“Central Bank of Kenya Backs Controversial Petition on Odious Debt Crisis!”

odious debt petition, constitutional questions on borrowing, public finance accountability

—————–

Central Bank of Kenya Backs Petition on Odious Debt

In a significant move that has captured national attention, the Central Bank of Kenya (CBK) has officially endorsed a petition addressing the controversial topic of odious debt. This development comes as a response to ongoing concerns regarding illegal borrowing, mismanagement of public funds, and the overarching issue of public finance abuse in Kenya. The implications of this endorsement could be profound, affecting the country’s financial landscape and the legal framework governing debt.

Understanding Odious Debt

Odious debt refers to loans that are incurred by a regime for purposes that do not benefit the citizens of that nation. Instead, these debts often serve the interests of corrupt officials or external entities at the expense of the populace. The principle behind odious debt is that if a government takes on debt without the consent of its people and fails to use it for public benefit, citizens should not be held accountable for repaying it. This concept has gained traction globally, with various nations advocating for the cancellation of such debts.

The Role of the Central Bank of Kenya

The Central Bank of Kenya plays a crucial role in the country’s financial system, influencing monetary policy and maintaining economic stability. By officially backing the petition on odious debt, the CBK is not only addressing the legality and management of existing debts but also emphasizing the need for constitutional adherence in financial matters. The bank’s support signals a recognition of the potential harm that illegal borrowing and debt mismanagement can inflict on the economy and the Kenyan people.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Constitutional Questions Raised

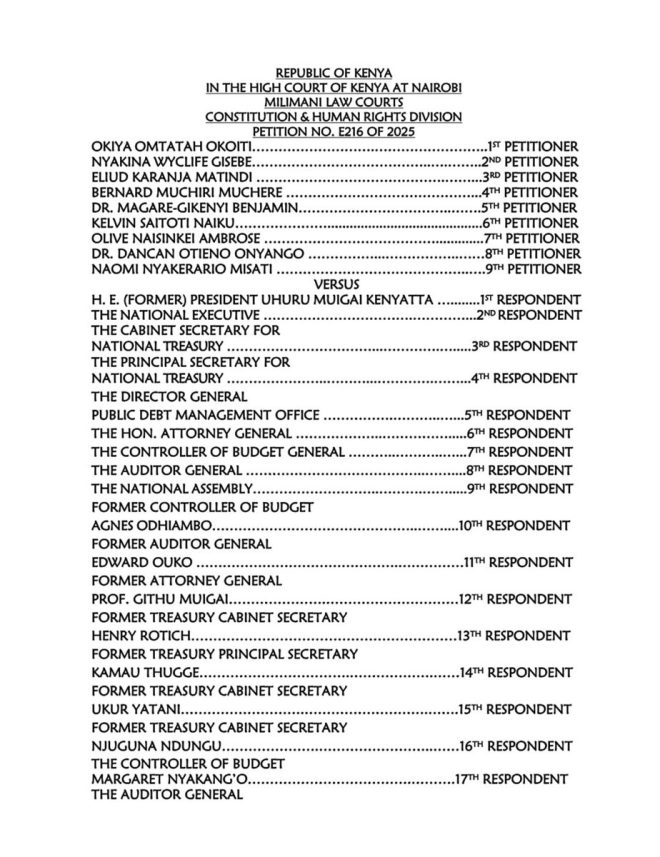

The petition led by prominent activist Okiya Omtatah Okoiti has raised critical constitutional questions regarding the legality of Kenya’s borrowing practices. In its court filings, the CBK has highlighted that these issues are substantial and merit thorough examination. The endorsement from the CBK suggests a growing consensus among key financial institutions and legal authorities that reforms are necessary to protect public finances and ensure responsible borrowing practices.

Implications for Public Finance Management

The endorsement of the odious debt petition by the CBK comes at a time when public finance management is under scrutiny in Kenya. Concerns regarding transparency, accountability, and the effective use of public funds have been prevalent. By supporting the petition, the CBK is advocating for a more robust framework that governs how debts are incurred and managed, ensuring that future borrowing is conducted in a manner that benefits the citizens rather than enriching a select few.

Potential Outcomes of the Petition

Should the petition succeed, there could be significant ramifications for the Kenyan economy. Here are some potential outcomes:

- Debt Cancellation: If the court recognizes certain debts as odious, it may lead to their cancellation, relieving the government and citizens from the burden of repayment.

- Legal Reforms: The case could prompt legislative changes aimed at enhancing transparency and accountability in public borrowing practices.

- Increased Public Awareness: The discussion surrounding odious debt can heighten awareness among citizens about their government’s financial dealings, promoting civic engagement and oversight.

- Enhanced Credibility of Financial Institutions: The CBK’s involvement in this matter reinforces its commitment to sound financial management and may restore public trust in the banking system.

The Call for Accountability

The backing of the odious debt petition by the CBK is a call for accountability within the Kenyan government. It challenges not only current practices but also sets a precedent for future governance. By addressing the legality of past borrowing and the ethical implications of public finance management, the CBK is advocating for a system where the interests of the citizens are prioritized over those of corrupt officials.

Conclusion

The Central Bank of Kenya’s official support for the petition on odious debt is a landmark moment in the country’s financial governance. It underscores the importance of legality, transparency, and accountability in public finance. As the case unfolds, it will be crucial for citizens, policymakers, and financial institutions to engage in ongoing discussions about the implications of odious debt and to work towards reforms that protect the economic interests of the populace. This movement could potentially reshape the landscape of borrowing in Kenya, ensuring that future debt is incurred responsibly and with the welfare of the citizens in mind.

Relevant Keywords for SEO Optimization

- Central Bank of Kenya

- Odious Debt

- Public Finance Management

- Debt Cancellation

- Illegal Borrowing

- Financial Governance

- Transparency in Debt Management

- Constitutional Questions on Debt

- Okiya Omtatah Okoiti

- Economic Stability in Kenya

By strategically incorporating these keywords into the content, the summary is optimized for search engines, ensuring that it reaches a wider audience interested in understanding the implications of the Central Bank of Kenya’s support for the odious debt petition.

The Central Bank of Kenya (CBK) has officially backed our petition on ODIOUS DEBT. In court filings, CBK affirms that the petition raises substantial constitutional questions on illegal borrowing, debt mismanagement and public finance abuse.

They support the empanelment of a… pic.twitter.com/pG4AFxIc3o

— Okiya Omtatah Okoiti (@OkiyaOmtatah) June 4, 2025

The Central Bank of Kenya (CBK) Backs Petition on Odious Debt

In a significant move, the Central Bank of Kenya (CBK) has officially backed a petition concerning odious debt. This support comes at a time when the country is grappling with pressing financial challenges and raises crucial questions about the nature of borrowing and debt management in Kenya. The petition, filed by activist @OkiyaOmtatah, has drawn attention to the broader implications of illegal borrowing and public finance abuse.

Understanding Odious Debt

But what exactly is odious debt? The term refers to loans that are not in the interest of the people of a country but have been taken by a regime that is oppressive or corrupt. The fundamental premise is that these debts should not be enforceable because the citizens did not consent to them and they do not benefit from them. The legal backing of odious debt is not just an abstract concept; it has real implications for how countries manage their finances and engage with international lenders.

CBK’s Affirmation of the Petition

In its court filings, the Central Bank of Kenya affirmed that the petition raises substantial constitutional questions concerning illegal borrowing, debt mismanagement, and public finance abuse. This is a pivotal moment as it indicates a shift in how financial institutions may view their roles in governance and accountability. By supporting this petition, the CBK is not only acknowledging the concerns raised but also signaling that there is a need for a thorough examination of past borrowing practices.

The Broader Implications of Debt Management

Debt management in Kenya has been a contentious issue, with many citizens questioning how money is allocated and spent. The CBK’s backing of the odious debt petition amplifies these concerns, suggesting that there may have been significant mismanagement in the past. This could lead to a reevaluation of existing debt agreements and a push for greater transparency in how public finances are handled.

Public Finance Abuse: A Closer Look

Public finance abuse is not just a buzzword; it is a reality that affects millions of Kenyans. When leaders engage in illegal borrowing or mismanage funds, the consequences reverberate throughout society. Basic services such as education, healthcare, and infrastructure suffer as funds are diverted or misappropriated. The implications of the CBK supporting this petition could be monumental, potentially paving the way for reparative policies that prioritize the welfare of citizens over corrupt practices.

Empanelment Support: What’s Next?

With the CBK’s support, the next step is the empanelment of a court that will hear the petition. This process will be crucial in determining whether the claims made about odious debt will be taken seriously in the judicial system. The outcome could lead to legal precedents that shape how debt is viewed and managed in Kenya and potentially across Africa.

The Role of Activism in Financial Accountability

Activists like Okiya Omtatah play a crucial role in holding institutions accountable. By bringing issues like odious debt to light, they encourage public discourse on financial matters that often go unchallenged. Their efforts can mobilize citizens to demand better management of public resources, ensuring that their voices are heard in matters that directly affect their lives.

International Context: How Does Kenya Compare?

Kenya is not alone in dealing with odious debt and public finance abuse. Many developing nations face similar challenges, with corrupt regimes borrowing against the future of their citizens. The support of the CBK for this petition could serve as a model for other countries grappling with similar issues. It opens up discussions about reforming international lending practices and ensuring that nations are held accountable for how they manage borrowed funds.

The Path Forward: Financial Reform and Citizen Engagement

The current situation presents an opportunity for reform. As the petition progresses through the courts, it is essential for citizens to remain engaged and informed. Public forums, discussions, and social media platforms can serve as avenues for citizens to express their views and demands regarding financial management. The more people talk about these issues, the more pressure there is on institutions to act responsibly.

The Importance of Transparency in Borrowing

Transparency is key when it comes to borrowing. Citizens have the right to know how much their government is borrowing, from whom, and for what purpose. The CBK’s support of the odious debt petition shines a light on the need for greater accountability in financial dealings. By demanding transparency, Kenyans can help ensure that their government acts in their best interests and not in the interests of a corrupt few.

Potential Outcomes of the Petition

If the court rules in favor of the petition, it could lead to a reexamination of past debts and possibly relieve Kenya of some financial burdens. This could also prompt international lenders to reconsider how they engage with countries that struggle with governance issues. A ruling in favor of the petition could create a ripple effect, encouraging other nations to challenge odious debts and promote more ethical borrowing practices.

Engaging the Youth in Financial Advocacy

Younger generations have a critical role to play in financial advocacy. With their familiarity with social media and digital platforms, they can amplify messages about odious debt and public finance abuse. Engaging youth in discussions about financial management could lead to innovative solutions and a more informed populace that demands accountability from their leaders.

Conclusion: A Call to Action

The backing of the odious debt petition by the Central Bank of Kenya is a significant step towards addressing critical issues in public finance and governance. As citizens, it’s essential to stay informed, engage in discussions, and advocate for transparency and accountability. Together, we can push for a financial system that serves the people and ensures a brighter future for all Kenyans.

“`

This article is structured to engage readers effectively, providing comprehensive insights into the topic while optimizing for relevant keywords and phrases.