“SHOCKING: Treasury Sec warns Newsom’s Tax Withholding Could Lead to Jail!”

taxpayer protection, government accountability, fiscal responsibility

—————–

Breaking news: Potential Criminal Charges for Governor Gavin Newsom Over Tax Dollar Withholding

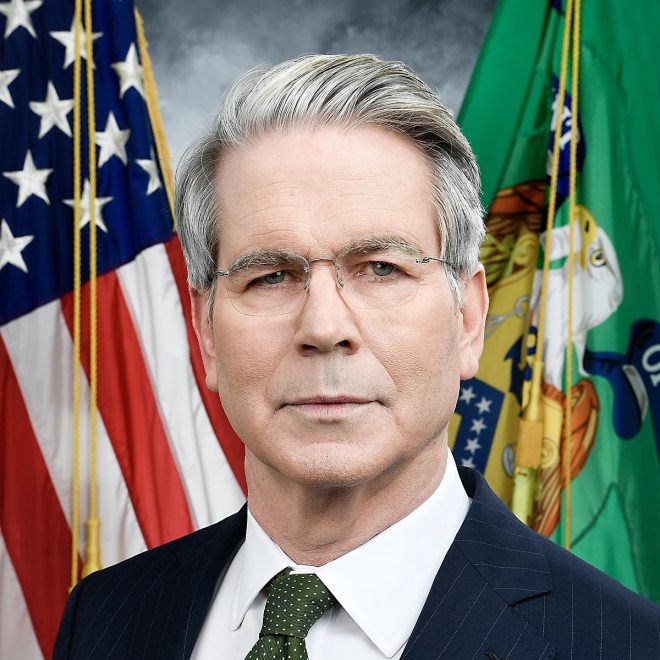

In a startling announcement that has reverberated throughout the political landscape, Treasury Secretary Scott Bessent has issued a stern warning to California Governor Gavin Newsom regarding his controversial plan to withhold tax dollars from the federal government. This move could potentially lead to criminal charges against Newsom, who is accused of threatening to commit "criminal tax evasion." This situation is unfolding against a backdrop of heightened tensions between state and federal authorities, particularly concerning fiscal responsibility and the management of taxpayer funds.

The Context of the Warning

The warning from Treasury Secretary Bessent comes amid ongoing discussions about the financial obligations of states to the federal government. The administration has been particularly vigilant when it comes to ensuring that tax revenues are collected and properly allocated. Bessent’s strong statement signifies the federal government’s commitment to uphold tax laws and enforce compliance among state leaders, particularly those who may be seen as acting outside of these legal frameworks.

Implications of Withholding Tax Dollars

The implications of Governor Newsom’s proposed actions are serious. By withholding tax dollars, Newsom could be undermining the financial foundation of federal programs that rely on these funds. This could not only jeopardize essential services but also set a dangerous precedent for other states considering similar actions. The concept of tax evasion—whether by individuals or government officials—carries significant legal consequences, and Bessent’s comments suggest that the federal government is prepared to take action if necessary.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Accusation of Tax Evasion

The term "criminal tax evasion" is particularly loaded. It suggests deliberate intent to defraud the government and misappropriate taxpayer dollars. Should Newsom proceed with his plan, he could find himself facing legal scrutiny and potential prosecution. This situation raises critical questions about the responsibilities of state governors and their relationship with federal tax laws.

Political Fallout

The political fallout from this situation could be significant. Newsom, who has already been a polarizing figure in California politics, may face increased scrutiny from both his supporters and detractors. Critics may use this incident to challenge his leadership and fiscal policies, while supporters may rally around him, framing the issue as a matter of state sovereignty and resistance to federal overreach.

Public Reaction and Media Coverage

Public reaction to Bessent’s warning has been swift, with media outlets and social media platforms buzzing with discussions about the potential consequences of Newsom’s actions. Many are questioning the legality of withholding tax dollars and what it means for the future of state-federal relations. The media’s role in disseminating this information is crucial, as it shapes public perception and understanding of the complexities involved in this issue.

The Legal Framework

To understand the ramifications of this situation, it is essential to examine the legal framework surrounding tax collection and state-federal relations. The U.S. Constitution grants the federal government the authority to levy taxes, and states are expected to comply with federal tax laws. When a state governor threatens to withhold tax dollars, it raises significant legal questions about compliance, accountability, and the potential for legal repercussions.

Potential Outcomes

As this situation unfolds, various outcomes are possible. If Governor Newsom chooses to proceed with his plan, he may face legal challenges that could lead to court proceedings. Conversely, he may reconsider his actions in light of the potential consequences, including criminal charges. The involvement of federal authorities suggests that the government is taking this matter seriously and is prepared to act decisively.

A Call for Dialogue

In this contentious environment, a call for dialogue between state and federal leaders is crucial. Rather than escalating tensions, both parties must seek common ground to address the underlying issues contributing to this conflict. Open communication could pave the way for more effective governance and a better understanding of the respective roles of state and federal authorities in managing taxpayer dollars.

Conclusion

The warning issued by Treasury Secretary Scott Bessent serves as a stark reminder of the complexities surrounding state-federal relations and the responsibilities that come with managing taxpayer funds. Governor Gavin Newsom’s potential plan to withhold tax dollars raises serious legal and ethical questions that could have far-reaching implications. As this story continues to develop, it will be essential for all stakeholders—politicians, taxpayers, and the media—to stay informed and engaged in the discussion surrounding these critical issues. The outcome of this situation may well shape the future of governance in California and beyond, making it a pivotal moment in the intersection of state and federal power.

By understanding the nuances of this issue, we can better appreciate the intricacies of tax law, the importance of fiscal responsibility, and the delicate balance of power that defines the relationship between state and federal governments. As the political landscape evolves, the need for transparency, accountability, and responsible leadership becomes ever more apparent.

BREAKING: Treasury Secretary Scott Bessent just warned Gavin Newsom can face CRIMINAL CHARGES if he follows through on withholding tax dollars from the federal government.

“Governor Newsom is threating to commit CRIMINAL TAX EVASION. His plan: defraud the American taxpayer… pic.twitter.com/2l2nSB5hrt

— Eric Daugherty (@EricLDaugh) June 8, 2025

BREAKING: Treasury Secretary Scott Bessent just warned Gavin Newsom can face CRIMINAL CHARGES if he follows through on withholding tax dollars from the federal government.

In a stunning turn of events, Treasury Secretary Scott Bessent has issued a dire warning to California Governor Gavin Newsom regarding his recent plans to withhold state tax dollars from the federal government. This move could potentially lead to serious legal repercussions for Newsom, including criminal charges for what has been labeled as “criminal tax evasion.” The stakes are high, and the implications extend beyond just California’s state budget; they could ripple through the entire nation.

Let’s unpack what this all means. The tension between state and federal authorities isn’t new, but it seems to be reaching a boiling point. Newsom’s intention to withhold federal tax dollars could be seen as an act of defiance against federal policies, and Bessent’s statement adds a layer of urgency that many are finding hard to ignore. So, what exactly is at the heart of this conflict?

“Governor Newsom is threatening to commit CRIMINAL TAX EVASION. His plan: defraud the American taxpayer.”

This statement from Bessent lays out a serious accusation. To claim that a sitting governor is planning to commit criminal tax evasion is no small matter. If Newsom goes through with his plans, it could signal a new chapter in state-federal relations, particularly regarding funding and taxation. Bessent’s comments suggest that the federal government is prepared to take a hard stance against what it perceives as a threat to the integrity of tax law and the principles of the American tax system.

But what does withholding tax dollars entail? Essentially, if California decides to withhold funds, it could mean that the state is refusing to send federal tax revenue back to the federal government. This could be motivated by a variety of factors, including disagreements over federal policies or a desire to keep more money within the state for local programs and initiatives. However, if this withholding is deemed illegal, Bessent’s warning indicates that the consequences could be severe.

The Implications of Withholding Tax Dollars

Withholding tax dollars could have far-reaching implications for California. The state relies heavily on federal funding for various programs, including healthcare, education, and infrastructure. If Newsom were to follow through with his plan, it could jeopardize these critical services. The question then arises: is this a risk worth taking for the sake of state autonomy?

Moreover, the legal ramifications could be extensive. If the federal government decides to pursue criminal charges against Newsom, it could lead to a protracted legal battle that might distract from pressing state issues. Legal experts are already weighing in, suggesting that the implications of such a confrontation could extend beyond California, affecting other states considering similar actions.

Public Reaction and Political Landscape

The public response to Bessent’s warning has been mixed. Supporters of Newsom argue that he is standing up for state rights and autonomy, pushing back against what they see as federal overreach. They believe that governors should have the power to make decisions that best serve their states, especially in areas like taxation and public funding.

On the other hand, critics are quick to point out that withholding tax dollars could be seen as an irresponsible move that ultimately harms the very citizens Newsom aims to protect. The debate is heating up, and it seems that every word from either side is being scrutinized by the media and the public alike.

The Bigger Picture: State vs. Federal Authority

This incident brings to light a larger question of authority between state and federal governments. The tension is palpable, and it raises important questions about the balance of power in the United States. Are states allowed to unilaterally decide how to handle federal funds, or is there a legal framework that must be adhered to?

As this situation unfolds, it will be interesting to see how other states react. Will they support Newsom’s stance, or will they distance themselves from what could be perceived as a reckless gamble? The political landscape is shifting, and the outcome of this standoff could set a precedent for future state-federal relations.

Conclusion: What Lies Ahead for Governor Newsom

As the dust settles from Secretary Bessent’s warning, all eyes are on Governor Newsom. The implications of his choices could have lasting effects not only for California but for the entire nation’s approach to state and federal relations. Will he back down, or will he dig in his heels and proceed with his plans? Only time will tell, but one thing is clear: the stakes have never been higher.

For those looking to stay informed on this developing story, make sure to follow reputable news sources that are covering the ongoing situation closely. As this political drama unfolds, it’s bound to capture the attention of citizens across the country, and perhaps even spark a broader conversation about the future of governance in America.