Meta Shareholders Shockingly Reject Bitcoin Treasury Proposal: What’s Next?

Meta shareholders vote outcome, cryptocurrency treasury strategies, impact of Bitcoin on corporate finance

—————–

Meta Shareholders Reject Bitcoin Treasury Assessment: A Major Decision in Corporate Finance

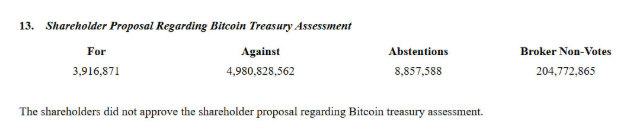

On June 2, 2025, a significant event unfolded within the corporate landscape as Meta Platforms, Inc. (formerly Facebook, Inc.) faced a pivotal vote concerning the inclusion of Bitcoin in its treasury management strategy. In a decisive move, 95% of Meta’s shareholders voted against a proposal to assess the potential benefits and risks of adopting Bitcoin as a part of the company’s treasury assets. This development has sparked discussions about the future of cryptocurrencies within major corporations and the implications for the tech industry at large.

Understanding the Context of the Proposal

The proposal for a Bitcoin treasury assessment was likely driven by the increasing interest in cryptocurrencies and their potential as alternative assets. Over recent years, Bitcoin has gained traction not only as a digital currency but also as a store of value akin to gold. Many corporations, including Tesla, MicroStrategy, and Square, have incorporated Bitcoin into their balance sheets, citing its potential for appreciation and as a hedge against inflation.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

In light of these trends, the proposal aimed to evaluate how Bitcoin could fit into Meta’s financial strategy. Advocates for the assessment argued that, given Meta’s substantial cash reserves, exploring Bitcoin could enhance shareholder value and position the company favorably in an evolving financial landscape.

Shareholder Reaction: A Resounding "No"

Despite the growing prominence of Bitcoin, Meta’s shareholders overwhelmingly rejected the proposal. The 95% vote against the assessment highlights a significant reluctance among investors to embrace cryptocurrency as a viable treasury asset for the company. This decision raises questions about the overall sentiment towards cryptocurrencies among institutional investors and the inherent risks associated with such volatile assets.

One of the primary concerns likely influencing shareholder sentiment is the volatility of Bitcoin. The cryptocurrency market is notorious for its price fluctuations, which can pose substantial risks to a company’s financial stability. Given Meta’s recent challenges, including regulatory scrutiny and public relations issues, shareholders may have favored a more conservative approach to treasury management.

Implications for Meta and the Tech Industry

The rejection of the Bitcoin treasury assessment proposal is significant not only for Meta but also for the broader tech industry. As more companies explore the potential of cryptocurrencies, Meta’s decision may serve as a cautionary tale for others contemplating similar moves. The overwhelming shareholder dissent suggests that, despite the hype surrounding Bitcoin, there remains a level of skepticism regarding its integration into corporate finance.

Moreover, this decision could influence how other tech giants approach cryptocurrency. Companies may reassess their stances on digital assets, weighing the potential benefits against the risks as highlighted by Meta’s shareholders. The reaction from Meta’s investors could lead to a more cautious approach by other corporations, focusing on traditional treasury management strategies rather than venturing into the uncertain waters of cryptocurrency.

The Future of Bitcoin in Corporate Finance

While Meta’s shareholders have rejected the proposal for a Bitcoin treasury assessment, the broader conversation about cryptocurrency in corporate finance is far from over. The increasing acceptance of Bitcoin and other digital currencies among retail investors and financial institutions poses an important question: Will corporations eventually embrace cryptocurrencies, or will they remain on the sidelines?

As the cryptocurrency market continues to evolve, it is possible that companies like Meta may revisit the idea of incorporating Bitcoin into their treasury management strategies. Future developments in regulation, market stability, and public perception could all play a role in shaping corporate attitudes toward digital assets.

Conclusion: A Turning Point for Corporate Cryptocurrency Adoption

The decision by Meta shareholders to reject the Bitcoin treasury assessment is a pivotal moment that underscores the complexities of integrating cryptocurrencies into corporate finance. While the rejection reflects a cautious investor sentiment, it also highlights the evolving landscape of digital assets and their potential impact on traditional business models.

As the conversation around Bitcoin and cryptocurrencies continues, corporations will need to navigate the delicate balance between innovation and risk management. The future of Bitcoin in corporate treasury strategies remains uncertain, but the ongoing developments in the cryptocurrency space will undoubtedly shape the decisions of businesses in the years to come.

In summary, Meta’s rejection of the Bitcoin treasury proposal serves as a reminder of the challenges and opportunities that lie ahead as companies grapple with the implications of adopting cryptocurrencies. As the digital asset landscape matures, it will be fascinating to observe how corporations adapt and respond to the growing influence of Bitcoin and other cryptocurrencies in the world of finance.

Related Topics to Explore

- The Role of Cryptocurrencies in Corporate Finance

- Understanding Bitcoin’s Volatility and Its Impact on Investments

- How Major Corporations Are Adapting to the Digital Currency Revolution

- The Future of Cryptocurrency Regulation and Its Effects on Businesses

As corporate attitudes towards cryptocurrencies evolve, it remains crucial for investors and stakeholders to stay informed about the ongoing developments in this dynamic field. The rejection of the Bitcoin treasury assessment at Meta is just one chapter in a much larger narrative about the intersection of technology, finance, and innovation in the 21st century.

JUST IN: Meta shareholders reject a #Bitcoin treasury assessment.

95% voted against the proposal. pic.twitter.com/wCWZGDo5sR

— Bitcoin Magazine (@BitcoinMagazine) June 2, 2025

Meta Shareholders Reject Bitcoin Treasury Assessment: A Deep Dive

In a surprising turn of events, Meta shareholders have overwhelmingly rejected a proposal for a Bitcoin treasury assessment, with a staggering 95% voting against it. This news, highlighted by Bitcoin Magazine, has sent ripples through both the crypto and tech communities, raising questions about the future of cryptocurrency in corporate finance and Meta’s strategic direction.

What Does This Mean for Bitcoin?

When a major player like Meta (formerly Facebook) dismisses a Bitcoin treasury assessment, it sends a clear message about the current sentiment towards cryptocurrency among corporate shareholders. This rejection could signify a lack of confidence in Bitcoin as a stable asset for long-term investment, especially given its notorious volatility. For many investors and enthusiasts, Bitcoin represents a revolutionary shift in how we view money, but this decision raises eyebrows about its viability in a corporate treasury context.

Understanding Bitcoin Treasury Assessments

A Bitcoin treasury assessment typically involves evaluating the potential benefits and risks of holding Bitcoin as part of a company’s treasury assets. This can include considerations of liquidity, market stability, and regulatory compliance. The rejection by Meta shareholders indicates that the majority may view these assessments as more risk than reward. As companies explore the incorporation of digital currencies into their financial strategies, this vote serves as a critical case study.

Why Did Shareholders Vote Against It?

Shareholder decisions are rarely spontaneous; they are often based on a thorough analysis of market trends, company performance, and broader economic indicators. A few key factors likely influenced the overwhelming rejection of the Bitcoin proposal:

- Volatility Concerns: Bitcoin’s price has seen dramatic fluctuations, which could jeopardize a company’s financial stability. Shareholders may fear that adopting Bitcoin could expose Meta to unnecessary risks.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is still evolving. Companies like Meta are cautious about engaging with assets that could invite scrutiny from regulators, particularly given the company’s history with compliance issues.

- Focus on Core Business: Meta is primarily focused on social media, advertising, and the development of the metaverse. Shareholders may believe that branching into cryptocurrency could distract from the company’s core mission and lead to complications.

The Bigger Picture: Corporate Crypto Adoption

The rejection of a Bitcoin treasury assessment by Meta resonates with a broader trend in corporate America. While some companies have embraced cryptocurrencies, others remain skeptical. For instance, companies like Tesla and MicroStrategy have invested heavily in Bitcoin, while traditional giants like JPMorgan have expressed caution. This dichotomy illustrates that while some see Bitcoin as the future of finance, others are still weighing the risks versus the potential benefits.

Implications for Meta and Other Tech Giants

The decision by Meta’s shareholders could have significant implications for the company and other tech giants contemplating similar proposals. Here’s what we might expect moving forward:

- Increased Caution: Following this vote, other companies might adopt a more cautious approach when considering cryptocurrency investments. Meta’s experience could lead to a wait-and-see attitude as they observe how the market evolves.

- Alternative Investments: Companies may choose to explore other digital assets or technologies that align more closely with their business models, avoiding the pitfalls of cryptocurrency volatility.

- Innovation in Financial Strategies: Despite the rejection, the conversation around cryptocurrency in corporate finance will likely continue. Companies may seek innovative ways to integrate digital currencies without directly investing in them.

The Future of Bitcoin in Corporate Finance

Even though Meta shareholders rejected the Bitcoin treasury assessment, the future of Bitcoin and other cryptocurrencies in corporate finance remains a hot topic. As technology continues to evolve, companies may find ways to incorporate these digital assets into their financial strategies while mitigating risks. This could involve developing clearer regulatory frameworks or adopting stablecoins that offer the benefits of cryptocurrency without the extreme volatility.

Public Perception of Bitcoin

This decision also reflects the ongoing debate regarding public perception of Bitcoin. While many view it as a groundbreaking innovation that could redefine finance, others see it as a speculative bubble. The overwhelming rejection of the Bitcoin proposal by Meta’s shareholders suggests that there is still a significant level of skepticism within traditional finance circles.

Engaging with the Crypto Community

For companies like Meta, engaging with the cryptocurrency community may provide valuable insights into how to approach digital currencies. Building partnerships with blockchain innovators or participating in educational initiatives could help bridge the gap between traditional finance and the burgeoning world of cryptocurrencies.

Conclusion: The Road Ahead

As the dust settles on this recent vote, it’s clear that the conversation around Bitcoin and corporate treasury assessments is far from over. Meta’s decision to reject the proposal reflects broader sentiments within the corporate world, highlighting the need for companies to carefully consider their approach to cryptocurrencies. As the market evolves, so too will the strategies that companies employ to navigate this complex and ever-changing landscape. Whether or not Bitcoin finds a place in corporate treasuries remains to be seen, but what’s certain is that the dialogue will continue, prompting more companies to evaluate their stance on digital currencies.

For those interested in following this developing story, keep an eye on reputable news outlets and crypto communities to stay updated on the latest trends and insights. Your perspective on Bitcoin’s future could very well shape the next chapter of its journey.