Trump’s Shocking Proposal: Abolish Debt Limit to Avert Economic Disaster!

debt ceiling reform, economic policy implications, Trump financial strategy

—————–

Trump Proposes to Eliminate the Debt Limit to Avert Economic Crisis

In a significant political development, former President Donald trump has suggested that the United States should entirely abolish the federal debt limit. This statement comes amid ongoing debates about economic stability, fiscal responsibility, and the management of national debt. As economic uncertainties loom, Trump’s proposal raises pertinent questions about the implications of such a drastic policy change.

Understanding the Debt Limit

The debt limit, or debt ceiling, is a cap set by Congress on the amount of money that the federal government is allowed to borrow. Once this limit is reached, the government cannot issue any more Treasury bonds, bills, or notes. This situation can lead to a government shutdown or even a default on its obligations if Congress does not raise or suspend the debt ceiling in time.

Historically, debates around the debt limit have been contentious, often leading to political standoffs. Critics of the debt ceiling argue that it creates unnecessary economic uncertainty and poses risks to financial markets. Proponents, however, view it as a critical tool for enforcing fiscal discipline and accountability in government spending.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Trump’s Stance on the Debt Limit

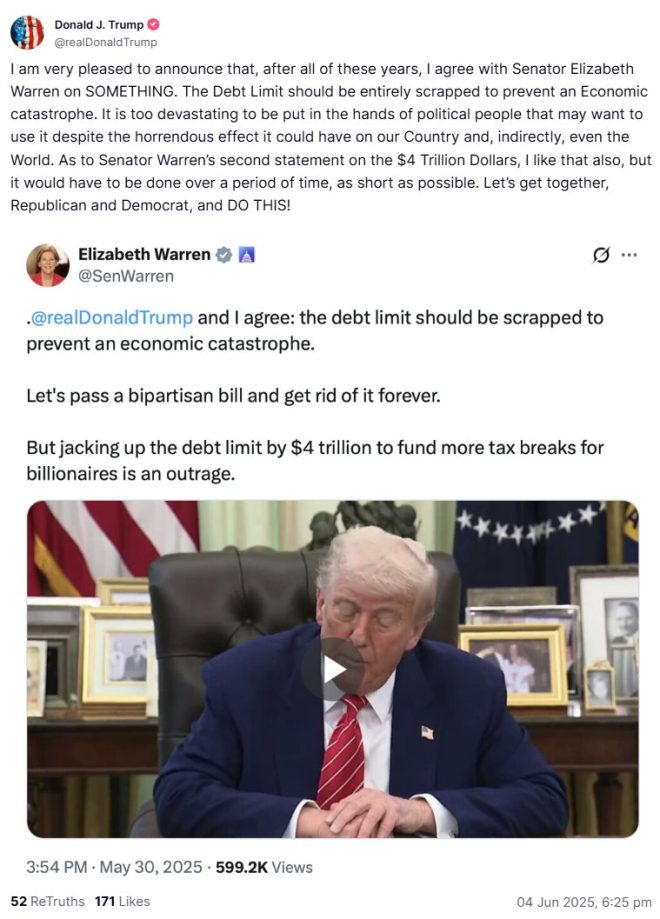

In a recent tweet, Trump emphasized the need to scrap the debt limit altogether to prevent what he termed an "economic catastrophe." His stance suggests that the current framework of the debt ceiling could exacerbate economic challenges, particularly in times of crisis.

Trump’s argument is rooted in the idea that the government needs the flexibility to manage its finances effectively, especially during economic downturns. By removing the debt ceiling, he believes that the government could ensure stability and continued funding for essential services without the fear of hitting an arbitrary borrowing limit.

Potential Economic Implications

The implications of eliminating the debt limit are profound. Advocates of Trump’s proposal argue that it could lead to a more robust economy, as it would allow the government to respond more effectively to economic crises. This flexibility could enable increased spending on infrastructure, social programs, and other initiatives aimed at stimulating growth.

However, critics warn that scrapping the debt limit could lead to unchecked government borrowing, potentially resulting in inflation, higher interest rates, and increased national debt. A growing national debt could jeopardize the country’s financial stability and lead to a loss of confidence among investors.

The Political Landscape

Trump’s proposal has significant political ramifications. The issue of the debt limit is often a flashpoint between Democrats and Republicans. Many Democrats have traditionally supported raising the debt limit to ensure that the government can meet its obligations, while some Republicans have used it as a bargaining chip to push for spending cuts.

By advocating for the elimination of the debt limit, Trump is positioning himself against a longstanding political norm. This move could resonate with his base, who may view it as a bold stance against what they perceive as government overreach and inefficiency. Conversely, it could alienate more moderate Republicans and independents who may view the proposal as fiscally irresponsible.

Economic Experts Weigh In

Economic experts have expressed mixed opinions on Trump’s proposal. Some economists argue that eliminating the debt limit could reduce the likelihood of government shutdowns and defaults, which have historically led to market volatility. These experts suggest that a more flexible borrowing framework could enhance the government’s ability to respond to economic emergencies, such as recessions or natural disasters.

On the other hand, many economists caution against the potential risks of removing the debt ceiling. They argue that without a limit, there would be less incentive for fiscal responsibility, leading to unsustainable levels of debt. Critics advocate for a balanced approach that involves both responsible spending and a clear framework for managing the national debt.

Public Reaction

Public reaction to Trump’s proposal has been varied. Supporters argue that the current debt ceiling process is outdated and counterproductive, advocating for a more modern approach to fiscal policy. They believe that the government should prioritize economic stability and growth over arbitrary limits on borrowing.

Meanwhile, opponents express concern about the long-term consequences of such a policy change. Many citizens are already wary of rising national debt and its potential implications for future generations. The debate surrounding this issue is likely to intensify as more people engage in discussions about fiscal responsibility, economic growth, and governmental accountability.

The Road Ahead

As the political landscape continues to evolve, the debate over the debt limit is far from settled. Trump’s proposal to eliminate the debt ceiling will undoubtedly spur discussions within Congress and among the American public. Lawmakers will need to weigh the potential benefits of greater flexibility against the risks of increased borrowing and fiscal irresponsibility.

Furthermore, economic conditions will play a significant role in shaping this discourse. If the economy experiences downturns or instability, the urgency to address the debt limit could intensify, pushing policymakers to consider radical changes to current practices.

Conclusion

In conclusion, Donald Trump’s recent proposal to scrap the debt limit is a bold and controversial move that could reshape the future of fiscal policy in the United States. While the idea of eliminating the debt ceiling may appeal to some as a means of ensuring economic stability, it also raises critical questions about fiscal responsibility and long-term economic health. As discussions continue, the nation will be watching closely to see how this debate unfolds, particularly in the context of ongoing economic challenges and political dynamics. The implications of this proposal could resonate well beyond the immediate future, influencing how the government manages its finances for generations to come.

BREAKING: Trump says the debt limit should be entirely scrapped to prevent an economic catastrophe pic.twitter.com/zN7t24cJT7

— unusual_whales (@unusual_whales) June 4, 2025

BREAKING: Trump says the debt limit should be entirely scrapped to prevent an economic catastrophe pic.twitter.com/zN7t24cJT7

— unusual_whales (@unusual_whales) June 4, 2025

BREAKING: Trump says the debt limit should be entirely scrapped to prevent an economic catastrophe pic.twitter.com/zN7t24cJT7

— unusual_whales (@unusual_whales) June 4, 2025

In a surprising move, former President Donald Trump has thrown his hat into the ring regarding the ongoing debate about the national debt limit. His recent statement, claiming that the debt limit should be entirely scrapped to avert an economic catastrophe, has stirred up conversations across various platforms—from news outlets to social media. But what does this really mean, and why is it such a hot topic? Let’s dive into the implications of scrapping the debt limit and what it might mean for the economy.

Understanding the Debt Limit

The debt limit, also known as the debt ceiling, is a cap set by Congress on how much debt the federal government can carry at any given time. Essentially, it restricts how much money the government can borrow to meet its existing legal obligations, which include funding for social security, military salaries, interest on the national debt, and other federal programs. When the government reaches this limit, Congress has to take action—either by raising the cap or suspending it altogether. Failing to do so could lead to severe consequences, including defaulting on loans.

Trump’s Bold Proposal

Trump’s assertion to completely eliminate the debt limit is bold and controversial. His argument is rooted in the idea that the current cap hampers the government’s ability to respond effectively to economic crises. By scrapping the debt limit, he believes that the government could act more decisively during downturns, thus preventing economic catastrophes. This perspective taps into a broader debate about fiscal policy and government spending, especially in times of crisis.

The Economic Implications

So, what would happen if the debt limit were scrapped? Proponents argue that it could provide more flexibility to the government in managing economic challenges. For example, during a recession, the government could ramp up spending to stimulate the economy without the constant fear of exceeding the debt limit. However, critics warn that removing this cap could lead to reckless spending and increase the national debt to unsustainable levels. The concern is that without a limit, there might be less incentive for fiscal responsibility.

Historical Context

To understand the potential ramifications of scrapping the debt limit, it’s essential to look at the historical context. The debt ceiling has been raised numerous times in the past, often accompanied by intense political debates. Each time Congress faces the decision to raise the limit, it brings anxiety about fiscal responsibility and the long-term implications of increasing national debt. For instance, during the Obama administration, the debt ceiling was raised multiple times, which sparked debates about government spending and fiscal policy. Similarly, Trump himself faced challenges regarding the debt limit during his presidency, raising important questions about how to balance economic growth and fiscal responsibility.

Public Opinion and Political Ramifications

Trump’s recent comments are likely to resonate with his base, who may view his proposal as a means to prioritize economic growth over fiscal constraints. However, public opinion on the debt limit is mixed. Many Americans are concerned about the national debt and its implications for future generations. Polls show that while some support increased government spending to stimulate the economy, others fear that eliminating the debt limit could lead to financial instability.

Potential Alternatives to Scrapping the Debt Limit

Instead of completely abolishing the debt limit, some experts suggest alternatives that could provide the necessary flexibility while still maintaining some fiscal discipline. For instance, Congress could consider implementing a more dynamic debt ceiling that adjusts based on economic indicators like GDP growth or inflation rates. This approach could allow for more responsive fiscal policy without completely abandoning the concept of a debt limit.

The Role of the Federal Reserve

The Federal Reserve also plays a crucial role in managing the economy and the national debt. If the debt limit were scrapped, the Fed would need to navigate a new landscape where government spending could theoretically increase without restrictions. This could lead to inflationary pressures if not managed carefully. The Fed’s dual mandate—to promote maximum employment and stable prices—would become even more challenging in a scenario where government spending isn’t capped.

Looking Ahead: What’s Next?

As the debate continues, it’s clear that Trump’s comments have reignited discussions about fiscal policy and the national debt. Whether or not Congress will seriously consider scrapping the debt limit remains to be seen. However, it’s essential for citizens to stay informed and engaged in these discussions, as they have a direct impact on the economy and the future of financial stability in the country.

Conclusion

In summary, Trump’s proposal to eliminate the debt limit is a significant point of discussion with potential implications for the economy. While the idea might offer some flexibility in times of crisis, it also brings forth concerns about financial responsibility and the long-term impact of unchecked government spending. As we navigate these complex discussions, it’s vital to consider both the pros and cons to ensure a balanced approach to fiscal policy.

Staying informed about these issues, understanding the historical context, and engaging in public discourse will be crucial as we move forward in tackling economic challenges. Whether you agree with Trump’s proposal or not, the conversation surrounding the debt limit is essential for shaping the future of our nation’s financial health.