Bitfinex Transfers $731M in Bitcoin to Jack Mallers: What’s the Real Motive?

Bitcoin transfer news, cryptocurrency investment strategies, digital asset management 2025

—————–

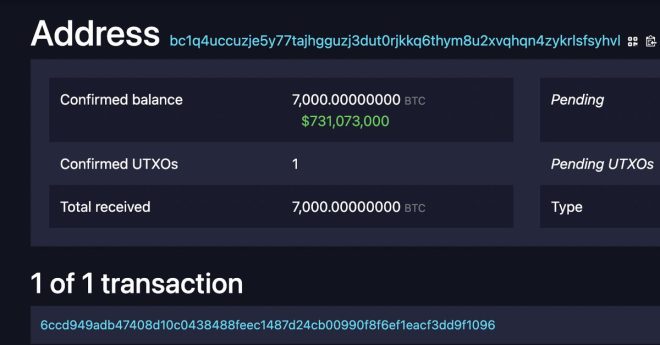

In a significant development in the cryptocurrency space, it has been reported that Bitfinex, a leading cryptocurrency exchange, has transferred a staggering 7,000 Bitcoin, valued at approximately $731 million, to Jack Mallers’ Twenty One Capital. This transaction was highlighted in a tweet from Bitcoin Magazine, which has garnered attention due to its substantial implications for the crypto market and the entities involved.

### Overview of the Transaction

The transfer of 7,000 Bitcoin represents one of the largest transactions in recent times and underscores the growing influence of institutional players in the cryptocurrency market. Jack Mallers, the founder of Strike and now associated with Twenty One Capital, is known for his innovative approaches to Bitcoin adoption and payment solutions. This transaction signals a potential strategic move, possibly aimed at leveraging Bitcoin’s value for future investments or technological developments in the blockchain space.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

### Significance of the Transfer

The significance of this large-scale transfer cannot be understated. It showcases the increasing confidence of institutional investors in Bitcoin as a long-term asset. The value of Bitcoin has seen significant fluctuations, yet its adoption by major financial players continues to grow. By transferring such a large amount, Bitfinex is not just facilitating a transaction; it is essentially reinforcing Bitcoin’s position as a legitimate asset class.

This move may also indicate a shift in how Bitcoin is perceived and utilized by large financial entities. Instead of merely being a speculative asset, Bitcoin is increasingly viewed as a strategic investment vehicle. Jack Mallers’ involvement adds another layer of interest, as he has been a vocal proponent of Bitcoin’s potential to transform global finance.

### Implications for the Crypto Market

The transaction has broader implications for the crypto market. It may trigger renewed interest from other institutional investors who have been observing the market’s developments. Large transactions like this often lead to speculation and can impact Bitcoin’s price trajectory. Investors and analysts will be closely monitoring the market for any signs of volatility or price movement resulting from this transfer.

Moreover, this event could encourage further adoption of Bitcoin by other financial institutions. As entities like Bitfinex and Twenty One Capital engage in high-value transactions, it signals to the market that Bitcoin is becoming an integral part of the financial ecosystem. This could lead to increased liquidity and market stability, which are essential for broader adoption.

### The Role of Bitfinex

Bitfinex has been a significant player in the cryptocurrency exchange market. Established in 2012, it has grown to become one of the largest exchanges by trading volume. The platform is known for its advanced trading features and services, which cater to both retail and institutional investors.

By facilitating this large transfer, Bitfinex is reinforcing its position as a leading exchange in the crypto space. The exchange has previously been associated with various controversies, but transactions of this magnitude can help reshape its image as a reliable and innovative platform in the evolving cryptocurrency landscape.

### Jack Mallers and Twenty One Capital

Jack Mallers has established himself as a key figure in the Bitcoin community. His work with Strike, a payment application that leverages Bitcoin, has drawn significant attention and acclaim. By moving to Twenty One Capital, Mallers is likely aiming to expand his influence and continue advocating for Bitcoin’s integration into everyday financial transactions.

Twenty One Capital, under Mallers’ guidance, is poised to explore new opportunities in the cryptocurrency market. The recent transfer of Bitcoin could be a precursor to innovative financial products or services that leverage Bitcoin’s capabilities, particularly in areas like payments, remittances, and potentially even investment vehicles.

### Future Outlook

The future of Bitcoin and the broader cryptocurrency market appears promising following this transaction. As institutional interest continues to grow, we may see more significant developments and partnerships emerging in the space. The involvement of players like Bitfinex and Jack Mallers indicates a trend toward greater legitimacy and acceptance of Bitcoin in traditional finance.

Investors should remain vigilant, as the market can be volatile, especially following high-value transactions. However, the increasing interest from institutional investors might provide a stabilizing effect in the long run.

### Conclusion

The recent transfer of 7,000 Bitcoin from Bitfinex to Jack Mallers’ Twenty One Capital marks a significant moment in the cryptocurrency landscape. It not only highlights the growing institutional interest in Bitcoin but also reinforces the legitimacy of cryptocurrency as a viable asset class. As the market continues to evolve, the implications of this transaction will likely resonate throughout the financial ecosystem, paving the way for further innovations and adoption in the world of digital currencies.

This event is a testament to the potential of Bitcoin to transform traditional finance and create new opportunities for investors and businesses alike. With Jack Mallers at the helm of Twenty One Capital, the future looks bright for Bitcoin and its role in the global economy. Investors and enthusiasts alike should keep a close eye on the developments stemming from this monumental transaction and the broader trends in the cryptocurrency market.

JUST IN: Bitfinex sent 7,000 #Bitcoin worth $731 million to Jack Mallers’ Twenty One Capital pic.twitter.com/kshqZwHz34

— Bitcoin Magazine (@BitcoinMagazine) June 2, 2025

JUST IN: Bitfinex sent 7,000 Bitcoin worth $731 million to Jack Mallers’ Twenty One Capital

When it comes to the world of cryptocurrency, news travels fast, especially when it involves significant amounts of Bitcoin. Just recently, Bitfinex made headlines by transferring a whopping 7,000 Bitcoin, valued at around $731 million, to Jack Mallers’ Twenty One Capital. This transaction is not just another number in the crypto ledger; it’s a pivotal moment that could have substantial implications for the market and the players involved.

So, why is this transfer so significant? Let’s dive deep into the details surrounding this monumental transaction.

Understanding the Players: Bitfinex and Jack Mallers

To grasp the full weight of this transaction, we first need to understand who Bitfinex is and the role Jack Mallers plays in the cryptocurrency ecosystem.

Bitfinex is one of the largest cryptocurrency exchanges in the world. It’s known for its liquidity and advanced trading features, making it a go-to platform for serious traders. However, it’s not without its controversies, facing scrutiny over transparency and security issues in the past.

On the other hand, Jack Mallers is a rising star in the crypto world. Known for his innovative approach to payments and the integration of Bitcoin into everyday transactions, he founded Strike, a company that’s been making waves in the Bitcoin payment space. His latest venture, Twenty One Capital, aims to push the boundaries of what’s possible with cryptocurrency investments and utilization.

The Transaction: What It Means for Bitcoin’s Future

The transfer of 7,000 Bitcoin from Bitfinex to Mallers’ Twenty One Capital is significant in multiple ways. Firstly, it showcases the trust that Bitfinex has in Mallers and his vision. By transferring such a large volume of Bitcoin, Bitfinex is effectively endorsing Mallers’ potential to innovate within the crypto space.

Moreover, this transaction represents a growing trend of institutional investment in Bitcoin. As more traditional investors and financial institutions recognize Bitcoin’s potential as a store of value and a hedge against inflation, large transactions like this one become increasingly common. The involvement of major players in the crypto space often serves to bolster confidence among retail investors, who may be more willing to enter the market when they see significant investment from trusted entities.

Implications for the Cryptocurrency Market

So, what does this mean for the broader cryptocurrency market? A transaction of this magnitude can have ripple effects across the entire ecosystem. For starters, it may influence Bitcoin’s price trajectory. Large movements of Bitcoin often lead to speculation and can result in price fluctuations, which can either lead to a bullish or bearish sentiment in the market.

Additionally, this transfer underscores the ongoing evolution of Bitcoin as a legitimate asset class. When large amounts of Bitcoin are being transferred for investment purposes, it signals to the market that Bitcoin is not just a speculative asset but is increasingly being viewed as a serious investment opportunity.

Jack Mallers and the Vision for Twenty One Capital

With the transfer of these 7,000 Bitcoin, Mallers is positioned to make significant moves in the crypto space. His vision for Twenty One Capital is to create a robust investment platform that harnesses the power of Bitcoin, aiming to facilitate its adoption in everyday transactions.

Mallers has already demonstrated a knack for innovation, particularly with the Strike app, which enables users to send and receive Bitcoin seamlessly. By leveraging this new capital from Bitfinex, Mallers can expand his operations and potentially introduce new features or services that could further integrate Bitcoin into daily financial activities.

The Bigger Picture: Institutional Adoption of Bitcoin

The transaction isn’t just a win for Mallers; it’s part of a larger narrative surrounding the institutional adoption of Bitcoin. More and more companies and financial institutions are starting to recognize Bitcoin’s potential as a digital asset.

In recent years, we’ve seen various companies add Bitcoin to their balance sheets, and investment funds focusing on cryptocurrency are becoming more prevalent. This growing acceptance of Bitcoin by institutional players indicates that it may soon be a standard part of investment portfolios, much like stocks or gold.

This shift is crucial because it can lead to increased stability in Bitcoin’s price and reduce volatility, which has long been a concern for both investors and everyday users. The more institutional money flows into Bitcoin, the more it can be seen as a legitimate asset rather than just a speculative bubble.

Looking Ahead: What’s Next for Bitcoin and Twenty One Capital?

As we look ahead, it’s clear that both Bitcoin and Jack Mallers’ Twenty One Capital are poised for exciting developments. The transfer of 7,000 Bitcoin is just one piece of a larger puzzle that continues to unfold in the cryptocurrency landscape.

For Bitcoin, the question remains: will this transaction lead to increased adoption and recognition as a legitimate asset class? For Mallers, the challenge will be to leverage this significant capital in a way that drives innovation and attracts more users to the Bitcoin ecosystem.

With the rapid pace of change in the crypto world, it’s essential to stay informed about these developments. Whether you’re an investor, a crypto enthusiast, or simply curious about the future of money, transactions like this one are worth keeping an eye on.

Final Thoughts on the Transaction

The recent transaction involving Bitfinex and Jack Mallers’ Twenty One Capital is a clear indicator of the growing maturity of the cryptocurrency market. It’s a reminder that Bitcoin is not just a passing trend; it’s here to stay, and significant players are actively shaping its future.

As the cryptocurrency landscape continues to evolve, staying informed and engaged is crucial. With innovations and investments pouring in, the future of Bitcoin and its role in the global economy is more exciting than ever. Keep your eyes peeled for what comes next, as the world of cryptocurrency is always full of surprises!