BlackRock Shocks Market: $131M Bitcoin Deposit Sparks Controversy!

BlackRock cryptocurrency investment, Bitcoin market trends 2025, Ethereum withdrawal strategies

—————–

BlackRock’s Significant Cryptocurrency Moves: A Game Changer for the Market

In recent news that has sent ripples through the cryptocurrency market, BlackRock, the world’s largest asset management firm, has made notable transactions involving Bitcoin (BTC) and Ethereum (ETH). This summary delves into the implications of these movements, exploring how they could influence the cryptocurrency landscape and what they mean for investors.

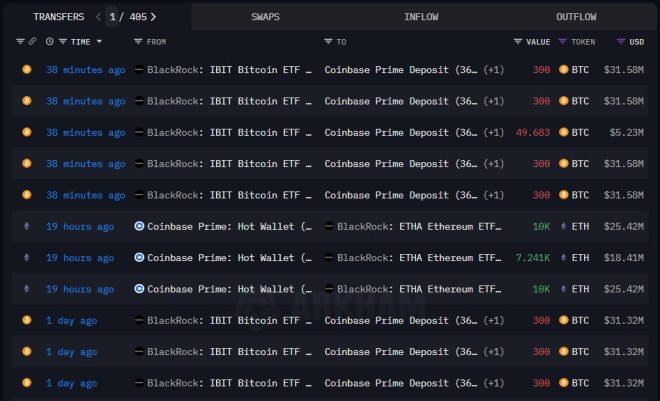

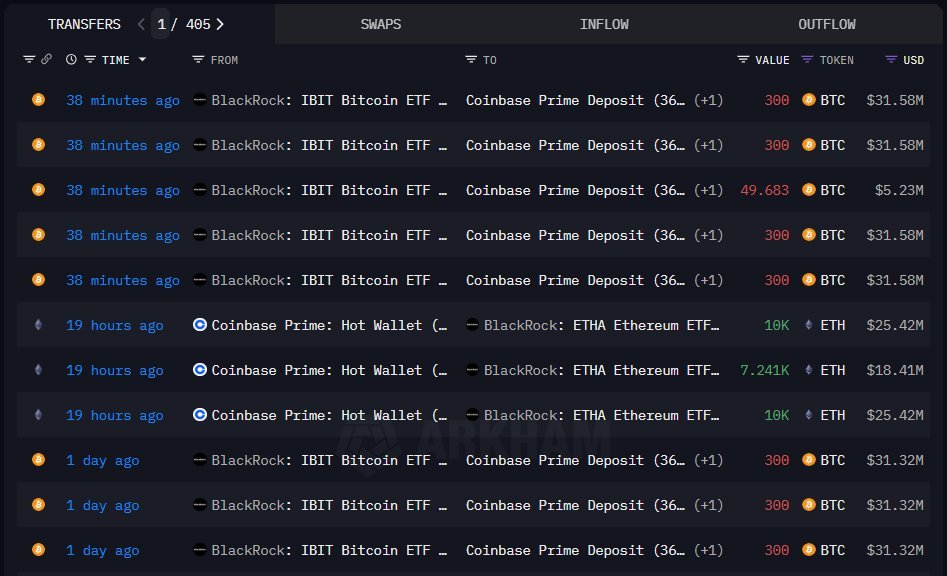

Overview of BlackRock’s Transactions

On June 3, 2025, Cointelegraph reported that BlackRock deposited an impressive 1,249.68 BTC, valued at approximately $131.55 million, into Coinbase. This was not an isolated incident; within just two days, BlackRock’s total Bitcoin deposits reached 5,362.37 BTC, equating to about $560.94 million. In stark contrast, the firm also withdrew 27,241.4 ETH, amounting to around $69.25 million, from the same platform.

Implications of the Deposits

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

1. Institutional Interest in Bitcoin

BlackRock’s significant Bitcoin deposits signal an increased institutional interest in Bitcoin, which could bolster its legitimacy and stability as a long-term investment. The influx of capital from such a reputable institution serves to validate Bitcoin as a serious asset class.

2. Market Response and Volatility

The market typically reacts strongly to movements by major players. BlackRock’s recent transactions could lead to increased volatility in Bitcoin prices as investors closely monitor the situation. The deposit of over $500 million in BTC is likely to create upward pressure on prices, as it reflects confidence in Bitcoin’s future performance.

3. Shift from Ethereum to Bitcoin

The simultaneous withdrawal of a large amount of ETH raises questions about the shifting preferences among institutional investors. This move may indicate a strategic pivot towards Bitcoin, potentially driven by the cryptocurrency’s established reputation as "digital gold." Such a shift could lead to a re-evaluation of Ethereum’s role in investment portfolios.

The Broader Impact on Cryptocurrency Market Dynamics

1. Institutional Adoption

BlackRock’s actions are part of a larger trend of institutional adoption in the cryptocurrency space. As large financial entities like BlackRock increase their stakes in digital assets, it could encourage smaller institutions and retail investors to follow suit, further legitimizing the market.

2. Regulatory Implications

With large institutions entering the cryptocurrency space, regulatory scrutiny is likely to intensify. BlackRock’s transactions could prompt regulators to establish clearer guidelines, which could benefit the market in the long run by providing a more secure environment for investment.

3. Influence on Altcoins

As Bitcoin continues to gain institutional support, altcoins like Ethereum may experience pressure to demonstrate their utility and value. Investors may become more selective, focusing on projects that offer unique solutions and technologies.

The Future of Bitcoin and Ethereum

1. Bitcoin’s Prospects

Given BlackRock’s recent investment, Bitcoin’s prospects appear promising. The growing institutional support could lead to greater stability and potentially higher prices, as more investors view Bitcoin as a hedge against inflation and economic uncertainty.

2. Ethereum’s Challenges and Opportunities

While Ethereum has faced challenges, particularly in the wake of BlackRock’s withdrawals, it still holds significant potential. The upcoming Ethereum upgrades and the platform’s transition towards a more energy-efficient proof-of-stake model could rejuvenate interest and investment in ETH.

Conclusion

BlackRock’s recent cryptocurrency activities underscore the growing trend of institutional investment in Bitcoin and the shifting dynamics within the cryptocurrency market. With substantial deposits into Bitcoin and withdrawals from Ethereum, BlackRock is not just influencing prices but also shaping the future trajectory of digital assets.

For investors, these developments serve as a crucial reminder of the importance of staying informed about market trends and the movements of institutional players. Whether you are a seasoned investor or just entering the cryptocurrency space, understanding these dynamics will be essential for navigating the evolving landscape of digital assets.

Key Takeaways

- BlackRock’s deposit of over $560 million in Bitcoin signals strong institutional interest.

- The simultaneous withdrawal of Ethereum raises questions about institutional preferences.

- Market volatility may increase as investors react to BlackRock’s significant moves.

- Institutional adoption could lead to greater regulatory clarity in the cryptocurrency space.

- The future of both Bitcoin and Ethereum remains promising, albeit with different challenges and opportunities.

As the cryptocurrency market continues to evolve, BlackRock’s actions will likely remain a focal point for investors and analysts alike. Keeping an eye on these developments will be crucial for anyone looking to understand the future of digital assets.

JUST IN: BlackRock deposits 1,249.68 $BTC ($131.55M) into Coinbase, totaling 5,362.37 $BTC ($560.94M) in 2 days, while withdrawing 27,241.4 $ETH ($69.25M) from the platform. pic.twitter.com/6YOCQKknjm

— Cointelegraph (@Cointelegraph) June 3, 2025

JUST IN: BlackRock deposits 1,249.68 $BTC ($131.55M) into Coinbase

BlackRock, the world’s largest asset manager, has made headlines recently with its significant cryptocurrency transactions. In a move that has stirred up discussions in the financial and crypto communities, BlackRock has deposited a whopping 1,249.68 Bitcoin (BTC) into Coinbase, worth approximately $131.55 million. This deposit is part of a larger strategy, as it totals to an astounding 5,362.37 BTC, valued at around $560.94 million, that BlackRock has deposited into the platform over just two days. But that’s not all—while making these deposits, BlackRock also withdrew a staggering 27,241.4 Ethereum (ETH), valued at $69.25 million. This activity has raised many eyebrows, prompting questions about BlackRock’s intentions and the potential implications for the cryptocurrency market.

Understanding BlackRock’s Crypto Strategy

What does it mean when a giant like BlackRock makes such significant moves in the cryptocurrency space? To put it simply, it signifies growing institutional interest in cryptocurrencies. BlackRock’s deposits into Coinbase aren’t just random transactions; they indicate a strategic approach to diversifying their asset portfolio. By increasing their Bitcoin holdings, BlackRock is likely looking to hedge against inflation and capitalize on Bitcoin’s potential as a store of value, much like gold.

Moreover, the withdrawal of Ethereum could suggest a reassessment of their investment strategy concerning altcoins. Ethereum has its own unique value propositions, especially with the rise of decentralized finance (DeFi) and smart contracts, but BlackRock’s current pivot might indicate a shift in focus towards Bitcoin as a more stable asset in the current market climate.

The Impact on the Crypto Market

When a major player like BlackRock enters or exits positions in the cryptocurrency market, it creates ripples that can affect prices and market sentiments. The recent deposits could potentially lead to bullish sentiments among investors, signaling that institutional players are confident in Bitcoin’s future.

As BlackRock continues to bolster its Bitcoin reserves, it might encourage other institutional investors to follow suit. This kind of institutional backing can provide much-needed legitimacy to Bitcoin and cryptocurrencies as a whole, helping to further integrate them into traditional financial systems.

Conversely, the withdrawal of such a significant amount of Ethereum may lead to some anxiety among ETH holders. It raises questions about whether these moves indicate a broader trend of institutions moving away from Ethereum. However, it’s essential to remember that market dynamics are complex, and one entity’s actions do not dictate the entire market’s trajectory.

What Does This Mean for Retail Investors?

So, what does all this mean for everyday investors like you and me? The first takeaway is that institutional interest in cryptocurrencies is on the rise, which could lead to increased price stability and growth for Bitcoin and other cryptocurrencies in the long run. When big players like BlackRock invest in crypto, it can lend credibility to the market and may encourage more widespread adoption.

However, it’s crucial to approach this news with a level head. While institutional investments can drive prices up, they can also lead to increased volatility, especially if these institutions decide to pull back at any time. Retail investors should always do their due diligence and consider their risk tolerance before diving into the crypto market.

Furthermore, the movements in Bitcoin and Ethereum highlight the importance of diversification. While Bitcoin may be seen as a more stable asset, Ethereum’s capabilities in DeFi, NFTs, and smart contracts shouldn’t be overlooked. It’s essential to strike a balance based on your investment strategy and risk profile.

Keeping an Eye on Future Developments

As the cryptocurrency landscape continues to evolve, it’s vital to stay updated on developments like those involving BlackRock. The company’s actions may set trends that could influence the broader market. Keeping track of institutional investments, regulatory changes, and technological advancements will help you make informed decisions.

Additionally, understanding how these big players operate can provide insights into potential market movements. BlackRock’s strategy may not just be about Bitcoin; it could lead to broader shifts in asset management and investment strategies across the board.

Conclusion

BlackRock’s recent activity of depositing 1,249.68 Bitcoin ($131.55M) into Coinbase, totaling 5,362.37 Bitcoin ($560.94M) in just two days, while withdrawing 27,241.4 Ethereum ($69.25M), has created significant buzz in the crypto world. These moves underscore the increasing institutional interest in cryptocurrencies, particularly Bitcoin, and offer a glimpse into the potential future of crypto investments.

For both institutional and retail investors, keeping an eye on these developments can provide valuable insights into the market’s direction. Whether you’re an experienced trader or just starting, understanding the implications of such large-scale transactions is crucial for navigating the dynamic landscape of cryptocurrency investment.