SEC Shocks Wall Street: Nasdaq’s New Crypto Index Sparks Fierce Debate!

cryptocurrency market trends, digital asset investment strategies, blockchain technology advancements

—————–

SEC Approves Nasdaq Crypto Index: A Game-Changer for Cryptocurrency Markets

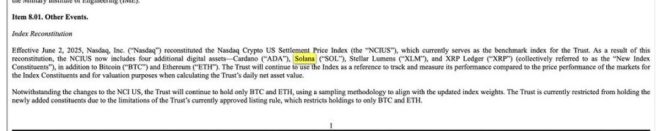

On June 7, 2025, a significant announcement rattled the cryptocurrency community when the U.S. Securities and Exchange Commission (SEC) approved the Nasdaq Crypto Index. This index includes popular cryptocurrencies such as XRP, ADA, XLM, and SOL, sparking excitement among traders and investors alike. The approval marks a pivotal moment for the cryptocurrency market, potentially leading to increased institutional investment and mainstream acceptance.

Understanding the Nasdaq Crypto Index

The Nasdaq Crypto Index is designed to provide a comprehensive benchmark for the performance of the cryptocurrency market. By including well-known cryptocurrencies like XRP (Ripple), ADA (Cardano), XLM (Stellar), and SOL (Solana), the index aims to capture a diverse range of assets, offering investors a reliable tool for tracking price movements and market trends.

Implications of SEC Approval

The SEC’s approval of the Nasdaq Crypto Index is a watershed moment for the cryptocurrency industry. It signifies a growing acceptance of digital assets by regulatory bodies, which could lead to several important developments:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Increased Legitimacy: The endorsement by the SEC lends credibility to the cryptocurrencies included in the index. This legitimacy can attract institutional investors who have been hesitant to enter the market due to regulatory uncertainties.

- Enhanced Market Accessibility: By providing an index that tracks major cryptocurrencies, the Nasdaq Crypto Index makes it easier for investors to enter the market. This increased accessibility can lead to a surge in trading volumes and overall market activity.

- Institutional Investment: With the SEC’s blessing, institutional investors may feel more comfortable allocating funds to cryptocurrencies. This influx of capital could drive the prices of the assets included in the index higher, benefiting existing holders.

- Mainstream Adoption: As cryptocurrencies gain more recognition from traditional financial institutions, their adoption may extend beyond trading and investing. We could see increased use cases in payments, remittances, and other financial services.

The Cryptocurrencies in Focus

XRP (Ripple)

XRP, created by Ripple Labs, is designed as a digital payment protocol that enables fast and low-cost international transactions. Its inclusion in the Nasdaq Crypto Index highlights its potential as a bridge currency for cross-border payments. The SEC’s approval may also bolster Ripple’s ongoing legal battle with the commission, where the clarity provided by the index could help Ripple’s case if XRP is recognized as a non-security.

ADA (Cardano)

Cardano is known for its emphasis on security and sustainability through a proof-of-stake consensus mechanism. Its inclusion in the Nasdaq Crypto Index showcases its growing popularity and the innovative technology behind it. Cardano’s active community and ongoing development efforts make it a strong contender for mainstream adoption.

XLM (Stellar)

Stellar aims to facilitate cross-border transactions and financial inclusion for the unbanked. With its focus on partnerships with financial institutions and governments, XLM’s presence in the index reinforces its mission to create a more accessible financial system. The SEC’s approval may lead to new collaborations that enhance its utility.

SOL (Solana)

Solana is recognized for its high throughput and low transaction costs, making it a popular choice for decentralized applications (dApps) and non-fungible tokens (NFTs). Its inclusion in the Nasdaq Crypto Index underscores its rapid growth and the increasing demand for scalable blockchain solutions. The SEC’s approval could further solidify Solana’s position in the DeFi space.

Market Reaction and Future Outlook

Following the announcement of the SEC’s approval, the cryptocurrency market experienced a bullish sentiment. Prices for XRP, ADA, XLM, and SOL surged as traders reacted to the news. This positive momentum could continue as more investors become aware of the Nasdaq Crypto Index and its implications for the broader cryptocurrency ecosystem.

Looking ahead, several factors will influence the future trajectory of the Nasdaq Crypto Index and the cryptocurrencies it encompasses:

- Regulatory Developments: Ongoing regulatory clarity will play a crucial role in shaping the cryptocurrency landscape. Continued collaboration between regulators and industry participants could lead to more favorable conditions for digital assets.

- Technological Advancements: The success of the cryptocurrencies in the Nasdaq Crypto Index will depend on their ability to innovate and adapt to changing market demands. Projects that prioritize scalability, security, and user experience are likely to thrive.

- Market Sentiment: Investor sentiment will continue to drive price movements in the cryptocurrency market. Positive news, such as institutional adoption and technological breakthroughs, can lead to increased interest and investment.

- Global Economic Factors: Broader economic conditions, including inflation rates, interest rates, and geopolitical events, will also impact the cryptocurrency market. Investors should remain vigilant and consider these factors when making investment decisions.

Conclusion

The SEC’s approval of the Nasdaq Crypto Index, which includes notable cryptocurrencies like XRP, ADA, XLM, and SOL, represents a significant milestone for the cryptocurrency industry. With enhanced legitimacy, increased accessibility, and the potential for institutional investment, the index could reshape the future of digital assets. As the market evolves, staying informed about regulatory developments, technological advancements, and market trends will be crucial for investors looking to navigate this dynamic landscape.

As excitement builds around the Nasdaq Crypto Index, it is essential for investors to conduct thorough research and consider their risk tolerance before diving into the world of cryptocurrencies. The future looks promising, and the potential for growth is vast as we witness the continued integration of digital assets into the mainstream financial ecosystem.

Breaking

JUST IN: SEC APPROVES NASDAQ CRYPTO INDEX INCLUDING $XRP, $ADA, $XLM & $SOL.

BULLISH pic.twitter.com/F4mpDa8jJt

— BALE (@AltcoinBale) June 7, 2025

Breaking

Exciting news just dropped in the crypto world! The U.S. Securities and Exchange Commission (SEC) has officially approved a new NASDAQ crypto index that includes some of the most talked-about cryptocurrencies today: $XRP, $ADA, $XLM, and $SOL. This announcement has sent waves of enthusiasm throughout the crypto community, and many are labeling this development as “BULLISH .”

With the SEC’s approval, the landscape for cryptocurrency investments is shifting. Investors and traders are buzzing with excitement, and there’s a lot to unpack regarding what this means for the future of these digital assets. Let’s dive into the details of this groundbreaking announcement and what it could mean for you.

JUST IN: SEC APPROVES NASDAQ CRYPTO INDEX

The SEC’s approval of the NASDAQ crypto index marks a significant milestone for the cryptocurrency space. This index will include major players like [**$XRP**](https://twitter.com/search?q=%24XRP), [**$ADA**](https://twitter.com/search?q=%24ADA), [**$XLM**](https://twitter.com/search?q=%24XLM), and [**$SOL**](https://twitter.com/search?q=%24SOL). Each of these cryptocurrencies has carved out its own niche and user base, and their inclusion in a NASDAQ index legitimizes their status in the financial landscape.

So why is this important? For starters, it opens up a new avenue for institutional investment. Having these cryptocurrencies listed on a respected exchange like NASDAQ might encourage traditional investors to dip their toes into the crypto waters. It’s a big deal, especially for those who have been hesitant due to regulatory concerns.

Understanding the Cryptocurrencies in the Index

Let’s break down what each of these cryptocurrencies brings to the table:

$XRP – The Cross-Border Pioneer

$XRP has gained significant traction as a cross-border payment solution. Developed by Ripple Labs, it aims to reduce transaction times and fees associated with international money transfers. With its backing from financial institutions and partnerships with various banks, $XRP is positioned as a strong player in the crypto market.

$ADA – The Smart Contract Innovator

$ADA, or Cardano, has been making waves with its focus on sustainability and scalability. Its platform enables developers to create smart contracts and decentralized applications (dApps) while prioritizing security and energy efficiency. As more businesses look for environmentally friendly solutions, $ADA’s emphasis on sustainability could give it a competitive edge.

$XLM – The Financial Inclusion Advocate

Stellar (XLM) is all about promoting financial inclusion. Its mission is to connect people with low-cost financial services, especially in underbanked regions. By facilitating quick and affordable cross-border transactions, Stellar is making strides in democratizing access to financial resources, which could be a game-changer in developing economies.

$SOL – The Speedy Blockchain

$SOL, the native token of the Solana blockchain, is known for its lightning-fast transaction speeds and low fees. By providing a platform for decentralized applications and crypto projects, Solana has gained popularity among developers. Its ability to handle thousands of transactions per second makes it a top choice for projects requiring speed and efficiency.

Why This Approval Matters for Investors

The SEC’s nod of approval is a significant step toward mainstream acceptance of cryptocurrencies. It signals to investors that the regulatory environment is becoming more favorable, which could lead to increased investment in these digital assets.

For those already invested in $XRP, $ADA, $XLM, or $SOL, this news could mean potential price increases as demand rises. Institutional investors often have deep pockets, and their entry into the market could drive prices higher, benefiting existing holders.

Furthermore, the launch of a NASDAQ crypto index may pave the way for more indices in the future, potentially bringing more cryptocurrencies into the limelight. This could lead to increased trading volumes and liquidity, making it easier for investors to enter and exit positions.

What’s Next for the NASDAQ Crypto Index?

With the SEC’s approval, the next steps involve the actual rollout of the NASDAQ crypto index. Investors will be keenly watching how it performs and what additional cryptocurrencies might be included in the future. Will we see more altcoins joining the ranks? Only time will tell.

Another aspect to consider is the impact of market volatility. Cryptocurrencies are known for their price swings, and while the SEC’s approval is a bullish sign, the market can be unpredictable. Investors should remain vigilant and stay informed about market trends and news that could affect their investments.

Strategies for Investing in the NASDAQ Crypto Index

If you’re considering investing in the NASDAQ crypto index or any of its components, here are some strategies to keep in mind:

1. Diversify Your Portfolio

Don’t put all your eggs in one basket. While $XRP, $ADA, $XLM, and $SOL are exciting investments, consider diversifying your portfolio with other cryptocurrencies or assets. This can help mitigate risk and provide a buffer against market volatility.

2. Stay Updated on Regulatory News

The regulatory landscape for cryptocurrencies is ever-changing. Stay informed about any new developments or changes in regulations that could impact your investments. Being proactive can help you make timely decisions.

3. Set Clear Investment Goals

Before diving into the crypto market, set clear investment goals. Are you looking for short-term gains or long-term investment? Having a strategy in place can help you navigate the market more effectively.

4. Use Dollar-Cost Averaging

If you’re worried about market volatility, consider using a dollar-cost averaging strategy. This involves investing a fixed amount at regular intervals, regardless of the price. It can help reduce the impact of price fluctuations on your overall investment.

Conclusion

The SEC’s approval of the NASDAQ crypto index is a significant milestone for cryptocurrencies, particularly for $XRP, $ADA, $XLM, and $SOL. This development not only legitimizes these digital assets but also opens up new avenues for investment from institutional players. As the market continues to evolve, staying informed and adapting your investment strategies will be crucial.

If you’re excited about the future of cryptocurrency, now is the time to stay engaged and be part of this dynamic landscape. Whether you’re a seasoned investor or just starting, the crypto world is full of opportunities waiting to be explored. So, buckle up and get ready for the ride!