BlackRock’s Shocking $77M Ethereum Purchase: What It Means for Crypto’s Future!

BlackRock investment strategy, Ethereum market trends, cryptocurrency utility growth

—————–

BREAKING news: BLACKROCK INVESTS $77 MILLION IN ETHEREUM

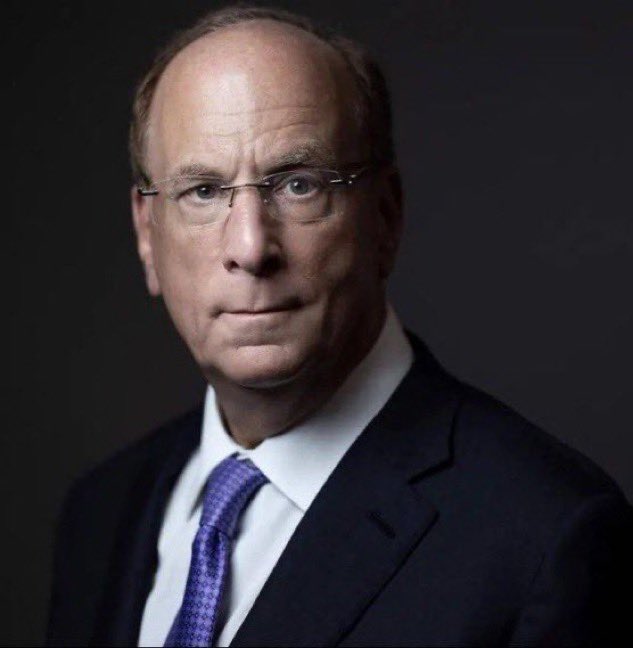

In a monumental move for the crypto market, BlackRock, the world’s largest asset manager, has made headlines by purchasing a staggering $77 million worth of Ethereum (ETH). This significant investment is being seen as a strong signal that institutional money is increasingly rotating into cryptocurrencies, particularly those with substantial utility like Ethereum.

The Impact of BlackRock’s Investment

BlackRock’s foray into Ethereum represents a pivotal moment for the cryptocurrency landscape. As a major player in the financial sector, BlackRock’s entry into the Ethereum market not only underscores the growing acceptance of digital assets among institutional investors but also highlights the potential of Ethereum as a leading blockchain platform.

Ethereum has long been recognized for its smart contract capabilities, which allow developers to build decentralized applications (dApps) across various industries, including finance, gaming, and supply chain management. By investing in ETH, BlackRock is positioning itself to capitalize on the ongoing evolution of blockchain technology and the increasing demand for decentralized finance (DeFi) solutions.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Why Ethereum?

Ethereum’s robust ecosystem has made it a preferred choice for many investors and developers. Here are a few reasons why BlackRock’s investment in Ethereum is particularly noteworthy:

- Smart Contracts: Ethereum’s smart contract functionality allows for programmable transactions that can facilitate various types of agreements without the need for intermediaries. This has opened new avenues for innovation and efficiency.

- DeFi and NFTs: The rise of decentralized finance (DeFi) and non-fungible tokens (NFTs) has been largely driven by the Ethereum network. By investing in ETH, BlackRock is tapping into these burgeoning markets that have shown tremendous growth and potential.

- Scalability and Upgrades: Ethereum has been undergoing significant upgrades, including the transition to Ethereum 2.0, which aims to improve scalability, security, and sustainability. This transition is expected to enhance Ethereum’s utility and attract more users and investors.

- Institutional Adoption: The move by BlackRock indicates a broader trend of institutional adoption of cryptocurrencies. As more financial giants enter the crypto space, confidence in digital assets is likely to grow, potentially leading to increased prices and market stability.

What This Means for the Crypto Market

BlackRock’s investment could serve as a catalyst for further institutional interest in cryptocurrencies. Here’s how this development might impact the market:

- Increased Legitimacy: With a company as prominent as BlackRock investing in Ethereum, cryptocurrencies may gain further legitimacy in the eyes of traditional investors. This could lead to an influx of capital from institutional players who were previously hesitant to enter the market.

- Price Surge: Historically, significant investments from major financial institutions have led to price surges in cryptocurrencies. BlackRock’s $77 million investment could contribute to a bullish trend for Ethereum and possibly influence other cryptocurrencies as well.

- Innovation and Development: As institutions invest in Ethereum, there will likely be increased funding for projects built on its blockchain. This could accelerate innovation in the DeFi and NFT spaces, leading to new applications and services that benefit the broader economy.

Conclusion

BlackRock’s $77 million investment in Ethereum is a groundbreaking development that highlights the increasing intersection of traditional finance and the cryptocurrency market. As institutional interest continues to grow, the implications for Ethereum and the broader crypto landscape are profound.

For investors, this may be an opportune moment to consider the potential of Ethereum and the opportunities it presents. The combination of BlackRock’s investment and the ongoing developments within the Ethereum ecosystem may signal a bright future for both the asset and the technology that underpins it.

Final Thoughts

In summary, BlackRock’s substantial investment in Ethereum is a clear indication that money is rotating into cryptocurrencies with tangible utility. As the financial world increasingly embraces digital assets, Ethereum stands out as a frontrunner due to its innovative features and wide-ranging applications. This pivotal moment could shape the future of the crypto market, making it essential for investors to stay informed and engaged in this rapidly evolving space.

BREAKING:

BLACKROCK JUST BOUGHT $77 MILLION WORTH OF $ETH!

MONEY IS ROTATING INTO UTILITY. pic.twitter.com/t8fltW2AeA

— Crypto Rover (@rovercrc) June 4, 2025

BREAKING:

BLACKROCK JUST BOUGHT $77 MILLION WORTH OF $ETH! This major financial player is making waves in the cryptocurrency world, and it’s hard not to get excited about what this means for Ethereum and the broader market. With such a significant investment, it’s clear that institutions are starting to recognize the utility of cryptocurrencies, particularly Ethereum.

MONEY IS ROTATING INTO UTILITY.

This statement couldn’t be more accurate, especially considering how the crypto landscape has evolved over the past few years. The shift towards utility-driven investments is a trend that’s gaining traction, and BlackRock’s move is a testament to that. Investors are no longer just looking for speculative plays; they want assets that offer real-world applications and solutions.

Why BlackRock’s Investment Matters

BlackRock, as one of the largest asset management firms in the world, has a significant influence on market trends. Their decision to invest in Ethereum signals to other institutional investors that the time to explore digital assets is now. By purchasing $77 million worth of $ETH, BlackRock is not just putting their money where their mouth is; they’re setting a precedent that could encourage more institutional investment in cryptocurrency.

The Importance of Ethereum

Ethereum is more than just a cryptocurrency; it’s a platform that enables the creation of smart contracts and decentralized applications (dApps). Its utility goes beyond mere transactions, which is why it’s often referred to as a “programmable blockchain.” This functionality makes Ethereum uniquely positioned to capture value in a way that many other cryptocurrencies cannot.

How Ethereum Stands Out

One of the key reasons BlackRock’s investment in Ethereum is noteworthy is the platform’s ongoing development and upgrades. Ethereum 2.0, which aims to improve scalability and reduce energy consumption, is a significant step forward. These upgrades not only enhance the network’s capabilities but also increase investor confidence. When big players like BlackRock invest, it’s often a sign that they believe the technology behind the asset is solid.

The Shift Towards Utility

The phrase “money is rotating into utility” encapsulates a larger trend in the investment world. Investors are recognizing that cryptocurrencies with real-world use cases are more likely to withstand market volatility. As blockchain technology matures, projects that offer tangible benefits will gain traction. BlackRock’s investment in Ethereum is a strategic move that aligns with this trend, signaling a shift in how investment dollars are being allocated.

Institutional Interest in Cryptocurrencies

Over the past few years, there has been a noticeable increase in institutional interest in cryptocurrencies. This interest is driven by a combination of factors, including the desire for portfolio diversification, the search for alternative assets, and the recognition of blockchain technology’s potential. The entry of firms like BlackRock into the cryptocurrency space legitimizes the market and encourages other institutional players to follow suit.

The Future of Ethereum and Institutional Investment

So, what does the future hold for Ethereum now that BlackRock has made such a significant investment? It’s likely that we’ll see increased interest from other large institutional investors, which could lead to a surge in the price of $ETH. As more money flows into the Ethereum ecosystem, we can expect to see further development of dApps and smart contracts, which will only serve to enhance Ethereum’s utility and value proposition.

Understanding the Market Reaction

Whenever a major financial institution makes a significant investment in a cryptocurrency, the market tends to react. Typically, this leads to increased trading volume and price appreciation. Investors and traders often look to these moves as indicators of market sentiment. With BlackRock’s $77 million purchase of Ethereum, many are optimistic about the future of both the cryptocurrency and the broader market.

How to Get Involved

If you’re interested in getting involved in the cryptocurrency space, now might be a good time to consider Ethereum. While prices can be volatile, the long-term potential of Ethereum as a utility-driven asset is promising. There are several ways to invest in Ethereum, including purchasing it through exchanges, investing in Ethereum-based funds, or even exploring staking opportunities.

The Role of Blockchain Technology

At its core, Ethereum is built on blockchain technology, which is revolutionizing various industries. From finance to supply chain management, the potential applications are vast. As more companies recognize the benefits of blockchain, the demand for Ethereum is likely to increase. BlackRock’s investment is a clear signal that traditional financial institutions are beginning to embrace this technology.

Final Thoughts on BlackRock’s Move

BlackRock’s $77 million purchase of Ethereum is a pivotal moment in the cryptocurrency landscape. It highlights the growing recognition of digital assets as viable investment options and underscores the shift towards utility-focused cryptocurrencies. As more institutional players enter the space, it’s essential for retail investors to stay informed and consider the long-term prospects of these technologies.

In a rapidly changing financial environment, understanding the motivations behind large investments can give you a strategic advantage. Keep an eye on how BlackRock and other institutions navigate the crypto landscape, as their moves could provide valuable insights into the future of digital assets.