US Treasury’s Shocking $10 Billion Debt Buy: Is This Financial Chaos Ahead?

US debt market trends, Treasury bond purchases 2025, government fiscal policy changes

—————–

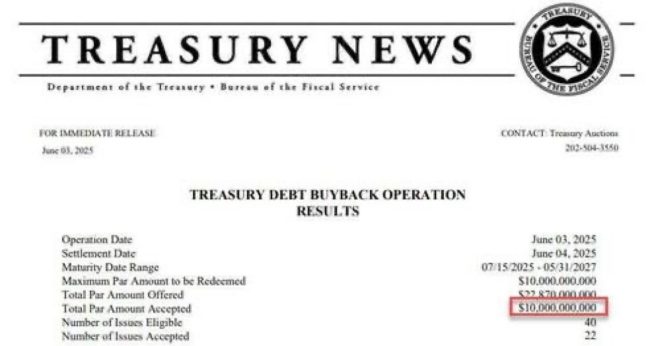

Breaking news: US Treasury Purchases Record $10 Billion of Its Own Debt

In a surprising twist in the financial landscape, the US Treasury has made headlines by purchasing a staggering $10 billion of its own debt, a record high. This significant move has sparked discussions among economists, investors, and the general public about its implications for the economy, monetary policy, and the future of fiscal management in the country. As this news reverberates through financial markets, it raises questions about the motivations behind such an action and its potential impact on the US economy and the global financial system.

Understanding the Context of the Purchase

The purchase of government debt by the Treasury is not an everyday occurrence and indicates a strategic maneuver in response to various economic pressures. This action comes at a time when the US economy is grappling with inflationary pressures, interest rate fluctuations, and the ongoing impacts of the COVID-19 pandemic. By buying its own debt, the Treasury aims to stabilize the market, manage interest rates, and ensure liquidity within the financial system.

The Role of Debt in Government Finance

Government debt is an essential tool for financing public spending and managing economic growth. When the Treasury issues bonds, it borrows money from investors, which is then used to fund various government programs and initiatives. However, excessive debt can lead to concerns about fiscal sustainability, raising interest rates and causing inflation.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The recent move by the US Treasury to buy back its debt can be seen as an effort to mitigate these risks. By reducing the amount of debt in circulation, the government can potentially lower interest rates, making borrowing cheaper for consumers and businesses. This, in turn, could stimulate economic activity and support recovery efforts.

Implications of the Record Purchase

The purchase of $10 billion in debt raises several critical questions about its implications for the US economy:

1. Inflation Control

One of the primary concerns among economists is the potential for inflation. With increased government spending and debt, there is a risk that inflation could spiral out of control. However, by buying back its debt, the Treasury may be attempting to curb inflationary pressures by reducing the overall money supply. This action could help stabilize prices and create a more balanced economic environment.

2. Interest Rate Management

The decision to purchase its own debt can also be seen as a strategic move to manage interest rates effectively. Lower interest rates can encourage borrowing and spending, which are crucial for economic growth. By reducing the supply of government bonds in the market, the Treasury may be able to influence interest rates downward, providing a boost to the economy.

3. Investor Confidence

Investor confidence plays a vital role in the stability of financial markets. By actively engaging in the bond market and purchasing its own debt, the US Treasury signals to investors that it is committed to maintaining stability and liquidity. This move may help bolster investor confidence, leading to increased investments in government bonds and other financial instruments.

The Role of the Money Printers

The phrase "ramp up the money printers" in the tweet by Crypto Rover highlights a concern that many have regarding the implications of such actions. The relationship between government debt and money supply is complex, and the risks of excessive money printing can lead to long-term economic challenges, including hyperinflation.

While the Treasury’s actions might provide short-term relief and stimulate growth, there is a fine line between effective fiscal management and irresponsible monetary policy. The challenge for policymakers will be to strike the right balance between supporting the economy and maintaining fiscal discipline.

What Does This Mean for Investors?

For investors, the recent move by the US Treasury presents both opportunities and risks. On one hand, lower interest rates could make bonds more attractive, while on the other hand, concerns about inflation and fiscal sustainability could lead to market volatility. Here are some key takeaways for investors:

1. Diversification is Key

In uncertain economic times, diversification remains a critical strategy for investors. By spreading investments across various asset classes, including stocks, bonds, and alternative investments, investors can mitigate risks associated with sudden market fluctuations.

2. Monitor Economic Indicators

Investors should keep a close eye on economic indicators, such as inflation rates, employment figures, and interest rates. These factors can significantly impact investment decisions and market trends. Staying informed about government policies and fiscal actions will also be essential for making sound investment choices.

3. Long-Term Perspective

While short-term market reactions can be volatile, maintaining a long-term perspective is crucial for successful investing. Economic cycles will continue to fluctuate, and having a long-term strategy can help investors navigate challenges and capitalize on opportunities.

Conclusion

The US Treasury’s record purchase of $10 billion of its own debt marks a significant moment in economic policy and raises important questions about the future of fiscal management and monetary policy. As the government navigates the complexities of the current economic landscape, the implications of this action will unfold over time.

For investors and the general public, understanding the motivations behind such moves and their potential impact on the economy is essential. While immediate concerns about inflation and interest rates are valid, the long-term effects of this decision will depend on how effectively the government manages its fiscal responsibilities moving forward.

As we continue to monitor the developments in this area, it is crucial to remain informed and proactive in understanding the ever-evolving economic landscape. The interplay between government actions, investor confidence, and market dynamics will shape the financial future of the United States and the global economy.

BREAKING:

US TREASURY BOUGHT A RECORD $10 BILLION OF ITS OWN DEBT!

RAMP UP THE MONEY PRINTERS. pic.twitter.com/3cWccGCpFl

— Crypto Rover (@rovercrc) June 5, 2025

BREAKING:

US TREASURY BOUGHT A RECORD $10 BILLION OF ITS OWN DEBT!

The news is buzzing with excitement and concern: the US Treasury has made headlines by purchasing a staggering $10 billion of its own debt. This unprecedented move raises questions about the financial strategies employed by the government and the implications for the economy at large. So, what does it mean that the US Treasury is ramping up the money printers? Let’s break it down and explore what this means for you and the broader financial landscape.

The Mechanics of Debt Buying

When the US Treasury buys its own debt, it’s essentially engaging in a practice known as “debt repurchase.” This process involves the government purchasing Treasury bonds, bills, or notes from the market. The reasoning behind this can vary—sometimes it’s to stabilize the bond market, manage interest rates, or inject liquidity into the economy. In recent times, such actions have been used to combat economic downturns, and the hefty $10 billion purchase is a clear indication of the government’s commitment to fostering economic stability.

You might be wondering, how does this affect you? Well, when the government buys its debt, it can lead to lower interest rates, making loans cheaper for consumers and businesses. This could mean lower mortgage rates and personal loan rates, which is usually a win for anyone looking to borrow money.

Why Now?

The timing of this record purchase is crucial. The global economy has been shaky, with inflation rates fluctuating and various sectors struggling. By ramping up the money printers, the Treasury aims to alleviate some of the financial pressures that both individuals and industries face. It’s a bold move designed to inject cash into the economy, supporting growth and potentially preventing a recession.

But there’s a flip side to this coin. Increased government spending can also lead to inflation, as more money in circulation can devalue currency. This is a delicate balance that the government must navigate. The challenge lies in ensuring that while stimulating growth, they don’t inadvertently fuel inflation to unsustainable levels.

The Role of the Federal Reserve

The Federal Reserve plays a crucial role in this scenario. As the central bank of the United States, it influences monetary policy and interest rates. When the Treasury buys its own debt, the Fed monitors these actions closely. They may adjust interest rates or implement other monetary policies in response to ensure that the economy remains stable.

In recent years, the Fed has engaged in quantitative easing, a strategy that involves purchasing government securities to increase the money supply. The Treasury’s recent $10 billion purchase could be seen as an extension of this strategy. It’s all interconnected, and understanding the relationship between the Treasury and the Fed can help you grasp the bigger picture of the US economy.

The Potential Impact on Inflation

One of the biggest concerns with the Treasury buying its debt is the potential impact on inflation. When there’s more money in circulation, the risk of inflation increases. If people start to spend that money, it can lead to higher demand for goods and services, which can drive prices up. For everyday consumers, this could mean paying more for groceries, gas, and other essentials.

It’s important to keep an eye on inflation rates following this move. If inflation rises significantly, the government may need to implement measures to control it, such as increasing interest rates. This can have a ripple effect on borrowing costs, affecting everything from car loans to credit cards.

What Experts Are Saying

Financial experts and economists are weighing in on this bold decision. Some argue that buying its own debt is a necessary step to support the economy, especially in uncertain times. Others caution that it could lead to long-term consequences if not managed carefully.

For instance, economist Mark Zandi from Moody’s Analytics suggests that while this move can provide short-term relief, it’s vital for the government to have a plan for managing debt levels in the future. “We need to strike a balance between stimulating growth and ensuring fiscal responsibility,” he notes.

It’s a conversation worth following, as the implications of this decision will likely unfold in the coming months.

The Public Reaction

Public reaction to the news of the Treasury’s record debt buy has been mixed. Many people are relieved at the prospect of lower interest rates, which can ease financial burdens. However, there’s also apprehension about the potential for inflation and how it might impact day-to-day life.

Social media platforms, like Twitter, have been abuzz with opinions and analyses, as seen from users like [Crypto Rover](https://twitter.com/rovercrc/status/1930524032195043628?ref_src=twsrc%5Etfw). The sentiment ranges from optimism about the government’s proactive measures to skepticism regarding the long-term consequences. It’s a hot topic that’s resonating with both financial experts and the average consumer.

Looking Ahead

So, what’s next? The government’s decision to purchase $10 billion of its own debt is just one piece of a larger puzzle. As the economy continues to evolve, it’s essential to stay informed about monetary policies and how they affect you personally.

Keep an eye on inflation rates and interest rates in the coming months. If you’re considering a big purchase, like a house or a car, it may be worth acting sooner rather than later, especially if rates are low now. On the other hand, if inflation starts to rise, it could be a signal to reassess your financial strategies.

In this rapidly changing financial landscape, knowledge is power. By understanding the implications of the Treasury’s actions, you can make informed decisions that align with your financial goals.

Final Thoughts

The US Treasury’s record purchase of its own debt is a significant development that warrants attention. As we navigate the complexities of the economy, it’s crucial to stay informed and proactive. Whether you’re an investor, a homeowner, or just someone trying to make sense of the financial world, understanding these moves can help you better prepare for what lies ahead.

Stay curious, stay informed, and keep an eye on how this situation unfolds. The financial landscape is always changing, and being in the know can make all the difference.