BlackRock’s Massive Ethereum Purchase: What Are They Preparing For?

BlackRock Ethereum investment, cryptocurrency market trends 2025, institutional adoption of digital assets

—————–

BlackRock’s Bold Move: Investing Heavily in Ethereum

In a significant development for the cryptocurrency market, BlackRock, one of the world’s largest asset management firms, has made headlines by acquiring hundreds of millions in Ethereum (ETH). This strategic investment is stirring excitement and speculation among crypto enthusiasts and investors alike, suggesting that BlackRock recognizes a pivotal shift in the digital asset landscape.

Understanding BlackRock’s Investment Strategy

BlackRock’s foray into Ethereum signals a growing acceptance of cryptocurrencies among institutional investors. Historically, the firm has been cautious about digital assets, but this bold move indicates a shift in sentiment. As traditional financial institutions begin to embrace blockchain technology, BlackRock’s actions could pave the way for other firms to follow suit.

Why Ethereum?

Ethereum, the second-largest cryptocurrency by market capitalization after Bitcoin, is known for its smart contract functionality and decentralized applications (dApps). The platform has gained traction not only as a digital currency but also as a foundation for various innovative technologies, including decentralized finance (DeFi) and non-fungible tokens (NFTs). BlackRock’s investment in Ethereum could be driven by its potential for growth and the increasing demand for Ethereum-based solutions.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Implications for the Cryptocurrency Market

BlackRock’s acquisition of a substantial amount of ETH could have significant implications for the cryptocurrency market. Institutional investments often lead to increased legitimacy and acceptance of digital assets, which can boost confidence among retail investors. This influx of institutional capital may lead to heightened volatility and an upward trend in Ethereum’s price, as demand increases.

What This Means for Retail Investors

For retail investors, BlackRock’s move serves as a crucial indicator of the evolving landscape of cryptocurrency investments. As traditional financial giants recognize the potential of cryptocurrencies, individual investors may feel more compelled to enter the market. However, it is essential for retail investors to approach this space with caution, as the volatility of cryptocurrencies can lead to significant risks.

The Future of Ethereum

Looking ahead, the future of Ethereum appears promising, especially with the backing of major financial institutions like BlackRock. As Ethereum continues to evolve and adapt, including the transition to Ethereum 2.0, which aims to improve scalability and reduce energy consumption, the platform is likely to attract further investment and development. This evolution could solidify Ethereum’s position in the market and enhance its utility across various sectors.

Conclusion: A Turning Point for Cryptocurrency Investments

BlackRock’s aggressive investment in Ethereum marks a potential turning point for the cryptocurrency market. As institutional players increasingly recognize the value of digital assets, the landscape is shifting towards broader acceptance and integration. For both institutional and retail investors, keeping an eye on developments in this space is crucial. As BlackRock continues to make waves in the crypto world, its actions could dictate the future trajectory of Ethereum and the broader market.

Key Takeaways

- BlackRock’s recent investment in Ethereum indicates a significant shift in institutional interest towards cryptocurrencies.

- Ethereum’s smart contract capabilities and growing ecosystem make it an attractive investment.

- The influx of institutional capital could lead to increased legitimacy and price volatility in the cryptocurrency market.

- Retail investors should approach the market with caution despite the promising developments.

- The future of Ethereum looks bright, particularly with upgrades like Ethereum 2.0 on the horizon.

FAQs

What is Ethereum?

Ethereum is a decentralized blockchain platform that enables developers to build and deploy smart contracts and decentralized applications (dApps). It is the second-largest cryptocurrency by market cap, following Bitcoin.

Why is BlackRock investing in Ethereum?

BlackRock is investing in Ethereum due to its potential for growth, innovative technology, and increasing demand for blockchain solutions in various sectors. This move reflects a broader trend of institutional acceptance of digital assets.

What does this mean for the future of cryptocurrencies?

BlackRock’s investment could signify increased legitimacy for cryptocurrencies, leading to greater acceptance and potentially driving up prices as institutional and retail investors enter the market.

Should retail investors be concerned about volatility?

Yes, retail investors should be mindful of the high volatility associated with cryptocurrencies. While the market presents opportunities for profit, it also carries significant risks that should be carefully considered before investing.

How can I stay informed about cryptocurrency trends?

To stay informed about cryptocurrency trends, consider following reputable financial news outlets, subscribing to cryptocurrency analysis websites, and engaging with online communities dedicated to discussions about digital assets.

By understanding the implications of BlackRock’s investment in Ethereum, investors can better navigate the evolving landscape of cryptocurrency and make informed decisions about their investment strategies. The growing interest from institutional players like BlackRock could herald a new era for digital assets, making it imperative for both institutional and retail investors to stay engaged with this dynamic market.

BREAKING

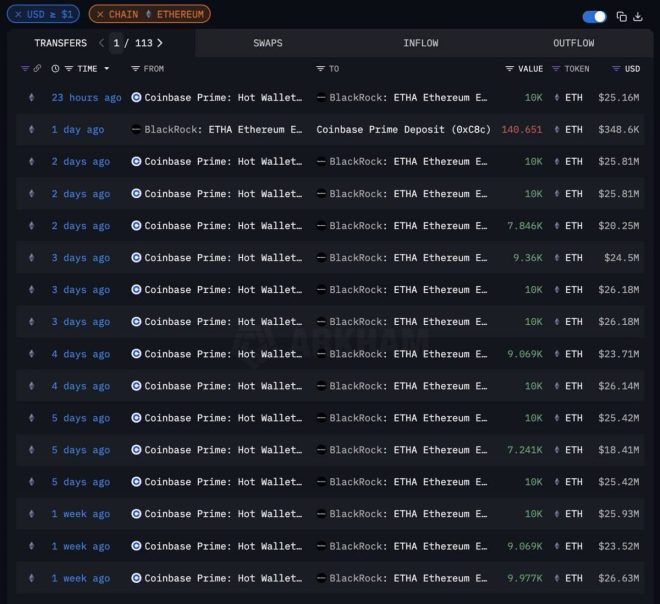

BLACKROCK IS SCOOPING UP HUNDREDS OF MILLIONS IN ETH

THEY KNOW WHAT’S COMING pic.twitter.com/pII94Di91a

— Crypto Beast (@cryptobeastreal) June 8, 2025

BREAKING

If you’ve been keeping an eye on the crypto market lately, you might have come across some exhilarating news. BlackRock, one of the largest asset management firms in the world, is reportedly scooping up hundreds of millions in Ethereum (ETH). The excitement surrounding this move is palpable, and many are speculating that BlackRock knows something the rest of us don’t. Let’s dive into what this all means and why it matters.

BLACKROCK IS SCOOPING UP HUNDREDS OF MILLIONS IN ETH

So, what’s the deal with BlackRock and Ethereum? For those who may not be familiar, BlackRock is a titan in the investment world, managing trillions in assets globally. Their recent acquisition of Ethereum has sent ripples through the crypto community, especially among investors and analysts eager to understand the implications.

The fact that such a major player is investing heavily in cryptocurrency indicates a growing acceptance of digital assets within traditional finance. It’s no secret that Ethereum has established itself as a leading platform for decentralized applications (dApps) and smart contracts. BlackRock’s decision to invest in ETH could signal a forthcoming bullish trend in the market.

Experts believe that BlackRock’s move is strategic, positioning themselves to capitalize on potential future gains in the cryptocurrency ecosystem. With Ethereum’s scalability upgrades and the transition to Ethereum 2.0, the platform is poised for significant growth, making it an attractive investment.

THEY KNOW WHAT’S COMING

The phrase “they know what’s coming” has been swirling around since the news broke. So, what exactly do they know? In the ever-evolving landscape of cryptocurrency, information is power. BlackRock’s decision to invest heavily in Ethereum might suggest that they foresee a significant uptick in adoption or a major market shift that could favor ETH.

One of the most talked-about aspects of Ethereum is its potential to facilitate decentralized finance (DeFi) applications. DeFi is revolutionizing finance by allowing individuals to lend, borrow, and trade without traditional intermediaries, and Ethereum is at the forefront of this movement. As more people and institutions recognize the value of DeFi, the demand for Ethereum could skyrocket.

Additionally, with the increasing interest in non-fungible tokens (NFTs) and metaverse applications, Ethereum’s versatility is becoming more apparent. BlackRock’s investment could be a bet on not just the future of cryptocurrency but on the broader digital economy that’s emerging.

Understanding the Broader Implications

The implications of BlackRock’s investment extend beyond just their balance sheet. When such a massive institution makes a significant move into cryptocurrencies, it can lead to increased legitimacy for the entire sector. Retail investors often look to institutional players for cues on when to enter or exit markets. Seeing a name like BlackRock investing in ETH might encourage more individuals to dive into crypto, further driving demand and prices.

Moreover, BlackRock’s involvement in cryptocurrency could pave the way for increased regulatory clarity. Large firms typically have the resources to engage with regulators, which could lead to a more structured and secure environment for cryptocurrency trading and investment. This could attract even more institutional investments, creating a positive feedback loop for the market.

What Can Investors Learn from This?

If you’re an investor or someone merely curious about cryptocurrency, BlackRock’s move is a clear indicator that it’s time to pay attention. Here are a few takeaways that might help guide your decisions:

1. **Research Is Key**: Understanding the fundamentals of Ethereum and its use cases is essential. Don’t just follow the crowd; dive into what makes ETH valuable.

2. **Timing Matters**: While it may be tempting to jump in immediately after hearing news like this, patience can be a virtue in investing. Look for entry points that align with your financial goals.

3. **Diversify Your Portfolio**: While Ethereum is exciting, don’t put all your eggs in one basket. Consider diversifying your investments across different assets to mitigate risk.

4. **Stay Informed**: Keep an eye on news and updates from reputable sources. The crypto landscape changes rapidly, and staying informed can provide you with valuable insights.

5. **Long-Term Perspective**: Investing in cryptocurrency can be volatile. Maintaining a long-term perspective can help you weather the storms of market fluctuations.

Community Reactions and Speculations

The reaction from the crypto community has been a mix of excitement and skepticism. Some see BlackRock’s investment as a validation of the crypto market, while others are wary of the influence such large institutions can have. There’s also concern about potential market manipulation, as large investments can lead to significant price swings.

Social media platforms, particularly Twitter, have been buzzing with discussions around BlackRock’s strategy. Influencers and analysts alike are weighing in on the potential ramifications, sparking debates about the future of Ethereum and the broader crypto market.

In the end, while it’s important to remain optimistic, it’s equally crucial to approach the situation with a level head. The crypto market is notorious for its volatility, and while BlackRock’s investment could signal bullish trends, it’s always wise to be prepared for fluctuations.

Conclusion: The Future of Cryptocurrency

BlackRock’s acquisition of hundreds of millions in Ethereum is a significant moment for the crypto market. It not only highlights the growing acceptance of digital assets within traditional finance but also suggests that the future holds exciting possibilities for Ethereum and other cryptocurrencies.

As we continue to navigate this evolving landscape, it’s essential to stay informed and make strategic investment decisions. Whether you’re a seasoned investor or just starting, BlackRock’s bold move into ETH is a reminder of the potential that lies within the world of cryptocurrency.

If you want to keep up with the latest developments in crypto and investment strategies, make sure to follow trusted sources and join discussions with fellow enthusiasts. The future of finance is here, and it’s paving the way for a more decentralized and innovative world.