“Record Tariff Revenue Sparks Controversy: Are American Consumers Paying the Price?”

tariff revenue increase, US customs taxes growth, trade policy impact 2025

—————–

Record Tariff Revenue Collected in the US: An Overview

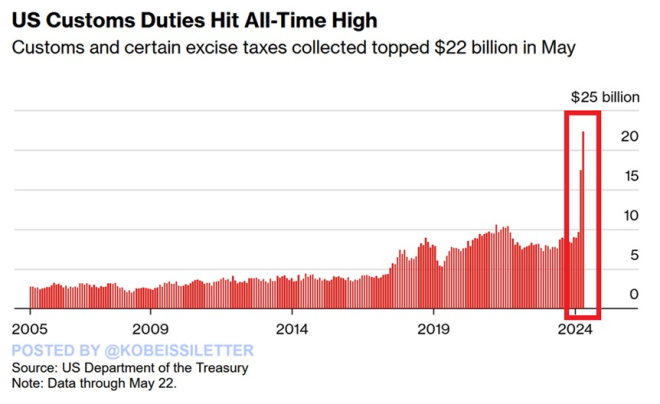

In a significant economic development, the United States has reported a record collection of tariff revenue in May, amounting to an impressive $22.3 billion. This figure marks a considerable increase from the previous month, where tariff revenue stood at $16.5 billion. The rapid growth in tariff revenue, which has more than doubled over the last two months, suggests a substantial shift in trade dynamics and government revenue generation strategies. This article delves into the implications of these figures, the factors driving this increase, and what it means for the US economy moving forward.

Understanding Tariff Revenue

Tariff revenue is generated from taxes imposed on imported goods and certain excise taxes. These tariffs are designed to protect domestic industries by making imported goods more expensive, thereby encouraging consumers to buy American-made products. The recent surge in tariff revenue is indicative of several underlying economic trends, including changes in international trade policies, import volumes, and consumer behavior.

Monthly and Year-to-Date Tariff Revenue Analysis

As highlighted in the recent report by The Kobeissi Letter, the tariff revenue collected in the first five months of 2025 has reached approximately $67.2 billion. This year-to-date figure underscores the significant role tariffs play in the federal government’s revenue stream. The doubling of tariff revenue in just two months points to an increased reliance on these taxes as a source of income, particularly as the government navigates various economic challenges.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Key Factors Contributing to Increased Tariff Revenue

- Shifts in Trade Policy: The US has seen several shifts in trade policy aimed at protecting domestic industries. These policies often lead to increased tariffs on specific imports, resulting in higher revenue collection.

- Increased Import Activity: The surge in tariff revenue can also be attributed to an increase in import activity. As consumer demand rises, businesses are importing more goods, which subsequently leads to higher tariff collections.

- Economic Recovery Post-Pandemic: As the economy continues to recover from the impacts of the COVID-19 pandemic, increased consumer spending has resulted in a greater volume of imports. This rise in imports has directly contributed to the record-high tariff revenue.

Implications for the US Economy

The record tariff revenue has several implications for the US economy. While increased tariff collections can indicate a robust economy, they also reflect ongoing trade tensions and the complexities of international trade relationships.

Potential Positive Outcomes

- Increased Government Revenue: The surge in tariff revenue provides the government with additional funds that can be used for various public initiatives, infrastructure projects, and social programs.

- Protection of Domestic Industries: Higher tariffs can help shield domestic industries from foreign competition, potentially leading to job creation and economic growth in certain sectors.

Possible Negative Effects

- Inflationary Pressures: Higher tariffs can lead to increased prices for imported goods, contributing to inflationary pressures in the economy. Consumers may face higher costs for everyday items as businesses pass on these costs.

- Retaliatory Measures: Increased tariffs may provoke retaliatory measures from other countries, leading to trade wars that can negatively impact US exporters and the overall economy.

The Future of Tariff Revenue

As the US government continues to rely on tariffs as a source of revenue, it is crucial to monitor the evolving trade landscape. Policymakers must balance the need for revenue generation with the potential consequences of high tariffs on consumers and international relations.

Strategies Moving Forward

- Evaluate Tariff Policies: Continuous evaluation of tariff policies is essential. Policymakers should assess the effectiveness of tariffs in protecting domestic industries versus the potential drawbacks of increased consumer prices and strained trade relationships.

- Diversify Revenue Sources: While tariffs have proven to be a significant revenue stream, diversifying sources of government revenue can help mitigate the risks associated with fluctuating tariff collections.

- Engage in Trade Negotiations: Proactive engagement in trade negotiations can help reduce tensions with trading partners and minimize the risk of retaliatory tariffs, fostering a more stable trade environment.

Conclusion

The record tariff revenue collected in May 2025 is a noteworthy development in the US economic landscape. While it highlights the government’s ability to generate income through tariffs, it also raises important questions about the long-term implications of such reliance. Balancing domestic protection with international trade relationships will be key as the US navigates its economic future. As the situation evolves, stakeholders from various sectors will need to remain vigilant and adaptable to the changing dynamics of tariffs and trade.

BREAKING: Tariff revenue collected in the US in May hit a record $22.3 billion, following $16.5 billion in April.

Customs and certain excise taxes have more than DOUBLED over the last 2 months.

Year-to-date, the government has collected ~$67.2 billion in tariff revenue.

As a… pic.twitter.com/NdoosDFmn9

— The Kobeissi Letter (@KobeissiLetter) June 2, 2025

BREAKING: Tariff Revenue Collected in the US in May Hit a Record $22.3 Billion, Following $16.5 Billion in April

The recent surge in tariff revenue is turning heads across the economic landscape. In May, the United States set a new record by collecting an astounding $22.3 billion in tariff revenue, following a solid $16.5 billion in April. This remarkable increase has sparked conversations about the implications for the economy and trade policies. Let’s unpack what this means for American taxpayers, businesses, and the overall economy.

Understanding Tariff Revenue and Its Impact

So, what exactly is tariff revenue? Essentially, tariffs are taxes imposed on imported goods, designed to regulate trade and protect domestic industries. When the government collects tariff revenue, it contributes to the country’s overall income, which can be allocated to various public services and infrastructure projects. In the context of the recent figures, the US government has collected roughly $67.2 billion in tariff revenue year-to-date, showcasing a significant increase in these revenues.

This increase can be attributed to several factors, including changing trade agreements, rising global inflation, and heightened scrutiny of foreign goods. The implications of such high tariff collections can be far-reaching, affecting everything from consumer prices to international relations.

Customs and Certain Excise Taxes Have More Than Doubled Over the Last 2 Months

It’s not just tariff revenue that has seen a spike; customs and certain excise taxes have also more than doubled in just two short months. This is a clear indication that the government is ramping up its efforts to collect revenue from international trade. But why the sudden increase?

Part of the answer lies in the ongoing global economic shifts. As countries navigate the complexities of trade relationships, tariffs and taxes are often adjusted to reflect new realities. For instance, with supply chains still recovering from the pandemic, many businesses are facing rising costs. These costs are often passed down to consumers, resulting in higher prices for everyday goods.

The doubling of customs and excise taxes can also be seen as a strategic move by the government to boost revenue in a time of economic uncertainty. With inflation affecting budgets nationwide, the federal government’s increased focus on tariff collections could serve as a crucial lifeline for funding essential services.

Year-to-Date, the Government Has Collected ~$67.2 Billion in Tariff Revenue

When we look at the year-to-date figures, the $67.2 billion in tariff revenue collected thus far raises eyebrows. This is not just a small uptick; it’s a significant amount that indicates a shift in how the US approaches international trade. The revenue collected can be crucial in addressing budget deficits, funding public programs, and even investing in infrastructure projects.

But the increase in tariff revenue also begs the question: How will this impact American consumers? Higher tariffs can lead to increased prices for imported goods, meaning that consumers may find themselves paying more at the checkout line. This is an essential factor to consider as we navigate the implications of these financial changes.

Moreover, the debate surrounding tariffs often revolves around protectionism versus free trade. Critics argue that high tariffs can stifle competition and innovation, while proponents believe they protect domestic industries from foreign competition. The current state of tariff revenue showcases the complexities of these discussions, as policymakers seek a balance between generating revenue and fostering a competitive market.

The Broader Economic Implications of Increased Tariff Revenue

The record-breaking tariff revenue has broader implications that extend beyond just numbers. It plays a significant role in the ongoing discussions about trade policies, economic recovery, and international relations. As governments around the world adjust their strategies in response to changing global dynamics, it’s clear that the US is taking a more aggressive approach to trade.

This development could signal a shift in how the US engages with its trading partners. With increased revenue from tariffs, there may be potential for the government to invest in domestic industries, promote job growth, and even negotiate more favorable trade agreements. However, the challenge lies in ensuring that these actions do not inadvertently escalate trade tensions with other countries.

Additionally, the increase in tariff revenue brings to light the importance of transparency in government revenue collection. As taxpayers, understanding where this revenue goes and how it impacts public services is crucial. Many citizens are keen to see how the government plans to utilize this newfound revenue to benefit society as a whole.

What This Means for American Businesses

For American businesses, the surge in tariff revenue can have mixed implications. On one hand, domestic companies may benefit from reduced competition from foreign imports, allowing them to capture a larger market share. On the other hand, businesses that rely on imported goods may face higher costs, which can lead to increased prices for consumers.

Small businesses, in particular, may feel the pinch as they navigate rising supply costs. This is especially true for industries that heavily depend on imported materials. Business owners must adapt to the changing economic landscape, which may involve reevaluating supply chains and pricing strategies.

Furthermore, the increase in tariff revenue may also encourage businesses to invest in domestic production. As the government collects more from tariffs, companies may see an opportunity to expand their operations within the US, leading to job creation and economic growth.

The Consumer Perspective: What to Expect

As consumers, the ripple effects of increased tariff revenue and rising customs taxes will likely be felt at the checkout counter. Higher tariffs on imported goods can translate into increased prices for everyday products, from electronics to clothing. This could impact household budgets, especially for families already grappling with inflation.

In addition to higher prices, consumers may also notice a reduction in the variety of products available. With some imports becoming more expensive, retailers might opt to stock fewer foreign products. This could alter shopping habits and force consumers to seek alternatives, whether through domestic products or different brands.

As the situation evolves, it’s essential for consumers to stay informed about changes in pricing and product availability. Awareness of where products come from and how tariffs impact pricing can empower consumers to make more informed purchasing decisions.

Conclusion: The Future of Tariff Revenue in the US

The recent spike in tariff revenue is more than just a number; it reflects the complexities of the current economic landscape. With record collections and rising customs taxes, the implications for businesses and consumers alike are substantial. As we move forward, it’s crucial to keep an eye on how these changes will shape trade policies and economic strategies in the US.

While the government may benefit from increased revenue, the ultimate test will be how effectively it translates this revenue into tangible benefits for American citizens and businesses. As the economy continues to evolve, so too will the discussions surrounding tariffs and trade, making it an important topic for years to come.