Trump’s Bold $6.7 Trillion Deficit Cut: Is It Genius or Economic Suicide?

deficit reduction strategies, economic impact of fiscal policies, federal budget management 2025

—————–

The One Big Beautiful Bill: An Overview of the trump Administration’s Deficit Reduction Strategy

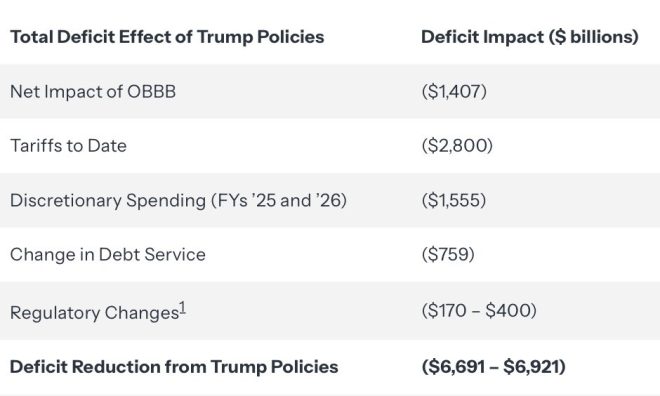

In the modern economic landscape, deficit reduction has become a crucial topic of discussion among policymakers, analysts, and citizens alike. The recent announcement from the Trump Administration regarding their ambitious deficit reduction plan, referred to as "The One Big Beautiful Bill," has sparked significant interest. This initiative aims to address the national deficit in a manner that is both comprehensive and effective, with estimates suggesting that it could lead to a remarkable reduction of over $6.7 trillion over the next decade.

Understanding the Deficit Reduction Strategy

As highlighted in a tweet from Rapid Response 47, the One Big Beautiful Bill represents just one facet of a broader strategy employed by the Trump Administration to tackle the national deficit. This initiative comes at a time when the U.S. economy faces mounting pressures from various fronts, including rising national debt and the need for sustainable fiscal policies. The strategy encapsulates a variety of measures designed to curtail spending, increase revenue, and promote economic growth.

Key Components of the One Big Beautiful Bill

The One Big Beautiful Bill emphasizes several critical components that together form a cohesive approach to deficit reduction. These components include:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Spending Cuts: The bill proposes significant cuts to discretionary spending across various sectors, targeting wasteful expenditures and reallocating resources more efficiently. By identifying areas where spending can be trimmed without compromising essential services, the administration aims to create a more balanced budget.

- Tax Reforms: The plan includes reforms to the tax code aimed at increasing revenue without placing undue burdens on middle-class families. By closing loopholes and ensuring that higher-income earners contribute their fair share, the administration hopes to bolster government revenues significantly.

- Economic Growth Initiatives: Encouraging economic growth is a pivotal element of the deficit reduction strategy. By investing in infrastructure, job creation, and innovation, the administration seeks to stimulate the economy, ultimately leading to higher tax revenues and reduced reliance on deficit financing.

- Entitlement Reform: The One Big Beautiful Bill also addresses the need for reforms in entitlement programs, which constitute a significant portion of federal spending. By ensuring the long-term sustainability of programs like Social Security and Medicare, the administration aims to alleviate some of the fiscal pressures associated with an aging population.

The Impact of the Trump Administration’s Strategy

The potential impact of this deficit reduction strategy is substantial. With projections indicating a reduction of over $6.7 trillion in the national deficit over the next decade, the One Big Beautiful Bill could play a pivotal role in stabilizing the U.S. economy. By reducing the deficit, the administration aims to foster a more favorable environment for investment, lower interest rates, and ultimately improve the country’s credit rating.

Furthermore, a successful deficit reduction plan can have profound implications for future generations. By addressing the national debt now, policymakers can help ensure that future citizens are not burdened with excessive debt repayment and can enjoy a more prosperous economic landscape.

Challenges and Criticisms

While the One Big Beautiful Bill presents a promising approach to deficit reduction, it is not without its challenges and critics. Some analysts argue that the proposed spending cuts may disproportionately affect vulnerable populations, leading to increased hardship for those who rely on government services. Additionally, the feasibility of achieving such significant tax reforms remains a contentious issue, with concerns about potential pushback from special interest groups and lobbyists.

Moreover, the complexity of implementing entitlement reforms poses its own set of challenges. Many Americans rely heavily on programs like Social Security and Medicare, and any changes to these systems could provoke strong opposition from constituents.

Conclusion

The One Big Beautiful Bill represents a bold step in the Trump Administration’s efforts to address the national deficit comprehensively. By combining spending cuts, tax reforms, economic growth initiatives, and entitlement reforms, the administration aims to create a sustainable fiscal environment that benefits all Americans. While challenges and criticisms abound, the potential for reducing the national deficit by over $6.7 trillion within the next decade cannot be overlooked.

As the administration moves forward with this ambitious strategy, it is essential for policymakers, analysts, and citizens to engage in informed discussions about the implications of such reforms. Ultimately, the success of the One Big Beautiful Bill will depend on its ability to balance fiscal responsibility with the needs of the American people, ensuring a prosperous and sustainable future for generations to come.

In summary, the One Big Beautiful Bill is more than just a legislative proposal; it is a vision for a financially stable future. As the Trump Administration navigates the complexities of deficit reduction, the outcomes will undoubtedly influence the economic landscape for years to come.

The One Big Beautiful Bill is just one aspect of @POTUS’s deficit reduction strategy.

In less than five months, the Trump Administration has started deficit reduction that could exceed $6.7 trillion over the next decade. pic.twitter.com/gSAInlny25

— Rapid Response 47 (@RapidResponse47) June 7, 2025

The One Big Beautiful Bill is just one aspect of @POTUS’s deficit reduction strategy

When it comes to managing the economy, a strong deficit reduction strategy is essential. The One Big Beautiful Bill is just one aspect of @POTUS’s deficit reduction strategy, which is making waves across the nation. It’s not just a catchy phrase; it’s a comprehensive approach aimed at tackling the growing national debt and restoring fiscal balance. So, what’s the deal with this bill, and how does it fit into the broader picture of the Trump Administration’s fiscal policies? Let’s dive in and explore!

Understanding Deficit Reduction

Before we get into the specifics of The One Big Beautiful Bill, it’s important to understand what deficit reduction really means. In simple terms, deficit reduction refers to policies and strategies implemented to decrease the amount by which government spending exceeds its revenue. A lower deficit is crucial because it can lead to reduced national debt, which in turn promotes economic stability and growth.

The Trump Administration has outlined a plan that could potentially reduce the deficit by over $6.7 trillion in the next decade. This ambitious goal has garnered attention, and it’s essential to break down how they intend to achieve it.

Key Components of The One Big Beautiful Bill

The One Big Beautiful Bill isn’t just a standalone piece of legislation; it’s part of a larger framework aimed at fiscal responsibility. Here are some of the key components that make it tick:

– **Tax Reforms:** One of the primary features of this bill is the introduction of tax reforms designed to simplify the tax code and close loopholes. By ensuring that everyone pays their fair share, the government can increase revenue without raising tax rates for the average citizen.

– **Spending Cuts:** The bill proposes targeted cuts in government spending, focusing on areas where waste and inefficiency have been identified. By reallocating resources more effectively, the administration aims to streamline operations and maximize the impact of taxpayer dollars.

– **Entitlement Reform:** Another significant aspect is the proposed reforms to entitlement programs. These programs, while essential, have been a considerable burden on federal finances. The bill suggests a careful re-evaluation of these programs to ensure their sustainability for future generations.

– **Investment in Growth:** While cuts and reforms are necessary, the bill also emphasizes the importance of investing in areas that promote economic growth. This includes infrastructure development and support for innovation and technology sectors, which can ultimately lead to increased job creation and tax revenues.

In Less Than Five Months

In less than five months, the Trump Administration has made significant strides in this deficit reduction strategy. The speed and urgency with which they are addressing the issue demonstrate a commitment to fiscal responsibility. But what has been accomplished so far?

– **Legislative Progress:** The administration has already introduced several measures aimed at reducing the deficit. These initiatives are being discussed in Congress, and there is a palpable sense of momentum building around the proposed reforms.

– **Public Support:** The One Big Beautiful Bill has garnered substantial public interest, with many citizens expressing support for a plan that aims to reduce the national debt. This backing is crucial, as public opinion can significantly influence legislative outcomes.

– **Economic Indicators:** Early indicators suggest that the strategies outlined in the bill could positively impact the economy. By focusing on fiscal responsibility, the administration aims to foster an environment conducive to growth and prosperity.

Potential Impact of Deficit Reduction

So, why does deficit reduction matter, and what could it mean for the average American? The implications of a successful deficit reduction strategy are far-reaching:

– **Stability in Financial Markets:** A reduced deficit can lead to greater confidence in the U.S. economy. Investors are more likely to invest in a country that demonstrates fiscal responsibility, which can lead to lower interest rates and increased investment.

– **Sustained Economic Growth:** By reducing the national debt, the government can free up resources for essential services and future investments. This, in turn, can lead to job creation and improved living standards for citizens.

– **Future Generations:** A successful deficit reduction strategy is not just about immediate benefits; it’s also about ensuring that future generations inherit a stable and sustainable economy. By addressing fiscal challenges now, we can pave the way for a brighter future.

The Role of Public Engagement

Public engagement is a crucial element in the success of deficit reduction strategies. The One Big Beautiful Bill has sparked discussions among citizens, policymakers, and experts alike. Here’s how public involvement can make a difference:

– **Awareness and Education:** As more people learn about the implications of the deficit and the strategies proposed, they become better equipped to engage in meaningful conversations about fiscal policy. This awareness can lead to more informed voters who advocate for responsible governance.

– **Accountability:** With public interest comes the demand for accountability. Citizens can hold their elected officials responsible for the implementation of the bill and the success of the deficit reduction strategy, ensuring that their voices are heard.

– **Collaboration:** Engaging the public also fosters collaboration between government officials and constituents. By working together, they can identify areas of concern and suggest solutions that benefit everyone.

Challenges Ahead

While The One Big Beautiful Bill is ambitious and well-intentioned, it’s not without its challenges. Navigating the complexities of government bureaucracy and political opposition can pose significant hurdles. Here are some of the challenges that may arise:

– **Bipartisan Support:** Gaining bipartisan support for any major piece of legislation can be difficult. The administration will need to work diligently to bring both sides of the aisle together to support The One Big Beautiful Bill.

– **Implementation:** Even if the bill passes, the implementation of its provisions will require careful planning and execution. Ensuring that the proposed reforms are effectively rolled out is critical to achieving the desired outcomes.

– **Public Perception:** Maintaining public support throughout the process is essential. If citizens feel that the bill doesn’t deliver on its promises, it could lead to disillusionment and pushback against the administration’s efforts.

The Future of Fiscal Policy in America

Looking ahead, The One Big Beautiful Bill represents a pivotal moment in America’s approach to fiscal policy. With a focus on deficit reduction, the Trump Administration is taking steps to address long-standing economic challenges. The success of these initiatives will largely depend on public engagement, bipartisan cooperation, and effective implementation.

As we witness these developments unfold, it’s crucial for citizens to remain informed and engaged. The future of our economy is in all our hands, and together, we can advocate for a sustainable and prosperous financial landscape.

In summary, The One Big Beautiful Bill is just one aspect of @POTUS’s deficit reduction strategy that has the potential to reshape America’s economic future. With an ambitious target of reducing the deficit by over $6.7 trillion in the next decade, the Trump Administration is committing to a path of fiscal responsibility that promises benefits for current and future generations alike. It’s an exciting time to be engaged in the conversation about our nation’s financial health, and every voice matters in this important dialogue.