M2 Money Supply Soars to $21.86 Trillion—Is Crypto About to Explode?

M2 money supply growth, cryptocurrency investment trends, economic impact of monetary policy

—————–

M2 Money Supply Reaches New Heights: Implications for Cryptocurrency

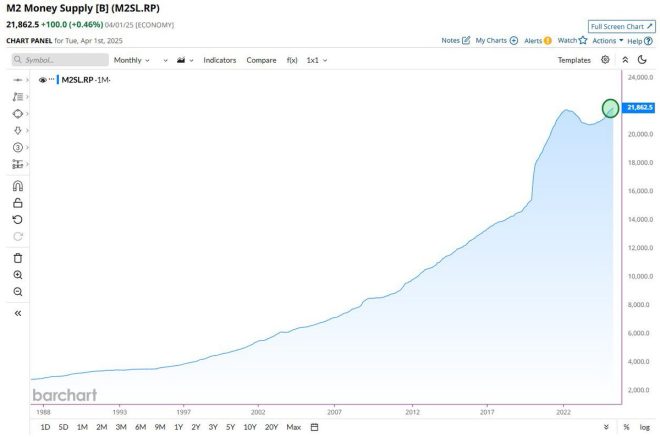

In a significant economic update, the M2 money supply has surged to an unprecedented $21.86 trillion, marking a new all-time high. This substantial increase raises critical questions about the implications for various financial markets, especially the cryptocurrency sector. As the flow of money into digital assets begins to shift, understanding the dynamics at play is crucial for investors and enthusiasts alike.

What is M2 Money Supply?

M2 money supply encompasses a broad measure of the total amount of money available in an economy at a particular time. This includes cash, checking deposits, and easily convertible near money. The rise in M2 indicates that more money is circulating, which can influence inflation rates, interest rates, and overall economic growth. With the latest figure reaching $21.86 trillion, investors are keenly aware of the potential effects this could have on various asset classes, including cryptocurrencies.

The Connection Between M2 Money Supply and Cryptocurrency

The recent record in M2 money supply brings forth an intriguing possibility: an influx of capital into the cryptocurrency market. Historically, when the money supply increases, it often leads to higher investments in alternative assets, including stocks, commodities, and cryptocurrencies. As traditional financial markets face challenges, investors may seek refuge in digital currencies, which are perceived as a hedge against inflation.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Potential Impact on Crypto Markets

- Increased Investment: With more money circulating in the economy, it is plausible that a portion of this capital will flow into cryptocurrencies. Investors looking for high-growth opportunities might turn to Bitcoin, Ethereum, and other altcoins as they seek to capitalize on potential price surges.

- Inflation Hedge: As the money supply increases, inflation concerns typically arise. Cryptocurrencies, particularly Bitcoin, have been touted as a hedge against inflation due to their limited supply. As more individuals and institutions recognize the potential of digital currencies to preserve value, we could see a significant uptick in adoption.

- Market Volatility: The crypto market is known for its volatility. An influx of new investments could lead to rapid price movements, both upward and downward. While this can create opportunities for traders, it also poses risks that investors should be aware of.

- Institutional Adoption: With the rise in M2 money supply, there is a chance that institutional players will increase their exposure to cryptocurrencies. The involvement of major financial institutions can further legitimize digital assets and drive prices higher, creating a feedback loop of increased investment and higher valuations.

The Role of Speculation

Speculation plays a significant role in the cryptocurrency market. The announcement of the M2 money supply hitting new heights may lead to speculative trading as investors react to news and trends. Social media platforms, especially Twitter, have become hotbeds for discussions around cryptocurrency, with many traders and analysts sharing insights and predictions. The tweet from Crypto Beast highlights this speculative nature, suggesting that the current economic climate could be a catalyst for a surge in crypto investments.

Risks and Considerations

While the potential for growth in the cryptocurrency market is enticing, it is crucial for investors to approach with caution. Several risks must be considered:

- Regulatory Risks: As cryptocurrencies gain traction, governments worldwide may implement regulations that could impact the market. Investors should stay informed about regulatory developments that could affect their holdings.

- Market Sentiment: The crypto market is heavily influenced by sentiment. Negative news or shifts in investor confidence can lead to rapid declines in prices, underscoring the importance of vigilance and research.

- Technological Risks: The underlying technology of cryptocurrencies is still evolving. Issues such as security vulnerabilities, scalability, and network congestion can affect the usability and value of digital assets.

Conclusion

The recent spike in the M2 money supply to $21.86 trillion presents a unique opportunity for cryptocurrency investors. As more capital becomes available, the potential for increased investment in digital assets is significant. However, with these opportunities come challenges and risks that must be navigated carefully.

Investors should remain informed about economic trends, regulatory developments, and market sentiment as they consider their strategies in the ever-evolving landscape of cryptocurrencies. As the tweet from Crypto Beast suggests, the flow of money into crypto could lead to transformative changes in the market, making it an exciting time for those involved in the world of digital assets.

By staying ahead of the curve and understanding the implications of economic indicators like the M2 money supply, investors can make more informed decisions in their cryptocurrency endeavors.

BREAKING

M2 Money Supply hits new all-time high of $21.86 Trillion.

Wait until this money flow into crypto. pic.twitter.com/5ouimVbEyd

— Crypto Beast (@cryptobeastreal) June 3, 2025

BREAKING

Big news in the financial world! The M2 Money Supply has officially hit a jaw-dropping all-time high of $21.86 Trillion. This significant milestone opens up a myriad of possibilities, especially when we consider where this money might flow next. The buzz on social media, particularly from influential accounts like @cryptobeastreal, suggests that a substantial chunk of this cash could find its way into the cryptocurrency market. So, what does this mean for crypto enthusiasts and investors?

M2 Money Supply Hits New All-Time High of $21.86 Trillion

To understand the implications of the M2 Money Supply reaching such an astronomical figure, we first need to grasp what M2 actually is. M2 includes all the physical cash and liquid assets that can be quickly converted to cash. This encompasses everything from coins and paper money to checking accounts and savings deposits. The rise to $21.86 Trillion reflects a significant increase in liquidity within the economy, which can spur spending, investment, and, consequently, inflation.

When you consider that the M2 Money Supply has been steadily increasing, one can only wonder about the potential impacts on various sectors, and particularly on cryptocurrencies. The idea that this liquidity could flow into crypto is both exciting and somewhat concerning, as rapid influxes of capital can lead to heightened volatility.

Wait Until This Money Flows Into Crypto

Now, let’s dive into the juicy part: the potential impact on the cryptocurrency market. As more capital flows into the economy, and with the M2 Money Supply hitting record levels, there’s a strong likelihood that investors will seek alternative assets to hedge against inflation and currency devaluation. Cryptocurrencies, often viewed as a hedge against traditional financial systems, could see a significant uptick in investment as a result.

Many people are already speculating on which cryptocurrencies might benefit the most. Bitcoin has always been the front-runner, but altcoins are gaining traction as well. Ethereum, for instance, continues to innovate with its smart contract capabilities, while newer projects are emerging that promise faster transactions and better scalability. As the money supply increases, investors might diversify their portfolios, seeking both stability and growth potential offered by various cryptocurrencies.

The Role of Inflation in Driving Crypto Demand

Inflation is a key player in this scenario. When traditional currencies lose purchasing power, people often turn to assets that can preserve their wealth. Cryptocurrencies have become increasingly popular in this regard. The decentralized nature of crypto makes it appealing, especially in times of economic uncertainty. With the M2 Money Supply reaching new heights, inflation fears may push more investors toward digital assets.

For example, if a significant portion of the $21.86 Trillion in M2 finds its way into crypto, we might see a surge in demand that could drive prices up dramatically. It’s a classic case of supply and demand. If more people want to buy Bitcoin or Ethereum, and the supply remains relatively fixed, prices are bound to rise.

Investor Sentiment and Market Trends

As we see this trend unfold, it’s essential to keep an eye on investor sentiment. Social media is a powerful tool in shaping perceptions and trends in the crypto market. Platforms like Twitter and Reddit have become hubs for crypto discussions, and the enthusiasm (or lack thereof) can greatly impact market behavior. The “wait until this money flows into crypto” sentiment could act as a self-fulfilling prophecy, driving prices up as more investors jump on the bandwagon.

Moreover, the media plays a crucial role in shaping public perception. As more financial news outlets cover the implications of the M2 Money Supply increase, we can expect heightened interest in cryptocurrencies. This could lead to a wave of new investors entering the market, further driving up demand and prices.

The Risks of a Sudden Influx of Capital

However, it’s not all sunshine and rainbows. A sudden influx of capital can lead to extreme market volatility. If too much money floods into crypto too quickly, it can create bubbles that are vulnerable to bursts. Investors must be cautious and do their due diligence before diving into this potentially lucrative but risky market.

Additionally, regulatory bodies are keeping a close watch on the cryptocurrency space. As more capital enters, governments may feel compelled to impose regulations to protect investors and maintain economic stability. This could impact market dynamics significantly, either positively or negatively. Keeping an eye on regulatory developments is crucial for anyone investing in crypto.

How to Prepare for the Potential Crypto Surge

If you’re considering investing in cryptocurrencies as the M2 Money Supply continues to rise, here are a few tips to prepare:

- Research: Understand the different cryptocurrencies, their use cases, and the technology behind them. Knowledge is power!

- Diversify: Don’t put all your eggs in one basket. Consider holding a mix of different cryptocurrencies to spread out your risk.

- Stay Updated: Follow news and trends in both the traditional financial world and the crypto space. This will help you make informed decisions.

- Be Cautious: Remember that high potential rewards come with high risks. Only invest what you can afford to lose.

Conclusion

The recent spike in the M2 Money Supply to $21.86 Trillion has set the stage for an exciting chapter in the cryptocurrency narrative. With the potential for a significant flow of money into crypto markets, investors are keenly watching how this plays out. While there are opportunities for substantial gains, it’s vital to approach this landscape with caution and informed decision-making. The crypto world is ever-evolving, and now is a pivotal moment that could redefine how we view and interact with digital currencies.

Stay tuned and keep your eyes peeled, as the intersection of traditional finance and cryptocurrency continues to unfold in fascinating ways!