BlackRock’s Shocking $26M ETH Purchase: What This Means for Crypto’s Future!

Ethereum investment trends, Coinbase cryptocurrency purchases, institutional buying momentum

—————–

BREAKING news: BLACKROCK’S SIGNIFICANT INVESTMENT IN ETHEREUM

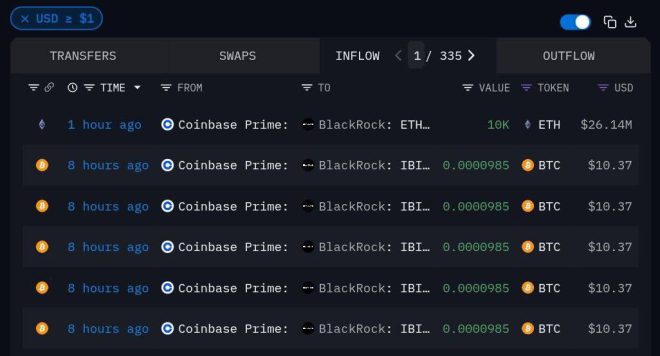

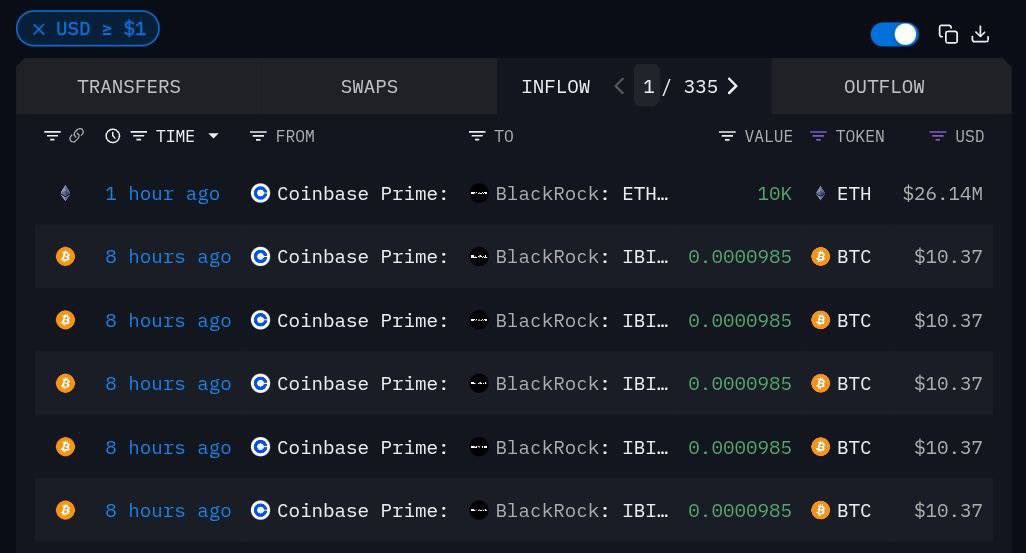

In a major development within the cryptocurrency market, BlackRock, a global investment management corporation, has made headlines with its recent acquisition of 10,000 ETH, valued at approximately $26.2 million. This strategic move, executed through Coinbase, has sparked excitement among investors and analysts alike, leading to bullish sentiment surrounding Ethereum (ETH).

BLACKROCK’S ROLE IN THE CRYPTOCURRENCY MARKET

BlackRock is one of the largest asset managers in the world, holding trillions in assets under management. Their entry into the cryptocurrency space has been closely watched, as it signals institutional interest in digital assets. With this latest purchase of Ethereum, BlackRock underscores its confidence in the cryptocurrency’s potential for growth.

WHAT DOES THIS MEAN FOR ETHEREUM?

The acquisition of such a substantial amount of ETH by a prominent institutional investor like BlackRock is likely to have several implications:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Increased Legitimacy: BlackRock’s investment lends credibility to Ethereum, positioning it as a viable asset class for institutional investors. This could encourage more funds to consider allocating resources to cryptocurrencies.

- Price Surge Potential: News of BlackRock’s acquisition has already generated excitement in the crypto community, leading to a potential price surge for ETH. Investors are generally optimistic about the price appreciation of Ethereum, especially given its smart contract capabilities and the growing decentralized finance (DeFi) ecosystem.

- Market Dynamics: The influx of institutional capital can significantly affect market dynamics. As major players like BlackRock enter the space, liquidity and trading volume are likely to increase, potentially leading to greater price stability for Ethereum.

BLACKROCK AND COINBASE: A STRATEGIC PARTNERSHIP

BlackRock’s choice to execute this purchase through Coinbase, one of the largest cryptocurrency exchanges, highlights the importance of trusted platforms in the crypto ecosystem. Coinbase’s regulatory compliance and security measures make it a preferred choice for institutional investors looking to enter the market while mitigating risks.

THE FUTURE OF ETHEREUM

As the cryptocurrency landscape continues to evolve, Ethereum remains at the forefront due to its robust technology and adaptability. The network’s transition to Ethereum 2.0 aims to enhance scalability, security, and sustainability, making it an attractive option for both retail and institutional investors.

BULLISH MARKET SENTIMENT

The bullish sentiment surrounding Ethereum is further fueled by several factors:

- DeFi Growth: The decentralized finance sector has expanded rapidly, with Ethereum being the backbone of most DeFi projects. As more users interact with decentralized applications (dApps), demand for ETH is likely to increase.

- NFT Boom: Non-fungible tokens (NFTs) have gained immense popularity, primarily built on the Ethereum blockchain. The continued interest in NFTs could drive further demand for ETH, as users require the currency to engage in transactions.

- Institutional Adoption: As demonstrated by BlackRock’s recent investment, institutional adoption of Ethereum is on the rise. This trend could lead to a more mature market, further solidifying Ethereum’s position as a leading cryptocurrency.

CONCLUSION

BlackRock’s acquisition of 10,000 ETH for $26.2 million is a significant milestone for the cryptocurrency industry. This move not only reflects growing institutional interest but also highlights the potential of Ethereum as a leading digital asset. As the market reacts positively to this news, investors are encouraged to keep an eye on Ethereum’s developments and the broader implications of institutional investments in cryptocurrencies.

The future looks promising for Ethereum, as it continues to innovate and adapt in a rapidly changing market. With the backing of major players like BlackRock, ETH is poised for exciting growth ahead.

Investors should consider this development seriously, as it could shape the future of both Ethereum and the broader cryptocurrency landscape. As always, thorough research and risk assessment are essential before making investment decisions in this volatile market.

Stay updated on developments in the cryptocurrency space, and watch how Ethereum continues to thrive in the wake of institutional interest.

BREAKING:

BLACKROCK HAS JUST BOUGHT 10,000 ETH WORTH $26.2 MILLION ON COINBASE.

BULLISH FOR $ETH pic.twitter.com/gYwvoL8TFk

— Ash Crypto (@Ashcryptoreal) June 3, 2025

BREAKING:

Big news is making waves in the cryptocurrency market today: BlackRock has just bought 10,000 ETH worth $26.2 million on Coinbase. This significant investment is not just a number; it’s a clear indication of growing institutional interest in Ethereum and the crypto space as a whole. BlackRock, the world’s largest asset manager, is known for its cautious yet strategic investments, and this move is sparking excitement among crypto enthusiasts and investors alike.

BULLISH FOR $ETH

With this recent purchase, many are feeling bullish for $ETH. The Ethereum network has been gaining traction, and BlackRock’s entry into this space could potentially influence other institutional investors to follow suit. This is not just about the purchase itself; it’s about what it signifies for the future of Ethereum and cryptocurrencies in general.

Understanding BlackRock’s Investment Strategy

BlackRock’s investment strategy is often seen as a bellwether for market trends. When they make a move, people take notice. Their decision to invest in Ethereum, particularly at a time when the cryptocurrency market is oscillating, suggests they see long-term value in the asset. According to Forbes, BlackRock has been eyeing Ethereum for a while, recognizing its potential to revolutionize various sectors through smart contracts and decentralized applications.

The Impact of Institutional Investment on Crypto

Institutional investments like BlackRock’s can have a profound impact on the cryptocurrency market. When large firms enter the space, it usually leads to increased legitimacy and confidence in cryptocurrencies. This influx of capital can drive prices up, as more investors feel secure jumping into the market. According to a report by Bloomberg, such investments often lead to a ripple effect, encouraging retail investors to participate.

What This Means for Ethereum’s Future

The purchase of 10,000 ETH isn’t just a one-off event; it represents a larger trend of adoption. With Ethereum 2.0 and the transition to a proof-of-stake model, many believe that Ethereum is poised for tremendous growth. This transition is aimed at making the network more efficient and sustainable. As Ethereum continues to evolve, institutional backing from companies like BlackRock could provide the support needed for further advancements.

Market Reactions to BlackRock’s Announcement

Market reactions to this announcement have been overwhelmingly positive. Following the news, Ethereum experienced a significant uptick in price. Many traders and investors are now closely monitoring how this will impact the overall market sentiment. The bullish sentiment surrounding Ethereum is palpable, with many analysts predicting further price increases as institutional interest grows.

The Broader Implications of BlackRock’s Investment

BlackRock’s investment does not only impact Ethereum; it also sends a message about the future of other cryptocurrencies. As one of the largest asset managers globally, their endorsement of Ethereum could lead to a broader acceptance of digital assets among traditional finance players. This could pave the way for more cryptocurrencies to gain institutional interest, which is crucial for the overall maturation of the crypto market.

Ethereum’s Importance in the Decentralized Finance (DeFi) Space

Ethereum holds a vital role in the growing DeFi ecosystem. Many of the leading DeFi protocols are built on Ethereum, and with BlackRock’s investment, we can expect increased development and innovation in this space. The DeFi sector has already shown immense growth, and with more significant players entering the market, it could expand even further. According to CoinDesk, DeFi allows users to lend, borrow, and trade without the need for traditional banks, making it a compelling alternative for many.

How to Navigate the Current Crypto Landscape

If you’re looking to navigate the current crypto landscape, keep an eye on Ethereum and the developments surrounding it. With institutional investments like BlackRock’s, there’s a strong possibility of increased volatility and opportunity. Make sure to stay updated on market trends, and consider diversifying your portfolio to include assets that show promise based on these developments.

Conclusion: A New Era for Ethereum and Cryptocurrency

BlackRock’s recent purchase of 10,000 ETH is a landmark event in the cryptocurrency space. It signals not just a commitment to Ethereum but also the potential for wider acceptance of digital assets in traditional finance. As we look to the future, the implications of this investment will likely unfold over time, impacting not only Ethereum but the broader cryptocurrency market. With increasing institutional interest, the next chapter for cryptocurrencies could be just around the corner.

So, whether you’re a seasoned investor or just getting started in the crypto world, this is a moment to pay attention to. The bullish sentiment surrounding $ETH could be an exciting opportunity for many, and BlackRock’s endorsement only adds to the growing narrative of digital currencies becoming a staple in financial markets.