“May Jobs Shock: Just 37K Added—Is Stagflation Here and Panic Justified?”

job market trends, economic inflation impact, labor force analysis

—————–

ADP Employment Report: May 2025 Job Growth Disappoints

In a surprising turn of events, the ADP (Automatic Data Processing) report for May 2025 has revealed that only 37,000 new jobs were added in the U.S. economy, significantly below the anticipated forecast of 110,000. This disappointing figure has raised concerns about the state of the economy, with many analysts suggesting that the country may be on the brink of stagflation. As economic conditions tighten, both policymakers and the general public are left wondering the implications of these numbers for future growth and stability.

Understanding the ADP Employment Report

The ADP Employment Report is a crucial indicator of the health of the U.S. job market. It provides a monthly snapshot of the number of jobs added or lost in the private sector. This report is often seen as a precursor to the official employment data released by the Bureau of Labor Statistics (BLS) later in the month. While the ADP report is not as comprehensive as the BLS data, it is closely watched by economists, investors, and policymakers alike.

The disappointing job growth figure for May 2025 marks a significant departure from previous months, where job creation had been more robust. This sudden slowdown raises questions about the underlying factors contributing to this trend and whether it signals a broader economic downturn.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Implications of Stagflation

Stagflation is a term used to describe an economic condition characterized by stagnant economic growth, high unemployment, and rising inflation. This troubling combination poses a unique challenge for policymakers, as traditional measures to stimulate growth, such as lowering interest rates, may exacerbate inflationary pressures.

The recent job growth figures have led to increasing fears of stagflation taking hold in the U.S. economy. Several key factors contribute to these concerns:

- Rising Inflation: Inflation rates have been steadily climbing, driven by supply chain disruptions, increased consumer demand, and rising production costs. As prices rise, consumers may cut back on spending, leading to slower economic growth.

- Weak Job Creation: The significant miss in job creation suggests that businesses are hesitant to hire amid economic uncertainty. This reluctance can lead to higher unemployment rates, further contributing to the stagnation aspect of stagflation.

- Consumer Confidence: The combination of rising prices and stagnant wages can erode consumer confidence, impacting spending habits. When consumers are uncertain about their financial future, they are less likely to make significant purchases, which can lead to further economic slowdown.

Public Reaction and Concerns

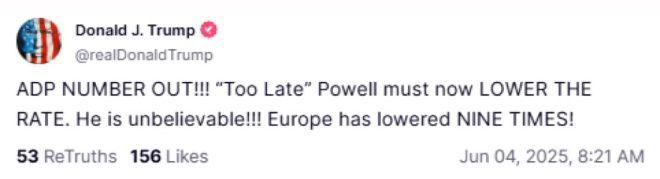

The reaction to the ADP report has been palpable, with many expressing concern about the potential for stagflation. On social media, individuals have taken to platforms like Twitter to voice their worries. One notable tweet from user @TheMaineWonk humorously captures the anxious sentiment: “And Grandpa is freaking out.” This lighthearted remark underscores a broader anxiety among the public regarding the economy’s direction.

As people reflect on the implications of the ADP report, there are calls for proactive measures to mitigate the potential onset of stagflation. Economists and financial experts are urging policymakers to consider a balanced approach that addresses both inflation and unemployment.

The Path Forward: What Can Be Done?

Addressing the challenges posed by a potential stagflation scenario requires a multifaceted approach. Here are some strategies that policymakers and economists might consider:

- Monetary Policy Adjustments: The Federal Reserve may need to carefully navigate interest rate adjustments to strike a balance between curbing inflation and supporting job growth. While raising rates can help control inflation, it can also stifle borrowing and investment.

- Fiscal Stimulus: Targeted fiscal stimulus measures aimed at low- and middle-income households can help boost consumer spending. By providing financial relief to those most affected by rising prices, policymakers can stimulate demand and support economic growth.

- Investment in Infrastructure: Investing in infrastructure projects can create jobs and stimulate economic activity. By prioritizing infrastructure development, the government can help address unemployment while also enhancing long-term economic productivity.

- Supply Chain Improvements: Addressing supply chain disruptions is crucial to mitigating rising costs and ensuring that businesses can operate efficiently. Policymakers can work with industry stakeholders to identify bottlenecks and implement solutions.

- Monitoring Economic Indicators: Ongoing monitoring of key economic indicators, including inflation rates, unemployment figures, and consumer confidence, will be essential in assessing the effectiveness of policy measures and making necessary adjustments.

Conclusion

The disappointing job growth figures reported by ADP for May 2025 have raised alarms about the potential for stagflation in the U.S. economy. As concerns mount, it is clear that proactive measures will be necessary to address the challenges posed by rising inflation and stagnant economic growth. Policymakers, businesses, and consumers must remain vigilant and adaptable as they navigate these turbulent economic waters. With the right strategies in place, it is possible to foster a more resilient economy that supports job growth and stability in the face of uncertainty.

In summary, the ADP report serves as a crucial reminder of the complexities of the modern economy and the need for coordinated efforts to ensure sustainable growth and prosperity for all.

ADP: Only 37,000 new jobs were added in May- a huge miss from the forecast of 110,000.

Stagflation is en route.

And Grandpa is freaking out. pic.twitter.com/NeXYr8j8Xj

— Maine (@TheMaineWonk) June 4, 2025

ADP: Only 37,000 New Jobs Were Added in May – A Huge Miss from the Forecast of 110,000

The latest report from ADP has sent shockwaves through the economic landscape, revealing that only **37,000 new jobs were added in May**. This disappointing figure stands in stark contrast to the forecasted **110,000**, sparking concerns about the state of the job market and what it means for the economy as a whole. So, what does this mean for you, me, and, yes, even Grandpa?

In the world of economics, numbers tell a story, and this report paints a picture that isn’t too rosy. The job market has always been a key indicator of economic health, and when the numbers fall short like this, it raises eyebrows. The fear of **stagflation** is becoming a hot topic again, and it’s not just the economists who are worried; everyday folks are starting to feel the pinch too.

Stagflation Is En Route

Stagflation—a term that combines stagnation and inflation—isn’t a situation anyone wants to see. It’s characterized by stagnant economic growth, high unemployment, and rising prices. Essentially, you’re stuck in a rut where the economy isn’t growing, jobs are disappearing, and the cost of living keeps rising. And with news like this from ADP, it feels like we’re headed down that path.

When you think about it, it’s a vicious cycle. High inflation means the cost of goods and services rises, making it harder for families to make ends meet. This, in turn, can lead to decreased consumer spending, which affects businesses and leads to job losses. It’s a downward spiral that can be tough to escape. With only **37,000 new jobs** added when we expected **110,000**, the alarm bells are ringing.

And Grandpa Is Freaking Out

Now, let’s talk about Grandpa. If there’s anyone who’s seen economic ups and downs, it’s the older generation. They remember the oil crises of the 1970s and the recessions that followed. So when they hear that **only 37,000 new jobs** were added in May, you can bet they’re worried. Grandpa might be sitting on his porch, shaking his head, wondering how it all went so wrong.

This anxiety isn’t just about numbers; it’s about the future. Many older individuals rely on fixed incomes, and with rising prices, their purchasing power diminishes. If the economy takes a nosedive, it could mean a tighter budget and fewer options for them. It’s not just about jobs; it’s about stability and the ability to enjoy retirement without financial stress.

The Broader Economic Implications

So, what’s next? The **ADP report** is just one piece of the puzzle. When you look at the bigger picture, you see that these job numbers are part of a broader economic narrative. Experts are now questioning the effectiveness of current economic policies and whether they’re doing enough to stimulate job growth.

With the Federal Reserve’s recent interest rate hikes aimed at curbing inflation, there’s a balancing act going on. The goal is to control rising prices without stifling job creation. But as we can see from the **ADP report**, the job market isn’t responding as hoped. If businesses are hesitant to hire due to economic uncertainty, we could see these job numbers continue to lag.

What Does This Mean for Job Seekers?

For those on the hunt for jobs, this report brings mixed messages. On one hand, the low job creation number may signal a tighter job market, but it could also mean that employers are getting more selective. It’s crucial for job seekers to stand out in this environment.

Networking, updating resumes, and honing skills are more important than ever. It might also be worth considering industries that are still hiring, even in tough times. Healthcare, tech, and renewable energy sectors often show resilience, even when the economy is shaky.

The Impact on Consumers

Consumers are likely to feel the effects of this news too. With only **37,000 new jobs** added, consumer confidence could take a hit. When folks feel uneasy about their job security, they tend to tighten their wallets. This can lead to decreased spending, which, as mentioned earlier, impacts businesses and job creation.

Inflation is already affecting daily life, from grocery bills to gas prices. If people start cutting back on spending, it could lead to even more economic stagnation. The relationship between consumer behavior and job growth is cyclical, and we could be at a tipping point.

Government Response and Economic Policy

In light of the **ADP report**, it’s likely we’ll see discussions around economic policy ramp up. Government officials may need to rethink strategies to stimulate job growth and combat rising prices. Whether it’s through tax incentives for businesses or increased funding for job training programs, action will be necessary to turn this ship around.

Economic policies need to adapt to the changing landscape. If the forecast of **110,000 new jobs** was overly optimistic, it’s time to reassess and recalibrate. The focus should be on sustainable growth that benefits everyone, not just the upper echelons of society.

Keeping an Eye on Future Trends

As we move forward, it’s essential to keep an eye on upcoming economic indicators. While one report shouldn’t set the tone for the entire year, it does highlight the importance of monitoring trends. Will job growth stabilize, or are we in for a longer stretch of uncertainty?

Investors and consumers alike should stay informed. Following credible sources for economic updates and analysis can help you make better decisions, whether you’re planning a budget, investing, or simply trying to navigate daily life.

The Takeaway

In summary, the recent **ADP report** revealing that only **37,000 new jobs were added in May**—a stark miss from the forecasted **110,000**—is a wake-up call for everyone. The looming threat of **stagflation** and Grandpa’s anxiety are not just anecdotes; they reflect real concerns about the economy’s direction.

As we navigate these uncertain waters, it’s important to remain vigilant, informed, and proactive. Whether you’re a job seeker, a consumer, or simply someone trying to make sense of the economic landscape, understanding these changes will be key to weathering the storm ahead. The next few months will be crucial, and staying engaged with economic trends will help you stay prepared for whatever comes next.

For more insights on economic trends and employment news, check out credible sources like [ADP Research Institute](https://www.adp.com) or [Bureau of Labor Statistics](https://www.bls.gov).