifies a growing demand for stablecoins amidst market fluctuations. Tether has faced scrutiny in the past regarding its reserves and transparency, but the company has continuously emphasized its commitment to maintaining the peg and ensuring that every USDT is backed by an equivalent US dollar in reserves. This recent minting is a clear indicator of Tether’s ongoing relevance in the crypto space.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Why TRON?

The choice to mint USDT on the TRON blockchain is noteworthy. TRON has been gaining traction due to its ability to handle a high volume of transactions at a low cost. Its smart contract capabilities and fast transaction speeds make it an attractive platform for stablecoins like USDT. By utilizing TRON, Tether aims to enhance the efficiency of USDT transactions, making it more accessible for users and traders.

Implications of the Minting

The minting of $1 billion USDT on TRON has several implications for the cryptocurrency market:

- Increased Liquidity: The addition of new USDT tokens increases liquidity within the market. This is crucial for traders looking to enter or exit positions without causing significant price fluctuations.

- Market Stability: Stablecoins like USDT play a pivotal role in stabilizing the cryptocurrency market. During periods of volatility, traders often flock to stablecoins to preserve their capital. The recent minting can help absorb some of the market’s fluctuations.

- Enhanced Adoption: As more USDT becomes available, its usage in decentralized finance (DeFi) and other blockchain applications is likely to increase. This can lead to greater adoption of TRON and Tether, ultimately benefiting the overall ecosystem.

- Investor Confidence: The minting serves as a signal to investors that Tether is actively managing its supply in response to market demand. This proactive approach can help bolster confidence among users regarding the stability and reliability of USDT.

Market Reactions

Following the announcement of the minting, there was a noticeable uptick in trading activity across various exchanges. Investors and traders closely monitor such developments, as they can significantly impact market sentiment. The increased availability of USDT may lead to more trading pairs and greater opportunities for arbitrage across different platforms.

Conclusion

The recent minting of $1 billion USDT on the TRON blockchain marks a pivotal moment for both Tether and the broader cryptocurrency market. As stablecoins continue to gain traction, the role of USDT as a reliable medium of exchange cannot be overstated. This development not only enhances liquidity but also reinforces the importance of stablecoins in providing stability amid market volatility.

In an ever-evolving digital landscape, Tether’s decision to mint on TRON highlights the adaptability and responsiveness of the cryptocurrency ecosystem. As the market continues to mature, developments like these will play a crucial role in shaping the future of digital finance. Investors, traders, and enthusiasts should remain vigilant and informed as the implications of such large-scale mintings unfold.

For those looking to stay updated on the latest developments in the cryptocurrency world, following trusted sources like Cointelegraph is essential. By keeping an eye on market movements and regulatory changes, participants in the crypto space can make more informed decisions and navigate the complexities of this dynamic environment.

In summary, Tether’s minting of $1 billion USDT is not just a routine operation; it is a testament to the growing importance of stablecoins in the cryptocurrency ecosystem. As we move forward, the implications of this minting will likely resonate across the market, influencing trading strategies, investment decisions, and the overall perception of cryptocurrencies as a viable financial alternative.

JUST IN: 1 billion $USDT ($1,000,799,999) freshly minted at Tether Treasury on TRON. pic.twitter.com/GRsFJl9wNU

— Cointelegraph (@Cointelegraph) June 9, 2025

JUST IN: 1 billion $USDT ($1,000,799,999) freshly minted at Tether Treasury on TRON.

The cryptocurrency world is buzzing with news as Tether, the issuer of the popular stablecoin, has just minted a whopping **1 billion $USDT**—equivalent to around **$1,000,799,999**—at the Tether Treasury on the TRON blockchain. This move has grabbed the attention of investors and crypto enthusiasts alike, and it’s essential to dive into what this means for the market, Tether, and the broader cryptocurrency ecosystem.

Understanding Tether and $USDT

Before we break down the implications of this minting, let’s quickly recap what Tether and its stablecoin, $USDT, are all about. Tether (USDT) is a type of cryptocurrency known as a stablecoin, designed to keep its value pegged to a reserve asset—in this case, the US dollar. This means that for every $1 of USDT in circulation, there should ideally be $1 held in reserve by Tether. The idea is to provide the stability of fiat currency while still allowing users to leverage the benefits of blockchain technology.

The TRON blockchain is known for its scalability and speed, making it an attractive option for transactions involving USDT. With this recent minting, the total supply of USDT on TRON is poised for an increase, which can have various effects on the cryptocurrency market.

The Significance of Minting $1 Billion USDT

Minting such a massive amount of USDT can be a double-edged sword. On one hand, it reflects Tether’s confidence in the growing demand for stablecoins and their utility in trading, lending, and other financial services within the crypto space. On the other hand, it raises questions about Tether’s reserves and the stability of the USDT peg. It’s crucial for Tether to maintain transparency regarding their reserves to ensure trust among users and investors.

When Tether mints new USDT, it often indicates increased demand from traders and investors looking for liquidity. This is particularly pertinent in volatile markets, where stablecoins act as a safe haven. The infusion of $1 billion into the market could also signal bullish sentiment, encouraging more trading and investment activity.

Impact on the TRON Blockchain

The TRON blockchain has established itself as a robust platform for decentralized applications (dApps) and smart contracts. With Tether’s decision to mint $1 billion USDT on TRON, it’s likely to see increased activity and transactions. This can lead to enhanced developer interest and possibly more projects being built on the TRON network.

Moreover, TRON’s partnership with Tether has been a strategic advantage. As USDT becomes more prevalent on TRON, it can facilitate easier transactions and trading within the TRON ecosystem. This could further solidify TRON’s position in the competitive landscape of blockchain platforms.

Market Reactions and Future Prospects

Whenever Tether makes significant moves, the market tends to react swiftly. The minting of $1 billion USDT could lead to fluctuations in the prices of various cryptocurrencies. Traders might rush to capitalize on the new liquidity, potentially leading to price surges or corrections in the market.

Looking ahead, the continuous minting and circulation of USDT will likely shape the dynamics of the cryptocurrency market. Stablecoins are becoming increasingly essential as more investors look for ways to mitigate risk while still participating in the market. This trend may lead to further innovations in how stablecoins are utilized, from lending platforms to decentralized finance (DeFi) applications.

The Role of Transparency and Trust

As Tether continues to mint large amounts of USDT, maintaining transparency regarding its reserves becomes critical. Users want to know that their digital dollars are backed by real assets. In response to scrutiny, Tether has made efforts to provide assurance regarding its reserves, including periodic attestations by third-party firms. However, the demand for greater transparency remains high, and users are increasingly aware of the importance of trust in the crypto space.

Should Tether continue to bolster its transparency efforts, it could enhance user confidence and potentially lead to broader adoption of USDT across various platforms and use cases.

Potential Risks and Concerns

While the minting of $1 billion USDT can be seen as a positive development, it also brings with it several risks and concerns. The main worry revolves around market manipulation—large amounts of newly minted USDT could be used to influence cryptocurrency prices. Additionally, the lack of regulatory clarity surrounding stablecoins poses a risk to users and investors alike.

Furthermore, if Tether were ever unable to maintain its dollar peg, it could lead to significant market instability. The crypto community will be watching closely to see how Tether navigates these challenges in the coming months.

Conclusion: What’s Next for Tether and $USDT?

As Tether continues to mint $USDT and expand its presence on the TRON blockchain, the cryptocurrency landscape will undoubtedly feel the impact. With increased liquidity, potential price movements, and ongoing discussions about transparency and regulation, there are many factors at play.

Investors and crypto enthusiasts should stay informed and critically evaluate the developments surrounding Tether and its stablecoin. This latest minting serves as a reminder of the dynamic nature of the cryptocurrency market and the pivotal role stablecoins like USDT play within it.

For ongoing updates on Tether and cryptocurrency trends, make sure to follow reliable sources, and keep an eye on market shifts. The future of digital currencies is as exciting as ever, and staying informed will help you navigate this ever-evolving space.