China’s Manufacturing Crisis: Is the World’s Factory Facing Collapse?

manufacturing downturn in China, economic impact of low manufacturing activity, China’s industrial performance trends 2025

—————–

China’s Manufacturing Activity Declines: A Closer Look at the Data

On June 4, 2025, a significant economic update emerged from China, highlighting a worrying trend in the country’s manufacturing sector. According to a tweet from Barchart, China’s manufacturing activity has plummeted to its lowest level since September 2022. This decline is a concerning indicator for the global economy, given China’s pivotal role as the world’s manufacturing powerhouse. This summary delves into the implications of this downturn, its potential causes, and what it means for both China and the international market.

Understanding the Decline in Manufacturing Activity

China’s manufacturing sector is a critical component of its economy, contributing significantly to GDP and employment. When manufacturing activity contracts, it can signal broader economic issues. The recent data indicates that this contraction has reached levels not seen in nearly three years, raising alarms among economists and market analysts.

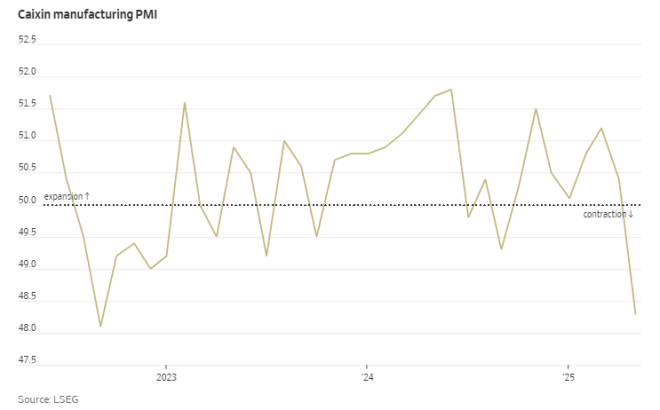

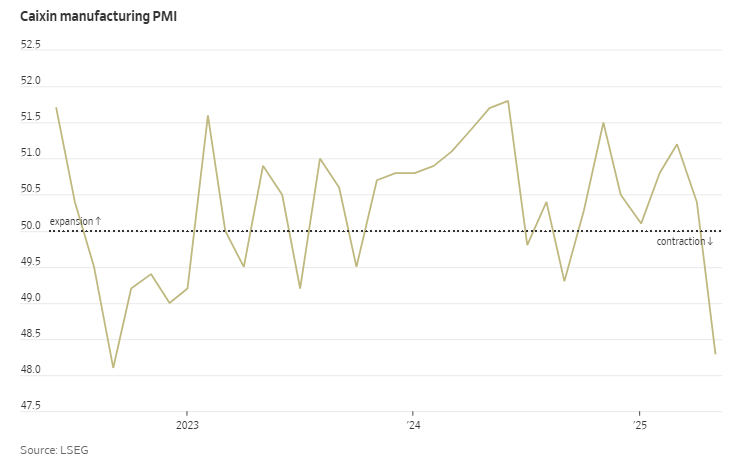

The manufacturing Purchasing Managers’ Index (PMI), a key economic indicator, reflects the health of the manufacturing sector. A PMI below 50 indicates contraction, while a figure above 50 signifies expansion. The latest reports suggest that China’s PMI has fallen below this critical threshold, suggesting that many manufacturers are facing challenges that could lead to layoffs, reduced production, and decreased exports.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Key Factors Contributing to the Decline

Several factors may be contributing to the slump in China’s manufacturing activity:

1. Global Economic Slowdown

The global economy has been experiencing a slowdown, influenced by rising interest rates, inflationary pressures, and geopolitical tensions. As demand for goods decreases worldwide, China’s export-driven economy suffers, leading to reduced manufacturing activity.

2. Supply Chain Disruptions

Despite the easing of COVID-19 restrictions, supply chain disruptions continue to impact production. Issues such as shipping delays, raw material shortages, and logistical challenges have hampered the ability of manufacturers to operate efficiently.

3. Domestic Economic Policies

China’s government has implemented various policies in response to economic challenges, including measures to control debt and real estate market instability. These policies, while aimed at stabilizing the economy, may inadvertently constrain manufacturing capabilities and reduce investment in new projects.

4. Technological Transition

As China transitions towards a more technology-driven economy, traditional manufacturing sectors may face obsolescence. This shift can lead to temporary declines in output as industries adapt to new technologies and processes.

Implications of the Decline for China

The decline in manufacturing activity poses several significant implications for China:

1. Economic Growth Concerns

China’s economy has relied heavily on manufacturing for decades, and a sustained downturn could impede overall growth. Analysts predict that if manufacturing continues to weaken, it could lead to lower GDP growth rates, impacting employment and consumer spending.

2. Increased Unemployment

A decrease in manufacturing output often correlates with job losses, which can have a cascading effect on the economy. Increased unemployment can lead to reduced consumer spending, further exacerbating economic challenges.

3. Policy Adjustments

In response to declining manufacturing activity, the Chinese government may need to implement stimulus measures or other economic interventions to stabilize the sector. This could include measures to support small and medium-sized enterprises, encourage investment, and stimulate domestic demand.

Global Economic Impact

China’s manufacturing activity is not only crucial for its economy but also has far-reaching implications for the global market:

1. Impact on Global Supply Chains

As a central player in global supply chains, a slowdown in Chinese manufacturing can disrupt production and delivery timelines for businesses worldwide. Companies that rely on Chinese goods may face delays, increased costs, and potential inventory shortages.

2. Effects on Commodity Prices

China is one of the largest consumers of commodities. A decline in manufacturing activity could lead to decreased demand for raw materials, impacting global commodity prices. This shift could have consequences for economies that depend heavily on commodity exports.

3. Investor Sentiment and Market Volatility

Global investors closely monitor China’s economic indicators. A significant decline in manufacturing activity may trigger volatility in financial markets as investors reassess economic forecasts and potential risks associated with their investments.

Conclusion

The recent report indicating that China’s manufacturing activity has reached its lowest level since September 2022 serves as a crucial wake-up call for analysts, investors, and policymakers. The factors contributing to this decline are multifaceted and reflect both domestic challenges and global economic conditions.

As the world watches closely, the implications of this downturn will likely echo through various sectors and economies. Policymakers in China may need to take decisive action to mitigate the impacts of this decline, while businesses globally must prepare for potential disruptions in supply chains and shifts in market dynamics.

In summary, the health of China’s manufacturing sector is not just a national concern but a global one, with ramifications that extend well beyond its borders. Stakeholders in the global market must remain vigilant and responsive to these developments to navigate the complexities of an interconnected economic landscape.

BREAKING : China

China’s manufacturing activity plunges to lowest level since September 2022 pic.twitter.com/8IvPC5eaEh

— Barchart (@Barchart) June 4, 2025

BREAKING : China

In a startling economic development, China’s manufacturing activity plunges to lowest level since September 2022. This significant downturn raises alarms not only for the Chinese economy but also for global markets, given China’s pivotal role in the world’s supply chain. Recent reports indicate that the manufacturing Purchasing Managers’ Index (PMI) has dipped below the critical threshold, signaling a contraction in manufacturing activities across the country. As many of you know, a PMI reading below 50 indicates a contraction, and the latest numbers suggest that the situation could be more serious than anticipated.

Understanding the Manufacturing PMI

The Manufacturing PMI is a key economic indicator that gauges the health of the manufacturing sector. It is derived from a monthly survey of purchasing managers across various industries. When we see a PMI below 50, it suggests that manufacturing is slowing, which can have ripple effects throughout the economy. Notably, this recent plunge in China’s manufacturing activity could be linked to several factors, including reduced demand, supply chain disruptions, and geopolitical tensions. Many analysts are closely monitoring these developments, as they can significantly impact global trade patterns.

What Caused the Decline?

So, what exactly led to this decline in manufacturing? For starters, the ongoing fallout from the pandemic has stretched supply chains thin. Many companies are still grappling with the aftershocks of lockdowns and restrictions. Additionally, rising production costs, particularly in energy and raw materials, have made it challenging for manufacturers to operate profitably. Reuters reports that many manufacturers are now facing increased pressure to cut back on production, leading to layoffs and other cost-cutting measures.

The Impact on the Global Economy

The implications of a manufacturing slump in China extend far beyond its borders. As one of the largest manufacturers in the world, any slowdown in China can have significant repercussions for economies worldwide. Countries that rely heavily on Chinese goods, such as electronics, machinery, and textiles, may face shortages and increased prices. Furthermore, this situation could also lead to adjustments in trade policies and tariffs as countries seek to protect their own economic interests. news/business-57305012″>BBC News has highlighted how global markets are reacting to this news, with many stocks fluctuating in response to fears of reduced demand from China.

Reactions from Industry Experts

Industry experts are voicing concerns about the potential long-term effects of this downturn. Some analysts believe that the manufacturing sector could take a while to recover, especially if domestic and international demand continues to wane. CNBC has reported that many manufacturers are reevaluating their strategies in light of these developments, with some considering relocating production to countries with more stable economic conditions.

What Can Be Done?

Addressing the challenges facing China’s manufacturing sector will require a multifaceted approach. The Chinese government may need to implement stimulus measures to support manufacturers and boost demand. This could include tax breaks, financial aid, or investments in infrastructure to improve supply chain efficiency. Additionally, fostering innovation and encouraging domestic consumption could help to mitigate some of the adverse effects of this downturn. Forbes has suggested that focusing on technology and sustainability in manufacturing could be key to revitalizing the sector.

Future Outlook

Looking ahead, the outlook for China’s manufacturing sector remains uncertain. While some analysts are hopeful that the situation will stabilize, others caution that without significant interventions, the decline could persist. The global economic landscape is also shifting, with many countries exploring alternative manufacturing hubs to reduce dependency on China. This trend could further complicate the recovery process for Chinese manufacturers. As we continue to monitor these developments, it will be crucial for businesses, investors, and policymakers to stay informed and adaptable.

Conclusion

The recent plunge in China’s manufacturing activity to its lowest level since September 2022 is a critical warning sign for both the Chinese economy and the global marketplace. As we navigate through these turbulent times, staying informed about the changes in manufacturing trends will be essential for anyone looking to understand the broader economic implications. Whether you’re an investor, a business owner, or simply a curious observer, the unfolding situation in China will undoubtedly shape the economic landscape for years to come.

“`

This article is structured to provide comprehensive insights into the recent decline in China’s manufacturing activity while ensuring it is engaging and accessible to readers. The use of relevant links and keywords helps enhance its SEO optimization.