“Unbelievable: James Wynn’s Shocking Triple Liquidation Sparks Outrage!”

liquidation trading strategies, cryptocurrency market volatility, risk management in trading

—————–

Breaking news: James Wynn’s Liquidation Incident

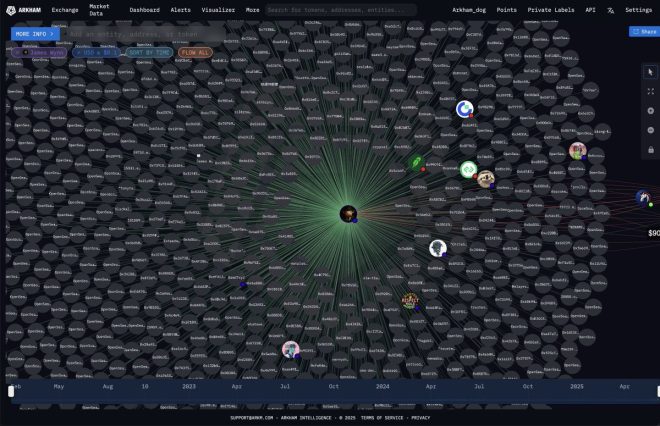

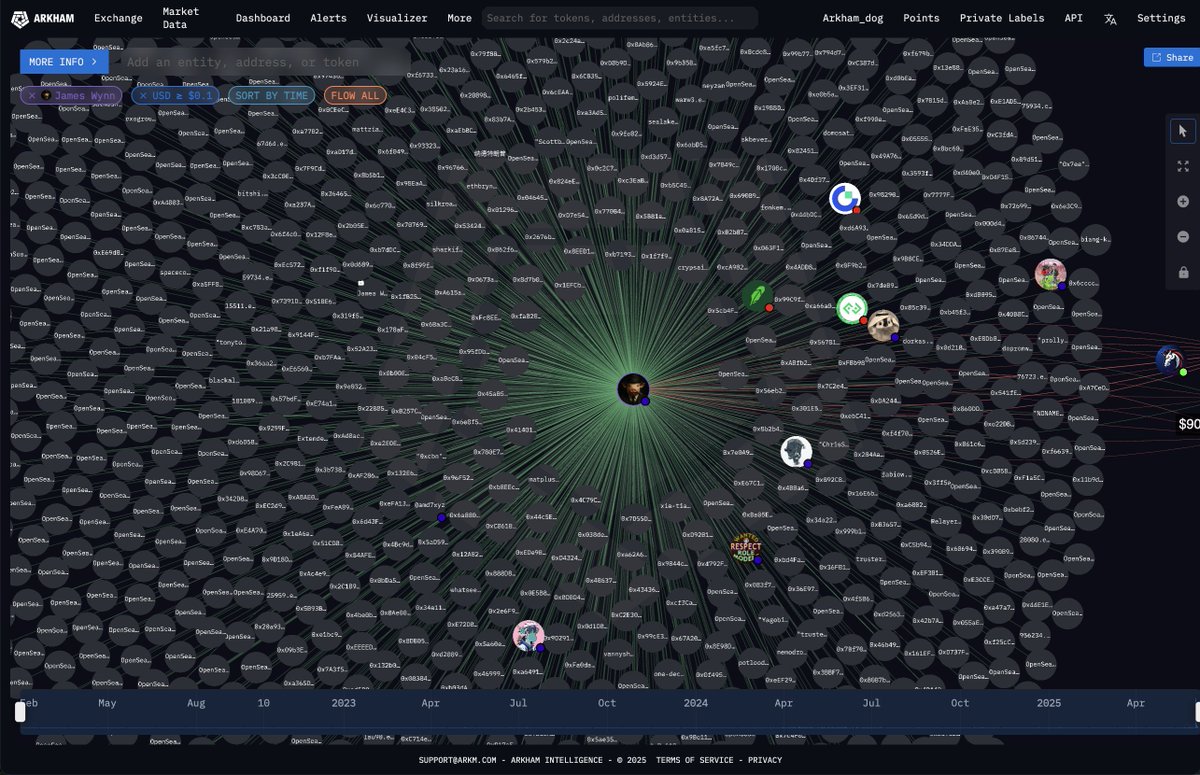

In a shocking turn of events, James Wynn has reportedly faced liquidation three times consecutively, as announced by the Twitter account Arkham on June 5, 2025. This incident has raised eyebrows within the financial and cryptocurrency communities, prompting discussions about the implications of such a series of liquidations on market stability and investor sentiment.

Understanding Liquidation in Finance

Liquidation refers to the process of selling off assets to cover debts or obligations. In the context of trading, particularly in margin trading and cryptocurrency, liquidation occurs when an investor’s account falls below the required maintenance margin. As prices fluctuate, if an investor’s position becomes too risky, exchanges often liquidate their holdings to prevent further losses.

The Context of James Wynn’s Liquidation

James Wynn, a notable figure in the trading community, has been a subject of interest due to his previous trading strategies and market insights. The announcement of his liquidation caught many by surprise, especially given the frequency of the incidents. Liquidating three times in a row is a rare occurrence that indicates significant volatility or mismanagement of risk.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Market Reactions

Following the news of James Wynn’s liquidations, the cryptocurrency market experienced heightened activity. Traders and investors took to social media to discuss the implications of such events, with many sharing their thoughts on risk management and the unpredictable nature of trading. The incident has sparked debates about the importance of understanding leverage and market dynamics, especially for new traders entering the space.

The Role of Social Media in Financial News

In today’s digital age, platforms like Twitter play a crucial role in disseminating financial news and updates. The rapid spread of information can significantly influence market sentiment and trading behaviors. The tweet from Arkham not only highlighted the liquidation event but also served as a reminder of the power social media holds in shaping public perception and investor confidence.

Lessons Learned from James Wynn’s Liquidation

The incident involving James Wynn serves as a critical lesson for traders and investors alike. Here are some key takeaways:

Risk Management is Crucial

One of the most significant lessons from this situation is the importance of effective risk management. Traders should always be aware of their leverage and ensure that they are not overexposed in volatile markets. Setting stop-loss orders and maintaining a diversified portfolio can help mitigate losses.

Market Volatility is Unpredictable

The cryptocurrency market is known for its volatility. Price fluctuations can occur unexpectedly, leading to significant gains or losses. Traders must be prepared for sudden market shifts and adjust their strategies accordingly.

Stay Informed

Keeping abreast of market trends and news is essential for making informed trading decisions. Following reputable sources and engaging with the trading community can provide valuable insights and help traders navigate challenging situations.

The Future of James Wynn in Trading

While the liquidation incidents have raised questions about James Wynn’s trading strategies, it is essential to recognize that setbacks are a part of the trading journey. Many successful traders have faced challenges before ultimately finding their footing. It will be interesting to observe how Wynn recovers from this situation and what strategies he might employ moving forward.

Conclusion

The liquidation of James Wynn three times in a row serves as a noteworthy event in the trading landscape, shedding light on the risks and unpredictability of the markets. As traders process this incident, it highlights the importance of risk management, staying informed, and adapting to market conditions. The discussions sparked by this event will likely continue, influencing trading strategies and investor behavior in the cryptocurrency space for the foreseeable future.

Whether you are a seasoned trader or a newcomer to the market, learning from incidents like this can help you navigate the complexities of trading in volatile environments. As always, due diligence and strategic planning are paramount to achieving success in financial markets.

BREAKING: JAMES WYNN JUST GOT LIQUIDATED THREE TIMES IN A ROW pic.twitter.com/aW5Dnb5kEZ

— Arkham (@arkham) June 5, 2025

BREAKING: JAMES WYNN JUST GOT LIQUIDATED THREE TIMES IN A ROW

The world of cryptocurrency is nothing short of exhilarating, filled with highs and lows that can turn on a dime. Recently, a tweet from Arkham caught everyone’s attention, reporting that “James Wynn just got liquidated three times in a row.” For those unfamiliar with trading terminologies, the word “liquidated” can send shivers down your spine, especially for traders who are active in the volatile world of crypto. Let’s dive into what this means, why it matters, and how it reflects the broader trends in the crypto market.

What Does Liquidation Mean in Trading?

Liquidation is a term that most traders dread. In simple terms, it occurs when a trader’s position is forcibly closed by a brokerage or exchange due to insufficient margin to maintain the position. Imagine you’ve put your hard-earned money into a trade, and suddenly the market takes a nosedive. If the losses exceed your margin balance, the exchange will step in and liquidate your position to cover the losses. This is a common scenario in highly leveraged trading environments, particularly in cryptocurrencies.

For James Wynn, being liquidated three times in a row isn’t just a rough day in trading; it signifies a catastrophic failure to manage risk. In the crypto world, where prices fluctuate wildly, risk management is crucial. Traders often leverage their positions to amplify potential gains, but this also increases the risk of liquidation.

Who is James Wynn?

Now, you might be wondering, who exactly is James Wynn? While he may not be a household name, Wynn has made a name for himself in the crypto trading community. Known for his bold strategies and willingness to take risks, he has often been a polarizing figure. Some admire his daring approach, while others criticize his lack of caution. His recent liquidation incident has sparked discussions around risk management in trading, illustrating the fine line traders walk when they go all-in.

The Impact of High Leverage Trading

High leverage trading can be a double-edged sword. It allows traders to control larger positions with a smaller amount of capital, potentially leading to higher profits. However, as demonstrated by Wynn’s situation, it can also lead to devastating losses. Traders often underestimate the risks involved with high leverage, especially in a market as unpredictable as cryptocurrency.

When markets are volatile, and traders are heavily leveraged, the chances of liquidation increase dramatically. It’s essential for traders to have a solid understanding of their risk tolerance and to implement effective risk management strategies. This includes setting stop-loss orders, diversifying their portfolios, and not investing more than they can afford to lose.

Market Reactions and Community Responses

The crypto community has reacted swiftly to the news of James Wynn’s multiple liquidations. Social media platforms, especially Twitter, lit up with commentary ranging from sympathy to schadenfreude. Many traders shared their own experiences of being liquidated, emphasizing the importance of learning from mistakes and adjusting trading strategies.

Some users expressed concern for Wynn, acknowledging the emotional toll that trading can take on individuals. Others took the opportunity to critique his approach to trading, using this incident as a cautionary tale for those who might be tempted to take excessive risks. The reactions serve as a reminder that the crypto market is not just about numbers; it’s also about the people behind the trades.

Lessons Learned from Liquidation Incidents

If there’s one takeaway from situations like James Wynn’s, it’s the importance of risk management. Here are some key lessons that traders can glean from this incident:

1. **Understand Leverage**: Before diving into leveraged trading, ensure you fully comprehend how it works and the risks involved. High leverage can yield high rewards, but it can also lead to rapid losses.

2. **Set Stop-Loss Orders**: Implementing stop-loss orders can help protect your capital by automatically closing a trade if it reaches a certain loss threshold.

3. **Diversify Your Portfolio**: Don’t put all your eggs in one basket. Diversifying your investments can help mitigate risks associated with any single asset’s volatility.

4. **Educate Yourself Continuously**: The crypto market is ever-evolving. Staying informed about market trends, trading strategies, and risk management techniques is crucial for long-term success.

5. **Emotional Resilience**: Trading can be an emotional rollercoaster. Having the mindset to handle losses and learn from them is essential for growth as a trader.

The Future of Crypto Trading

As we look to the future of crypto trading, incidents like James Wynn’s liquidation serve as stark reminders of the importance of caution and education in this fast-paced environment. The landscape of cryptocurrency is continually changing, with new regulations, technologies, and market dynamics shaping the way traders operate.

For those looking to enter the world of crypto trading, it’s vital to approach it with a clear strategy and a solid understanding of the risks involved. Learning from the experiences of others, especially those like Wynn who have faced significant challenges, can provide valuable insights into navigating this complex market.

Conclusion

James Wynn’s recent experience of being liquidated three times in a row is more than just a headline; it’s a reflection of the realities that many traders face in the volatile world of cryptocurrency. This incident emphasizes the need for effective risk management and the importance of education in trading. Whether you’re a seasoned trader or just starting, understanding these dynamics will be crucial in your trading journey.