Russia’s Biggest Bank Unveils Controversial Bitcoin-Linked Bonds – What’s Next?

structured cryptocurrency investments, Russian financial innovation, Bitcoin-backed securities

—————–

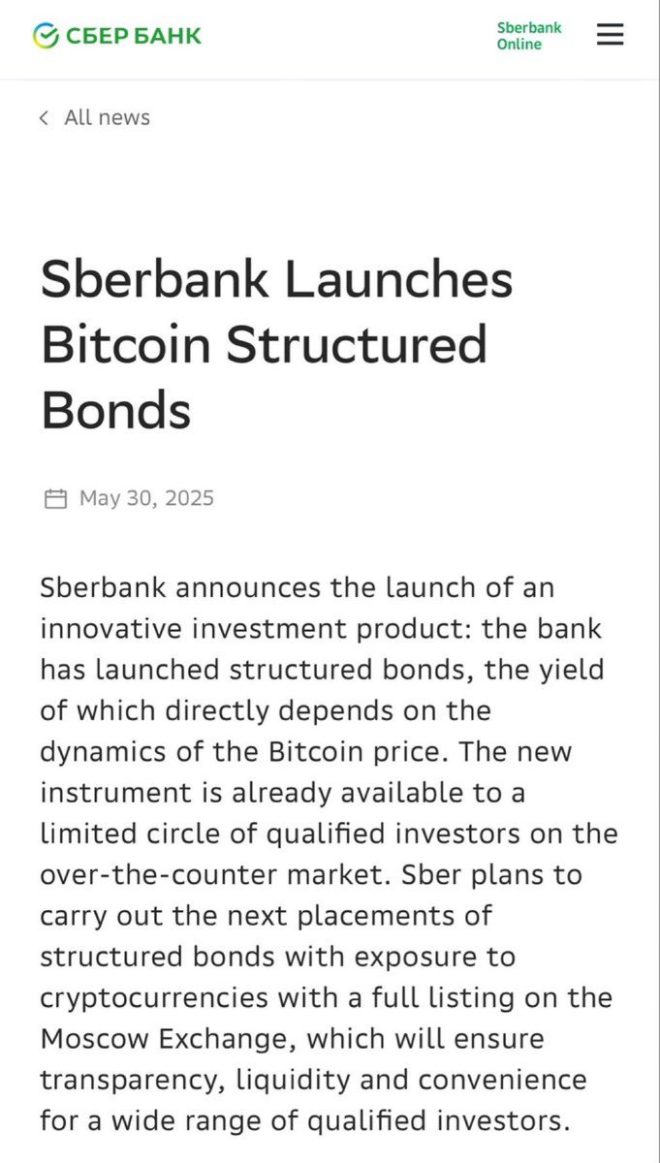

Breaking news: Russia’s Largest Bank Launches Bitcoin-Tied Structured Bonds

In a significant development in the world of finance and cryptocurrency, Russia’s largest bank has officially launched structured bonds that are tied to Bitcoin. This groundbreaking move is poised to reshape the investment landscape, especially in the context of cryptocurrency’s increasing acceptance and integration into traditional financial markets. With this announcement, Russia is positioning itself at the forefront of the cryptocurrency revolution, signaling a major shift in how digital assets are perceived and utilized in conventional banking systems.

The Rise of Bitcoin in Traditional Finance

Bitcoin, the pioneering cryptocurrency, has seen a meteoric rise since its inception in 2009. Initially regarded as a speculative asset, Bitcoin has gradually gained traction as a legitimate investment vehicle. As institutional interest grows, financial products linked to Bitcoin are becoming more commonplace. The launch of structured bonds tied to Bitcoin by Russia’s largest bank represents a novel approach to integrating cryptocurrency into mainstream finance, potentially attracting both retail and institutional investors.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Understanding Structured Bonds

Structured bonds are a type of debt instrument that combines traditional bonds with other financial products, such as derivatives. They often offer higher yields than standard bonds, but come with increased risk. By tying these structured bonds to Bitcoin, the bank is effectively allowing investors to gain exposure to the cryptocurrency market without directly purchasing Bitcoin. This could appeal to traditional investors who are skeptical about buying cryptocurrencies outright but want to benefit from their potential price appreciation.

Implications for the Russian Economy

The launch of Bitcoin-tied structured bonds could have profound implications for the Russian economy. As one of the largest economies in the world, Russia’s embrace of cryptocurrency could influence other nations to follow suit. This move could also attract foreign investment, as global investors seek to capitalize on Russia’s innovative financial products. Additionally, it may enhance the country’s reputation as a hub for cryptocurrency and blockchain technology, further driving economic growth and development.

Regulatory Considerations

While the launch of these structured bonds is a positive step for cryptocurrency adoption, it also raises questions about regulation. The Russian government has been historically cautious about cryptocurrencies, often expressing concerns over their potential use in illegal activities and capital flight. The successful implementation of Bitcoin-tied structured bonds will require clear regulatory frameworks to ensure compliance and protect investors. As the landscape evolves, it will be crucial for regulators to balance innovation with oversight.

Conclusion

The launch of structured bonds tied to Bitcoin by Russia’s largest bank is a landmark event in the intersection of traditional finance and cryptocurrency. This development not only highlights the increasing acceptance of digital assets within conventional banking systems but also sets a precedent for other countries to explore similar initiatives. As the financial landscape continues to evolve, it will be essential for investors, regulators, and financial institutions to stay informed and adapt to the changing dynamics of the market.

In summary, this groundbreaking initiative marks a pivotal moment in the ongoing integration of cryptocurrencies into mainstream finance, presenting new opportunities and challenges for investors and regulators alike. As Bitcoin continues to gain traction, it will be fascinating to observe how this trend unfolds and its potential impact on the global financial system.

BREAKING:

RUSSIA’S LARGEST BANK

OFFICIALLY LAUNCHES STRUCTURED BONDS TIED TO #BITCOIN. pic.twitter.com/msE7TbqqwB— Crypto Rover (@rovercrc) June 8, 2025

BREAKING:

RUSSIA’S LARGEST BANK

OFFICIALLY LAUNCHES STRUCTURED BONDS TIED TO BITCOIN

It’s an exciting time for cryptocurrency enthusiasts and investors alike! Recently, news broke that Russia’s largest bank has officially launched structured bonds tied to Bitcoin. This development could signal a significant shift in how traditional finance interacts with digital currencies. If you’re curious about what this means for the market, for Bitcoin itself, and for investors, then keep reading!

What Are Structured Bonds?

Structured bonds are investment products that combine traditional bonds with derivatives. They are designed to provide investors with certain risk and return profiles. In essence, they can be tailored to match the investor’s needs. By linking these bonds to Bitcoin, the bank is essentially saying, “Hey, we believe in the future of cryptocurrency, and we want you to benefit from it too!”

So, why are they doing this? For one, structured bonds can offer higher returns compared to regular bonds. When linked to Bitcoin, the potential for growth becomes even more appealing. This could attract a new wave of investors who are looking to diversify their portfolios but still want exposure to the cryptocurrency market.

Why Bitcoin?

Bitcoin has garnered a reputation as “digital gold” over the years, and for a good reason. Its scarcity, security, and decentralized nature make it an attractive asset for both individual and institutional investors. When a traditional financial institution like Russia’s largest bank decides to tie structured bonds to Bitcoin, it legitimizes the cryptocurrency even further.

Investors are increasingly recognizing Bitcoin as a viable asset class. A structured bond linked to Bitcoin can offer the potential for significant returns while also providing a level of security associated with traditional investments. This could be a game-changer, especially for those who may have been hesitant to dive into the cryptocurrency waters.

The Implications for the Cryptocurrency Market

The launch of these structured bonds has far-reaching implications for the cryptocurrency market. For one, it could lead to increased institutional investment in Bitcoin. As more traditional financial entities begin to embrace cryptocurrencies, we may see a more stable market environment. This could reduce the volatility that has characterized Bitcoin and other cryptocurrencies for years.

Furthermore, this move could also encourage other banks and financial institutions worldwide to explore similar products. If Russia’s largest bank finds success with these structured bonds, it may pave the way for more innovative financial products tied to cryptocurrencies.

Regulatory Considerations

Of course, it’s essential to consider the regulatory landscape surrounding cryptocurrencies. Russia has had a tumultuous relationship with Bitcoin and other digital currencies in the past. However, this latest development indicates a potential shift in regulatory attitudes. If major banks are willing to engage with Bitcoin, it might prompt regulators to develop clearer and more supportive frameworks for cryptocurrency investments.

This could lead to a more robust and secure environment for investors, further driving adoption and innovation in the sector. But what does this mean for the everyday investor?

How Can Investors Take Advantage?

For those looking to get in on the action, the launch of structured bonds tied to Bitcoin provides a unique opportunity. Here are a few ways you can take advantage of this trend:

1. **Research and Understand**: Before jumping in, it’s crucial to understand what structured bonds are and how they work. Familiarizing yourself with the risks and rewards can help you make informed decisions.

2. **Diversify Your Portfolio**: Adding structured bonds linked to Bitcoin can be a way to diversify your investment portfolio. By combining traditional investments with cryptocurrency exposure, you might find a balance that suits your risk tolerance.

3. **Stay Updated**: The cryptocurrency landscape is constantly evolving. Keep an eye on news and updates related to Bitcoin and structured bonds to make the best investment decisions.

4. **Consult a Financial Advisor**: If you’re unsure about how to navigate this new investment avenue, consulting a financial advisor can provide personalized insights based on your financial goals.

The Future of Banking and Cryptocurrency

This development isn’t just a win for Bitcoin; it’s a signal of the changing relationship between traditional banking and cryptocurrencies. As more banks and financial institutions recognize the potential of digital currencies, we may see an increase in innovative financial products that integrate the best of both worlds.

Imagine a future where your bank account earns interest in Bitcoin, or where you can take out loans backed by your crypto assets. The possibilities are endless, and the launch of structured bonds tied to Bitcoin is just the first step in this exciting journey.

Global Impact of Russia’s Move

While this news is specifically about Russia’s largest bank, the global implications cannot be overlooked. Other countries may take note of Russia’s initiative and consider their own approaches to integrating cryptocurrencies into their financial systems.

This move could inspire more countries to develop clearer regulatory frameworks that foster innovation while ensuring investor protection. The interconnectedness of global finance means that changes in one nation can ripple across borders, influencing markets and investment strategies worldwide.

Challenges Ahead

Despite this positive development, there are challenges ahead. The cryptocurrency market is still rife with speculation, and the volatility associated with Bitcoin can be a double-edged sword. Investors should be cautious and stay informed about the risks involved.

Additionally, the regulatory landscape remains uncertain. While this move from Russia’s largest bank could encourage a more supportive regulatory environment, the reality is that regulations can change quickly. Keeping abreast of legal developments in your country is crucial for making sound investment decisions.

Final Thoughts

The launch of structured bonds tied to Bitcoin by Russia’s largest bank marks an exciting chapter in the world of finance. This development reflects a growing acceptance of cryptocurrencies within traditional banking systems and could pave the way for innovative financial products in the future.

For investors, this could be an opportunity to explore new avenues for growth and diversification. However, it’s essential to approach this new landscape with a clear understanding of the risks and rewards involved.

As we watch this space evolve, one thing is clear: the intersection of traditional finance and cryptocurrency is just beginning, and the possibilities are as vast as the digital frontier itself. Whether you’re a seasoned investor or just dipping your toes into the world of cryptocurrencies, staying informed and engaged will be key to navigating this exciting new terrain.