Tether’s Shocking $1.4 Billion Bitcoin Transfer: A Bold Investment Gamble?

Tether investment strategy, Bitcoin market trends 2025, Twenty One Capital financial moves

—————–

Tether’s Significant Investment in Bitcoin: An Overview

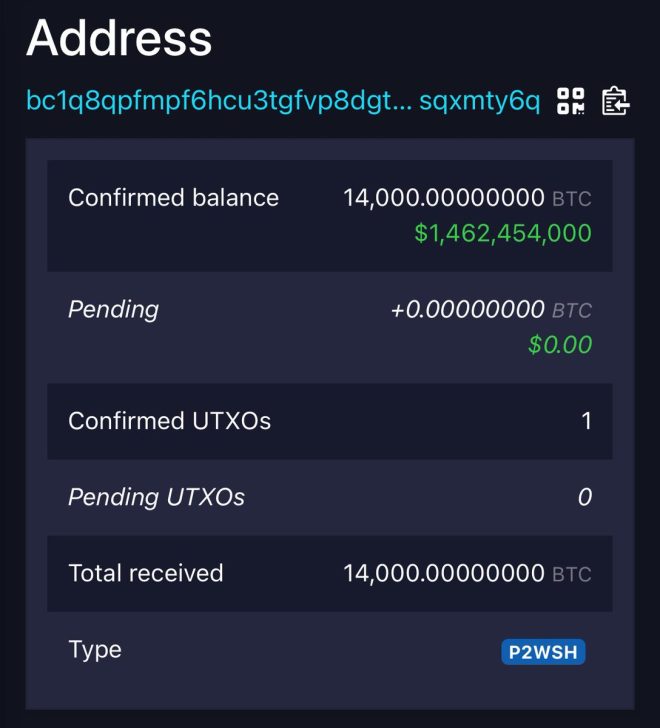

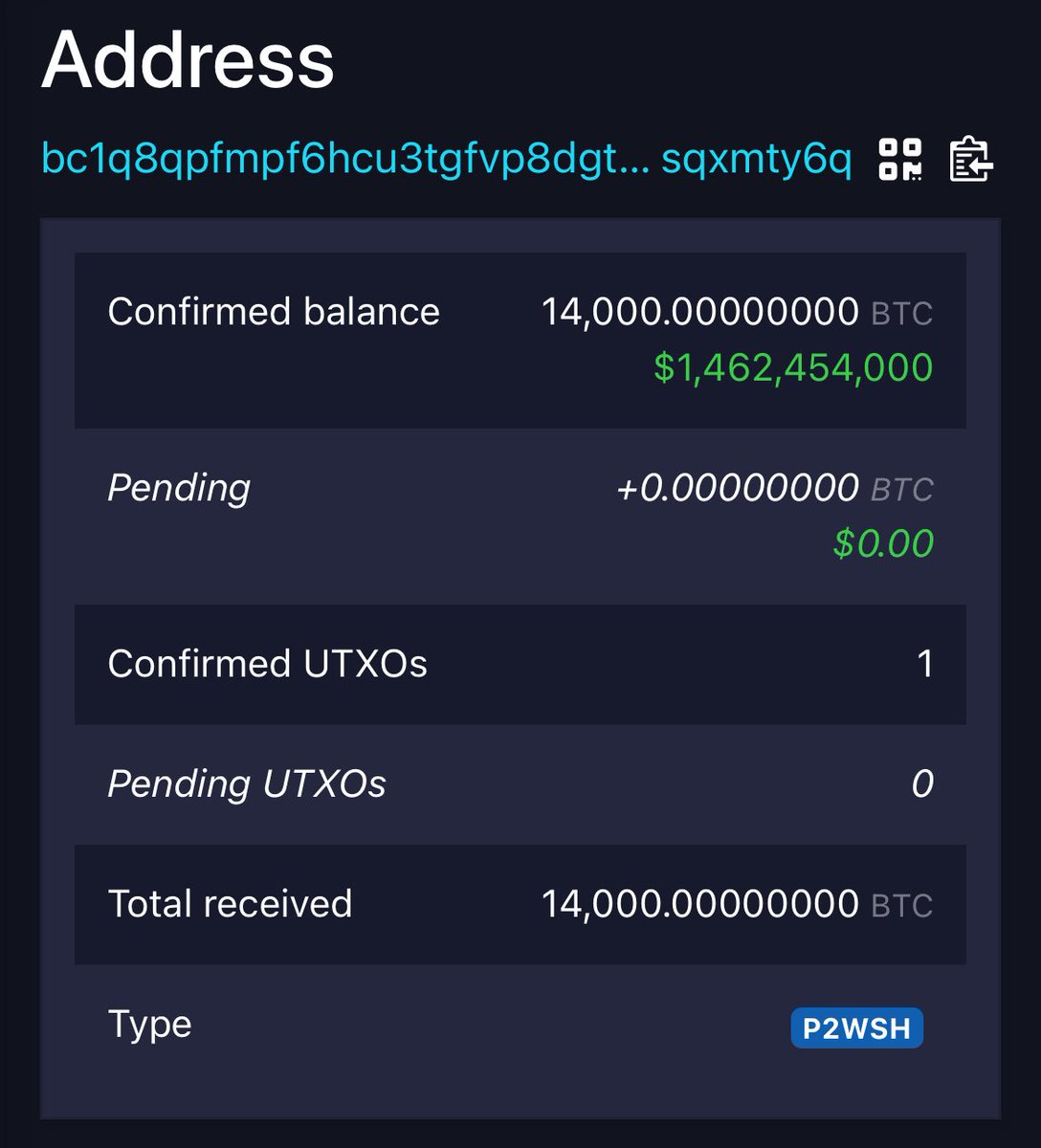

In a significant development within the cryptocurrency market, Tether, the company behind the largest stablecoin by market capitalization, has made headlines by transferring 14,000 Bitcoin (BTC) valued at over $1.4 billion to Twenty One Capital (XXI). This strategic investment reflects Tether’s continued commitment to expand its influence in the cryptocurrency ecosystem and highlights the growing importance of Bitcoin as a core asset in institutional portfolios.

Understanding Tether’s Role in the Cryptocurrency Market

Tether (USDT) is a cryptocurrency that aims to maintain a stable value by pegging its worth to traditional fiat currencies, primarily the U.S. dollar. This stability makes it a popular choice for traders and investors looking to mitigate the volatility often associated with other cryptocurrencies. Tether has become a staple in the cryptocurrency landscape, providing liquidity and acting as a bridge between fiat currencies and digital assets.

The decision to invest in Bitcoin aligns with Tether’s overall strategy to diversify its holdings and leverage the potential for long-term growth in the cryptocurrency market. Bitcoin, often referred to as digital gold, has seen substantial appreciation in value over the years, making it an attractive investment for both individual and institutional investors.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Impact of the Transfer on the Cryptocurrency Market

The transfer of 14,000 BTC to Twenty One Capital represents a significant influx of capital into the Bitcoin market. Such substantial transactions can influence market sentiment and pricing. As Tether moves its assets, it may create ripples throughout the cryptocurrency ecosystem, prompting other investors to consider similar strategies.

This investment not only underscores Tether’s confidence in Bitcoin’s future but also signals to the market that institutional interest in cryptocurrencies remains robust. As more institutions enter the space, the potential for increased adoption and stability in the market rises, creating a more favorable environment for both retail and institutional investors.

Twenty One Capital: A Key Player in the Investment Landscape

Twenty One Capital (XXI) is a notable entity in the cryptocurrency investment space. By receiving such a substantial amount of Bitcoin from Tether, XXI is positioned to leverage this capital for various investment opportunities within the digital asset sector. The firm’s expertise and strategic approach to managing cryptocurrency investments will likely play a crucial role in how this substantial allocation is utilized.

The collaboration between Tether and Twenty One Capital could pave the way for innovative projects and initiatives within the cryptocurrency realm. With Tether’s backing, XXI may explore new avenues for growth, including venture capital investments in emerging blockchain technologies, partnerships with other crypto firms, or even the development of new financial products related to Bitcoin and other digital assets.

The Growing Trend of Institutional Investment in Bitcoin

Tether’s recent move is part of a broader trend of increasing institutional investment in Bitcoin. Over the past few years, prominent financial institutions and corporations have started to allocate portions of their portfolios to cryptocurrencies, particularly Bitcoin. This shift reflects a growing recognition of Bitcoin as a legitimate asset class and a potential hedge against inflation and economic uncertainty.

Organizations like MicroStrategy, Tesla, and Square have famously added Bitcoin to their balance sheets, signifying a shift in corporate strategy toward digital assets. Additionally, investment firms such as Grayscale and Fidelity have launched Bitcoin-focused products, making it easier for institutional investors to gain exposure to this digital currency.

The Future of Bitcoin and Tether’s Investment Strategy

As Tether continues to allocate a portion of its reserves to Bitcoin, the company reinforces its role as a key player in the cryptocurrency market. This investment strategy not only helps Tether diversify its holdings but also enhances its reputation as a forward-thinking entity in the digital currency landscape.

Looking ahead, Bitcoin’s future remains promising, with factors such as increasing mainstream adoption, advancements in blockchain technology, and the potential for regulatory clarity contributing to its growth trajectory. Tether’s investment in Bitcoin could serve as a catalyst for further exploration of digital assets, encouraging other companies to consider similar strategies.

Conclusion: A Milestone for Cryptocurrency Investment

Tether’s transfer of 14,000 Bitcoin to Twenty One Capital marks a significant milestone in the ongoing evolution of cryptocurrency investment. This move not only demonstrates Tether’s confidence in Bitcoin as a long-term asset but also highlights the growing trend of institutional involvement in the cryptocurrency space.

As more companies and investment firms recognize the value of Bitcoin, the landscape of digital assets will continue to evolve. Tether’s investment strategy could inspire further innovation and growth within the sector, ultimately contributing to the maturation of the cryptocurrency market.

Investors and market participants should keep a close eye on the developments stemming from this strategic partnership between Tether and Twenty One Capital, as it could signal new opportunities and trends within the world of cryptocurrency investment.

JUST IN: Tether moved 14,000 $BTC worth +$1.4 BILLION to Twenty One Capital (XXI) as part of its investment. pic.twitter.com/rEwuAVuqpS

— Bitcoin Archive (@BTC_Archive) June 2, 2025

JUST IN: Tether moved 14,000 $BTC worth +$1.4 BILLION to Twenty One Capital (XXI) as part of its investment

In the ever-evolving world of cryptocurrency, news travels faster than a hawk swooping in for its prey. Recently, the crypto community was buzzing about a significant move made by Tether, the company behind the USDT stablecoin. On June 2, 2025, Tether transferred a staggering 14,000 Bitcoin (worth over $1.4 billion) to Twenty One Capital (XXI). This bold maneuver raises eyebrows and ignites discussions about its implications on the market and what it means for investors and the industry as a whole.

Understanding Tether’s Move

To grasp the magnitude of Tether’s decision, it’s essential to understand a few key aspects. Tether is not just a stablecoin; it’s an essential player in the crypto ecosystem. By maintaining a stable value pegged to the US dollar, USDT serves as a bridge for traders and investors looking to navigate the volatile waters of cryptocurrency. This recent transaction could signal Tether’s strategic positioning in the market.

The transfer of 14,000 Bitcoins isn’t just a number; it signifies confidence and investment in the future. Tether’s move to funnel such a considerable amount into Twenty One Capital (XXI) suggests that they are betting on this investment firm and its potential for growth. But why Twenty One Capital? What does this partnership mean for both entities? Let’s dive deeper.

What is Twenty One Capital (XXI)?

Twenty One Capital is an investment firm that focuses on digital assets, particularly in the cryptocurrency space. Their expertise in managing and investing in a diverse range of digital assets makes them a valuable partner for Tether. By choosing to invest in XXI, Tether indicates a belief in their operational strategies and potential for high returns. This collaboration could also lead to innovations in how cryptocurrencies are managed and utilized in investment portfolios.

The Implications of This Investment

So, what does this colossal transfer mean for the wider cryptocurrency market? First off, it shows that Tether is not shying away from making bold moves. This could potentially boost investor confidence, as a stablecoin backing a significant investment might signal that Tether is in a strong position. When major players like Tether invest heavily, it often leads to increased market activity and could even influence Bitcoin’s price trajectory.

Additionally, such a sizable investment may encourage other institutional investors to take a closer look at cryptocurrencies. With Tether’s backing, Twenty One Capital is likely to attract more attention from those looking to enter the crypto space. This could lead to a ripple effect where other investment firms start exploring similar partnerships or investments, further validating the cryptocurrency market.

The Role of Bitcoin in Today’s Market

Bitcoin, often referred to as the gold standard of cryptocurrencies, continues to dominate the market. With Tether’s recent transfer, Bitcoin’s role as a store of value is again being highlighted. Despite the fluctuations in its price, Bitcoin has proven to be resilient. Tether’s investment can be seen as a vote of confidence in Bitcoin’s long-term viability.

Moreover, Bitcoin’s reputation as a hedge against inflation and economic instability makes it an attractive asset for institutional investors. As they begin to recognize its potential, Bitcoin could see a surge in adoption, leading to even greater price increases and market stability.

What This Means for Investors

For everyday investors, Tether’s massive transfer presents both opportunities and risks. On one hand, it may be an opportune moment to invest in Bitcoin, given the influx of capital and potential positive market momentum. However, with such large movements, there’s always the risk of volatility. Investors need to stay informed and consider their strategies carefully.

As the cryptocurrency landscape continues to evolve, staying updated on significant events like this one is crucial. Following reliable sources and engaging with communities can provide valuable insights into market shifts and trends. Remember, the crypto world is as unpredictable as it is exciting.

Market Reactions and Future Outlook

The immediate reaction to Tether’s announcement was a mix of excitement and skepticism. While some analysts believe this move could lead to a bullish trend for Bitcoin, others caution that it could trigger short-term volatility. The crypto market is notorious for its rapid price swings, and such large transfers often create ripples that can affect trader sentiment.

As we look ahead, it’s crucial to consider how this investment by Tether might influence the broader market dynamics. If Twenty One Capital leverages this investment wisely, it could pave the way for innovative financial products and services in the crypto space. Moreover, as more institutional players enter the market, we may see increased regulatory scrutiny, which could shape the future of cryptocurrency investments.

Final Thoughts

Tether’s recent move to transfer 14,000 BTC worth over $1.4 billion to Twenty One Capital is a significant development in the cryptocurrency landscape. It showcases the growing interest and confidence in digital assets from major players. As the market continues to evolve, staying informed and adaptable will be key for investors navigating this exciting yet unpredictable terrain.

Keep an eye on how this investment unfolds, as it could very well set the stage for future trends in cryptocurrency investment and management. The world of digital assets is full of potential, and with strategic moves like Tether’s, it’s clear that the journey is just beginning.