“Desperate Gamble: James Wynn Bets His Last Dollars on Bitcoin’s Future!”

Bitcoin trading strategies, cryptocurrency investment trends 2025, financial risk management in crypto

—————–

James Wynn’s Bold Bitcoin Bet: A Risky Move in the Crypto World

In a recent tweet that has captured the attention of cryptocurrency enthusiasts, James Wynn made headlines by revealing that he has decided to invest his last few hundred dollars into Bitcoin. This bold move has sparked discussions among traders and investors about the potential risks and rewards of investing in cryptocurrencies, particularly Bitcoin, which has seen significant fluctuations in its market value.

The Current state of Bitcoin

Bitcoin, the world’s first and most widely known cryptocurrency, has experienced a volatile journey since its inception in 2009. Initially valued at just a few cents, Bitcoin reached an all-time high of nearly $65,000 in April 2021 before witnessing dramatic declines. As of June 2025, Bitcoin’s price remains unpredictable, leading many investors to question the feasibility of entering or exiting the market at the right time.

The Significance of Wynn’s Investment

Wynn’s decision to allocate his remaining funds to Bitcoin raises important questions about investment strategies in the cryptocurrency market. By using his last few hundred dollars to long Bitcoin, he is essentially betting on an upward price movement in the near future. This decision is particularly noteworthy given the inherent risks associated with cryptocurrencies, which can experience sharp price swings due to market sentiment, regulatory news, and technological developments.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Understanding the Long Position

To "long" Bitcoin means to buy the cryptocurrency with the expectation that its price will rise. Investors who go long on Bitcoin typically believe in its long-term potential and are willing to ride out any short-term volatility. Wynn’s choice to take a long position with his limited funds suggests that he is optimistic about Bitcoin’s future prospects, possibly driven by factors such as increased adoption, institutional investment, or technological advancements.

The Risks Involved

Investing in Bitcoin, particularly with a small amount of capital, involves significant risks. The cryptocurrency market is known for its unpredictability, and prices can be influenced by a variety of factors, including:

- Market Sentiment: Investor emotions can greatly impact Bitcoin’s price. Fear or euphoria can lead to rapid price changes.

- Regulatory News: Government regulations can affect market dynamics. Positive news may drive prices up, while negative news can lead to declines.

- Technological Developments: Upgrades to the Bitcoin network or competing cryptocurrencies can influence investor confidence.

Wynn’s decision to invest his last few hundred dollars highlights the high-risk, high-reward nature of cryptocurrency investments. For many, Bitcoin represents an opportunity for significant returns, but it also poses the risk of complete financial loss.

Community Reactions

The crypto community has reacted to Wynn’s tweet with a mix of support and skepticism. Some followers commend his bravery, suggesting that taking calculated risks is part of the investment journey. Others caution against such drastic measures, emphasizing the importance of financial stability and risk management.

The Potential for Growth

Despite the risks, Bitcoin remains a popular investment choice, particularly among younger investors and those seeking alternative asset classes. The cryptocurrency’s potential for growth continues to attract attention. Factors such as increased institutional investment, mainstream acceptance, and advancements in blockchain technology may contribute to Bitcoin’s value over the long term.

Conclusion: A Cautionary Tale

James Wynn’s decision to invest his last few hundred dollars in Bitcoin serves as a reminder of the volatile nature of the cryptocurrency market. While the potential for profit is enticing, investors must carefully consider their financial situation, risk tolerance, and the broader market landscape before making such significant decisions.

As the cryptocurrency market evolves, stories like Wynn’s will continue to emerge, prompting discussions about the balance between risk and reward. For those contemplating similar investments, it is crucial to stay informed, conduct thorough research, and seek professional financial advice when necessary.

In summary, Wynn’s bold move highlights the allure and dangers of cryptocurrency investments. As Bitcoin continues to capture the imagination of investors worldwide, stories like this serve as both inspiration and cautionary tales for those navigating the unpredictable world of digital currencies.

BREAKING

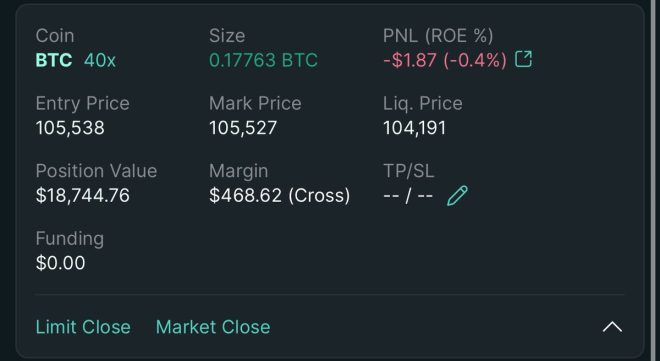

JAMES WYNN USES HIS LAST FEW HUNDRED DOLLARS TO LONG BITCOIN pic.twitter.com/gciDOOd4wI

— Crypto Beast (@cryptobeastreal) June 8, 2025

BREAKING

In a move that’s causing quite a stir in the crypto community, James Wynn has reportedly used his last few hundred dollars to long Bitcoin. The tweet from @cryptobeastreal has caught the attention of many, sparking debates about risk, investment strategies, and the volatile world of cryptocurrency. This kind of bold decision can be a double-edged sword; let’s dig into what it means for Wynn, the crypto market, and potential investors.

JAMES WYNN USES HIS LAST FEW HUNDRED DOLLARS TO LONG BITCOIN

Investing your last few dollars into something as unpredictable as Bitcoin is definitely a gamble. Many people are raising eyebrows at Wynn’s decision, asking questions like, “Is this a wise investment?” and “What does long Bitcoin even mean?” For those new to trading, going long essentially means you’re betting that the price will go up. If it does, Wynn could potentially turn his few hundred dollars into a larger sum. But if it doesn’t, he risks losing it all. This situation brings up the age-old debate: is it better to play it safe or take big risks for potentially big rewards?

Understanding Bitcoin and the Market Dynamics

Bitcoin has been on a wild ride since its inception. The cryptocurrency market is notorious for its volatility, where prices can surge or plummet within hours. For example, just a few months ago, Bitcoin was hovering around a new all-time high. However, as many seasoned traders will tell you, it’s not just about the price; it’s about understanding market trends, investor sentiment, and global economic factors that can influence Bitcoin’s value.

Investors like James Wynn are often driven by a mix of optimism and fear of missing out (FOMO). This psychological component can push someone to make hasty decisions, especially in a market that’s constantly fluctuating. But what does it mean for a new investor to see someone like Wynn taking such a bold step?

Should You Follow James Wynn’s Lead?

While Wynn’s decision to long Bitcoin could inspire some to jump into trading, it’s essential to remember that investing in cryptocurrencies is not for everyone. If you’re contemplating putting your last few dollars into Bitcoin or any other cryptocurrency, consider your financial situation carefully. Are you in a position to lose that money? Always remember, the more you invest, the more you stand to lose, especially in a market as unpredictable as this one.

For many, investing should start with education. Familiarizing yourself with terms like “long Bitcoin,” market trends, and the tools available for trading is crucial. There are countless resources available online, including forums, tutorials, and trading platforms that can help you gain a better understanding of the landscape.

Risk Management in Crypto Trading

One of the most important aspects of any investment strategy is risk management. For James Wynn, the risk is enormous, given that he’s using what appears to be his last few hundred dollars. For those inspired by his decision, it’s vital to have a plan in place. Consider setting stop-loss orders, diversifying your investments, or only trading with money you can afford to lose. Remember, the crypto market can be incredibly unforgiving.

Creating a strategy that aligns with your risk tolerance is essential. Some investors prefer a more conservative approach, while others thrive on high-risk, high-reward scenarios. It’s all about finding what works best for you. Learning from others’ experiences, like those of James Wynn, can be beneficial, but don’t forget to do your own research.

The Power of Community in Crypto

One aspect of crypto trading that often gets overlooked is the importance of community. The crypto community is filled with passionate individuals sharing insights, strategies, and experiences. Platforms like Twitter, Reddit, and dedicated forums offer a wealth of information. Following accounts like @cryptobeastreal can provide you with real-time updates and discussions about market moves, trends, and other traders’ experiences.

Engaging with the community can provide valuable insights, but it’s also essential to be cautious about the information you consume. Not all advice will be sound, and the crypto space can sometimes be filled with hype and speculation. It’s crucial to develop your critical thinking skills and make informed decisions.

The Future of Bitcoin

As James Wynn makes his bold bet on Bitcoin, many are left wondering: what does the future hold for this cryptocurrency? Analysts and enthusiasts alike have differing opinions on where Bitcoin is headed. Some predict it will reach new heights, while others caution that we might be on the brink of a correction.

Staying informed about market trends, regulatory news, and technological advancements can help you gauge where Bitcoin might be headed. Following reputable news sources and keeping an eye on market analytics are great ways to stay in the loop.

Final Thoughts on Longing Bitcoin

Whether you’re inspired by James Wynn’s bold move or cautious about diving into the crypto world, one thing is for sure: the landscape of cryptocurrency is ever-evolving. It’s a space filled with opportunities, but it also comes with its fair share of risks.

If you’re considering making a move in crypto, take a moment to reflect on your financial situation and investment strategy. There’s no one-size-fits-all approach, and what works for one person may not work for another. Remember to educate yourself, engage with the community, and make informed decisions. Who knows? With the right strategy and a bit of luck, you might just find yourself riding the wave of Bitcoin’s next big surge.

In the end, investing is a personal journey. Whether you take inspiration from James Wynn’s last-minute investment or choose a more conservative route, the most important thing is to stay informed and make choices that align with your financial goals.