“Tesla’s China Surge: Is It Sustainable or Just a Bubble Waiting to Burst?”

Tesla China insurance growth, electric vehicle market trends, automotive industry performance 2025

—————–

Tesla China Insured Units: A Week of Impressive Growth

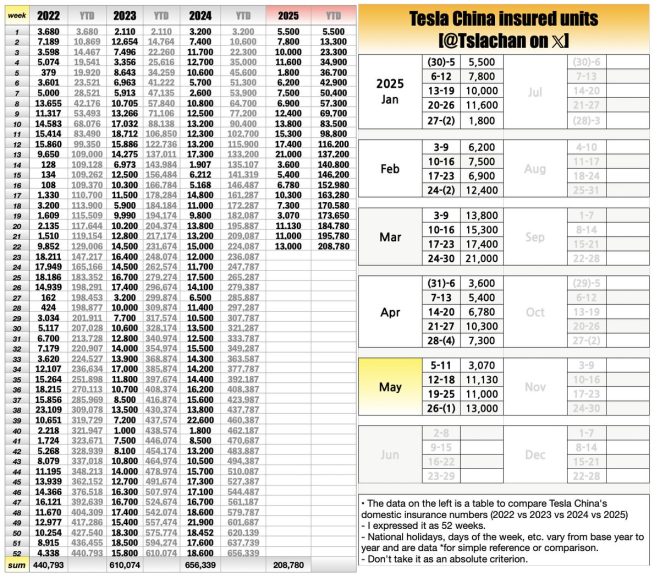

In recent news, Tesla has showcased remarkable growth in its insured units in China, demonstrating the company’s resilience and popularity in one of the world’s largest electric vehicle (EV) markets. The data shared by Tsla Chan on Twitter outlines the impressive numbers for Tesla’s insured units over the course of a week, highlighting a significant uptick in sales and interest.

Breakdown of Insured Units

From May 5 to June 1, Tesla China reported the following insured unit figures:

- May 5-11: 3,070 units

- May 12-18: 11,130 units

- May 19-25: 11,000 units

- May 26 – June 1: 13,000 units

This data reflects a +18.2% week-over-week growth, showcasing a strong demand for Tesla vehicles in China.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Factors Contributing to Growth

Several factors contribute to Tesla’s success in the Chinese market:

- Brand Reputation: Tesla has established itself as a leader in the electric vehicle industry, known for its innovative technology and high-performance vehicles. The brand’s reputation significantly influences consumer purchasing decisions.

- Government Support: The Chinese government has been advocating for EV adoption through various incentives, subsidies, and infrastructure investments. These initiatives make electric vehicles more accessible and appealing to consumers.

- Local Manufacturing: Tesla’s Gigafactory in Shanghai plays a pivotal role in its operations in China. By manufacturing vehicles locally, Tesla can reduce costs, improve supply chain efficiency, and cater to the growing demand more effectively.

- Diverse Product Line: Tesla offers a range of models, from the Model 3 to the Model Y, which appeals to different segments of the market. This diverse product offering enables the company to capture a broader audience.

- Technological Advancements: Tesla’s continuous innovation in battery technology and autonomous driving features enhances its vehicles’ attractiveness, providing consumers with cutting-edge technology.

Implications for Investors and the Market

The surge in insured units signals positive momentum for Tesla and could have significant implications for investors and the broader EV market. Here are a few considerations:

- Stock Performance: An increase in sales often correlates with improved stock performance. Investors are likely to view this growth as a bullish signal for Tesla’s stock, potentially driving up demand for shares.

- Market Leadership: As Tesla continues to dominate the EV market in China, it solidifies its position as a leader in the industry. This leadership not only enhances brand loyalty but also sets the stage for future growth and expansion.

- Competitive Landscape: The rise in Tesla’s insured units puts pressure on competitors in the EV space. Automakers such as NIO, Xpeng, and others will need to innovate and adapt to maintain market share.

- Global Implications: Tesla’s success in China is not just a localized phenomenon; it reflects broader trends in the global automotive industry. The growing acceptance of electric vehicles worldwide may lead to increased investments and advancements in EV technology.

Conclusion

Tesla’s recent growth in insured units in China is a testament to the company’s strong market presence and the increasing demand for electric vehicles. With a week-over-week increase of 18.2%, the figures indicate a positive trend for Tesla’s future in the Chinese market. As the EV landscape continues to evolve, Tesla remains at the forefront, driving innovation and setting benchmarks for competitors.

Investors and stakeholders should keep a close eye on these developments, as they could significantly influence market dynamics and investment strategies in the electric vehicle sector. Tesla’s ability to adapt and thrive in such a competitive environment will be crucial in maintaining its leadership position and ensuring sustained growth in the years to come.

$TSLA

BREAKING: Tesla China insured units5-11: 3,070

12-18: 11,130

19-25: 11,000

26-(1): 13,000* +18.2% WoW pic.twitter.com/5L35urXGGz

— Tsla Chan (@Tslachan) June 4, 2025

$TSLA BREAKING: Tesla China Insured Units

In recent news, Tesla has reported a significant uptick in its insured units in China, showcasing the company’s stronghold in the world’s largest automotive market. This update is particularly exciting for investors and enthusiasts alike, as it highlights the growing demand for electric vehicles (EVs) in the region. Let’s dive into the numbers that have everyone buzzing:

<May 2025>

From May 5th to 11th, Tesla saw 3,070 insured units. This figure may seem modest compared to later weeks, but it sets the stage for a remarkable growth trajectory. The following week, from May 12th to 18th, the number of insured units skyrocketed to 11,130. This jump indicates a surge in consumer interest and perhaps the success of Tesla’s marketing strategies in China.

Continuing this upward trend, from May 19th to 25th, the insured units were recorded at 11,000. While this shows a slight dip from the previous week, it is still a commendable figure that underlines Tesla’s consistent performance. Then, from May 26th to June 1st, the company achieved an impressive 13,000 insured units. This marks an overall increase of 18.2% week-over-week, which is a substantial growth rate and speaks volumes about Tesla’s operational efficiency and consumer appeal in China.

The Significance of These Numbers

For anyone keeping an eye on the EV market, these statistics are more than just numbers; they reflect Tesla’s adaptability and the growing acceptance of electric vehicles among Chinese consumers. With the Chinese government promoting EV adoption through various incentives, Tesla is well-positioned to capitalize on this opportunity.

What’s even more intriguing is how these figures correlate with the broader trends in the automotive industry. The demand for electric vehicles in China has surged, driven by a combination of environmental concerns and government policies aimed at reducing pollution. It’s no wonder that investors are keenly watching Tesla’s movements in this market.

Understanding the Market Dynamics

China is not just a market; it’s a battleground for automakers, especially in the EV sector. With local competitors like BYD and NIO also vying for market share, Tesla has to stay on its toes. The recent surge in insured units can be attributed to several factors, including Tesla’s strong brand recognition, innovative technology, and a growing network of Superchargers that make owning an EV more convenient.

Moreover, as consumers become increasingly eco-conscious, the shift towards sustainable energy solutions is inevitable. Tesla’s commitment to sustainability resonates with this demographic, making it a preferred choice among electric vehicle buyers in China.

Investor Implications

For investors, the news of Tesla’s growing insured units in China is a beacon of hope. The stock, represented by the ticker symbol $TSLA, has shown resilience and potential for growth, especially with the company’s expansion plans. With the latest data indicating a positive trend, many investors are optimistic about the stock’s future performance.

Furthermore, Tesla’s ability to adapt to market conditions and consumer preferences can instill confidence in its long-term growth. As the company continues to innovate and expand its product offerings, the potential for increased sales and profitability remains high.

Challenges Ahead

While the numbers are promising, Tesla is not without its challenges. Competition is fierce, and local manufacturers are stepping up their game. Additionally, global supply chain issues and regulatory hurdles can impact production and sales. Investors should remain cautious and keep an eye on these external factors that could affect Tesla’s growth trajectory.

The Road Ahead for Tesla in China

Looking forward, the outlook for Tesla in China appears bright. The company continues to invest heavily in its manufacturing capabilities, as seen with the expansion of Gigafactory Shanghai. This facility is crucial for meeting the growing demand for Tesla vehicles in the region. Furthermore, with the introduction of new models and innovations, Tesla aims to maintain its competitive edge.

As Tesla continues to ramp up its production and streamline its operations, we can expect even more impressive numbers in the coming weeks. Consumers are increasingly leaning towards electric vehicles, and Tesla is at the forefront of this transition. The company’s commitment to sustainability and innovation positions it well for future success in one of the most lucrative automotive markets in the world.

Conclusion: The Tesla Phenomenon in China

To sum it up, the recent surge in Tesla’s insured units in China signifies not just a momentary spike but a broader trend towards electric vehicle adoption. With a robust strategy and a growing consumer base, Tesla is set to lead the charge in the EV market. As investors and enthusiasts alike keep a close watch on these developments, it’s evident that Tesla’s story in China is just getting started.

“`