Biden Administration’s Bold Move: Is Crypto Facing Its Final Days?

cryptocurrency regulation impact, digital asset market future, Biden administration economic policy

—————–

Biden Administration’s Stance on Cryptocurrency: A Path to Extinction?

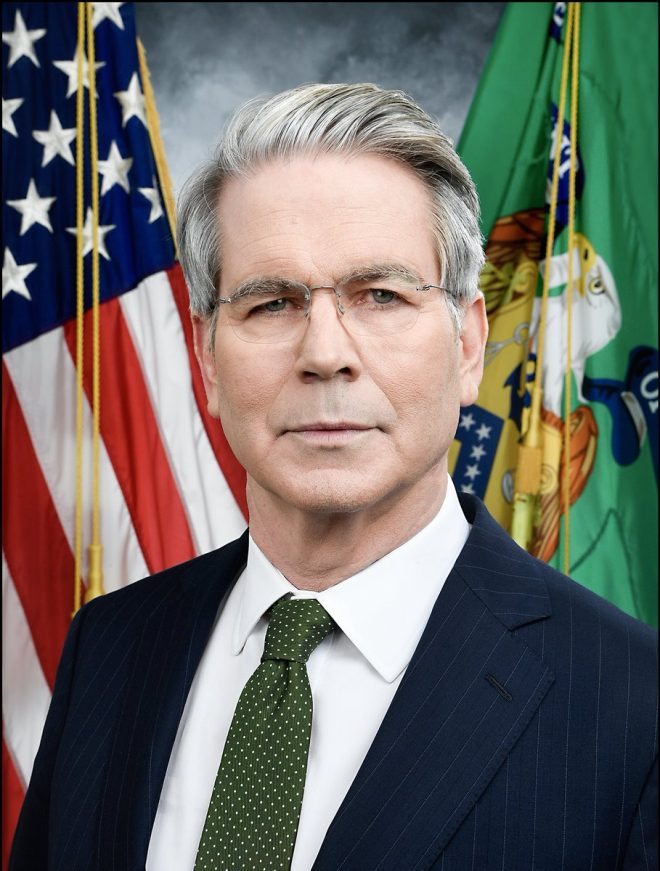

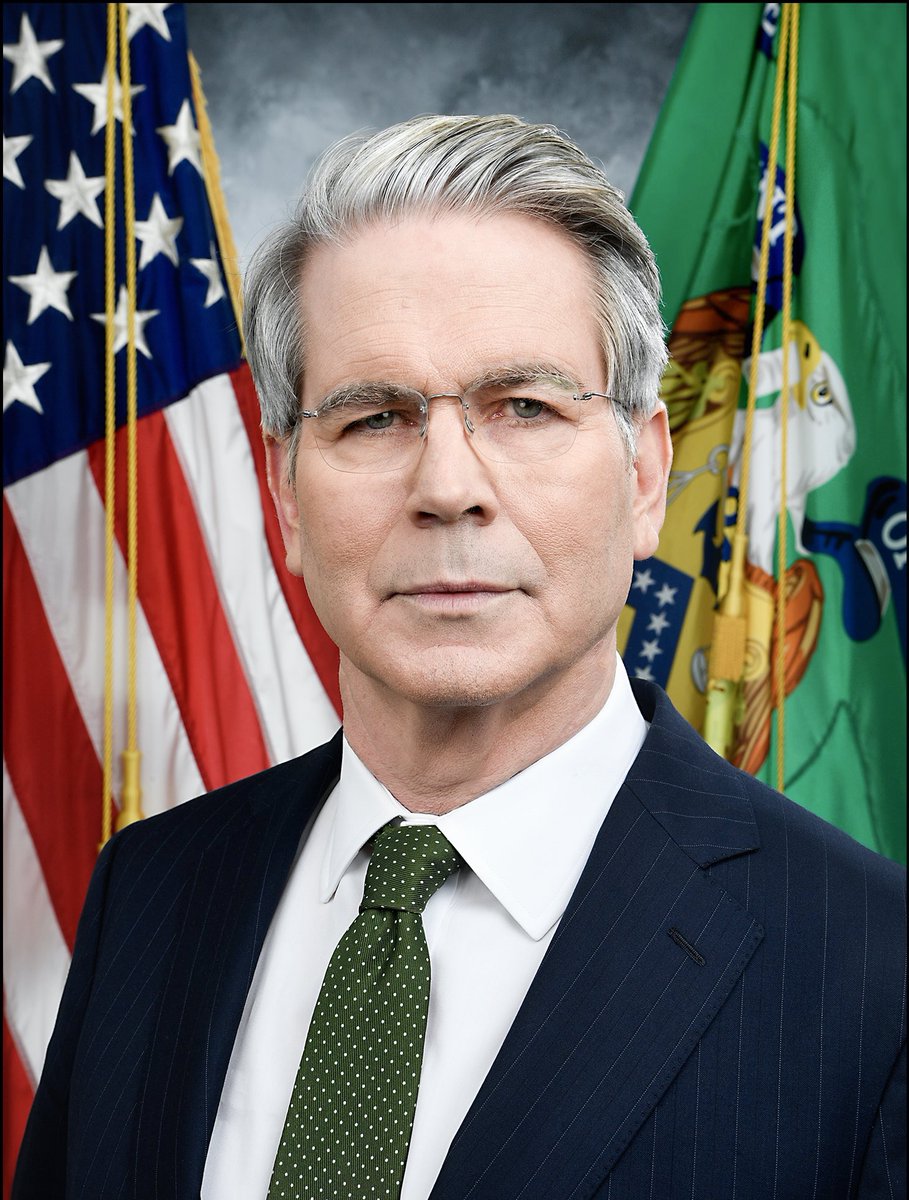

In a significant development for the cryptocurrency industry, U.S. Treasury Secretary Bessent has publicly stated that the Biden administration is steering the crypto sector towards what she termed "a path of extinction." This statement has reverberated through financial markets and the cryptocurrency community, raising questions about the future of digital currencies in the United States and beyond. As cryptocurrency continues to gain traction globally, the implications of government regulations and policies cannot be underestimated.

Understanding the Statement

Treasury Secretary Bessent’s remarks come at a time when the regulatory landscape for cryptocurrencies is shifting rapidly. The Biden administration has been vocal about its intentions to impose stringent regulations on the crypto market, citing concerns over consumer protection, financial stability, and the potential for illicit activities like money laundering and fraud. The phrase "path of extinction" suggests a concerted effort to diminish the viability of cryptocurrencies as mainstream financial instruments.

Implications for the Cryptocurrency Market

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Regulatory Challenges: One of the most pressing concerns for investors and businesses in the crypto space is the regulatory uncertainty that comes with such statements. Increased scrutiny from regulatory bodies can lead to stricter rules governing how cryptocurrencies are bought, sold, and traded. This could deter new investors and stifle innovation within the industry.

- Impact on Innovation: The cryptocurrency market has been a hotspot for technological innovation, with numerous projects aiming to solve real-world problems through blockchain technology. However, if the regulatory environment becomes overly restrictive, it could hinder the development of new technologies and solutions that could benefit society.

- Investor Sentiment: The sentiment in the cryptocurrency market can be heavily influenced by government statements and actions. Bessent’s comments could lead to panic selling among investors, resulting in a decline in the value of cryptocurrencies. On the other hand, if the market perceives these regulations as an opportunity for legitimization, it could lead to renewed interest and investment.

The Broader Economic Context

The Biden administration’s approach to cryptocurrency is part of a more extensive economic strategy that aims to create a fair and equitable financial system. Concerns over the volatility and speculative nature of cryptocurrencies have led to calls for greater regulation to protect consumers and ensure market stability. The administration’s focus on regulating financial technologies aligns with its broader goals of reforming the financial system to be more inclusive and secure.

Public Reaction and Industry Response

Given the significant implications of Bessent’s statements, there has been a mixed reaction from the public and industry stakeholders.

- Support for Regulation: Some advocates for cryptocurrency regulation argue that a clear framework is necessary to protect investors from fraud and scams. They believe that regulation could bring legitimacy to the industry and encourage institutional investment.

- Opposition from Crypto Advocates: On the other hand, many crypto enthusiasts and advocates argue that excessive regulation could stifle innovation and limit consumer choice. They contend that cryptocurrencies offer a decentralized alternative to traditional financial systems, which can empower individuals and promote financial inclusion.

The Future of Cryptocurrency in the U.S.

As the Biden administration continues to refine its approach to cryptocurrency regulation, the future of digital currencies in the U.S. remains uncertain. There are several potential scenarios that could unfold:

- Moderate Regulation: The administration might opt for a balanced approach, implementing regulations that protect consumers without stifling innovation. This could involve developing clear guidelines for cryptocurrency exchanges, Initial Coin Offerings (ICOs), and other aspects of the crypto ecosystem.

- Strict Regulation: If the administration pursues a strict regulatory framework, it could lead to significant challenges for the cryptocurrency industry. Many companies may choose to relocate to jurisdictions with more favorable regulations, resulting in a drain of talent and innovation from the U.S.

- Legitimization of Crypto: Conversely, if the regulations are perceived as fair and constructive, they could legitimize cryptocurrencies in the eyes of traditional investors, leading to broader adoption and integration into the financial system.

Conclusion

The comments from Treasury Secretary Bessent highlight the Biden administration’s serious stance on cryptocurrency regulation, signaling a shift that could redefine the landscape of digital currencies in the U.S. While the potential for innovation remains strong, the path forward will depend on how regulators balance the need for consumer protection with the desire to foster a vibrant and innovative financial ecosystem. As the situation continues to evolve, stakeholders in the cryptocurrency market will need to stay informed and adapt to the changing regulatory environment.

In summary, the rhetoric surrounding cryptocurrency regulations under the Biden administration is critical for anyone involved in the crypto space. With the future of digital currencies potentially hanging in the balance, ongoing dialogue and engagement between the government and the crypto community will be essential in shaping a framework that supports both innovation and security.

JUST IN: Treasury Secretary Bessent says the Biden administration put crypto on a path of extinction. pic.twitter.com/eaV2NAuA03

— Watcher.Guru (@WatcherGuru) June 3, 2025

JUST IN: Treasury Secretary Bessent says the Biden administration put crypto on a path of extinction

In a stunning announcement that sent shockwaves through the financial and cryptocurrency communities, Treasury Secretary Bessent stated that the Biden administration has effectively put cryptocurrency on a path of extinction. This statement raises significant questions about the future of digital currencies in the United States and beyond. What does this mean for investors, businesses, and the broader crypto ecosystem? Let’s dive into the implications of this bold claim.

Understanding the Statement

The assertion from Secretary Bessent came during a press briefing where she detailed the administration’s stance on digital currencies. The idea that the government could extinguish cryptocurrency is not just alarming; it’s a call to action for many who have invested time and resources into this innovative technology. The Secretary’s comments suggest that there could be more stringent regulations coming down the pipeline, which could potentially stifle innovation and investment in the crypto space.

Cryptocurrencies like Bitcoin and Ethereum have revolutionized the way we think about money and transactions. They operate on decentralized networks, allowing for peer-to-peer transactions without the need for intermediaries like banks. However, with growing concerns about consumer protection, fraud, and market volatility, the government may feel compelled to step in more aggressively.

The Regulatory Landscape

The regulatory landscape for cryptocurrency is constantly evolving. In recent years, we’ve seen various countries take different approaches to digital currencies. Some have embraced them, while others have sought to ban them outright. The Biden administration’s approach seems to lean towards the latter, according to Secretary Bessent’s comments. This could lead to a scenario where the government imposes strict regulations that could limit the use and viability of cryptocurrencies.

For instance, the administration might consider regulations that require crypto exchanges to adhere to traditional banking laws, making it harder for businesses and individuals to trade or invest in cryptocurrencies. Such measures could include mandatory reporting of transactions, higher compliance costs, and even the potential for taxation that could diminish the appeal of crypto investments.

Impact on Investors

For investors, this announcement is particularly concerning. Many individuals have poured their savings into cryptocurrencies, believing in their potential for high returns. If the government enacts stringent regulations, it could lead to a significant drop in the value of these digital assets. Investors might find themselves in a precarious position, wondering whether to hold onto their assets in hopes of a recovery or to sell off before regulations take hold.

Moreover, the uncertainty created by such statements can lead to increased volatility in the market. Investors thrive on information, and when that information is as dire as a potential “path of extinction,” it creates panic. Many may rush to sell, leading to a drop in prices and further instability in the market.

Business Implications

Businesses that have incorporated cryptocurrencies into their operations will also feel the impact of these comments. Companies that accept Bitcoin or Ethereum as payment could find themselves facing new compliance hurdles, making it more complicated and costly to do business. This could deter small businesses from adopting cryptocurrency, stifling innovation and growth in a sector that has the potential to reshape the economy.

Furthermore, startups focused on blockchain technology and cryptocurrencies may struggle to secure funding if investors perceive a high level of risk associated with potential government regulations. Venture capitalists and angel investors may be hesitant to back projects that could be impacted by a hostile regulatory environment, which could lead to a slowdown in technological advancements.

The Global Context

The United States is not the only country grappling with the implications of cryptocurrency. Worldwide, nations are looking to establish their own regulatory frameworks. As countries like El Salvador embrace Bitcoin as legal tender, the U.S. risks falling behind in the global race for cryptocurrency adoption. This could lead to a scenario where American innovation is stifled while other nations reap the benefits of a flourishing digital economy.

Additionally, if the United States implements stringent regulations while other countries adopt a more lenient stance, we might see a capital flight where investors and businesses relocate to more crypto-friendly jurisdictions. This could further diminish the U.S.’s standing as a leader in technology and finance.

What Can We Expect Moving Forward?

As the dust settles from Secretary Bessent’s announcement, many are left wondering what the future holds for cryptocurrency in the U.S. Will we see a wave of new regulations aimed at curbing the use of digital currencies, or will the government find a way to strike a balance that allows for innovation while ensuring consumer protection? The answer remains unclear.

One possibility is that lawmakers will engage with industry leaders to create a regulatory framework that fosters innovation while addressing concerns about fraud and consumer protection. This collaborative approach could mitigate some of the fears surrounding the extinction of cryptocurrency.

The Role of the Crypto Community

The crypto community has always been resilient and adaptable. As the landscape shifts, it’s essential for enthusiasts, investors, and businesses to stay informed and engaged. Advocating for reasonable regulations that protect consumers while allowing for growth in the crypto space will be crucial in the coming months and years.

Moreover, dialogue between regulators and the crypto community can help ensure that any proposed regulations are practical and beneficial for all parties involved. Open channels of communication can lead to better understanding and ultimately more balanced policies that support innovation while safeguarding the interests of consumers.

Conclusion

Secretary Bessent’s statement about the Biden administration putting cryptocurrency on a path of extinction has raised significant concerns across the financial landscape. Investors, businesses, and the broader crypto community must navigate this uncertain terrain carefully. While the future remains unpredictable, staying informed and engaged with the evolving regulatory landscape will be vital for anyone involved in the world of digital currencies.

As we move forward, it will be interesting to monitor how the government chooses to approach cryptocurrency regulation and how the community responds to these challenges. The potential for innovation and growth in this space remains strong, but it will require collaboration and understanding from all stakeholders to ensure a thriving future for cryptocurrencies.

“`

This article covers the implications of the statement made by Treasury Secretary Bessent regarding the Biden administration’s stance on cryptocurrency, while maintaining an engaging and conversational tone. The content is optimized for SEO with relevant keywords and structured using HTML headings for better readability and search engine visibility.