U.S. Treasury’s Shocking $10 Billion Debt Buyback: Economic Lifeline or Trap?

U.S. debt management strategies, Treasury bond repurchase impact, federal fiscal policy trends

—————–

U.S. Treasury Makes History with $10 Billion Debt Buyback

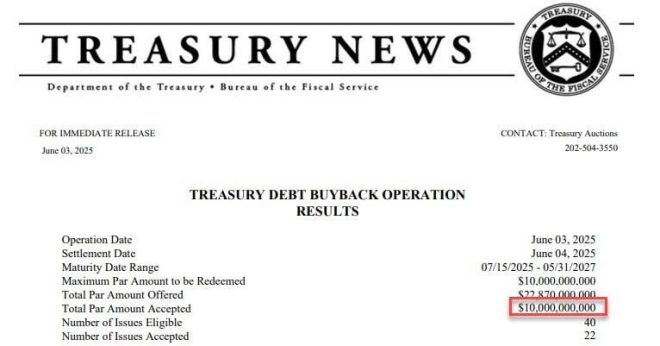

In a groundbreaking financial maneuver, the U.S. Treasury has announced the acquisition of $10 billion of its own debt, marking the largest buyback in history. This bold step, shared via social media by Ash Crypto, indicates a significant shift in the government’s strategy to manage its fiscal responsibilities and optimize its balance sheet.

Understanding the Debt Buyback

A debt buyback occurs when an entity repurchases its own outstanding bonds, effectively reducing the total debt in circulation. By executing this buyback, the U.S. Treasury aims to decrease its overall debt load, potentially lowering interest payments and improving fiscal health. This action also signals confidence in the U.S. economy, as it demonstrates the government’s ability to manage its financial obligations proactively.

Reasons for the Buyback

Several factors may have contributed to this monumental decision:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Interest Rates: With interest rates fluctuating, the Treasury may find it advantageous to buy back debt at a lower cost. This can save the government substantial amounts in interest payments over time.

- Market Conditions: Favorable market conditions and investor sentiment may have provided an opportune moment for the Treasury to execute such a large buyback.

- Debt Management Strategy: This buyback could be part of a broader strategy to manage national debt efficiently, especially in light of growing concerns regarding the U.S. deficit.

Implications of the Buyback

The implications of the U.S. Treasury’s $10 billion debt buyback are far-reaching:

Economic Confidence

This unprecedented buyback could signal strong economic confidence within the U.S. government. By repurchasing its debt, the Treasury may be indicating that it believes in the stability and growth of the economy, fostering investor confidence and potentially encouraging more investment.

Impact on Interest Rates

The buyback may also influence interest rates. As the Treasury reduces its outstanding debt, it could lead to lower yields on government bonds. This can have a cascading effect on interest rates across the economy, potentially leading to lower borrowing costs for consumers and businesses.

Fiscal Responsibility

This action highlights a commitment to fiscal responsibility. By actively managing debt levels, the Treasury is taking steps to ensure long-term economic stability. This can reassure both domestic and international investors about the U.S.’s financial health.

Potential Risks of Debt Buybacks

While the buyback presents numerous advantages, there are also risks involved:

- Market Reactions: The market’s reaction to such a significant buyback can be unpredictable. Investors may interpret the move in various ways, potentially leading to volatility.

- Debt Levels: Lowering the debt too rapidly could have unintended consequences, such as reduced liquidity in the bond market.

- Future Borrowing Needs: The Treasury must balance current fiscal strategies with future borrowing needs. An aggressive buyback could limit flexibility in managing future debt obligations.

The Future of U.S. Debt Management

As the U.S. Treasury navigates this historic buyback, the future of debt management will likely focus on maintaining economic stability while managing fiscal responsibilities. Observers will be keen to see how this move affects broader economic indicators, such as GDP growth, consumer confidence, and inflation rates.

Conclusion

The U.S. Treasury’s recent buyback of $10 billion in its own debt marks a significant milestone in fiscal policy and debt management. This historic action showcases the government’s proactive approach to managing national debt, fostering economic confidence, and potentially altering the landscape of interest rates in the U.S. economy. As the implications of this buyback unfold, stakeholders across the financial spectrum will watch closely to gauge its impact on the future of the U.S. economy.

For more insights on U.S. financial policies and economic trends, stay tuned to trusted financial news sources and expert analyses.

BREAKING:

U.S. TREASURY JUST BOUGHT BACK $10 BILLION OF ITS OWN DEBT, THE LARGEST BUYBACK EVER. pic.twitter.com/UJQucozd9N

— Ash Crypto (@Ashcryptoreal) June 5, 2025

BREAKING:

In a groundbreaking move that has sent shockwaves through financial markets, the U.S. Treasury has announced it has bought back a staggering $10 billion of its own debt. This marks the largest buyback in history, a significant step that raises many questions about the implications for the economy and what it means for investors and taxpayers alike.

U.S. TREASURY JUST BOUGHT BACK $10 BILLION OF ITS OWN DEBT, THE LARGEST BUYBACK EVER.

When you hear the term “buyback,” you might think of a company repurchasing its stock to boost its price. But what does it mean when a government buys back its own debt? Essentially, the U.S. Treasury is taking a proactive approach to manage its liabilities and improve its financial position. By purchasing its own bonds, the Treasury reduces the amount of debt it owes to outside investors. This can be a powerful tool for managing interest rates and fiscal policy.

The Mechanics of a Debt Buyback

So, how does a debt buyback actually work? When the Treasury buys back its bonds, it typically does so on the open market. This means that it purchases bonds that are held by investors, including banks, financial institutions, and even foreign governments. The process involves the Treasury using its cash reserves to buy these bonds, effectively reducing its debt load.

The U.S. has engaged in buybacks before, but this latest move is particularly significant for a few reasons. First, the sheer size of the buyback—$10 billion—indicates a strong commitment to managing debt levels. Secondly, it reflects a strategic approach to monetary policy, especially in times of economic uncertainty.

Why Buybacks Matter

Now you might be wondering why this matters to you. Well, the implications of such a massive debt buyback can ripple through the economy. For one, reducing the amount of debt can lead to lower interest rates. When the government buys back bonds, it decreases the supply of those bonds available in the market. According to Forbes, this can push yields down, making borrowing cheaper for consumers and businesses.

Lower interest rates can stimulate spending and investment, which is especially crucial during economic downturns. If businesses can borrow at lower rates, they’re more likely to invest in growth, hire more employees, and contribute to a healthier economy overall.

The Broader Economic Context

Let’s consider the broader economic context. The announcement comes at a time when many are concerned about rising inflation and economic stability. The Treasury’s decision to buy back debt can be seen as a response to these challenges, aiming to provide a cushion against potential economic shocks. According to Bloomberg, this buyback is part of a larger strategy to maintain fiscal responsibility while navigating a complex economic landscape.

Reactions from the Market

Market reactions to the announcement have been varied. Some investors view this as a positive sign of fiscal health and responsibility from the government. Others, however, worry about the long-term implications of such a large buyback. Critics argue that while it may provide short-term relief, it could lead to larger issues down the line, particularly if the government continues to increase its debt levels.

It’s important to note that not everyone is on board with this strategy. Economists from different schools of thought have raised concerns about the sustainability of government debt. The question remains: how much debt is too much? The balance between stimulating the economy and maintaining fiscal discipline is a delicate one, and the buyback could be a double-edged sword.

What This Means for Investors

If you’re an investor, you might be asking yourself how this buyback impacts your portfolio. In the short term, lower interest rates could boost the stock market as companies invest more in growth. However, if inflation continues to rise, the Federal Reserve may have to act aggressively to combat it, potentially leading to higher interest rates in the future.

For bond investors, this buyback could mean lower yields, which might make bonds less attractive compared to stocks. According to The Wall Street Journal, investors should be cautious and consider diversifying their portfolios to mitigate potential risks associated with rising inflation or changing interest rates.

The Political Landscape

The political ramifications of this buyback are also worth considering. With the upcoming elections, the government’s fiscal policies will be under scrutiny. This buyback could be used as a talking point by those in favor of a responsible fiscal approach, while opponents may argue it masks deeper issues with the national debt.

As public sentiment shifts, lawmakers will need to navigate a challenging landscape, balancing the need for economic stimulus with the necessity of addressing long-term fiscal sustainability. It’s a complex situation that could shape the political discourse for years to come.

Looking Ahead

As we look ahead, the implications of this historic buyback will likely unfold over the coming months and years. Will it lead to sustained economic growth, or will it create a new set of challenges for the government and taxpayers? While the answers are still unclear, one thing is certain: this $10 billion buyback is a pivotal moment in U.S. financial history, and its effects will be felt for a long time.

In conclusion, the U.S. Treasury’s decision to buy back $10 billion of its own debt is a significant event that deserves attention. Whether you’re an investor, a taxpayer, or just someone interested in economic policy, the implications of this move are far-reaching. Keep an eye on the markets and the political landscape as this story continues to develop.

Stay informed and engaged as we navigate these complex issues together. The financial world is constantly changing, and understanding the nuances can help you make informed decisions about your future.