MicroStrategy’s Saylor Sparks Debate: Is His Next BTC Buy a Risky Gamble?

MicroStrategy Bitcoin investment, Saylor cryptocurrency strategy, BTC purchase announcement

—————–

MicroStrategy’s Saylor Teases Another BTC Buy: A Look at the Latest Developments

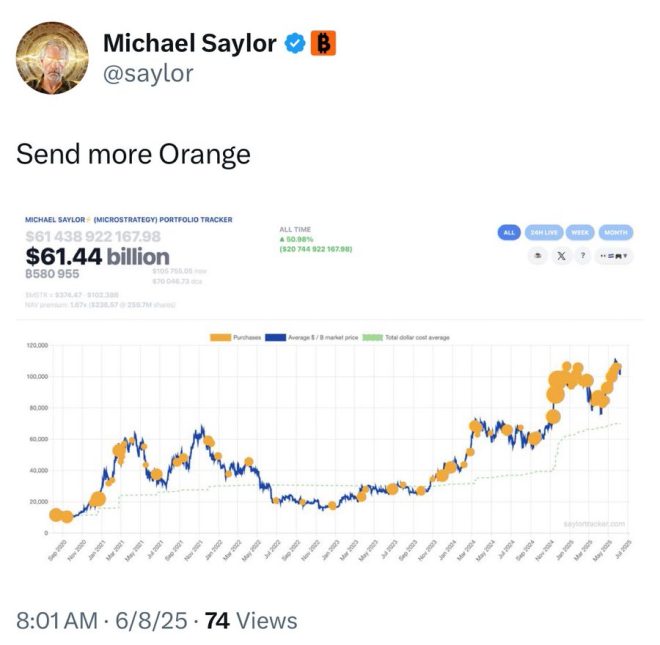

In a recent tweet that has captured the attention of cryptocurrency enthusiasts, Jeremy (@Jeremyybtc) reported on MicroStrategy’s CEO Michael Saylor hinting at yet another significant Bitcoin (BTC) purchase. This announcement comes at a time when the cryptocurrency market continues to experience fluctuations, making Saylor’s strategy particularly noteworthy for investors and followers of Bitcoin’s trajectory.

The Significance of MicroStrategy in the Bitcoin Ecosystem

MicroStrategy has made headlines for its aggressive acquisition of Bitcoin since 2020. As one of the first publicly traded companies to adopt Bitcoin as a primary treasury reserve asset, MicroStrategy’s moves have influenced other corporations and institutional investors to consider the cryptocurrency as a legitimate investment. Under Saylor’s leadership, the company has amassed a substantial amount of Bitcoin, significantly boosting its balance sheet and establishing itself as a major player in the crypto space.

Saylor’s Bitcoin Strategy: A Closer Look

Michael Saylor’s approach to Bitcoin investment has been driven by his belief in the long-term value of the cryptocurrency. He views Bitcoin as a hedge against inflation and a superior store of value compared to traditional assets. Saylor has often emphasized the importance of holding Bitcoin rather than seeking short-term gains. His commitment to accumulating Bitcoin, regardless of market conditions, has garnered both support and criticism from various corners of the financial world.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

In his latest tweet, Saylor’s teaser about another BTC buy hints at MicroStrategy’s strategy of dollar-cost averaging (DCA) into Bitcoin. This method allows the company to mitigate the risk associated with Bitcoin’s price volatility by spreading purchases over time, rather than making one large investment at a single price point. This tactic not only helps in managing risk but also positions MicroStrategy to take advantage of potential price dips in the market.

The Market’s Reaction

The announcement of another potential Bitcoin purchase by Saylor has sparked excitement among investors and traders alike. Market sentiment often reacts positively to news of large institutional buys as they signal confidence in Bitcoin’s future. The cryptocurrency market is heavily influenced by sentiment, and Saylor’s consistent bullish outlook on Bitcoin contributes to an overall positive narrative surrounding the asset.

Moreover, Saylor’s actions tend to inspire other investors to consider the implications of holding Bitcoin as part of their investment strategy. As a high-profile figure in the tech and finance sectors, Saylor’s endorsement of Bitcoin adds credibility to the cryptocurrency, attracting more attention and investment into the space.

Why Is Bitcoin Significant Right Now?

Bitcoin continues to capture the interest of both retail and institutional investors for various reasons:

- Inflation Hedge: With rising inflation rates globally, many investors see Bitcoin as a safe haven. Its limited supply—capped at 21 million coins—makes it an attractive option for those looking to protect their wealth.

- Growing Acceptance: More companies and institutions are beginning to accept Bitcoin as a form of payment or investment. This growing acceptance contributes to increasing demand and stability within the market.

- Technological Advancements: The Bitcoin network continues to evolve, with improvements in scalability, security, and transaction speed. These advancements enhance its utility and appeal as a global currency.

- Decentralization: As a decentralized asset, Bitcoin offers a level of control and ownership that traditional financial systems do not. This aspect is particularly appealing in the current economic climate.

What’s Next for MicroStrategy and Bitcoin?

As we anticipate Saylor’s next move, the crypto community remains eager to see how MicroStrategy’s strategy will unfold. The company has already established itself as a cornerstone of Bitcoin investment, and any further acquisitions will likely impact market dynamics.

Investors will be closely watching for further updates on the exact amount Saylor intends to stack this time, as well as the timing of the purchase. Such information could provide insights into market trends and potential price movements.

Conclusion

Michael Saylor’s latest hint at another Bitcoin purchase is a testament to his unwavering belief in the cryptocurrency and its potential to reshape the financial landscape. MicroStrategy’s continued investment strategy is not just about accumulating Bitcoin; it represents a broader message about the future of finance and the role of digital assets in a rapidly changing economic environment.

As the cryptocurrency market evolves, Saylor’s actions will continue to draw interest and scrutiny. For investors looking to navigate the complexities of Bitcoin, understanding the implications of institutional buying—especially from influential figures like Saylor—can provide valuable insights into market trends and future opportunities.

In summary, MicroStrategy under Saylor’s leadership remains a pivotal player in the Bitcoin narrative. With another potential buy on the horizon, all eyes are on the company as it continues to shape the future of cryptocurrency investment.

BREAKING:

MicroStrategy’s Saylor teases another BTC buy

how much is he stacking this time? pic.twitter.com/8F4ZZ6Q16H

— Jeremy (@Jeremyybtc) June 8, 2025

BREAKING:

When it comes to the world of cryptocurrency, few names resonate as strongly as MicroStrategy’s Michael Saylor. Recently, news broke that Saylor is teasing yet another Bitcoin (BTC) purchase. This excitement has left many in the crypto community buzzing with questions. Just how much is he stacking this time? Let’s dive into what this means for the market and for Saylor himself.

MicroStrategy’s Saylor teases another BTC buy

Michael Saylor has been a vocal advocate for Bitcoin, often proclaiming its value as a hedge against inflation and a smart investment for the future. His company, MicroStrategy, has amassed a significant amount of Bitcoin, making headlines for its bold investment strategy. As crypto enthusiasts await details on Saylor’s latest potential buy, the anticipation is palpable. Will this be a game-changer for the market?

How much is he stacking this time?

The question on everyone’s lips is, “How much Bitcoin is Saylor planning to buy this time?” While the exact figure remains under wraps, analysts and fans speculate that it could be substantial, given Saylor’s history of large acquisitions. In the past, MicroStrategy has purchased thousands of BTC, significantly influencing Bitcoin’s market dynamics. Saylor’s strategic moves often send ripples through the crypto waters, impacting prices and investor sentiment. If you’re curious about his previous purchases, you can check out detailed reports on platforms like CoinDesk.

The Impact of Saylor’s Purchases on Bitcoin

Every time Saylor announces a new Bitcoin buy, it stirs the market. Many investors see Saylor’s confidence in Bitcoin as a sign of its potential for growth. The more institutional backing Bitcoin receives, the more legitimacy and stability it gains in the eyes of traditional investors. This latest tease adds another layer of intrigue to the already volatile crypto market. Saylor’s moves often lead to increased buying pressure, which can elevate Bitcoin’s price. For those looking to invest, keeping an eye on Saylor’s decisions is crucial.

Why Is MicroStrategy Investing Heavily in Bitcoin?

So, what’s driving Saylor and MicroStrategy to invest so heavily in Bitcoin? The key lies in the fundamentals of Bitcoin as an asset class. Bitcoin is often compared to digital gold, and many believe it will serve as a store of value in the face of inflation and economic uncertainty. Saylor has articulated his belief that Bitcoin is a superior asset compared to traditional fiat currencies and other investments. His company views Bitcoin not just as a speculative asset but as a strategic reserve that could appreciate significantly over time. If you want to understand more about Saylor’s investment philosophy, check out his interviews and discussions on platforms like YouTube.

The Community’s Reaction

The crypto community is buzzing with excitement and speculation regarding Saylor’s upcoming purchase. On social media, many have taken to platforms like Twitter to voice their opinions and predictions. Some are optimistic, believing that Saylor’s continued investment will push Bitcoin to new heights. Others express caution, reminding fellow investors about the inherent risks in the crypto market. Regardless of the differing opinions, the community is undoubtedly engaged, reflecting the passion and enthusiasm that Bitcoin continues to generate.

Saylor’s Previous Bitcoin Acquisitions

It’s worth looking back at Saylor’s previous acquisitions to understand the scale of his investments. MicroStrategy first made headlines in August 2020 when it purchased 21,454 BTC for $250 million. Since then, the company has made numerous buys, totaling over 100,000 BTC. Each purchase has been meticulously planned, often timed with market conditions and Bitcoin’s price fluctuations. These strategic buys have positioned MicroStrategy as one of the largest institutional holders of Bitcoin, which has sparked interest from other companies and investors.

The Future of Bitcoin and Institutional Investment

As Saylor teases another BTC buy, it raises questions about the future of Bitcoin and institutional investment in the crypto space. With figures like Saylor leading the charge, it’s clear that more institutions are beginning to take Bitcoin seriously. This trend could pave the way for wider acceptance and integration of Bitcoin into traditional financial systems. As regulations become clearer and more institutions dip their toes into the crypto waters, we might see Bitcoin solidifying its place as a mainstream asset class.

What This Means for Retail Investors

For retail investors, Saylor’s activities can serve as both a guiding light and a cautionary tale. His confidence in Bitcoin is infectious, but it’s crucial for individual investors to do their own research and understand the risks involved. The crypto market can be highly volatile, and decisions based solely on the actions of high-profile investors can lead to significant losses. Therefore, while it’s exciting to follow Saylor’s journey, it’s essential to invest wisely and with caution.

Keeping Up with Saylor’s Moves

For those eager to stay updated on Saylor’s next moves, following him on social media and keeping tabs on MicroStrategy’s announcements is a good strategy. Platforms like Twitter are excellent for real-time updates, where Saylor often shares his thoughts on Bitcoin and the broader market landscape. Engaging with the community on forums and discussion boards can also provide valuable insights and perspectives from fellow investors.

The Bigger Picture: Bitcoin’s Role in the Global Economy

Saylor’s continued investments in Bitcoin highlight a growing trend of institutional adoption that could reshape the global economy. As more businesses recognize Bitcoin as a viable asset, it could lead to increased demand and further price appreciation. The implications of this shift are vast and could affect everything from monetary policies to the way we view wealth and assets in the digital age.

Conclusion: The Anticipation Builds

As we await more details on Saylor’s latest Bitcoin purchase, the excitement within the crypto community continues to build. His ongoing confidence in Bitcoin not only fuels market speculation but also encourages a broader conversation about the future of digital assets. Whether you’re a seasoned investor or just getting started, keeping an eye on figures like Saylor can provide valuable insights into the evolving landscape of cryptocurrency. So, how much is he stacking this time? Only time will tell, but one thing is for sure: the world will be watching closely.

“`

This article keeps the reader engaged while ensuring that it remains SEO-optimized with relevant keywords and structured headings for easy navigation.