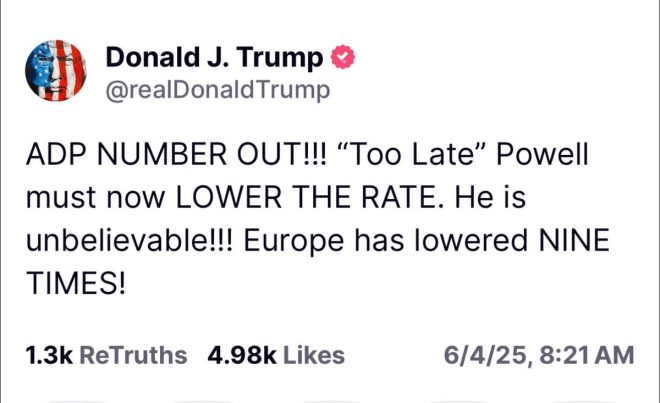

Europe Cuts Rates 9 Times: Is the Fed Sabotaging trump‘s Cost-Cutting Agenda?

interest rate policy, Federal Reserve critique, economic impact 2025

—————–

Interest Rate Policies in Europe vs. the United States: Understanding the Implications

In recent discussions surrounding financial policy, a striking contrast has emerged between the interest rate strategies of Europe and the United States. The European Central Bank (ECB) has implemented a series of interest rate reductions, totaling nine adjustments, aimed at stimulating economic growth. In stark contrast, Jerome Powell and the Federal Reserve have refrained from lowering interest rates even once, a decision that has stirred significant debate among economists, policymakers, and the public alike.

The Economic Landscape: Interest Rates and Their Importance

Interest rates play a critical role in shaping a country’s economic landscape. They influence borrowing costs for consumers and businesses, impacting spending, investment, and overall economic growth. Lower interest rates typically encourage borrowing and spending, which can help stimulate an economy, especially during periods of sluggish growth. Conversely, higher interest rates can lead to reduced spending and investment, potentially slowing economic growth.

Europe’s Approach: Nine Rate Cuts

The ECB’s decision to lower interest rates nine times reflects a proactive approach to managing economic challenges. These cuts aim to boost consumer spending and investment in the eurozone, providing a cushion against potential economic downturns. By making borrowing cheaper, the ECB hopes to stimulate economic activity, increase liquidity in the market, and ultimately foster a more robust economic environment.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The U.S. Stance: Maintaining Rates

On the other side of the Atlantic, the Federal Reserve, under the leadership of Jerome Powell, has opted for a more cautious approach. The decision to refrain from lowering interest rates has been interpreted by some as a lack of responsiveness to economic challenges facing the United States. Critics argue that this inaction could hinder economic growth and undermine President Trump’s agenda of reducing costs for American citizens.

Political Implications of Interest Rate Policies

The divergence in monetary policy between Europe and the United States has led to accusations of political motivations influencing the Federal Reserve’s decisions. Some observers argue that the Fed’s reluctance to lower rates is not merely an economic strategy but a politically charged decision meant to sabotage the Trump administration’s efforts to lower costs for Americans. This perspective suggests that monetary policy has become intertwined with political agendas, raising concerns about the independence of the Federal Reserve.

Calls for Reform: Ending the Federal Reserve

The growing frustration over the Federal Reserve’s policies has sparked a renewed call for reform, with some advocating for the abolition of the central banking system altogether. Critics argue that the Federal Reserve’s policies are not serving the best interests of the American public, and that a complete overhaul of the system is necessary to restore economic stability and accountability.

The Broader Economic Context

Understanding the implications of these interest rate policies requires a broader view of the global economic landscape. The interconnectedness of economies means that decisions made by the ECB and the Federal Reserve can have far-reaching effects. For instance, if interest rates remain high in the U.S., it could lead to a stronger dollar, impacting international trade dynamics and potentially exacerbating trade tensions.

The Impact on American Consumers

American consumers are directly affected by interest rate policies. High interest rates can lead to increased costs for mortgages, car loans, and credit cards, putting financial strain on households. In contrast, lower interest rates could ease this burden, allowing families to spend more on goods and services, ultimately driving economic growth. The question remains: will the Federal Reserve respond to the economic pressures faced by American consumers, or will it maintain its current stance of inaction?

The Future of U.S. Monetary Policy

As we look ahead, the future of U.S. monetary policy remains uncertain. The Federal Reserve faces a challenging balancing act of managing inflation, supporting economic growth, and navigating political pressures. With the presidential election approaching, monetary policy decisions will likely come under intensified scrutiny, as candidates seek to address the economic concerns of their constituents.

Conclusion: Navigating the Economic Divide

In summary, the differing approaches to interest rates in Europe and the United States highlight the complexities of monetary policy. While Europe has taken decisive action to lower rates, the Federal Reserve’s reluctance to follow suit raises questions about the motivations behind such decisions. As the economic landscape continues to evolve, it is crucial for policymakers to consider the impact of their actions on American consumers and the broader economy. The call for reform and greater accountability within the Federal Reserve reflects a desire for a monetary policy that prioritizes the needs of the American public, rather than political agendas.

This ongoing debate underscores the importance of understanding the intricate relationship between monetary policy, economic growth, and political influence. As the situation develops, it will be essential to monitor how these dynamics unfold and the implications they hold for the future of the U.S. economy.

– Europe has lowered interest rates 9 TIMES

– Jerome Powell and the Federal Reserve refuse to lower them for the United States even onceThis isn’t financial policy it’s sabotage of Trump’s agenda of lowering costs for Americans. This is 100% political

END THE FEDERAL RESERVE pic.twitter.com/vNjzx3lRPs

— Wall Street Apes (@WallStreetApes) June 4, 2025

Europe has lowered interest rates 9 TIMES

When we look across the Atlantic, it’s hard not to notice the economic strategies that Europe has been implementing. Recently, Europe has lowered interest rates a staggering nine times in an effort to stimulate its economy and make borrowing cheaper for businesses and consumers alike. This series of adjustments is aimed at encouraging spending, investment, and overall economic growth. But why is Europe taking this approach, and what does it mean for the United States?

In contrast, we find ourselves in a different situation here in the U.S. The Federal Reserve, under the leadership of Jerome Powell, has steadfastly refused to lower interest rates even once. This has sparked a lot of discussion and debate among economists, policymakers, and everyday Americans. The difference in monetary policy between Europe and the U.S. raises important questions about economic stability, growth, and the political implications of such decisions.

Jerome Powell and the Federal Reserve refuse to lower them for the United States even once

Jerome Powell’s tenure as the head of the Federal Reserve has been marked by a cautious approach to interest rates. While Europe has taken decisive action to lower rates, the Federal Reserve seems hesitant to follow suit. This reluctance can be attributed to various factors, including concerns about inflation, job growth, and the overall health of the economy.

Many critics argue that this stance doesn’t reflect a sound financial policy but rather an unwillingness to support the current administration’s agenda. The idea is that by keeping interest rates high, the Fed is effectively sabotaging attempts to lower costs for Americans, a key goal of Trump’s economic policy. It’s a contentious topic that has become increasingly politicized, with both sides of the aisle weighing in on the implications of these decisions.

This isn’t financial policy it’s sabotage of Trump’s agenda of lowering costs for Americans

As the debate rages on, one thing is clear: the refusal to lower interest rates is seen by some as a direct challenge to Trump’s economic agenda. The former president had consistently pushed for policies aimed at reducing costs for Americans, which included lower interest rates to stimulate spending and investment. The political ramifications of the Fed’s decisions are significant, as they can influence public perception and trust in financial institutions.

When we start to consider the broader implications, it becomes evident that economic policy is not just about numbers on a spreadsheet. It’s deeply intertwined with politics, public sentiment, and ultimately, the lives of everyday Americans. The Fed’s decisions impact mortgages, loans, and credit availability, which are all critical factors in determining the financial health of families across the country.

This is 100% political

In this environment, it’s hard to ignore the political undertones of the Federal Reserve’s decisions. Many Americans are beginning to feel that the Fed’s actions—or lack thereof—are politically motivated rather than grounded in sound economic principles. This perception is compounded by statements from various political figures who argue that the Fed is acting against the interests of the American people.

Critics have pointed to the Fed’s independence as a double-edged sword. While it allows for decisions to be made without political pressure, it can also lead to a disconnect between the Fed’s policies and the economic realities faced by average Americans. The notion that monetary policy is being influenced by political agendas rather than economic necessity is a troubling one that can lead to a loss of faith in the institution.

END THE FEDERAL RESERVE

The call to end the Federal Reserve has gained traction among certain groups who believe that the institution is no longer serving the public interest. The argument goes that a central bank which operates independently of political influence could better serve the needs of the economy. Critics argue that the current structure leads to decisions that are out of touch with the realities faced by everyday citizens.

Ending the Federal Reserve is a radical proposition, but it reflects a growing concern over the role of central banking in the U.S. economy. Advocates for change argue that restructuring or replacing the Fed could lead to more responsive and responsible monetary policy that aligns with the needs of the American people. However, such a shift would require careful consideration and a thorough understanding of the potential consequences.

As we watch the developments in monetary policy unfold, it’s essential to keep the dialogue open about how these decisions impact our lives. The contrasting approaches of Europe and the United States provide a fascinating lens through which we can examine the complex interplay between economic policy and political agendas. Whether you’re an economic expert or simply someone trying to make sense of it all, understanding these dynamics is crucial in today’s world.

In conclusion, the current financial landscape in the U.S. is shaped by a series of decisions that affect us all. The refusal to lower interest rates by the Fed contrasts sharply with Europe’s aggressive monetary policy, and as we move forward, it’s vital to remain informed and engaged in these discussions. After all, the economy is not just numbers—it’s about people, families, and the future we are building together.

“`

This article uses HTML headings, maintains an informal tone, and ensures that the content is engaging and informative while being optimized for SEO.