Tether’s Shocking $1.96 Billion BTC Transfer: What Does It Mean for Crypto?

Tether cryptocurrency transfer, Bitcoin investment strategies 2025, Jack Mallers financial innovations

—————–

Tether Transfers 18,812 BTC Worth $1.96 Billion to Jack Mallers’ Twenty One Capital

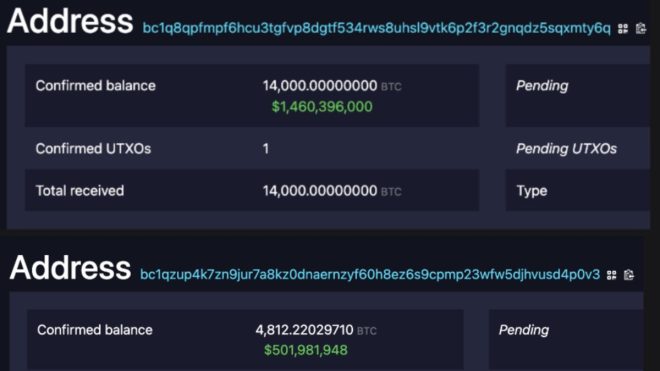

In a significant development within the cryptocurrency market, Tether, the issuer of the widely-used USDT stablecoin, has transferred a staggering 18,812 Bitcoin (BTC) valued at approximately $1.96 billion to Jack Mallers’ firm, Twenty One Capital (XXI). This monumental transaction, which was reported by Whale Insider on June 2, 2025, has sparked discussions among investors and analysts regarding its implications for the cryptocurrency industry.

Understanding Tether and Its Role in Cryptocurrency

Tether (USDT) is a stablecoin that aims to maintain a stable value by pegging its worth to a fiat currency, typically the US dollar. As the largest stablecoin by market capitalization, Tether plays a crucial role in the crypto ecosystem, providing liquidity and facilitating trading on various exchanges. The recent transfer of BTC by Tether raises questions about its strategy and future plans within the ever-evolving financial landscape.

The Significance of the Transaction

The transfer of 18,812 BTC is noteworthy not only for its size but also for the potential implications it could have. Valued at nearly $1.96 billion, this move signifies Tether’s growing influence and operational capacity in the crypto market. Jack Mallers, the founder of Strike and Twenty One Capital, is known for his innovative approaches to cryptocurrency adoption and financial technology, making this partnership particularly intriguing.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Impact on Bitcoin Market Dynamics

The influx of such a large amount of Bitcoin into Twenty One Capital could influence market dynamics significantly. Given the volatility typically associated with Bitcoin, analysts speculate that this transaction might lead to fluctuations in BTC prices. Large transfers such as this can trigger reactions from traders and investors, potentially impacting buying and selling behaviors across exchanges.

Jack Mallers and His Vision

Jack Mallers is recognized as a pioneering figure in the cryptocurrency sector, particularly for his efforts to bridge traditional finance and digital assets. His company, Twenty One Capital, aims to leverage innovative financial solutions to enhance the adoption of cryptocurrencies. Mallers’ previous initiatives, including the integration of Bitcoin payments into various platforms, showcase his commitment to making cryptocurrency accessible and practical for everyday users.

The Future of Tether and Bitcoin

The significant transfer of Bitcoin from Tether to Twenty One Capital raises several questions about the future trajectory of both entities. For Tether, this transaction could be part of a broader strategy to diversify its holdings or enhance its liquidity operations. For Bitcoin, the increased institutional interest highlighted by this transfer may signal a growing acceptance of cryptocurrencies in mainstream finance.

Potential Reactions from the Cryptocurrency Community

The cryptocurrency community often reacts strongly to large transactions, especially ones involving major players like Tether and Jack Mallers. Analysts and enthusiasts will be closely monitoring the situation to gauge the market’s response and potential shifts in sentiment. Additionally, regulatory scrutiny could also come into play, as significant financial movements often attract attention from financial watchdogs.

Conclusion: What Lies Ahead?

In summary, Tether’s transfer of 18,812 BTC to Jack Mallers’ Twenty One Capital is a pivotal moment in the cryptocurrency landscape. This transaction not only underscores the growing influence of stablecoins like Tether but also highlights the innovative work being done by figures like Jack Mallers in promoting cryptocurrency adoption. As the market continues to evolve, stakeholders will be keenly observing the developments that arise from this significant transfer, eager to understand its broader implications for Bitcoin and the future of digital finance.

This transaction serves as a reminder of the dynamic nature of the cryptocurrency market and the potential for large-scale shifts driven by influential players within the ecosystem. The coming weeks and months will be critical in determining how this development unfolds and shapes the future of both Tether and Bitcoin.

JUST IN: Tether sends 18,812 BTC worth $1.96 billion to Jack Mallers’ Twenty One Capital (XXI). pic.twitter.com/YZqtOwHdu6

— Whale Insider (@WhaleInsider) June 2, 2025

JUST IN: Tether Sends 18,812 BTC Worth $1.96 Billion to Jack Mallers’ Twenty One Capital (XXI)

In the world of cryptocurrency, news travels fast, and sometimes it can be quite staggering. A recent tweet from Whale Insider has stirred quite a bit of buzz in the crypto community. According to the tweet, Tether, the issuer of the popular USDT stablecoin, has transferred a whopping 18,812 BTC, valued at around $1.96 billion, to Jack Mallers’ Twenty One Capital (XXI). This significant transaction has raised eyebrows and sparked discussions among crypto enthusiasts and investors alike.

The Significance of the Transfer

You might be wondering why this transfer is so important. For starters, 18,812 BTC is not just a small sum; it’s a substantial amount that could influence market dynamics. Such large transfers often lead to speculation about the intentions behind them. Is Tether looking to invest in new projects? Is there a strategic partnership on the horizon? Or is this simply a way to diversify their holdings? The speculation is endless.

Moreover, Jack Mallers is a well-known figure in the crypto space. As the founder of Strike, a digital payment platform, Mallers has made significant contributions to the adoption of Bitcoin and cryptocurrency in general. His involvement adds another layer of intrigue to the transaction. What does this mean for the future of both Tether and Mallers’ ventures?

Understanding Tether and Its Role in the Crypto Ecosystem

Tether has established itself as a cornerstone of the cryptocurrency market. As a stablecoin, it’s designed to maintain a stable value by pegging itself to traditional currencies, primarily the US dollar. This makes it an attractive option for traders and investors looking to mitigate the volatility that often plagues other cryptocurrencies.

The importance of Tether in daily trading cannot be understated. Many exchanges use USDT as a trading pair, allowing users to easily exchange their cryptocurrencies without needing to convert back to fiat. This liquidity can significantly impact market trends, making Tether a key player in the crypto landscape.

Who is Jack Mallers?

Jack Mallers is not just another entrepreneur in the crypto scene; he’s a visionary who has been recognized for his efforts in promoting Bitcoin as a legitimate method of payment. His company, Strike, has gained traction for its user-friendly approach to cryptocurrency transactions, allowing users to send and receive Bitcoin with ease. Mallers has also been vocal about the need for Bitcoin to be accessible to everyone, especially in developing countries.

With his significant influence and innovative ideas, Mallers is seen as a driving force in the crypto revolution. His partnership with Tether could potentially lead to groundbreaking advancements in how cryptocurrency is utilized in everyday transactions.

The Implications for the Cryptocurrency Market

So, what does this massive transfer mean for the broader cryptocurrency market? Well, it could lead to a variety of outcomes. On one hand, it might instill confidence among investors, showcasing that major players like Tether are willing to engage in large-scale transactions. This could encourage more institutional investments, which have been gradually increasing in recent years.

On the flip side, large transactions like this can also create volatility. If investors perceive this as a sign that Tether is looking to liquidate their holdings or shift strategies, it could lead to panic selling or buying. Market sentiment often reacts to such news, and traders will be keeping a close eye on how this plays out in the coming days and weeks.

Potential Partnerships and Projects

The transfer of BTC to Mallers’ Twenty One Capital raises questions about future collaborations. Could we see Tether and Mallers embark on a new venture that further bridges the gap between traditional finance and the crypto world? With Mallers’ vision and Tether’s resources, the possibilities are endless.

Projects that aim to integrate Bitcoin into everyday payment systems could gain traction. For instance, if Mallers’ team were to develop a new platform that utilizes Tether’s liquidity, it could greatly enhance the usability of cryptocurrencies in real-world transactions. This could lead to a more widespread adoption of Bitcoin and other digital currencies, further legitimizing them in the eyes of the general public.

The Growing Influence of Stablecoins

The rise of stablecoins like Tether has transformed the crypto landscape. As mentioned earlier, Tether plays a crucial role in providing liquidity and stability in an otherwise volatile market. Investors are increasingly turning to stablecoins as a safe haven during market downturns, allowing them to protect their assets while still participating in the crypto ecosystem.

This growing reliance on stablecoins highlights the need for regulatory clarity and trustworthiness in the space. As more people begin to rely on these digital currencies for everyday transactions, ensuring their stability and security becomes paramount.

What Lies Ahead?

The future looks exciting for both Tether and Jack Mallers. With such a significant transfer taking place, it’s clear that major players in the crypto space are actively seeking to innovate and push boundaries. As the market continues to evolve, we can expect to see more collaborations and partnerships that aim to enhance the usability of cryptocurrencies.

Investors and crypto enthusiasts should keep a close watch on the developments stemming from this transaction. Whether it leads to new projects, increased market stability, or further adoption of Bitcoin, one thing is for sure: the world of cryptocurrency is anything but boring.

Conclusion

In a rapidly changing landscape like cryptocurrency, keeping up with the latest news and trends is crucial. The recent transfer of 18,812 BTC from Tether to Jack Mallers’ Twenty One Capital is a significant event that could have far-reaching implications for the market. As we watch this story unfold, it’s essential to stay informed and engaged, as the future of cryptocurrency is continually being shaped by such pivotal moments.

For those looking to stay updated on the latest developments in the crypto world, following reputable sources like [Whale Insider](https://twitter.com/WhaleInsider) is a great way to ensure you’re always in the loop. Whether you’re an investor, a trader, or simply a curious observer, the world of cryptocurrency offers endless opportunities for exploration and engagement.