Trump’s Shocking Proposal: Abolish U.S. Debt Limit to Avert Economic Disaster!

debt limit reform, economic stability 2025, Trump policy impact

—————–

BREAKING news: Trump Calls for Scrapping the U.S. Debt Limit

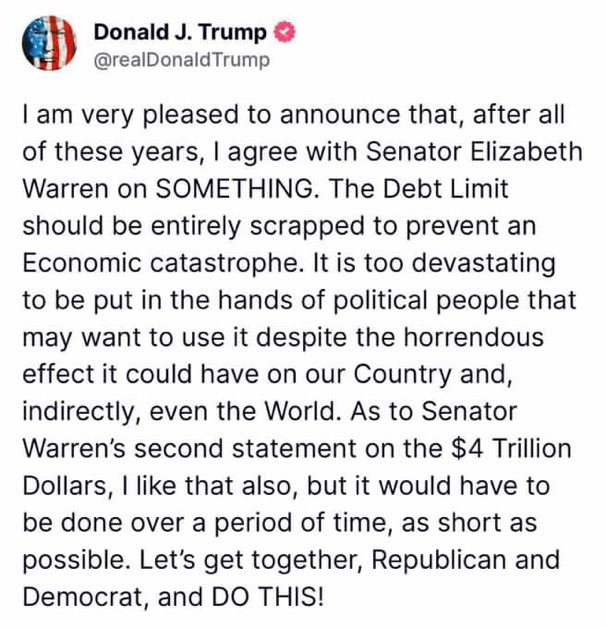

In a surprising turn of events, former President Donald trump has made headlines by advocating for the complete elimination of the U.S. debt limit. This bold statement comes amid ongoing discussions about the national debt and fiscal policy, and it has sparked a heated debate among economists, policymakers, and the public alike.

The Context of the Debt Limit Debate

The debt limit, or debt ceiling, is a cap set by Congress on the amount of money the federal government is allowed to borrow. It has been a contentious issue in American politics for years, often leading to standoffs between Democrats and Republicans. Critics argue that the debt limit can act as a hindrance to economic stability, while proponents believe it serves as a necessary check on government spending.

Trump’s assertion that the debt limit poses a threat of “economic catastrophe” highlights the urgency of the matter. He contends that the arbitrary nature of the debt ceiling can lead to unnecessary fiscal crises, including government shutdowns and financial instability in the markets. By eliminating the debt limit entirely, Trump believes that the government would have greater flexibility to manage its finances and respond to economic challenges without the looming threat of default.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Implications of Scrapping the Debt Limit

If the debt limit were to be scrapped entirely, it could lead to several significant implications for the U.S. economy. Proponents of this move argue that it would allow for more robust government spending during times of economic downturn, such as during a recession or a crisis like the COVID-19 pandemic. This increased spending could stimulate the economy and promote job growth.

However, opponents raise concerns about the potential for unchecked government spending. Without a debt limit, there may be less incentive for fiscal responsibility, leading to ballooning deficits and increased national debt. Critics warn that this could have long-term consequences, including higher taxes for future generations and potential inflationary pressures.

Economic Experts Weigh In

The economic community is divided on Trump’s proposal. Some economists agree that scrapping the debt limit could prevent crises and promote economic stability. They argue that the current system is flawed, as it often leads to political brinkmanship that can disrupt financial markets and undermine investor confidence.

On the other hand, many experts caution against such a radical change. They emphasize the importance of maintaining a responsible fiscal policy and the need for checks and balances to prevent excessive government borrowing. Critics argue that removing the debt ceiling could lead to fiscal irresponsibility and a lack of accountability in government spending.

Political Reactions

Trump’s call to eliminate the debt limit has elicited strong reactions from both sides of the political spectrum. While many of his supporters praise the move as a necessary step towards economic reform, critics within the republican Party caution against abandoning fiscal conservatism. Some Democrats also express skepticism, fearing that it could lead to unrestrained spending without proper oversight.

As the debate unfolds, lawmakers will need to consider the potential benefits and risks of eliminating the debt limit. The discussions will undoubtedly be complex, with various stakeholders pushing for their interests and perspectives to be heard.

The Future of U.S. Fiscal Policy

As the nation grapples with its fiscal policy, Trump’s proposal could set the stage for a broader conversation about the role of government in managing the economy. The ongoing challenges of national debt, economic growth, and fiscal responsibility will require careful consideration and collaboration among lawmakers.

In the coming weeks, it is likely that the topic of the debt limit will dominate headlines as politicians and economists weigh the pros and cons of Trump’s suggestion. The implications of this debate will not only impact current financial policies but could also shape the future of U.S. economic strategy for years to come.

Conclusion

In summary, Donald Trump’s recent call to scrap the U.S. debt limit entirely has reignited discussions about fiscal policy and economic strategy. While some view this as a necessary step towards avoiding economic catastrophe, others express concern about the potential consequences of such a move. As the debate unfolds, it will be essential for lawmakers and economic experts to engage in open dialogue to navigate the complexities of national debt and government spending. The outcome of this discussion could have lasting implications for the U.S. economy and its fiscal future.

Stay tuned for further updates as this story develops and the political landscape surrounding the debt limit continues to evolve.

BREAKING TRUMP JUST CALLED FOR SCRAPPING THE U.S. DEBT LIMIT ENTIRELY

SAYING IT POSES A THREAT OF ECONOMIC CATASTROPHE. https://t.co/KZvUBX8UMR

BREAKING TRUMP JUST CALLED FOR SCRAPPING THE U.S. DEBT LIMIT ENTIRELY

In a surprising move that has sent shockwaves through the political landscape, former President Donald Trump has proposed the complete elimination of the U.S. debt limit. According to Trump, this debt ceiling poses a significant threat of economic catastrophe, stirring up discussions about the implications of such a bold suggestion. With many Americans already feeling the pinch from rising inflation and economic uncertainty, the idea of scrapping the debt limit raises crucial questions about fiscal responsibility and economic stability.

SAYING IT POSES A THREAT OF ECONOMIC CATASTROPHE

Trump’s assertion that the debt limit could lead to an economic disaster isn’t entirely unfounded. The debt ceiling is a legislative cap on the amount of national debt that can be incurred by the U.S. Treasury. When the government reaches this limit, it can no longer issue new debt, which can lead to severe consequences, including a potential default. Defaulting on government debt could trigger a financial crisis, destabilizing markets and severely impacting the economy. Trump’s call to eliminate the debt limit aims to prevent such a scenario, arguing that it would allow for more flexibility in fiscal policy and government spending.

Understanding the U.S. Debt Limit

The U.S. debt limit has been a contentious issue for decades. It was first established in 1917, initially allowing the Treasury to issue bonds without specific congressional approval. However, as the government continued to borrow to fund various initiatives, the need for a debt ceiling became apparent. The limit has been raised numerous times, often accompanied by heated debates in Congress. Critics argue that the debt limit is an arbitrary constraint that hampers the government’s ability to respond effectively to economic challenges, while supporters contend that it is a necessary mechanism to promote fiscal discipline.

The Economic Implications of Scrapping the Debt Limit

Eliminating the debt limit could have profound implications for the economy. On one hand, it could provide the government with the flexibility to respond to crises without the constant threat of reaching the borrowing limit. In times of economic downturn, this could allow for increased spending on social programs and infrastructure projects, potentially stimulating growth. On the other hand, without a debt ceiling, there may be less incentive for the government to manage its finances responsibly, leading to unchecked borrowing and long-term fiscal challenges.

What Experts Are Saying

Economists and financial experts have mixed opinions on Trump’s proposal. Some argue that scrapping the debt limit could lead to greater economic stability, while others warn about the risks of increased national debt. According to a report from the Brookings Institution, raising the debt ceiling does not lead to increased government spending. Instead, it simply allows the government to meet its existing financial obligations. However, others believe that without a cap on borrowing, the government may be more likely to incur unsustainable levels of debt.

Public Reaction to Trump’s Proposal

The public’s response to Trump’s call for eliminating the debt limit has been polarized. Supporters argue that it is a necessary step to ensure economic stability, while critics express concern over the potential for increased national debt. Social media platforms have been abuzz with opinions, memes, and debates, reflecting the highly charged nature of this issue. Many Americans are worried about how such a significant change could impact their financial futures, particularly with inflation rates already on the rise.

Political Ramifications

Trump’s proposal has also ignited a firestorm of controversy within the political arena. Democrats and Republicans alike are grappling with the implications of such a radical change to fiscal policy. Some GOP members are wary of the idea, fearing that it could lead to a loss of control over government spending and an increase in deficits. Meanwhile, Democrats see an opportunity to push for more expansive fiscal policies that could benefit their constituents. The debate over the debt limit is likely to intensify as both parties navigate the complex political landscape surrounding this issue.

What’s Next for U.S. Fiscal Policy?

The future of the U.S. debt limit remains uncertain. As the country grapples with economic challenges, including inflation and supply chain disruptions, policymakers will need to consider the best approach to managing the national debt. Trump’s call to eliminate the debt ceiling adds another layer to this ongoing debate and raises significant questions about the balance between fiscal responsibility and economic growth. Experts suggest that any changes to the debt limit should be carefully considered, taking into account the potential long-term consequences for the economy.

Conclusion: A Call for Thoughtful Deliberation

Trump’s proposal to scrap the U.S. debt limit entirely has sparked a critical conversation about the role of fiscal policy in ensuring economic stability. As we move forward, it’s essential for policymakers, economists, and the public to engage in thoughtful deliberation about the implications of such a significant change. The balance between promoting economic growth and maintaining fiscal responsibility is delicate, and any decisions made will have lasting effects on the nation’s financial health.

“`

This article provides a comprehensive overview of Trump’s proposal to eliminate the U.S. debt limit, engaging readers with an informal tone while incorporating key phrases and structured headings for SEO optimization.