BlackRock’s Shocking Move: Are They Ditching Bitcoin for a Darker Agenda?

Blackrock bitcoin divestment, cryptocurrency market trends 2025, institutional investment strategies

—————–

Breaking news: BlackRock Sells Bitcoin

In a surprising turn of events, BlackRock, one of the world’s largest asset management firms, has made headlines by announcing the sale of its Bitcoin holdings. This significant development, shared by the Twitter account Crypto Beast, has sent ripples through the cryptocurrency market and has drawn the attention of investors, analysts, and enthusiasts alike.

The Implications of BlackRock’s Decision

BlackRock’s decision to sell Bitcoin raises numerous questions regarding the future of cryptocurrency investments and the overall market sentiment. As one of the first traditional financial institutions to embrace Bitcoin and other cryptocurrencies, BlackRock’s actions could be seen as a bellwether for institutional interest in digital assets.

The timing of this move is particularly notable. With Bitcoin’s price experiencing volatility and the broader market facing regulatory scrutiny, BlackRock’s divestment may signal a shift in institutional confidence in cryptocurrency. This decision could lead to a potential downturn in Bitcoin prices, as it may encourage other investors to reassess their positions.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Understanding BlackRock’s Role in the Crypto Market

BlackRock has been a key player in the financial landscape, managing trillions of dollars in assets. Its entry into the cryptocurrency market was viewed as a major endorsement of Bitcoin’s legitimacy. The firm’s previous investments in digital assets were interpreted as a sign that Bitcoin was becoming a mainstream investment option.

By selling its Bitcoin holdings, BlackRock may be responding to various factors, including regulatory challenges, market conditions, and internal investment strategies. Analysts will be closely monitoring these developments to gauge their impact on the broader cryptocurrency market.

Market Reactions and Investor Sentiment

The immediate reaction from the market following BlackRock’s announcement has been one of caution. Investors and traders are now analyzing the potential implications of this sale on Bitcoin’s price and the overall market dynamics. Historically, announcements from major financial institutions can lead to significant price fluctuations, and this case is no exception.

In the aftermath of the announcement, Bitcoin’s price may experience pressure as market participants digest the news and reassess their strategies. It is essential for investors to remain vigilant and informed, as news like this can create both opportunities and risks in the rapidly evolving cryptocurrency landscape.

The Future of Bitcoin and Institutional Investment

While BlackRock’s decision to sell Bitcoin may evoke concern among cryptocurrency enthusiasts, it is crucial to consider the broader context. Institutional investment in Bitcoin and other cryptocurrencies has grown significantly in recent years, with numerous firms exploring blockchain technology and digital assets.

Despite the current market turbulence, the long-term outlook for Bitcoin remains optimistic. Many analysts believe that the fundamentals of Bitcoin, including its scarcity and decentralized nature, will continue to attract institutional interest.

Additionally, as regulations surrounding cryptocurrencies evolve, there may be renewed interest from institutional investors who are waiting for clearer guidelines before committing significant capital to digital assets.

Conclusion: What This Means for Cryptocurrency Investors

BlackRock’s sale of Bitcoin is a pivotal moment in the cryptocurrency market, reflecting the complexities and challenges that come with institutional investment in digital assets. While this development may induce short-term volatility, it also serves as a reminder of the ever-changing landscape of cryptocurrency.

Investors should remain informed and adaptable, as market conditions can shift rapidly in response to news and developments from major players like BlackRock. As the cryptocurrency market continues to mature, it will be essential to analyze both the risks and opportunities presented by institutional involvement.

For now, the cryptocurrency community will be watching closely to see how BlackRock’s decision unfolds and what it means for the future of Bitcoin and the wider digital asset ecosystem.

In summary, while BlackRock’s decision to sell its Bitcoin holdings raises questions about institutional confidence in cryptocurrency, it also highlights the evolving nature of the market and the need for investors to stay alert and informed. The future of Bitcoin remains uncertain, but its resilience and potential for growth continue to capture the interest of both retail and institutional investors alike.

BREAKING

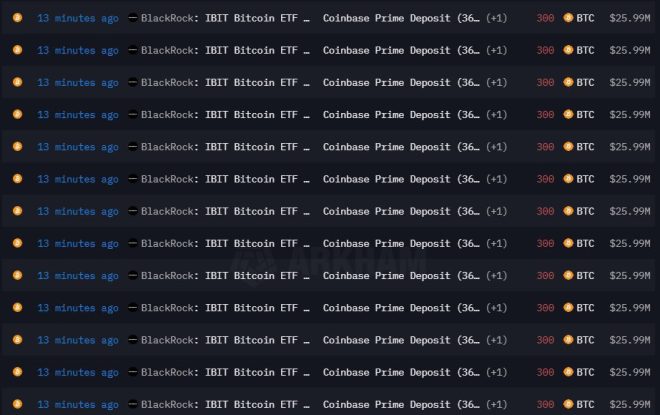

Blackrock are selling their bitcoin. pic.twitter.com/DMCWabM0FK

— Crypto Beast (@cryptobeastreal) June 5, 2025

BREAKING

In the world of finance and cryptocurrency, news travels fast, especially when it comes from a big player like BlackRock. Recently, a tweet from @cryptobeastreal caught the attention of many investors and enthusiasts alike, claiming that BlackRock are selling their bitcoin. This announcement raises numerous questions about the future of Bitcoin, the cryptocurrency market, and the implications of such a significant move by one of the largest asset management firms in the world.

Understanding BlackRock’s Position in the Crypto Market

BlackRock is no stranger to the world of cryptocurrency. As the largest asset manager globally, they have been exploring digital assets for some time. Their involvement in Bitcoin has drawn considerable attention, especially from institutional investors looking to enter the crypto space. But why would they decide to sell their Bitcoin holdings now? What does this mean for the cryptocurrency market?

The Rise of Bitcoin

Bitcoin has been on an incredible journey since its inception in 2009. Initially dismissed by many as a fleeting trend, it has now established itself as a legitimate asset class. The appeal of Bitcoin lies in its decentralized nature, limited supply, and potential as a hedge against inflation. As more institutional players like BlackRock entered the market, Bitcoin’s legitimacy grew, attracting a broader audience.

Why Is BlackRock Selling Their Bitcoin?

There could be various reasons behind BlackRock’s decision to sell their Bitcoin holdings. One potential factor could be the current market conditions. Bitcoin’s price can be notoriously volatile, and a significant player like BlackRock may be looking to capitalize on their investment while the price is favorable. Additionally, they might be reallocating funds to other emerging assets or sectors that they believe have more growth potential.

It’s also worth considering the regulatory landscape surrounding cryptocurrencies. Increased scrutiny from regulators could make it more challenging for institutional investors to hold digital assets. BlackRock’s move might be a strategic decision to navigate these challenges more effectively.

The Impact on the Cryptocurrency Market

When a giant like BlackRock makes a significant move like selling Bitcoin, it can have ripple effects throughout the cryptocurrency market. Investors often look to such firms for guidance, and this action could lead to increased panic selling or a shift in market sentiment. The news of BlackRock selling their Bitcoin could create uncertainty among retail investors, prompting them to reevaluate their positions.

Market Reactions

Since the announcement, Bitcoin’s price has shown signs of fluctuation, with traders reacting to the news. Historically, major sell-offs by large institutions can lead to short-term price declines. However, it is essential to view these events within the broader context of the market. Bitcoin has shown resilience in the past, often bouncing back after significant sell-offs.

Institutional Investment Trends

BlackRock’s decision may also signal a shift in institutional investment trends. While some firms might be pulling back on their Bitcoin investments, others could see this as an opportunity to buy at lower prices. The cryptocurrency market is still in its infancy, and many believe that the long-term potential of Bitcoin remains strong, even amid short-term volatility.

What Should Investors Do?

For investors watching this situation unfold, it’s crucial to stay informed and avoid making hasty decisions based on headlines. Here are a few tips to consider:

- Do Your Research: Keep an eye on market trends and analyze the reasons behind significant moves like BlackRock’s sale.

- Diversify Your Portfolio: Consider diversifying your investments to mitigate risks associated with cryptocurrency volatility.

- Stay Calm: Market reactions to news can often be exaggerated. Take a deep breath and think critically before making any moves.

The Future of Bitcoin and Institutional Investment

The cryptocurrency landscape is continually evolving, and the actions of major players like BlackRock can influence its direction. While some investors may interpret BlackRock’s decision to sell as a bearish signal, others might view it as a strategic repositioning in a rapidly changing market. The future of Bitcoin remains uncertain, but its potential as a transformative financial asset is undeniable.

Continued Interest in Digital Assets

Despite the sale, BlackRock’s previous interest in Bitcoin ETFs (exchange-traded funds) suggests that their overall stance on cryptocurrencies may not be entirely negative. They recognize the growing demand for digital assets and the potential for innovation in the sector. It is likely that BlackRock will continue to explore opportunities in this space, whether through Bitcoin or other cryptocurrencies.

The Role of Regulation

As the cryptocurrency market matures, regulatory developments will play a critical role in shaping institutional participation. BlackRock’s decision to sell could be influenced by regulatory pressures or uncertainty surrounding the future of Bitcoin and other digital currencies. Investors should keep an eye on regulatory news, as it can significantly impact market dynamics and investor sentiment.

Final Thoughts

BlackRock’s announcement that they are selling their Bitcoin has undoubtedly sent shockwaves through the cryptocurrency community. The reasons behind this decision are multifaceted, and its implications could shape the future of Bitcoin and institutional investment in digital assets. As always, the key for investors is to stay informed, remain level-headed, and make decisions based on thorough research rather than emotional reactions. The world of cryptocurrency is filled with opportunities, and understanding the landscape will allow investors to navigate it more effectively.

In the end, whether you’re a seasoned investor or just starting in the crypto world, keeping your finger on the pulse of these developments is essential. The cryptocurrency market is filled with surprises, and every piece of news, like BlackRock’s latest move, can serve as an opportunity to learn and grow your investment strategy.