“Trader’s $400K Last-Ditch Gamble: Will It Save Him or Signal Desperation?”

trading account strategies, risk management in trading, financial liquidity solutions

—————–

BREAKING

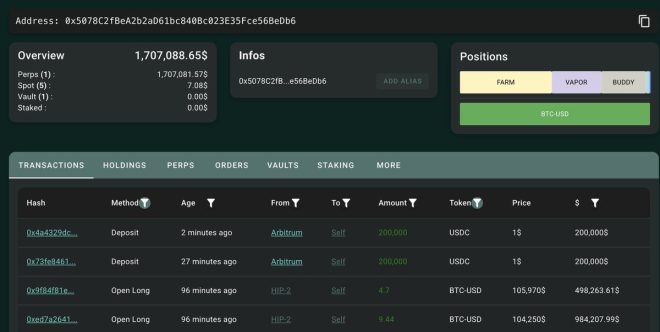

In a significant turn of events in the trading world, James Wynn has taken substantial measures to secure his financial position by depositing an additional $400,000 into his trading account. This move comes as a strategic response to avoid the potential risk of liquidation, which can occur when a trader’s account falls below the required margin level, leading to forced closure of positions by the brokerage.

Understanding Liquidation in Trading

Liquidation is a critical concept in trading, particularly in leveraged trading environments. When traders utilize margin to amplify their buying power, they must maintain a certain level of equity in their accounts. If the value of their positions declines significantly, their account equity may drop below the minimum required threshold, resulting in a margin call. If the trader cannot deposit additional funds or close positions, the brokerage may liquidate the trader’s assets to cover the losses. James Wynn’s proactive deposit illustrates the high stakes involved in trading and the importance of maintaining sufficient capital to avoid such scenarios.

Strategic Financial Decisions

James Wynn’s decision to inject an extra $400,000 into his trading account highlights the critical nature of liquidity management in trading. Securing additional capital not only mitigates the immediate risk of liquidation but also provides Wynn with the flexibility to navigate market fluctuations more effectively. Such strategic financial decisions are essential for traders looking to maintain their positions and capitalize on market opportunities without the threat of forced liquidation hanging over their heads.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Implications of Increased Capital

By increasing his trading capital, Wynn is not only safeguarding his current positions but also positioning himself for potential future trades. This influx of funds can be utilized to diversify his trading strategies, explore new markets, or take advantage of high-potential trading opportunities. In the fast-paced world of trading, where market conditions can change rapidly, having access to additional capital can be a game changer.

Market Reactions and Insights

The trading community is closely observing Wynn’s actions and their implications for the broader market. Increased capital infusion from prominent traders can signal confidence in the markets or specific assets. It can also lead to increased volatility as other traders react to such moves, either by following suit or adjusting their strategies in response. As Wynn stabilizes his position, traders across the board will analyze the underlying reasons for his decision and its potential impact on market sentiment.

Conclusion: The Importance of Risk Management

James Wynn’s recent decision to deposit an additional $400,000 into his trading account serves as a crucial reminder of the importance of risk management in trading. Liquidation can have devastating effects on a trader’s financial health and reputation, making it imperative for traders to maintain a robust capital reserve. This event underscores the need for traders to continuously assess their financial positions, manage their risks effectively, and be prepared to make swift decisions in response to market changes. By taking proactive steps, such as increasing capital, traders like James Wynn can navigate the complexities of the trading landscape with greater confidence and resilience.

For more insights on effective trading strategies and risk management, stay tuned to our updates and analyses on market trends and trading techniques.

BREAKING

To avoid liquidation, James Wynn deposited an extra $400,000 in his trading account. https://t.co/tHVP18eBcK

BREAKING

The world of trading is often unpredictable, and when financial stakes are high, the pressure can become overwhelming. Recently, a significant event unfolded involving James Wynn, a trader who found himself in a precarious situation. To avoid liquidation, James Wynn deposited an extra $400,000 in his trading account. This move has not only raised eyebrows but also sparked discussions on trading strategies and risk management in volatile markets. In this article, we’ll delve into what this means for Wynn, the implications for other traders, and some key takeaways for managing risk in trading.

Understanding Liquidation in Trading

Before we dive deeper, it’s essential to understand what liquidation means in the context of trading. Liquidation occurs when a trader’s account balance falls below the required margin level, forcing them to close positions to cover losses. This can happen swiftly, especially in volatile markets where prices fluctuate dramatically. For James Wynn, the threat of liquidation was real, prompting his significant $400,000 deposit to stabilize his trading position.

The Decision to Deposit $400,000

James Wynn’s decision to inject an additional $400,000 into his trading account speaks volumes about his commitment to his trading strategy and his willingness to take risks. This kind of financial maneuver is not common for every trader; many would think twice before risking such a substantial amount. But for Wynn, this was a calculated risk to maintain his trading positions and avoid being forced out of the market.

In trading, the ability to manage risk is crucial. By adding funds to his account, Wynn aimed to bolster his margin and give himself more breathing room. This move can be seen as a strategic play, allowing him to ride out the volatility and potentially recover losses. However, it also highlights the fine line traders walk between risk and reward.

Market Reactions and Implications

The trading community has been buzzing since the news broke. Many traders are curious about the circumstances leading up to James Wynn’s decision. Did he foresee the market movements that led to his precarious situation? Was this a one-off incident, or does it reflect broader trends in the trading landscape? Such questions are not uncommon, as traders analyze each other’s moves for insights into market behavior.

This scenario also raises awareness about the importance of having a robust risk management strategy in place. Traders must constantly evaluate their positions and make adjustments as needed. Wynn’s situation serves as a reminder that even seasoned traders can find themselves in challenging circumstances, emphasizing the need for vigilance and adaptability.

Lessons from James Wynn’s Situation

So, what can we learn from James Wynn’s experience? Here are some key takeaways for traders of all levels:

- Stay Informed: Understanding market trends and potential risks is vital. Traders should regularly analyze their positions and be aware of external factors that could impact their investments.

- Have a Risk Management Plan: A solid plan helps traders navigate through rough waters. This includes setting stop-loss orders and not over-leveraging their accounts.

- Be Prepared for Volatility: Markets can swing dramatically, and being prepared for such movements can help mitigate risks. Knowing when to add funds or cut losses is crucial.

The Role of Emotional Discipline

Trading is as much about psychology as it is about numbers. James Wynn’s decision to deposit a substantial amount highlights the emotional aspects of trading. It’s easy to let fear dictate your actions, especially when facing potential liquidation. However, maintaining emotional discipline can lead to more rational decision-making.

For many traders, the fear of loss can lead to hasty decisions. Wynn’s approach indicates a level of confidence and control, which is necessary to navigate the often tumultuous waters of trading. Cultivating a mindset that balances caution with confidence is essential for long-term success.

What’s Next for James Wynn?

As for James Wynn, the immediate future will likely involve closely monitoring his trades and the market’s movements. With an extra $400,000 in play, Wynn has a significant stake in the game, and how he navigates this situation will be closely watched by fellow traders and market analysts alike.

It’s also possible that this incident will encourage other traders to reassess their own strategies. Will they take similar risks? Or will they opt for a more cautious approach? The trading community thrives on learning from each other’s experiences, and Wynn’s decision could serve as a catalyst for discussions around risk management and trading psychology.

Conclusion: The Ongoing Learning Experience in Trading

Trading is a continuous learning experience, and events like James Wynn’s recent deposit can serve as valuable lessons for everyone involved. The world of finance is fraught with risks, and while it’s easy to get caught up in the excitement, it’s essential to remain grounded and strategic. Whether you’re a seasoned trader or just starting, remember that every decision counts, and being prepared can make all the difference.

Keep an eye on the market trends, learn from your experiences, and always have a plan in place. Who knows, maybe the next big trading decision will be yours, and it could lead to exciting opportunities.