Trump’s Bold Demand: Is the Fed Chair Ignoring America’s Economic Crisis?

Trump economic policy, Federal Reserve interest rates, Powell monetary policy critique

—————–

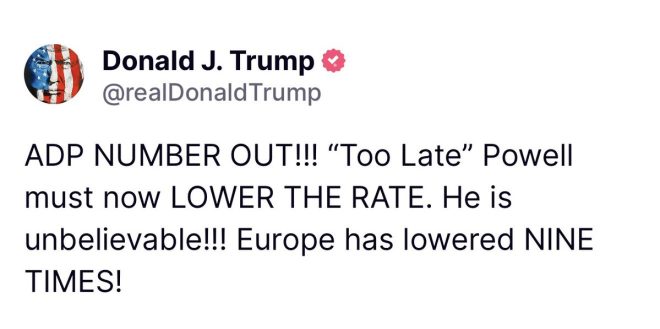

President trump Criticizes Fed Chair Powell and Calls for Rate Cuts

In a recent statement, former President Donald Trump has made headlines by publicly criticizing Federal Reserve Chair Jerome Powell, urging for immediate cuts to interest rates. Trump’s remarks come amidst ongoing concerns regarding the state of the U.S. economy, inflation rates, and the Federal Reserve’s monetary policies.

The Context of Trump’s Criticism

Trump’s comments are particularly significant given the current economic climate. The U.S. economy has been recovering from the impacts of the COVID-19 pandemic, but challenges such as inflation and supply chain disruptions continue to pose threats. As inflation rates rise, many are looking to the Federal Reserve to take decisive action. Trump’s demand for rate cuts reflects a broader concern among some economists and political figures regarding the pace of recovery and the need for supportive monetary policy.

The Implications of Interest Rate Cuts

Interest rates play a crucial role in the economy. When the Federal Reserve lowers rates, it typically makes borrowing cheaper for consumers and businesses, which can stimulate spending and investment. However, such actions can also lead to increased inflation if not carefully managed. Trump’s call for immediate rate cuts suggests he believes that the current rates are too high for a sustainable economic recovery.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The former president’s position on interest rates is not new; during his time in office, he frequently criticized the Fed for maintaining higher interest rates, asserting that they were hindering economic growth. His latest remarks signal a continued advocacy for more aggressive monetary policy to support economic growth.

The Response from Economists and Politicians

Trump’s call for rate cuts has sparked discussions among economists and political analysts. Many are evaluating the potential impacts of such a move on inflation and overall economic stability. While some agree that lower rates could provide a short-term boost to the economy, others caution that persistent inflation could undermine the benefits of rate cuts.

Critics of Trump’s stance argue that the Federal Reserve must prioritize long-term economic stability over short-term political pressures. They emphasize the importance of maintaining a careful balance between stimulating growth and controlling inflation. The Fed has a dual mandate to promote maximum employment and stable prices, and any decision to cut rates will require careful consideration of both objectives.

The Historical Context of Trump’s Relationship with the Fed

Trump’s relationship with the Federal Reserve has been contentious since he took office in 2017. He often expressed frustration with Powell’s decisions, particularly when the Fed raised interest rates. Trump believed that lower rates would benefit the economy and bolster his administration’s achievements, particularly in the lead-up to the 2020 presidential election.

This latest criticism of Powell aligns with Trump’s broader narrative of blaming external factors for economic challenges, a pattern he has followed throughout his political career. By targeting the Fed, Trump seeks to shift the focus away from other potential issues impacting the economy, such as global supply chain disruptions and labor shortages.

The Future of Federal Reserve Policy

As the Federal Reserve approaches its next policy meeting, Trump’s comments are likely to weigh on discussions among policymakers. The Fed is faced with the challenging task of navigating inflationary pressures while supporting economic recovery. While some members of the Fed may be sympathetic to calls for lower rates, others emphasize the need for caution in the face of rising prices.

The central bank’s independence is a critical aspect of its ability to make decisions based on economic data rather than political influence. Trump’s public criticism could complicate the Fed’s efforts to maintain that independence, particularly if it perceived as yielding to political pressure.

Conclusion

Trump’s recent remarks directed at Fed Chair Powell and his demand for immediate rate cuts highlight ongoing tensions between economic policy and political influence. As the U.S. economy continues to grapple with challenges, the debate surrounding interest rates and monetary policy will remain a focal point for both policymakers and the public.

In the coming weeks, all eyes will be on the Federal Reserve as it weighs the implications of Trump’s call for rate cuts and assesses the broader economic landscape. The balance between stimulating growth and controlling inflation will be key in shaping the future of U.S. monetary policy. As the situation unfolds, the interplay between economic indicators, political pressures, and Federal Reserve decisions will remain critical in determining the trajectory of the U.S. economy.

BREAKING: President Trump slams Fed Chair Powell, demands immediate rate cuts. https://t.co/dXaSKE1tAE

BREAKING: President Trump slams Fed Chair Powell, demands immediate rate cuts.

In the world of finance and politics, few things can shake the ground quite like a direct statement from a former president about the Federal Reserve. Recently, President Trump took to social media, expressing his discontent with Fed Chair Jerome Powell and calling for immediate rate cuts. This bold declaration has sent shockwaves through economic circles, prompting both praise and criticism from various stakeholders. Let’s dive deeper into what this means and why it matters.

Understanding the Context of Trump’s Demand

President Trump’s criticism of Powell isn’t just a random outburst; it’s rooted in the broader economic context. The Federal Reserve, which is responsible for managing the country’s monetary policy, has been under the microscope for its decisions regarding interest rates. Higher rates can slow down the economy by making borrowing more expensive, which can be detrimental to businesses and consumers alike. Trump’s demand for immediate rate cuts suggests he believes that easing monetary policy could stimulate economic growth, especially in the wake of ongoing inflation and supply chain issues.

With the midterm elections coming up, you can bet that economic performance will be a hot topic. The call for lower interest rates resonates with many voters who are feeling the pinch in their wallets. Moreover, it reflects Trump’s ongoing influence in the republican Party and his ability to shape the narrative around economic policy.

The Implications of Rate Cuts

When we talk about rate cuts, it’s essential to understand what this means for the average American. Lower interest rates can lead to cheaper loans, which can encourage spending and investment. For many families, this could mean more affordable mortgages or lower car loan payments. However, there’s a flip side to this coin.

While lower rates can spur economic growth, they can also contribute to inflation if the money supply grows too quickly. The Fed has been cautious about cutting rates in a high-inflation environment, as this could exacerbate the problem. Trump’s push for immediate cuts highlights a significant tension between stimulating growth and controlling inflation. It’s a delicate balancing act that the Fed must navigate carefully.

Trump’s Relationship with the Federal Reserve

Trump’s relationship with the Federal Reserve has always been a bit tumultuous. During his presidency, he frequently criticized Powell for not being aggressive enough with rate cuts. He often claimed that lower rates were essential for keeping the economy booming. His recent comments indicate that he hasn’t changed his stance.

This ongoing conflict raises questions about the independence of the Federal Reserve. The Fed is designed to operate free from political pressure, but Trump’s vocal demands put that independence to the test. It’s a complex issue that has implications not only for economic policy but also for the integrity of financial institutions in the U.S.

Reactions from the Financial Community

The financial community has been abuzz with reactions to Trump’s demands. Some analysts and economists argue that immediate rate cuts could be beneficial, especially for sectors like housing and consumer lending. They believe that easing monetary policy could help rejuvenate a slowing economy.

On the other hand, many financial experts warn against such drastic measures. They argue that cutting rates too quickly could lead to higher inflation, which would ultimately harm the very consumers Trump aims to help. The Fed has a tough job ahead, trying to sift through the noise and make decisions that will best serve the economy.

The Political Ramifications

Trump’s call for rate cuts isn’t just an economic issue; it’s a political one as well. By vocally criticizing Powell, Trump is positioning himself as a champion for the everyday American who is feeling the economic strain. This could bolster his support among voters who are struggling financially, especially in key swing states.

Moreover, his comments could influence Republican candidates who are running in the upcoming elections. They may feel pressured to adopt similar rhetoric, aligning themselves with Trump’s views on economic policy. This could lead to a shift in how the party approaches monetary policy moving forward.

What’s Next for the Federal Reserve?

In response to Trump’s demands and the broader economic landscape, the Federal Reserve faces a challenging decision. They must weigh the potential benefits of rate cuts against the risks of inflation. The upcoming meetings will likely be critical as they assess economic indicators and gauge the impact of their policies on the American public.

The Fed’s decisions will also be closely scrutinized by both political allies and opponents of Trump. If they choose to cut rates, they might be seen as bowing to political pressure. Conversely, maintaining higher rates could invite criticism from those who agree with Trump’s perspective. It’s a no-win situation, and the Fed will have to carefully navigate these waters.

How Citizens Can Prepare

For the average American, the uncertainty surrounding interest rates can be stressful. If you’re worried about how potential rate cuts could impact your finances, it’s a good time to reassess your financial situation. Consider locking in low-interest rates on loans while they’re still available, or paying down high-interest debt.

Staying informed about economic trends and the Fed’s decisions can also empower you to make better financial choices. Understanding the implications of Trump’s demands for rate cuts can help you navigate this complex environment and make informed decisions about your money.

Final Thoughts on Trump’s Demands

President Trump’s recent statement demanding immediate rate cuts from Fed Chair Powell has reignited the ongoing debate about monetary policy in the United States. As the economy faces various challenges, the implications of these demands will be felt across multiple sectors. Whether or not the Fed will heed Trump’s call remains to be seen, but one thing is certain: the interplay between politics and economics will continue to shape the financial landscape in the coming months.

So, as we watch this drama unfold, it’s essential to stay engaged and informed. The decisions made by the Federal Reserve now could have lasting effects on the economy and your personal finances.