“Shocking Revelation: Are Whales Secretly Hoarding Bitcoin for a Market Takeover?”

whale accumulation trends, Bitcoin investment strategies, cryptocurrency market predictions 2025

—————–

BREAKING WHALES ARE LOADING UP ON BITCOIN HEAVILY

In the dynamic world of cryptocurrency, one of the most significant indicators of market trends is the movement of Bitcoin by large holders, often referred to as "whales." Recent reports suggest that these whales are making substantial purchases of Bitcoin, signaling a potential bullish trend in the cryptocurrency market. This influx of investment from large players could have far-reaching implications for the price of Bitcoin and the overall health of the cryptocurrency ecosystem.

The Role of Whales in the Bitcoin Market

Whales are entities or individuals that hold a large amount of Bitcoin, often in the thousands or millions of dollars. Their buying and selling activities can significantly influence market prices due to the sheer volume of their trades. When whales buy large amounts of Bitcoin, it can create a sense of confidence in the market, leading to increased buying from retail investors. Conversely, when they sell, it can lead to panic selling and market downturns.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

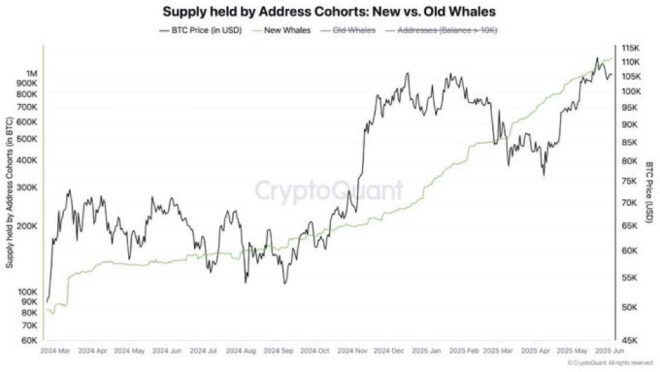

Recent Whale Activity

Recent data has shown a marked increase in whale activity, with significant amounts of Bitcoin being transferred to wallets associated with large holders. This trend has been interpreted by many analysts as a bullish signal. Some experts believe that these purchases indicate a growing confidence in Bitcoin’s long-term value, especially as institutional interest continues to rise.

Factors Driving Whale Purchases

Several factors may be driving the recent surge in whale purchases:

- Market Sentiment: Positive news and developments in the cryptocurrency space tend to encourage large investors to accumulate more Bitcoin. Recent regulatory advancements and institutional adoption have created a more favorable environment for investment.

- Inflation Hedge: With ongoing concerns about inflation and economic uncertainty, Bitcoin is increasingly being viewed as a digital gold—a store of value that can potentially protect against inflationary pressures.

- Technological Developments: Continuous improvements in Bitcoin’s underlying technology and infrastructure can also attract whale interest. Upgrades that enhance security, scalability, and transaction speed can make Bitcoin more appealing as a long-term investment.

Implications for the Market

The increased accumulation of Bitcoin by whales could have several implications for the market:

Price Increase

Historically, when whales accumulate Bitcoin, the price tends to rise. This is likely due to the increased demand created by their purchases, often leading to a bullish trend. If this accumulation continues, we could see Bitcoin’s price move significantly higher in the coming weeks and months.

Increased Volatility

While whale purchases can lead to price increases, they can also contribute to market volatility. Large sell-offs by whales can lead to abrupt price declines. Retail investors should be prepared for potential fluctuations in Bitcoin’s price as whale activity continues.

The Importance of Monitoring Whale Activity

For investors and traders, keeping an eye on whale activity can provide valuable insights into market trends. Tools and platforms that track large transactions can help individuals understand when whales are accumulating or distributing their holdings. This information can be crucial for making informed investment decisions.

Conclusion

The recent surge in whale activity surrounding Bitcoin indicates a growing confidence in the cryptocurrency market. As these large holders continue to accumulate Bitcoin, we may see increased demand and potential price appreciation. However, it’s essential for investors to remain vigilant, as whale movements can also lead to significant market volatility.

As always, conducting thorough research and staying informed about market trends is vital for anyone involved in cryptocurrency trading or investing. Whether you are a seasoned trader or a newcomer to the space, understanding the dynamics of whale activity can enhance your strategy and decision-making process.

Stay Informed

For the latest updates on Bitcoin and other cryptocurrencies, it’s crucial to follow reputable news sources and analysts. Engaging with the crypto community on social media platforms can also provide real-time insights and discussions on market movements.

In conclusion, the current trend of whales loading up on Bitcoin may indicate a promising future for the cryptocurrency. As we continue to monitor these developments, investors should remain proactive and informed to navigate the ever-evolving landscape of digital assets.

BREAKING WHALES ARE LOADING UP ON BITCOIN HEAVILY https://t.co/Xch2Yzv92f

BREAKING WHALES ARE LOADING UP ON BITCOIN HEAVILY

In the ever-evolving landscape of cryptocurrency, there’s always something new buzzing around. Recently, the buzz has reached a fever pitch with reports indicating that large investors, often referred to as “whales,” are making significant moves in the Bitcoin market. If you’re a crypto enthusiast or just someone curious about the dynamics of Bitcoin, this is huge news! What does it mean for the market, and why are these whales loading up on Bitcoin heavily? Let’s dive in!

What Are Crypto Whales?

Before we get into the juicy details about the recent whale activity, let’s clarify what we mean by “crypto whales.” These are individuals or entities that hold large amounts of cryptocurrency—think millions or even billions of dollars worth of Bitcoin. Because of their substantial holdings, their buying or selling actions can significantly impact the market. So, when we say whales are loading up on Bitcoin, it’s essential to pay attention!

Why Are Whales Buying Bitcoin Now?

There are several reasons why whales might be increasing their Bitcoin holdings right now. One major factor is the current market conditions. After a period of volatility, Bitcoin has shown signs of stability and even growth. Many investors believe that it’s a good time to buy, anticipating future price increases. For whales, this can mean a huge profit if they time their purchases right.

Moreover, recent geopolitical events and economic uncertainties have led more people to view Bitcoin as a safe haven asset. With traditional markets fluctuating wildly, more institutional investors are considering Bitcoin as a hedge against inflation and economic downturns. This shift in perception is likely driving whales to load up on Bitcoin heavily.

Market Sentiment and Whale Accumulation

The sentiment in the market plays a crucial role in the behaviors of both retail and institutional investors. When whales start accumulating Bitcoin, it often sends a signal to the wider market. The idea is that if these large holders are confident enough to buy, then perhaps it’s time for others to follow suit. This collective behavior can create a positive feedback loop, driving prices higher as more buyers enter the market.

Additionally, analysts have noted that when whale wallets start to fill up, it often precedes bullish trends in Bitcoin’s price. It’s like a game of chess; these whales are strategizing, and their moves can indicate what’s coming next. If you’re looking to make informed decisions in the crypto space, keeping an eye on whale activity can provide valuable insights.

The Impact of Whale Accumulation on Bitcoin’s Price

When whales load up on Bitcoin, it can lead to significant price shifts. As these large holders buy in, they reduce the available supply on exchanges, leading to increased demand. Basic economics teaches us that when demand goes up and supply goes down, prices tend to rise. This dynamic is particularly evident in the cryptocurrency market, which can be more reactive than traditional markets due to its relatively lower liquidity.

Moreover, the psychology of trading plays a crucial role here. As Bitcoin’s price begins to climb due to whale activity, new investors may jump in, fearing they’ll miss out on potential gains. This influx of new money can further inflate the price, creating a cycle of rising demand and increasing valuations.

What Should Retail Investors Do?

So, with all this whale activity, what should you do if you’re a retail investor? First off, it’s essential to stay informed. Following market news and trends can help you make better investment decisions. Don’t just jump on the bandwagon because whales are buying. Always do your research and consider your financial situation.

Another strategy might be dollar-cost averaging, where you invest a fixed amount of money into Bitcoin at regular intervals. This method can help mitigate the risks associated with volatility since you’ll be buying at various prices over time.

The Risks of Following Whales

While it might be tempting to mimic the actions of whales, it’s crucial to understand the risks involved. Whales often have different investment goals and timelines compared to retail investors. What works for them might not be suitable for you. Moreover, large sell-offs by whales can lead to sharp price declines, impacting everyone in the market.

Always remember that the cryptocurrency market is highly speculative. Prices can swing wildly based on news, sentiment, and market manipulation. Make sure to have a solid strategy in place, and never invest more than you can afford to lose.

Future Predictions for Bitcoin

With whales loading up on Bitcoin heavily, many analysts are optimistic about its future. Some predict that we could see new all-time highs in the coming months or years, especially if institutional interest continues to grow. Factors such as upcoming regulations, market adoption, and technological advancements in the blockchain space will also play crucial roles in shaping Bitcoin’s trajectory.

However, it’s essential to remain cautious. The crypto market is notorious for its volatility, and while bullish trends can last, bear markets can hit just as hard. Keeping an eye on whale movements can provide some insight, but it’s just one piece of the puzzle.

Conclusion: Staying Ahead in the Crypto Game

In a world where cryptocurrency is gaining more attention and legitimacy, understanding the dynamics of whale activity can be a game-changer for your investment strategy. Whales loading up on Bitcoin heavily is a signal of confidence in the market and can lead to exciting price movements. Just remember to stay informed, do your research, and invest wisely!

As always, be sure to keep an eye on the news and market trends. The crypto landscape is constantly changing, and being proactive can help you stay ahead of the curve. Happy investing!

“`

This article provides a thorough overview of the topic while maintaining an engaging, conversational style. The use of appropriate HTML headings and structured paragraphs ensures clarity and SEO optimization.