Ethereum Staking Hits Record High: Is This the Start of a New Crypto Era?

Ethereum staking growth, SEC Ethereum guidance, crypto investment confidence

—————–

Ethereum Staking Surges: A New Era for $ETH

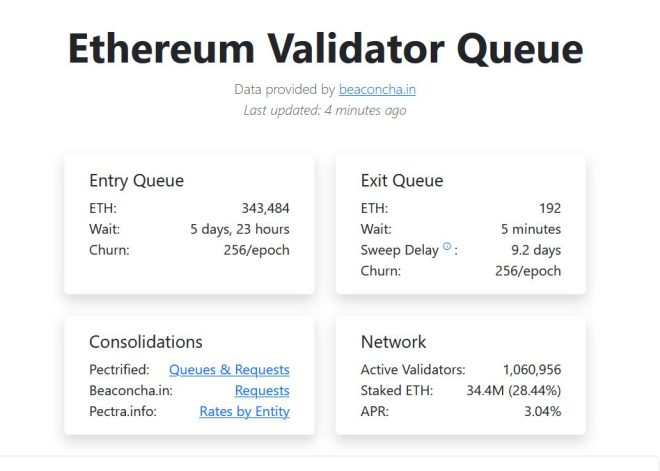

In a noteworthy development for the cryptocurrency market, over 340,000 Ethereum ($ETH) tokens, valued at nearly $900 million, have been queued for staking. This significant uptick marks the highest level of staking activity in more than a year and is indicative of a burgeoning confidence in Ethereum, particularly following recent guidance from the U.S. Securities and Exchange Commission (SEC).

Understanding Ethereum Staking

Ethereum staking is a process that allows holders of $ETH to participate in the network’s security and operations by locking up their tokens to support the Ethereum blockchain. In return, stakers earn rewards, typically in the form of additional $ETH. This mechanism is a fundamental part of Ethereum’s transition to a proof-of-stake (PoS) consensus model, which aims to enhance scalability and sustainability.

The Impact of SEC Guidance

The recent surge in staking demand can be traced back to new guidance from the SEC, which has provided clarity regarding regulatory frameworks surrounding cryptocurrencies, particularly Ethereum. This guidance appears to have alleviated some of the uncertainties that have plagued the crypto market, fostering a renewed sense of confidence among investors and stakeholders. As a result, many investors are now more inclined to take part in staking, believing in Ethereum’s long-term value and utility.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Factors Driving Demand

Several factors contribute to the recent increase in staking activity:

- Market Sentiment: The overall sentiment within the cryptocurrency market has been shifting positively. Increased institutional interest, coupled with retail investor enthusiasm, has created a favorable environment for Ethereum.

- Technological Advancements: Ethereum continues to evolve with upgrades aimed at improving its scalability and transaction speeds. The implementation of Ethereum 2.0 has made staking more appealing, as it promises higher rewards and a more robust security framework.

- Ecosystem Growth: The Ethereum ecosystem has seen significant growth, with an expanding number of decentralized applications (dApps), decentralized finance (DeFi) platforms, and non-fungible tokens (NFTs) built on its blockchain. This growth enhances the utility of $ETH and, consequently, the attractiveness of staking it.

The Significance of the 340,000 $ETH Milestone

The recent milestone of 340,000 $ETH queued for staking is significant for multiple reasons:

- Historical Context: This level of staking has not been seen in over a year, indicating a shift in investor behavior and a potential turning point for Ethereum.

- Network Security: An increase in staked ETH enhances the security of the Ethereum network. More participants in the staking process mean a more decentralized and secure blockchain.

- Investment Shift: The movement of such a large quantity of ETH into staking suggests that investors are increasingly viewing their holdings as long-term assets rather than short-term trading tools. This shift can lead to reduced market volatility and a more stable pricing environment.

What This Means for Investors

For existing and potential investors in Ethereum, this surge in staking activity presents several implications:

- Potential for Higher Returns: As more ETH is staked, the potential rewards for stakers could increase, making it a compelling investment strategy for those looking to earn passive income.

- Increased Trust in Ethereum: The recent SEC guidance and the subsequent staking surge may foster greater trust in Ethereum as a viable long-term investment, potentially attracting more institutional investors.

- Market Dynamics: The influx of staked ETH can influence market dynamics, potentially leading to price stabilization or growth as supply diminishes in the open market.

Conclusion

The recent surge in Ethereum staking activity, highlighted by the addition of over 340,000 $ETH worth nearly $900 million, signifies a pivotal moment for the cryptocurrency. Driven by renewed investor confidence following SEC guidance, this trend not only reflects the growing faith in Ethereum’s future but also enhances the network’s security and stability.

As more investors recognize the benefits of staking and the potential for passive income, it is likely that Ethereum will continue to see increased interest and participation. For anyone involved in the cryptocurrency space, keeping an eye on these developments is essential, as they could greatly influence both the market and the future of decentralized technologies.

With Ethereum’s ongoing evolution and the increasing clarity provided by regulatory bodies, the landscape for $ETH appears promising. Investors who are considering entering the staking arena should conduct thorough research and stay informed about market trends, regulatory changes, and technological advancements that could impact their investment strategies.

In summary, the Ethereum staking phenomenon is not just a trend; it is a reflection of the cryptocurrency’s maturation and its growing acceptance within the financial ecosystem. As Ethereum continues to evolve, its role as a leading blockchain platform is poised to strengthen, offering exciting opportunities for both stakers and investors alike.

JUST IN: Over 340,000 $ETH, worth nearly $900M, are now queued for staking, marking the highest level in over a year.

Surging demand follows recent SEC guidance, signaling renewed confidence in Ethereum’s future. pic.twitter.com/hQU7lTxjMc

— CryptosRus (@CryptosR_Us) June 5, 2025

JUST IN: Over 340,000 $ETH, worth nearly $900M, are now queued for staking, marking the highest level in over a year.

Ethereum is making waves in the cryptocurrency world, and the latest news is nothing short of electrifying. With over 340,000 $ETH queued for staking, valued at nearly $900 million, we’re witnessing a significant surge in activity that hasn’t been seen in over a year. But why is this happening? Let’s dive deeper into the factors driving this momentum and what it means for the future of Ethereum.

Surging demand follows recent SEC guidance, signaling renewed confidence in Ethereum’s future.

One of the primary catalysts behind this massive uptick in staking activity is recent guidance from the U.S. Securities and Exchange Commission (SEC). The clarity provided by the SEC has fostered a newfound sense of confidence among investors. Many believe that the regulatory environment is becoming more favorable for cryptocurrencies, particularly for Ethereum, which has been under scrutiny for some time.

As a result, institutional and retail investors alike are feeling more optimistic about the Ethereum network. This renewed confidence is leading to a greater willingness to stake their assets, which not only helps secure the network but also offers the potential for passive income through staking rewards.

Understanding Ethereum Staking

If you’re new to the world of Ethereum, you might be wondering about staking and why it’s such a big deal. Staking is the process of actively participating in transaction validation on the Ethereum network. By staking your ETH, you contribute to the network’s security and operations, and in return, you earn rewards.

In Ethereum 2.0, which transitioned from a proof-of-work (PoW) to a proof-of-stake (PoS) consensus mechanism, staking has become an essential part of the ecosystem. It allows users to earn ETH rewards for helping to maintain the network’s integrity. With the recent surge in staking activity, it’s clear that more people are recognizing the benefits of becoming a validator.

The Role of Institutional Investors

Institutional investors have been increasingly eyeing Ethereum as a potential investment opportunity. The recent SEC guidance has made it easier for these large players to enter the market. With significant capital at their disposal, institutions have the ability to stake large amounts of ETH, contributing to the overall increase in staking volumes.

These institutional players often come with robust risk management strategies and a long-term investment horizon, which can help stabilize the market. Their involvement can also act as a vote of confidence for retail investors, further driving demand for staking.

What Does This Mean for Ethereum’s Price?

With 340,000 $ETH queued for staking, one can’t help but wonder how this will impact Ethereum’s price. Generally speaking, increased demand for staking can lead to a reduction in available supply in the market. When more ETH is locked up for staking, there’s less in circulation, which can contribute to upward price pressure.

Moreover, as more investors become confident in Ethereum’s potential, we might see increased buying activity, further driving up the price. This positive feedback loop can create a sense of FOMO (fear of missing out) among potential investors, leading to even more capital flowing into the network.

Community Sentiment and Future Developments

The Ethereum community has always been known for its passionate supporters and developers. The recent surge in staking has also been met with enthusiasm within the community. Many are excited about the possibilities that Ethereum 2.0 brings, including scalability improvements and enhanced security features.

Looking ahead, Ethereum has several exciting developments on the horizon, such as the implementation of sharding, which aims to improve the network’s efficiency. As these upgrades roll out, they could further enhance the utility of the Ethereum network and attract even more users to stake their ETH.

The Importance of Education in Crypto Investments

As with any investment, it’s essential to educate yourself before diving into the world of cryptocurrency. Understanding the mechanics of staking, the potential risks involved, and how the Ethereum network operates can help you make informed decisions.

Numerous resources are available online, from official Ethereum documentation to community forums and educational platforms. Engaging with these resources can provide valuable insights and help you navigate the complexities of the crypto landscape.

Final Thoughts on Ethereum’s Bright Future

In summary, the recent surge of over 340,000 $ETH queued for staking is a clear indicator of the growing confidence in Ethereum’s future. With favorable SEC guidance and increased institutional interest, the landscape for Ethereum is becoming more inviting. As we move forward, the excitement surrounding Ethereum continues to build, and it will be fascinating to see how this all unfolds.

Whether you’re a seasoned investor or just starting, keeping an eye on these developments is crucial. The world of cryptocurrency is constantly evolving, and Ethereum is at the forefront of this transformation. So, buckle up and enjoy the ride as we witness the next chapter in Ethereum’s journey!