“Jerome Powell’s Rate Cut Standoff: Betting Market Sparks Economic Uproar!”

interest rate forecasts, Federal Reserve policy analysis, Jerome Powell economic outlook

—————–

Breaking news: Jerome Powell and Interest Rate Predictions

The financial world is abuzz with recent developments surrounding Federal Reserve Chair Jerome Powell and the outlook for interest rates. Betting platforms are signaling that Powell is unlikely to cut interest rates in the near future, prompting reactions from economists, investors, and market analysts. This article breaks down the implications of this prediction, the factors influencing the Fed’s decision-making, and what it means for the economy at large.

Understanding the Current Economic Climate

In the wake of the COVID-19 pandemic, the U.S. economy has experienced significant fluctuations. The Federal Reserve has implemented various monetary policies to stabilize the economy, including several interest rate cuts aimed at promoting borrowing and investment. However, as the economy shows signs of recovery, the question arises: will the Fed continue to keep rates low, or are hikes on the horizon?

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Role of Jerome Powell

Jerome Powell, who has been serving as the Chair of the Federal Reserve since February 2018, plays a pivotal role in shaping U.S. monetary policy. His decisions are closely watched by financial markets, as they have far-reaching implications for inflation, employment, and overall economic growth. Powell’s recent statements have suggested a cautious approach to rate cuts, emphasizing the need for careful evaluation of economic indicators before making significant changes.

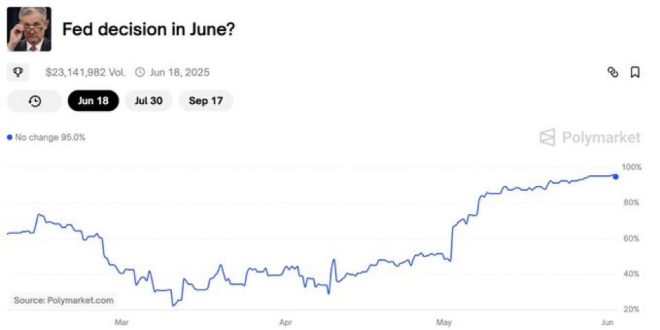

Betting Platforms and Rate Predictions

Betting platforms have become a fascinating barometer of market sentiment regarding interest rates. These platforms allow users to wager on various financial outcomes, including the likelihood of interest rate changes by the Federal Reserve. Recent predictions indicate that the consensus is leaning towards Powell maintaining current rates for the foreseeable future. This sentiment reflects a broader belief among investors and analysts that the economy, while improving, is not yet stable enough to warrant a reduction in rates.

Factors Influencing Interest Rate Decisions

Several key factors influence the Federal Reserve’s decisions on interest rates:

- Inflation Rates: The Fed aims to keep inflation around 2% to foster a stable economic environment. If inflation rates rise significantly, the Fed may consider hiking interest rates to cool off the economy.

- Employment Figures: Employment rates are a critical indicator of economic health. A robust job market can lead to increased consumer spending, which in turn can drive inflation. Powell is likely to monitor these figures closely.

- Global Economic Conditions: The interconnectedness of global economies means that international developments can impact U.S. monetary policy. Changes in trade agreements, geopolitical tensions, and economic performance of other nations can influence the Fed’s decisions.

- Consumer Confidence: The willingness of consumers to spend is crucial for economic growth. High consumer confidence typically encourages spending, while low confidence can lead to economic stagnation.

- Market Reactions: Financial markets often react to Fed announcements and predictions regarding interest rates. A stable or improving market can give the Fed more leeway to maintain current rates, while a volatile market may prompt a reassessment.

Implications for Investors

The prediction that Powell will not cut rates anytime soon has significant implications for investors. Lower interest rates generally encourage borrowing, which can boost stock prices and economic activity. Conversely, maintaining higher rates can lead to increased borrowing costs, potentially cooling off economic growth.

Investors may need to adjust their strategies based on this outlook. For example, sectors that typically benefit from low interest rates, such as real estate and consumer discretionary, may experience slower growth. Conversely, financial institutions often thrive in higher interest rate environments, as they can charge more for loans.

The Future of Monetary Policy

As we look ahead, the future of monetary policy under Jerome Powell remains uncertain. While the current predictions suggest that rate cuts are not imminent, the Fed’s approach could change based on evolving economic conditions. Powell has emphasized the importance of data-driven decision-making, which means that ongoing assessments of the economy will be crucial.

Additionally, the potential for unforeseen events, such as geopolitical tensions or economic shocks, could alter the Fed’s trajectory. Investors and analysts will need to stay vigilant and adaptable to navigate this dynamic landscape.

Conclusion

In summary, the current predictions from betting platforms indicate that Jerome Powell is unlikely to cut interest rates in the near future. This outlook is shaped by various factors, including inflation rates, employment figures, global economic conditions, and consumer confidence. For investors, this news may necessitate a reassessment of strategies, particularly in sectors sensitive to interest rate changes.

As we monitor the economic landscape, it’s essential to remain informed and prepared for potential shifts in monetary policy. Jerome Powell’s leadership will continue to play a critical role in shaping the economic future of the United States, and staying abreast of these developments is key for anyone involved in the financial markets.

Keep an eye on Federal Reserve announcements and economic indicators to better understand how these factors may influence future interest rate decisions.

BREAKING BETTING PLATFORM ARE PREDICTING THAT JEROME POWELL DOESN’T CUT RATES ANY TIME SOON https://t.co/MEi2v8Yzqo

BREAKING BETTING PLATFORM ARE PREDICTING THAT JEROME POWELL DOESN’T CUT RATES ANY TIME SOON

The financial world is buzzing right now! Betting platforms are making some bold predictions about the future of interest rates, specifically regarding Jerome Powell, the Chair of the Federal Reserve. If you’re curious about what this means for you, your investments, and the economy as a whole, you’re in the right place. Let’s dive into this situation and understand why experts believe that rate cuts are not on the horizon.

What’s the Scoop on Jerome Powell and Interest Rates?

Jerome Powell has been a significant figure in the financial landscape, especially during turbulent economic times. As the Chair of the Federal Reserve, his decisions carry a lot of weight, influencing everything from mortgage rates to the stock market. Recently, betting platforms have indicated that Powell is unlikely to cut interest rates anytime soon. This prediction comes as a surprise to many, especially those who were hoping for a rate reduction to stimulate the economy.

But why are these betting platforms so confident in their predictions? The data suggests that inflation is still a concern, and the Fed is likely to maintain a cautious approach. For those who are keen on understanding the intricacies of interest rates, it’s essential to keep a close eye on Powell’s statements and the Fed’s actions.

The Economic Landscape: Why Rate Cuts Are Off the Table

Understanding the broader economic landscape is crucial to grasping why rate cuts are being pushed aside. Inflation remains a hot topic, and the Fed is tasked with keeping it in check. Rates influence consumer spending and investment, and any changes can lead to significant shifts in the economy.

High inflation typically leads to higher interest rates as the Fed attempts to cool off the economy. If inflation remains stubbornly high, it’s unlikely that Powell and the Fed will consider cutting rates. The betting platforms, using sophisticated algorithms and economic indicators, have picked up on this trend, leading to their predictions.

For more insights on the relationship between interest rates and inflation, you can check out [The Balance](https://www.thebalance.com).

What Do Betting Platforms Say About Future Rate Cuts?

Betting platforms are not just guessing; they analyze vast amounts of data to make informed predictions. By looking at economic indicators, public sentiment, and Powell’s statements, they forecast future actions by the Fed. The current consensus suggests that a rate cut isn’t in the cards for the foreseeable future.

According to recent data from [MarketWatch](https://www.marketwatch.com), the likelihood of a rate cut happening anytime soon is dwindling. This has implications for various sectors, including housing and consumer goods. Higher interest rates mean borrowing costs will remain elevated, which can dampen consumer spending and investment.

Impact on Borrowers and Homebuyers

For those looking to borrow money or buy a home, the implications of Powell’s decision not to cut rates are significant. With interest rates likely to stay higher for longer, mortgage rates will also remain elevated. This can make homeownership less accessible for many, as monthly payments will be higher than they would be with lower rates.

If you’re in the market for a home, it’s essential to factor in these potential costs. You may want to consider locking in a rate if you find a favorable one, as waiting for a cut might lead to disappointment. Real estate experts are keeping a close watch on these developments, and it’s worth staying informed.

For more tips on navigating the housing market, visit [Zillow](https://www.zillow.com).

Stock Market Reactions to Rate Predictions

The stock market is another area that reacts strongly to interest rate predictions. When betting platforms indicate that rates will not be cut, investors often respond with caution. Higher interest rates can mean lower corporate profits, which can lead to a decline in stock prices.

Investors are keen on finding opportunities, but uncertainty around rate cuts can lead to volatility in the market. Many investors are now looking at alternative strategies to weather this storm. Some are shifting their focus to sectors that tend to perform well during high-interest-rate environments, such as utilities and consumer staples.

If you’re interested in stock market strategies during times of uncertainty, check out [Investopedia](https://www.investopedia.com).

The Fed’s Communication Strategy

One of the critical aspects of the Fed’s approach is its communication strategy. Jerome Powell and his team have been clear about their intentions regarding interest rates. Their transparency is aimed at managing market expectations, and it seems to be working—at least for now.

By signaling that they are not considering rate cuts, the Fed is trying to prevent any shock to the markets. This proactive communication helps maintain stability and encourages businesses and consumers to plan accordingly. The betting platforms are picking up on these signals, which is why their predictions align with the Fed’s current stance.

To understand more about the Fed’s communication strategy, you can visit [Federal Reserve](https://www.federalreserve.gov).

What’s Next for Jerome Powell and the Fed?

As we look ahead, it’s essential to consider what might influence Powell’s decisions in the future. Economic indicators, geopolitical events, and changes in consumer behavior can all play a role in shaping monetary policy. If inflation shows signs of cooling, the Fed may reassess its position on interest rates, but for now, the consensus remains unchanged.

Investors, homebuyers, and consumers should stay informed about upcoming Fed meetings and economic reports. These events can provide crucial insights into the direction of interest rates and the overall economy.

To stay updated on these developments, consider following reputable financial news sources such as [Bloomberg](https://www.bloomberg.com).

Final Thoughts: Understanding the Bigger Picture

As the betting platforms continue to predict that Jerome Powell won’t cut rates anytime soon, it’s vital for everyone to understand the implications of this situation. From the housing market to the stock market, the ripple effects of interest rate decisions can be significant. Staying informed, being proactive, and adjusting your financial strategies accordingly can help you navigate this complex landscape.

Remember, the economy is ever-changing, and while predictions can provide guidance, staying adaptable is key. Keep an eye on the news, follow economic indicators, and don’t hesitate to seek advice from financial professionals if you need it. The world of finance can be daunting, but with the right information and strategies, you can make informed decisions that benefit you in the long run.