“BlackRock’s Shocking Crypto Moves: $560M BTC Inflow Sparks Market Panic!”

Bitcoin investment strategies, cryptocurrency market movements, Ethereum withdrawal trends

—————–

BlackRock’s Major Cryptocurrency Movements: A Game Changer in the Market

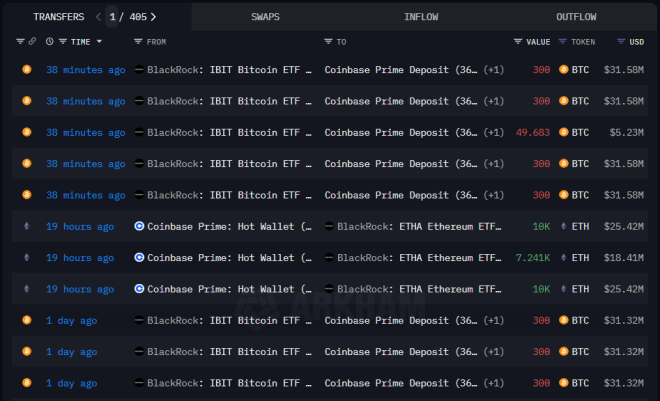

In a significant development for the cryptocurrency market, investment giant BlackRock has recently made headlines by depositing a staggering 1,249.68 Bitcoin (BTC) into Coinbase, valued at approximately $131.55 million. Over the past two days, BlackRock has deposited a total of 5,362.37 BTC, equivalent to an impressive $560.94 million. This bold move has drawn the attention of investors and analysts alike, prompting discussions about BlackRock’s strategy and its implications for the broader crypto landscape.

Understanding BlackRock’s Deposits

BlackRock’s decision to deposit such a large amount of Bitcoin into Coinbase is noteworthy for several reasons. First, it signals a strong belief in the future of Bitcoin and cryptocurrencies as a whole. As one of the largest asset management firms globally, BlackRock’s actions carry weight and can influence market sentiment significantly. The recent deposits suggest that BlackRock might be positioning itself to capitalize on Bitcoin’s potential for growth, especially in a volatile market.

Moreover, the deposits also underscore a growing trend among institutional investors. With BlackRock’s entrance into the Bitcoin market, other financial institutions may follow suit, further legitimizing cryptocurrency as an asset class. This influx of institutional capital could lead to increased liquidity in the market, potentially driving prices higher.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Withdrawals of Ethereum

In addition to the Bitcoin deposits, BlackRock has also made headlines with its withdrawal of 27,241.4 Ethereum (ETH), valued at around $69.25 million. This move raises questions about BlackRock’s overall strategy regarding its cryptocurrency holdings. While the deposits indicate a bullish stance on Bitcoin, the withdrawal of Ethereum could suggest a reevaluation of its position in the Ethereum market.

It’s essential to note that Ethereum has been facing its challenges, including scalability issues and competition from other blockchain platforms. BlackRock’s decision to withdraw a significant amount of ETH may reflect a strategic shift, focusing more on Bitcoin as a store of value while possibly monitoring the developments in the Ethereum ecosystem.

Implications for the Cryptocurrency Market

The recent activities of BlackRock have significant implications for the cryptocurrency market. First and foremost, it bolsters the notion that institutional interest in cryptocurrencies is growing. This increased interest can lead to enhanced legitimacy for cryptocurrencies in the eyes of traditional investors and financial institutions. As more institutional players enter the market, it could pave the way for regulatory clarity and broader acceptance of digital assets.

Furthermore, BlackRock’s Bitcoin deposits may serve as a catalyst for price movements. Historically, large institutional purchases have been associated with price surges in the cryptocurrency market. As investors closely watch BlackRock’s moves, it could create a sense of urgency to enter the market, driving demand and potentially pushing prices higher.

The Role of Coinbase

Coinbase, as the chosen platform for these transactions, plays a critical role in this narrative. As one of the largest cryptocurrency exchanges in the United States, Coinbase has positioned itself as a trusted platform for institutional investors. The fact that BlackRock is utilizing Coinbase for its transactions adds to the exchange’s credibility and may encourage other institutions to engage with the platform.

Coinbase’s user-friendly interface, robust security measures, and regulatory compliance make it an attractive option for institutional investors looking to enter the cryptocurrency space. As BlackRock’s deposits highlight the potential for institutional investment in cryptocurrencies, Coinbase stands to benefit from increased trading volume and user engagement.

The Future of Cryptocurrency Investments

As the cryptocurrency market continues to evolve, the involvement of institutional players like BlackRock will shape its future. The recent deposit of Bitcoin and withdrawal of Ethereum signals a pivotal moment for both the company and the cryptocurrency market. Investors should keep a close eye on BlackRock’s future moves, as they may provide insights into the broader trends within the crypto space.

In conclusion, BlackRock’s recent cryptocurrency transactions represent a significant development in the ongoing evolution of digital assets. With an investment worth over $560 million in Bitcoin and a strategic withdrawal of Ethereum, BlackRock is positioning itself as a key player in the cryptocurrency market. This move not only reflects growing institutional interest in Bitcoin but also emphasizes the importance of platforms like Coinbase in facilitating these transactions.

As the cryptocurrency landscape continues to mature, the actions of major institutional players will undoubtedly influence market dynamics. Investors and analysts alike will be keen to monitor BlackRock’s ongoing strategy and its impact on the overall cryptocurrency ecosystem. With the potential for increased adoption and regulatory clarity, the future of cryptocurrency investments looks promising, and BlackRock’s recent activities are just the beginning of a new chapter in this innovative financial frontier.

BREAKING:

BLACKROCK DEPOSITED 1,249.68 $BTC INTO COINBASE, WORTH 131.55 MILLION DOLLARS.

OVER THE PAST TWO DAYS, THEY DEPOSITED A TOTAL OF 5,362.37 BTC, VALUED AT 560.94 MILLION DOLLARS.

THEY ALSO WITHDREW 27,241.4 $ETH, WORTH 69.25 MILLION DOLLARS. pic.twitter.com/wHR2TpLYoL

— Crypto Rover (@rovercrc) June 3, 2025

BREAKING: BLACKROCK DEPOSITED 1,249.68 $BTC INTO COINBASE, WORTH 131.55 MILLION DOLLARS.

In a significant move that has sent ripples through the cryptocurrency market, BlackRock recently deposited 1,249.68 Bitcoin (BTC) into Coinbase. This deposit is valued at an impressive $131.55 million. For those who keep a close eye on crypto movements, BlackRock’s actions are always worth noting, given their influential position in the financial world. As institutional interest in Bitcoin and other cryptocurrencies grows, the implications of such transactions become increasingly relevant to investors and enthusiasts alike.

BlackRock’s recent activity marks a pivotal moment in the ongoing adoption of cryptocurrencies by large financial institutions. The company has been at the forefront of this shift, and their latest deposit is a clear signal of their commitment to digital assets. As one of the world’s largest asset managers, BlackRock’s involvement in cryptocurrency can potentially legitimize the market further, drawing in more institutional investors. This could lead to increased stability in Bitcoin’s price and a more robust ecosystem for cryptocurrencies overall.

OVER THE PAST TWO DAYS, THEY DEPOSITED A TOTAL OF 5,362.37 BTC, VALUED AT 560.94 MILLION DOLLARS.

In just two days, BlackRock has deposited a staggering total of 5,362.37 BTC, which equates to a whopping $560.94 million. This massive influx of Bitcoin into Coinbase showcases not only the company’s bullish stance on cryptocurrencies but also the growing trend of institutional investment. With Bitcoin’s price fluctuating and the market experiencing various cycles, such heavy investment indicates a long-term belief in the asset’s potential.

Investors and analysts are paying close attention to these movements, as they often serve as indicators of market sentiment. When institutions like BlackRock make significant transactions, it can lead to increased confidence among retail investors. This could potentially drive the price of Bitcoin higher as demand increases. Additionally, the sheer volume of Bitcoin being deposited suggests that BlackRock is positioning itself for a future where cryptocurrencies play a central role in financial markets.

THEY ALSO WITHDREW 27,241.4 $ETH, WORTH 69.25 MILLION DOLLARS.

In addition to their Bitcoin deposits, BlackRock also withdrew a substantial amount of Ethereum (ETH) — specifically, 27,241.4 ETH, valued at $69.25 million. This withdrawal raises questions about BlackRock’s strategy regarding Ethereum and its future role in their investment portfolio. Ethereum, being one of the leading cryptocurrencies, is known for its smart contract capabilities and is seen as a key player in the decentralized finance (DeFi) space.

The decision to withdraw such a significant amount of ETH might indicate a strategic reallocation of assets or a reaction to market conditions. It’s essential to consider that Ethereum’s ecosystem is evolving rapidly, and BlackRock’s actions could reflect ongoing adjustments in their investment strategy. As the DeFi landscape matures, institutions are likely to refine their approaches to balance risk and reward effectively.

What Does This Mean for the Cryptocurrency Market?

BlackRock’s recent transactions highlight a broader trend of institutional adoption in the cryptocurrency space. With large entities like BlackRock entering the market, there’s a growing belief that cryptocurrencies are becoming an integral part of the financial system. This could mean more stability and legitimacy for Bitcoin and Ethereum, which may attract more traditional investors who have been hesitant to dive into the crypto waters.

The influx of institutional funds can also lead to increased liquidity in the market, making it easier for retail investors to buy and sell cryptocurrencies without causing significant price fluctuations. Over time, this could lead to a more mature crypto market, which is better equipped to handle the volatility that has characterized it in the past.

Moreover, as institutional investors like BlackRock continue to engage with cryptocurrencies, we may see regulatory frameworks evolve to accommodate this new landscape. This can pave the way for clearer guidelines that could boost investor confidence and further drive adoption.

The Bigger Picture: Institutional Investment Trends

The trend of institutional investment in cryptocurrencies isn’t just confined to BlackRock. Other major financial institutions and hedge funds are also exploring the crypto space, creating a snowball effect that could fundamentally change the market. Companies like Fidelity and Goldman Sachs have also shown interest in Bitcoin and other cryptocurrencies, indicating a shift in how traditional finance views digital assets.

This growing acceptance among institutional players could lead to a more significant influx of capital into the crypto market. As more companies adopt cryptocurrencies as part of their investment strategies, the narrative surrounding digital assets is likely to shift from speculative investments to legitimate components of financial portfolios.

Investor Sentiment and Market Reactions

As news of BlackRock’s transactions spreads, it’s essential to consider how the broader investor community is reacting. The cryptocurrency market thrives on sentiment, and when major players like BlackRock make waves, it can significantly impact how retail investors and traders respond. Typically, bullish news leads to positive price movements, while any sign of caution from institutions can trigger sell-offs.

In this case, the deposits of Bitcoin and the withdrawal of Ethereum could create a mixed sentiment. While the influx of Bitcoin might be seen as a bullish indicator, the Ethereum withdrawal may raise eyebrows and lead to speculation about BlackRock’s confidence in the Ethereum ecosystem.

However, seasoned investors often remind us that the crypto market is notoriously volatile, and short-term reactions can be misleading. Instead, focusing on long-term trends and the underlying fundamentals of cryptocurrencies is crucial for making informed investment decisions.

The Future of Cryptocurrency Investments

Looking ahead, the actions of institutions like BlackRock are likely to shape the future of cryptocurrency investments. As more traditional financial institutions embrace digital assets, we may see increased demand for cryptocurrencies, leading to higher prices and greater market stability.

Moreover, innovations in blockchain technology and the growing popularity of decentralized finance could further influence how institutions approach cryptocurrency investments. As these technologies evolve, they will likely present new opportunities and challenges for investors and companies alike.

In summary, BlackRock’s recent deposits and withdrawals represent a significant moment in the cryptocurrency market. By depositing over 5,362 BTC and withdrawing a substantial amount of ETH, BlackRock is not just making waves but is also setting the stage for a future where cryptocurrencies play a central role in the global financial system. As we move forward, keeping an eye on these trends and understanding their implications will be crucial for anyone interested in the world of digital assets.