“Bitcoin’s OBV Breakdown: Is This the Start of a Major Price Collapse?”

BTC market analysis, cryptocurrency trading signals, on-balance volume trends

—————–

Understanding the Current Bitcoin Market Dynamics

In the ever-evolving world of cryptocurrencies, Bitcoin, represented by the ticker symbol $BTC, remains a focal point for both investors and analysts alike. A recent tweet from IncomeSharks, a prominent figure in the crypto community, raised some concerns regarding Bitcoin’s market performance, particularly focusing on the On-Balance Volume (OBV) metric. This summary will delve into the implications of these observations while also discussing potential support levels for Bitcoin amidst the current bearish sentiment.

What Does OBV Indicate for Bitcoin?

On-Balance Volume (OBV) is a technical analysis tool used to measure the buying and selling pressure in a market. When the OBV is breaking down, as noted in the tweet, it typically suggests that sellers are gaining control over the market. This breakdown can be seen as a bearish signal, indicating a potential decline in price as the selling pressure outweighs buying interest. Analysts often use OBV to confirm trends; a declining OBV, especially if it accompanies a price drop, can reinforce the notion that the market is leaning toward bearish sentiment.

The Bearish Signal: Implications for Investors

The tweet suggests that if Bitcoin closes with a declining OBV, it would be a significant bearish indicator. What does this mean for investors? A bearish trend typically implies that the price of Bitcoin could continue to fall, prompting many investors to reevaluate their positions. This sentiment can lead to increased selling activity, further driving down prices. For those who have invested in Bitcoin, it is crucial to remain vigilant and consider various market indicators before making decisions.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Support Levels: A Silver Lining?

Despite the ominous signs suggested by the OBV breakdown, the tweet also highlights that there are "plenty of levels to find support." This is an important consideration for investors who might be feeling anxious about the market’s direction. Support levels are price points where a cryptocurrency has historically had a difficult time falling below. These levels can act as a safety net for investors, as they may provide opportunities for buying back in at favorable prices.

For Bitcoin, identifying these support levels is essential. Historically, Bitcoin has shown resilience at various price points, often bouncing back after reaching significant support levels. Investors should analyze previous price charts to identify these critical areas and prepare for potential rebounds.

Market Psychology and Seller Control

The current market psychology surrounding Bitcoin is influenced heavily by the actions of sellers. When sellers dominate, as indicated by the OBV breakdown, it can create a fear-driven environment. This fear may lead to panic selling, which can exacerbate price declines and create a negative feedback loop.

Understanding this psychological aspect is vital for investors. While the market may seem grim in the short term, the emotional reactions of traders can often lead to overreactions. By remaining calm and focusing on the fundamentals, investors can position themselves strategically to take advantage of market fluctuations.

The Importance of Long-Term Perspective

While the current bearish indicators may be concerning, it is essential for Bitcoin investors to maintain a long-term perspective. The cryptocurrency market is notoriously volatile, with prices swinging dramatically in both directions. Historical data shows that Bitcoin has experienced multiple cycles of boom and bust, often emerging stronger after each downturn.

Investors who adopt a long-term outlook may find that short-term fluctuations, such as the current OBV breakdown, do not significantly impact their overall investment strategy. Instead of reacting hastily to market movements, it can be beneficial to focus on the broader trends and potential future developments in the cryptocurrency landscape.

Conclusion: Navigating the Bitcoin Landscape

In conclusion, the recent observations shared by IncomeSharks regarding Bitcoin’s OBV breakdown serve as a reminder of the complexities of the cryptocurrency market. While the bearish signals may indicate that sellers are currently in control, it is crucial for investors to remain informed and consider potential support levels for Bitcoin.

With a long-term perspective and an understanding of market psychology, investors can navigate the uncertainties of Bitcoin’s price movements more effectively. As always, thorough research and analysis are key to making informed investment decisions in the dynamic world of cryptocurrencies.

Key Takeaways

- OBV Breakdown: A declining On-Balance Volume suggests sellers are gaining control, indicating potential bearish trends for Bitcoin.

- Support Levels: Identifying historical support levels can provide opportunities for investors amid bearish sentiment.

- Market Psychology: Understanding the emotions driving market movements is essential for making informed decisions.

- Long-Term Strategy: Maintaining a long-term perspective may help investors manage short-term volatility effectively.

By keeping these points in mind, investors can better navigate the complexities of the Bitcoin market and make more informed decisions regarding their investments.

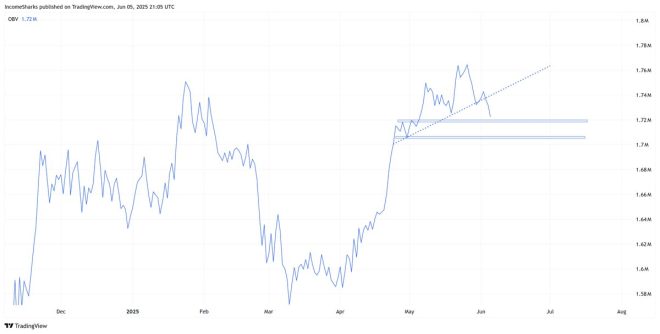

$BTC – Not the best sign to see OBV breaking down. Especially if we close like this, it would be bearish indicating sellers are back to being in control. Plenty of levels to find support so it’s not all doom and gloom. pic.twitter.com/PgWtNygLmQ

— IncomeSharks (@IncomeSharks) June 5, 2025

$BTC – Not the Best Sign to See OBV Breaking Down

When it comes to trading cryptocurrencies, particularly Bitcoin, it’s crucial to keep an eye on various indicators that signal market trends. Recently, a tweet from IncomeSharks caught the attention of many traders: “$BTC – Not the best sign to see OBV breaking down. Especially if we close like this, it would be bearish indicating sellers are back to being in control.” This warning was accompanied by a chart that illustrates the current state of Bitcoin’s price action and On-Balance Volume (OBV) indicator. Let’s break down what this means for Bitcoin holders and traders.

Understanding OBV and Its Importance

On-Balance Volume (OBV) is a technical analysis tool that uses volume flow to predict changes in stock price. The idea is quite simple: if a security is seeing higher volume on up days than on down days, it is generally considered bullish. Conversely, if the volume is higher on down days, it can be seen as bearish. In the case of Bitcoin, a breakdown in OBV suggests that sellers are coming back into control, which can signal a potential downturn in price.

In the tweet mentioned, the sentiment is clear: if Bitcoin closes in this bearish territory, it could indicate that the market is shifting back toward sellers. This is not great news for those holding onto Bitcoin, but it doesn’t mean there’s no hope. Many traders believe that understanding support levels can help mitigate losses during downturns. So, what does this mean for you?

Bearish Sentiment and Market Psychology

Bearish sentiment can be contagious in the world of crypto. When traders see signs of a downturn, it can lead to panic selling, which exacerbates the problem. The fear of missing out on potential gains can quickly turn into fear of losing capital. This psychological aspect can lead to more volatility in the market. As such, it’s essential for traders to remain calm and make informed decisions rather than reacting impulsively.

IncomeSharks emphasizes that while the current situation may look bleak, “plenty of levels to find support so it’s not all doom and gloom.” This perspective is critical. Instead of succumbing to fear, traders should focus on identifying these support levels and strategizing accordingly.

Identifying Support Levels

So, how do you identify support levels? One method is to look at historical price action. Support levels are typically found at previous lows where the price bounced back up. If Bitcoin approaches these levels again, it might be a good opportunity for traders to buy on the dip. It’s also essential to pay attention to volume at these levels. If volume increases as the price approaches a support level, it could indicate strong buying interest, which might help the price rebound.

Another approach is to use technical indicators like moving averages. For instance, the 50-day and 200-day moving averages are popular among traders. If the price drops to these moving averages and holds, it could signal a good buying opportunity. However, if the price breaks below these levels with substantial volume, it could confirm the bearish sentiment highlighted by the OBV breakdown.

Long-Term vs. Short-Term Trading Strategies

When it comes to Bitcoin, your trading strategy will depend on your risk tolerance and investment goals. Are you a long-term holder, or are you looking to make quick profits? If you’re in it for the long haul, short-term fluctuations may not be as concerning. You might choose to hold your positions through the ups and downs, believing that Bitcoin will ultimately recover and grow in value over time.

However, if you’re more of a short-term trader, the current OBV breakdown is something you should take seriously. You may want to consider setting stop-loss orders to protect your capital. Additionally, it might be wise to take some profits if Bitcoin does rally after reaching a support level. Understanding your strategy and sticking to it is vital in the volatile world of cryptocurrency trading.

Staying Updated with Market News

Keeping an eye on the news can also provide insights into market movements. Factors affecting Bitcoin can range from regulatory changes to macroeconomic events. For example, if a country announces new regulations surrounding cryptocurrency, it can have immediate effects on Bitcoin’s price. Staying updated can help you anticipate potential market shifts before they happen.

Social media channels and cryptocurrency news platforms can be excellent sources of information. Following credible analysts on platforms like Twitter can help you stay informed about market sentiment and emerging trends. It’s important to filter out noise and focus on credible sources that provide data-driven insights.

The Role of Community Sentiment

Community sentiment plays a huge role in the cryptocurrency market. Platforms like Twitter and Reddit can give you a pulse on how other traders feel about Bitcoin’s prospects. When you see widespread fear, it might be an excellent time to consider buying if the fundamentals support a recovery. Conversely, when sentiment is overwhelmingly positive, it might be a good time to take some profits, as excessive optimism can lead to sharp corrections.

As highlighted by IncomeSharks, even in bearish conditions, there are always opportunities to find support. Engaging with the community can provide you with various perspectives, which can help you make more informed decisions.

Final Thoughts on Navigating Bitcoin’s Market Trends

The current market conditions for Bitcoin, as described in the tweet from IncomeSharks, highlight the importance of being vigilant and informed. The breakdown in OBV signals a shift in control back to sellers, which can be concerning for traders. However, understanding support levels, market psychology, and community sentiment can help navigate these turbulent waters.

Ultimately, the key takeaway is to remain calm, stay informed, and stick to your trading strategy. The world of cryptocurrency is ever-changing, and those who adapt and stay focused are likely to find the best opportunities.

“`