Trump Demands Urgent Rate Cuts from Powell: Economic Chaos Looms Ahead!

Trump economic policy, Federal Reserve interest rates, Powell monetary policy action

—————–

Breaking news: Trump Calls for Immediate Rate Cuts by Powell

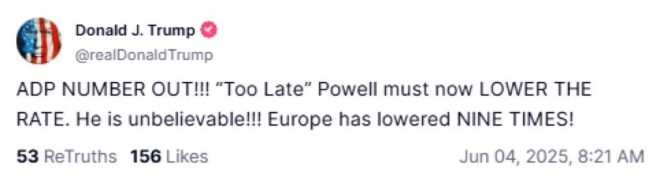

In a recent tweet that has sparked widespread discussion and speculation, former President Donald trump has publicly urged Federal Reserve Chairman Jerome Powell to lower interest rates immediately. This call comes amidst ongoing economic uncertainties and reflects Trump’s consistent stance on monetary policy during his presidency and beyond.

The Context of Trump’s Statement

Trump’s tweet, which was shared by the Twitter user Crypto Rover, emphasizes the urgency of the situation, suggesting that cutting rates could stimulate economic growth and alleviate financial pressures. The former president, known for his controversial and often direct communication style, is leveraging the platform to influence economic policy discussions at a critical time.

Understanding the Implications of Lower Interest Rates

Lowering interest rates can have significant implications for the economy. It typically leads to cheaper borrowing costs for individuals and businesses, encouraging spending and investment. This, in turn, can boost economic activity and potentially lead to job growth. However, it also raises concerns about inflation and the long-term impacts on the economy’s health.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Historical Context of Trump’s Views on Monetary Policy

During his presidency, Trump frequently criticized the Federal Reserve’s policies, particularly when he felt that interest rates were too high. He argued that lower rates were necessary to foster economic growth and maintain competitive advantages in global markets. His latest statement reflects a continuation of this narrative, as he seeks to influence Powell’s decisions during a period marked by economic volatility.

The Role of the Federal Reserve

The Federal Reserve plays a crucial role in managing the U.S. economy through monetary policy. Its decisions on interest rates can have far-reaching effects not only within the U.S. but also globally. Powell, as the current chairman, faces the challenge of balancing the need for economic growth with the risk of inflation, especially in light of recent economic trends.

Reactions to Trump’s Call for Rate Cuts

Reactions to Trump’s tweet have been mixed, with some supporters agreeing that lower rates could provide a much-needed boost to the economy. Critics, on the other hand, warn that such moves may exacerbate inflationary pressures and lead to long-term economic instability. Analysts and economists are closely monitoring the situation, as any changes in policy could have significant implications for markets and consumers alike.

The Broader Economic Landscape

The backdrop to Trump’s statement includes a complex economic landscape characterized by fluctuating inflation rates, labor market dynamics, and ongoing geopolitical tensions. The Federal Reserve’s decisions in the coming months will be critical in navigating these challenges. As Trump continues to voice his opinions on monetary policy, the interplay between political influence and economic decision-making remains a focal point for analysts.

Conclusion

Trump’s recent call for immediate interest rate cuts by Jerome Powell is a significant development in the ongoing discussion about U.S. monetary policy. As the former president continues to advocate for lower rates, the implications of such actions will be closely watched by economists, investors, and policymakers. The balance between stimulating economic growth and managing inflation will remain a key challenge for the Federal Reserve in the months ahead.

This emerging narrative surrounding Trump’s influence on economic policy highlights the intersection of politics and finance, as stakeholders consider the potential impacts of rate changes on everyday Americans and the broader economy.

BREAKING:

TRUMP SAYS POWELL MUST LOWER RATES NOW! pic.twitter.com/hNsoaQsN4b

— Crypto Rover (@rovercrc) June 4, 2025

BREAKING:

TRUMP SAYS POWELL MUST LOWER RATES NOW!

In a surprising twist that has sent ripples through financial markets, former President Donald Trump has made headlines with a bold statement urging Federal Reserve Chairman Jerome Powell to lower interest rates immediately. This call for action has sparked conversations among economists, investors, and everyday citizens, as many wonder how it could impact the economy and their financial futures.

The Context Behind Trump’s Statement

Interest rates play a crucial role in the economy, influencing everything from mortgage rates to business loans. When rates are high, borrowing becomes more expensive, which can slow down consumer spending and business investment. Conversely, lower rates can stimulate economic growth by encouraging spending and investment. Trump’s insistence on lowering rates now may stem from a desire to boost a lagging economy, especially as concerns over inflation and recession loom large.

On June 4, 2025, Trump took to Twitter to express his views, stating, “POWELL MUST LOWER RATES NOW!” This tweet, shared by @rovercrc, highlights his urgency and the expectation that the Federal Reserve act swiftly to prevent further economic downturns. You can check out the original tweet here.

The Implications of Lowering Rates

So, what does it mean if the Federal Reserve decides to lower interest rates? For one, it could make borrowing cheaper for consumers and businesses. Imagine being able to secure a mortgage at a lower rate or getting a loan for your small business with less interest to pay back. This could lead to increased spending, which in turn could help stimulate economic growth.

However, there are potential downsides as well. Lowering rates can lead to inflation if too much money chases too few goods. Additionally, it might weaken the value of the dollar, which could impact international trade and investments. It’s a delicate balance that the Federal Reserve must navigate carefully.

Market Reactions to Trump’s Call

Financial markets reacted swiftly to Trump’s statement. Stocks surged as investors interpreted his call as a signal that the Fed might indeed lower rates soon. Many traders are keeping a close eye on upcoming Fed meetings and economic reports to gauge the likelihood of a rate cut. The volatility in the markets underscores how political statements can influence economic conditions.

Moreover, the bond market often reacts to these sentiments, with yields typically falling when investors expect rate cuts. Lower yields can be attractive for investors looking for safer assets, but they can also lead to increased borrowing costs for governments and corporations if rates remain low for extended periods.

The Political Landscape and Economic Policy

Trump’s comments are not just about economics; they are also deeply intertwined with politics. Many observers note that he is positioning himself as a voice for the average American, advocating for policies that could lead to immediate financial relief for families struggling to make ends meet. This strategy resonates with voters who prioritize economic stability and growth.

However, it’s essential to consider the broader implications of such a statement. The Federal Reserve operates independently of the government, and while political pressure can influence its decisions, it must ultimately base its actions on economic data and forecasts. This independence is crucial to maintaining trust in monetary policy.

What Should Investors Do?

If you’re an investor, you might be wondering how to respond to these developments. First, it’s crucial to stay informed about the Federal Reserve’s decisions. Look for signals in economic indicators like employment rates, inflation numbers, and GDP growth. These factors will provide context for any potential rate cuts.

Diversifying your investments can also be a smart strategy during uncertain times. Consider spreading your investments across various asset classes—stocks, bonds, real estate—to mitigate risk. Staying agile and ready to adjust your portfolio in response to market changes can help you navigate these turbulent waters.

The Future of Interest Rates

The future trajectory of interest rates remains uncertain. While Trump’s call for lower rates reflects a desire for immediate economic stimulation, the Federal Reserve must weigh that against potential long-term consequences like inflation. Many economists anticipate that any decision to lower rates will be gradual, with the Fed wanting to ensure that they are not stoking inflationary pressures.

As we move forward, the interplay between political statements and economic actions will be closely watched. The upcoming Federal Reserve meetings will be critical in determining the direction of interest rates and, consequently, the economy.

Public Sentiment and Economic Awareness

It’s fascinating to see how public sentiment is influenced by statements from political figures like Trump. Many people may not follow economic indicators closely, but when a familiar name calls for action, it sparks interest and discussion. This underscores the importance of communication in economics—how messages are conveyed can significantly impact public perception and behavior.

Engaging with economic news and understanding the implications of monetary policy is more crucial than ever. Whether you’re a casual observer or a seasoned investor, being informed can empower you to make better financial decisions.

Conclusion: What’s Next?

As we await the Federal Reserve’s next steps, it’s essential to stay engaged with the ongoing dialogue around interest rates and economic policy. Trump’s call for Powell to lower rates now serves as a reminder of the intersection between politics and economics. Whether or not the Fed responds to this pressure, the implications for consumers and investors alike will be significant.

In the end, economic health is a shared responsibility. By staying informed and proactive, we can all contribute to a more stable financial future. So, keep your eyes on the news, stay educated about economic trends, and remember that your voice matters in the conversations shaping our economy.