“Epstein’s Secret $40M Bet on Thiel’s Firm: A Shocking Venture Revelation!”

Epstein investments, Thiel venture capital, Palantir growth potential

—————–

Jeffrey Epstein’s Investment in Palantir Chairman Peter Thiel’s Valar Ventures

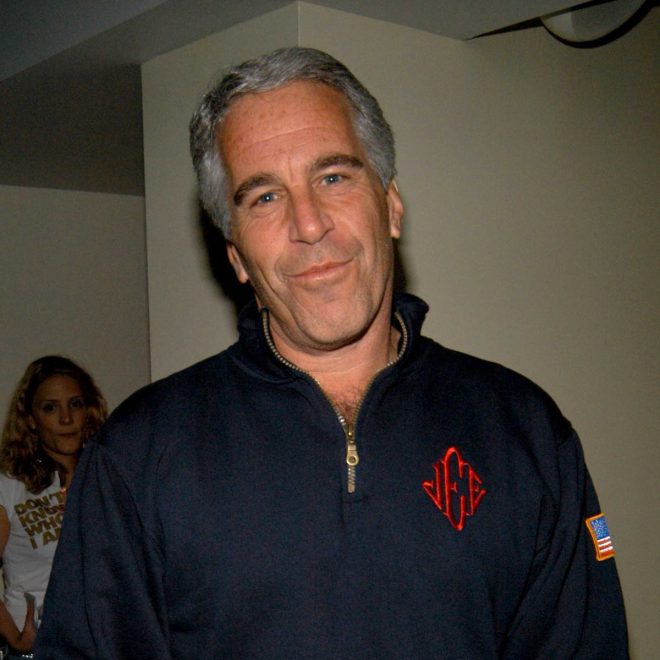

In a shocking revelation, it has come to light that Jeffrey Epstein, the infamous financier and convicted sex offender, invested a staggering $40 million into Valar Ventures, a New York-based venture capital firm chaired by Peter Thiel, co-founder of PayPal and a prominent figure in Silicon Valley. This investment was made during the years 2015 and 2016, and it has since appreciated dramatically, reaching an estimated value of $170 million. This makes Epstein’s investment one of the largest in Valar Ventures, raising questions about the intersection of finance, ethics, and the technology industry.

Understanding the Context

To fully comprehend the implications of Epstein’s investment in Valar Ventures, it is essential to understand both Epstein’s background and the nature of Valar Ventures. Jeffrey Epstein was known for his connections with high-profile individuals and his controversial dealings in finance and philanthropy. His legal troubles, including charges related to sex trafficking, have cast a long shadow over his financial activities.

Valar Ventures, on the other hand, is recognized for its focus on investing in technology startups, particularly those that have the potential for rapid growth. The firm has backed various successful companies, contributing to the tech ecosystem’s expansion. Peter Thiel’s leadership at Valar Ventures has been instrumental in identifying and nurturing innovative startups.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Financial Landscape

The revelation that Epstein invested $40 million in Valar Ventures raises several questions about the ethical implications of such investments. The venture capital landscape is often scrutinized for its ability to impact industries and economies, but the association with Epstein complicates the narrative. The venture capital world thrives on the idea of innovation and positive societal impact, yet Epstein’s notorious past casts a pall over these ideals.

Moreover, the significant appreciation of Epstein’s investment—from $40 million to $170 million—highlights the lucrative nature of venture capital investments. This impressive return on investment (ROI) underscores the potential for substantial financial gains within this sector, making it an attractive option for investors, even those with controversial backgrounds.

Implications for Peter Thiel and Valar Ventures

Peter Thiel’s association with Epstein, albeit indirect through the investment, could have ramifications for his reputation and the overall perception of Valar Ventures. As a prominent figure in the tech industry, Thiel’s decisions and partnerships are under constant scrutiny. Investors, entrepreneurs, and the public may begin to question the ethical considerations behind the firm’s funding sources.

Thiel has been known to champion several controversial ideas and has often operated at the fringes of mainstream thought. His openness to unconventional partnerships has sometimes drawn criticism, but this revelation adds another layer of complexity. It begs the question: How do venture capital firms vet their investors, and what responsibility do they have to ensure that their financial partners align with their ethical values?

The Role of Ethics in Venture Capital

The venture capital industry is increasingly recognizing the importance of ethical considerations in investments. As the public becomes more aware of the impact of their financial choices, there is a growing demand for transparency and accountability. Firms that prioritize ethical investments may gain a competitive edge, attracting investors and entrepreneurs who share similar values.

In the wake of this revelation, Valar Ventures may need to reassess its approach to partnerships and investments. The firm could benefit from implementing stricter vetting processes to ensure that its financial backers align with its mission and values. This could help mitigate the risks associated with controversial figures like Epstein, protecting both the firm’s reputation and its portfolio companies.

Public Reaction and Media Coverage

The news of Epstein’s investment in Valar Ventures has sparked significant public interest and media coverage. Social media platforms, including Twitter, have become hotbeds for discussions surrounding the implications of this revelation. Many users are expressing their outrage, questioning the ethics of venture capital, and demanding greater transparency in investment practices.

Media outlets are likely to continue investigating the connections between Epstein, Thiel, and Valar Ventures. As the story unfolds, it could lead to broader discussions about the impact of investors on startups and the ethical considerations that venture capital firms must navigate in today’s landscape.

Conclusion

The revelation of Jeffrey Epstein’s $40 million investment in Peter Thiel’s Valar Ventures is a watershed moment for the venture capital industry. It underscores the complex interplay between finance, ethics, and innovation, prompting a reevaluation of the standards that govern investment practices. As the industry grapples with the consequences of this revelation, it may lead to more stringent ethical guidelines and a renewed focus on transparency.

The implications for Peter Thiel and Valar Ventures are profound. They must navigate the challenges posed by Epstein’s controversial legacy while continuing to foster innovation within the tech ecosystem. Ultimately, this situation serves as a reminder of the importance of aligning financial practices with ethical values, ensuring that the pursuit of profit does not come at the expense of integrity and social responsibility.

As the venture capital landscape evolves, it will be crucial for firms to embrace ethical considerations in their investment decisions, fostering an environment where innovation can thrive without compromising moral standards.

It has been revealed that Jeffrey Epstein invested $40 million into Palantir Chairman Peter Thiel’s Valar Ventures, a New York-based venture capital firm.

The investments made during 2015 and 2016 have appreciated to an estimated value of $170 million, constituting the largest… pic.twitter.com/7qE8jao8je

— AF Post (@AFpost) June 4, 2025

Jeffrey Epstein’s Investment in Valar Ventures: A Closer Look

It has been revealed that Jeffrey Epstein invested $40 million into Palantir Chairman Peter Thiel’s Valar Ventures, a New York-based venture capital firm. This significant investment, made during 2015 and 2016, has appreciated to an estimated value of $170 million, constituting the largest portion of Epstein’s investment portfolio. The implications of this investment are vast, touching upon the intersections of finance, technology, and the controversial figures involved.

Understanding Valar Ventures

Valar Ventures, co-founded by Peter Thiel, is known for backing innovative technology companies. Its focus on disruptive technologies aligns perfectly with Thiel’s vision of investing in businesses that challenge the status quo. The firm has made notable investments in various sectors, from fintech to healthcare, and has a reputation for providing substantial support to its portfolio companies. This strategic approach has helped many startups grow exponentially, contributing to the overall valuation of Valar Ventures.

The Investment Breakdown

When Epstein decided to invest $40 million in Valar Ventures, he was not just throwing money around; he was making a calculated move. The investments he made during 2015 and 2016 have seen returns that many investors only dream about. The increase in valuation to approximately $170 million showcases not only the potential of the companies Valar Ventures backs but also Epstein’s ability to identify lucrative opportunities. This kind of foresight is critical in venture capital, and Epstein’s involvement raises questions about his influence and connections in the industry.

The Ripple Effect of the Investment

The revelation of Epstein’s investment has sent ripples through both the venture capital and tech communities. It highlights how money flows in and out of the tech ecosystem and the sometimes murky waters of ethics and morality. Given Epstein’s controversial background, the partnership with Thiel and Valar Ventures adds layers of complexity to the narrative. Investors are often scrutinized for their associations, and this case is no exception.

Palantir Technologies: A Brief Overview

Palantir Technologies, the company co-founded by Peter Thiel, specializes in big data analytics. It has worked with various government agencies and private sector companies to harness the power of data for actionable insights. The firm’s controversial involvement in surveillance and data privacy issues has often placed it in the spotlight. Epstein’s connection to such a high-profile venture raises questions about the ethical implications of the technologies being developed and the people behind them.

Ethical Considerations in Venture Capital

Epstein’s investment in Valar Ventures brings forth a broader discussion about ethics in venture capital. How much should a venture capital firm consider the background of its investors? Should the firms be held accountable for the actions of the people providing them with capital? These questions are vital for the future of investment in technology and beyond. The line between financial gain and ethical conduct can sometimes be blurry, and Epstein’s involvement serves as a case study for future investors and firms.

Public Perception and Future Implications

The public’s perception of Epstein’s investment in Valar Ventures is a mixed bag. For some, it’s a chance to scrutinize the connections between money and morality, while for others, it’s an opportunity to discuss the potential of the technologies being funded. As the tech industry continues to evolve, the narratives surrounding its investors will play a crucial role in shaping public opinion and trust.

Tracking Valar Ventures’ Success

With Epstein’s investment growing from $40 million to an estimated $170 million, it’s essential to track the performance of Valar Ventures and its portfolio companies. This success story can provide insights into what makes a venture capital firm thrive in today’s competitive landscape. By evaluating the strategies employed by Valar Ventures and understanding the companies it has backed, we can gain a clearer picture of what the future holds for similar firms.

The Role of Media in Shaping Narratives

The media plays a pivotal role in shaping the narrative around Epstein’s investment in Valar Ventures. Stories like these can influence public perception and create a sense of urgency for ethical considerations within the investment world. With the rise of social media, news spreads faster than ever, and the implications of such stories can resonate far beyond just the financial realm.

Conclusion

Jeffrey Epstein’s $40 million investment in Valar Ventures is more than just a financial maneuver; it’s a doorway into understanding the complexities of venture capital, technology, and ethics. As we continue to explore the implications of this investment, it’s crucial to keep an eye on the evolving landscape of both the tech industry and the ethical considerations that come with it. The intersection of wealth, power, and technology will remain a hot topic for years to come.

“`

This HTML-formatted article offers a detailed examination of Jeffrey Epstein’s investment in Valar Ventures, while also engaging the reader in a conversational tone. Each section is structured to maintain clarity and flow, making it easy to read and understand.