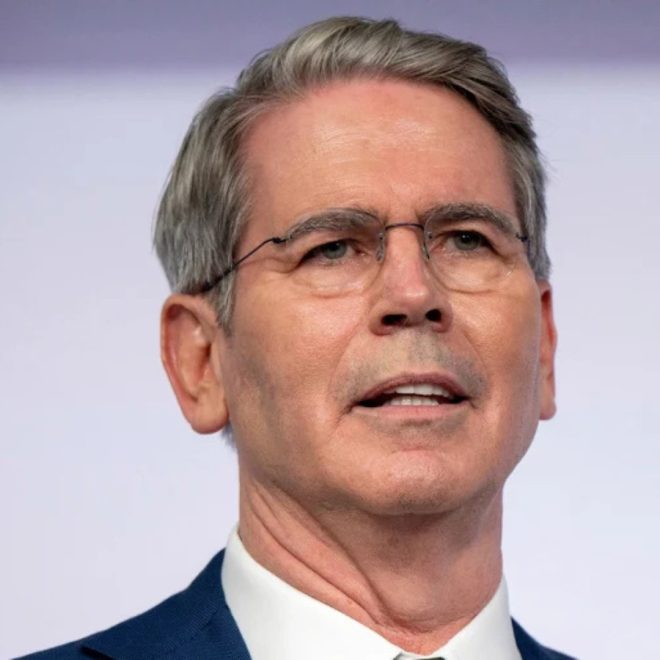

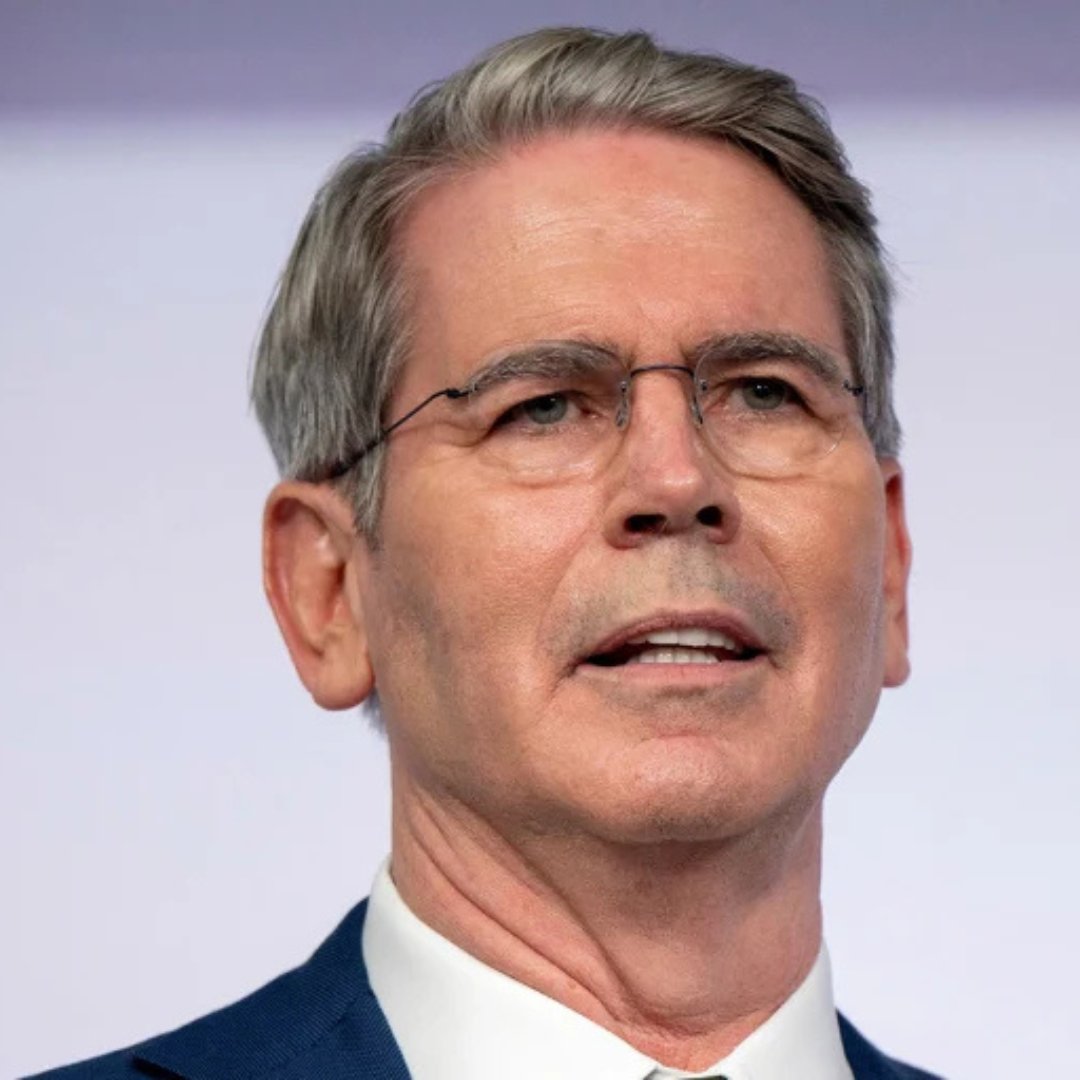

“Debt Ceiling Crisis: Treasury Sec. Bessent Claims ‘US Will Never Default’ – Is He Right?”

US debt ceiling news, Treasury Secretary statements, China export restrictions

—————–

U.S. Treasury Secretary Bessent Assures No Default Amid Upcoming Debt Ceiling Deadline

As the United States approaches a critical debt ceiling deadline in July, U.S. Treasury Secretary Bessent has made a firm statement asserting that the country "will never default." This declaration comes at a time of heightened concern regarding the nation’s financial stability and the potential ramifications of failing to raise the debt ceiling. In addition to addressing domestic fiscal issues, Secretary Bessent’s remarks indicate the importance of international relations, particularly with China, as discussions with President Xi are anticipated amidst ongoing export curbs from China.

Understanding the Debt Ceiling

The debt ceiling is a cap set by Congress on the amount of money that the government is allowed to borrow to cover expenses. When the ceiling is reached, the U.S. Treasury can no longer issue new debt without Congressional approval, which can lead to a government shutdown or a default on obligations. A default could have catastrophic consequences for the U.S. economy, potentially leading to increased borrowing costs, loss of investor confidence, and a decline in the value of the dollar.

Key Points from Secretary Bessent’s Statement

Secretary Bessent’s assurance that the U.S. "will never default" is aimed at calming fears among investors and the public. By reinforcing the government’s commitment to meeting its financial obligations, Bessent seeks to maintain stability in financial markets as the deadline approaches. This statement underscores the administration’s proactive stance in managing the country’s debt and fiscal policies.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Implications of the Debt Ceiling Crisis

Should Congress fail to raise the debt ceiling, several negative outcomes could unfold:

- Government Shutdown: Essential services could be halted, affecting millions of Americans reliant on government support.

- Increased Borrowing Costs: A default could lead to a downgrade in the U.S. credit rating, prompting higher interest rates for government borrowing, which in turn could affect consumer loans and mortgages.

- Economic Recession: A prolonged period of uncertainty could lead to decreased consumer spending and business investment, ultimately stalling economic growth.

- Global Impact: As the world’s largest economy, any financial instability in the U.S. has far-reaching effects, potentially leading to a global economic downturn.

The Context of International Relations

In the backdrop of these domestic financial concerns, Secretary Bessent’s comments also highlight the importance of international relations, particularly with China. The anticipated talks with President Xi indicate a recognition of the interconnectedness of global economies and the need for cooperation in navigating economic challenges.

China’s Export Curbs

China’s recent export restrictions have raised alarms in various sectors, particularly in technology and essential goods. These curbs are part of a broader strategy by the Chinese government to assert control over critical resources and technologies, which could have significant implications for American industries. The upcoming discussions between U.S. officials and President Xi are crucial for addressing these export issues and seeking a resolution that benefits both nations.

Conclusion

As the July debt ceiling deadline approaches, Secretary Bessent’s assertion that the U.S. "will never default" serves as a reassuring message to both domestic and international stakeholders. By maintaining a commitment to fiscal responsibility and engaging in dialogue with global leaders like President Xi, the U.S. aims to navigate these complex economic challenges effectively.

In summary, the combination of a looming debt ceiling crisis and international trade tensions requires careful management. The U.S. government’s proactive approach, as highlighted by Secretary Bessent’s statement, is vital in ensuring economic stability and fostering positive international relations. The coming weeks will be critical in determining how these factors will play out in the broader economic landscape.

JUST IN: Treasury Sec. Bessent says the US “will never default” as the July debt ceiling deadline nears.

Talks with Xi expected amid China export curbs. pic.twitter.com/x7UvVJAiQB

— Cointelegraph (@Cointelegraph) June 1, 2025

JUST IN: Treasury Sec. Bessent says the US “will never default” as the July debt ceiling deadline nears

In a recent announcement that has sent ripples through the financial world, Treasury Secretary Bessent reassured the public that the US will “never default” as we approach the crucial July debt ceiling deadline. This statement comes at a time when the financial markets are on high alert, and uncertainty looms large. The debt ceiling is a cap set by Congress on the amount of money that the federal government may borrow, and hitting that ceiling could have significant consequences for the economy.

Defaulting on debt obligations is something that no country wants to face, especially not the United States. The implications of such a situation would be catastrophic, potentially leading to skyrocketing interest rates, a decline in the value of the US dollar, and a loss of global confidence in the US economy. Hence, Secretary Bessent’s comments are not only timely but essential for maintaining public confidence in the government’s financial management.

Talks with Xi expected amid China export curbs

As we delve deeper into the implications of the debt ceiling situation, it’s crucial to note that the US is not operating in a vacuum. Global economic dynamics are at play, particularly with China. Recently, the US has been engaging in discussions with Chinese President Xi Jinping concerning export curbs. These talks are significant as they could shape the future of trade between the two largest economies in the world.

China has been implementing various export restrictions, which has raised concerns about supply chain disruptions and inflationary pressures globally. The talks with Xi are expected to address these issues and pave the way for more stable trade relations. With the debt ceiling deadline approaching, the timing of these negotiations couldn’t be more critical.

The Importance of the Debt Ceiling

Understanding the debt ceiling is vital for anyone interested in economics or finance. The debt ceiling does not dictate how much money the government can spend; rather, it limits how much money it can borrow. Once the ceiling is reached, the Treasury Department can no longer issue new debt to finance government spending, which can lead to a situation where the government cannot meet its obligations.

In the past, political standoffs regarding the debt ceiling have led to significant market volatility, with investors reacting to the uncertainty. Secretary Bessent’s assurance aims to quell fears and stabilize the market as we approach this important deadline. By stating that the US will never default, she is attempting to instill confidence in investors and the general public.

What Happens if the US Defaults?

The potential consequences of a US default are dire. If the government fails to meet its debt obligations, it could trigger a financial crisis. Investors would likely demand higher interest rates on US bonds, leading to increased borrowing costs for the government and, by extension, taxpayers. Moreover, a default could lead to a downgrade of the US credit rating, which would have long-lasting impacts on the economy.

Additionally, global markets would react negatively, as many foreign countries hold US debt. A loss of confidence in the US financial system could lead to a cascade of economic issues worldwide. This is why Bessent’s declaration is so crucial; it serves as a reassurance that the US government is committed to maintaining its financial integrity.

Current Economic Climate

As we navigate through these challenging times, it’s essential to keep an eye on the broader economic climate. The US economy is currently facing multiple challenges, including inflation, labor shortages, and supply chain disruptions. These factors add to the urgency of the upcoming debt ceiling deadline.

High inflation rates have forced the Federal Reserve to take measures that could impact economic growth. Increasing interest rates to combat inflation could slow down consumer spending, which is a significant driver of the economy. Therefore, the government must balance its approach to fiscal responsibility while also promoting economic growth.

Impact on American Households

The ramifications of the debt ceiling and potential default extend beyond Wall Street; they directly impact American households. If the government defaults, it could lead to increased interest rates on loans, mortgages, and credit cards. Families could find themselves paying more for everyday expenses, which would further strain their budgets.

Moreover, government programs that many Americans rely on could face funding cuts. Social Security, Medicare, and other essential services could be jeopardized if the government cannot borrow money to fund these programs. Thus, the stakes are incredibly high as we approach the July deadline.

What’s Next for the US Economy?

Looking ahead, the discussions between the US and China regarding export curbs will be critical. A resolution could lead to a more stable economic environment, allowing both countries to focus on growth rather than conflict. The outcome of these talks could also influence the Federal Reserve’s decisions on interest rates and economic policy moving forward.

As we approach the debt ceiling deadline, it’s vital for all stakeholders—government officials, investors, and everyday citizens—to stay informed and engaged. The dialogue surrounding the debt ceiling is not just a political issue; it’s one that affects the financial well-being of every American.

The Role of Public Confidence

One of the most important factors in maintaining economic stability is public confidence. Secretary Bessent’s statement aims to bolster that confidence. When people believe that the government will manage its finances responsibly, they are more likely to invest, spend, and engage with the economy positively.

Conversely, if uncertainty reigns, it can lead to a self-fulfilling prophecy where fear begets more fear, causing people to pull back on spending and investment. This is why clear communication from government officials is essential during these turbulent times.

Conclusion: Staying Informed

As the July debt ceiling deadline nears, staying informed about the developments surrounding this issue is crucial. The conversations between the US and China, the implications of potential default, and the overall economic climate are all interconnected. By understanding these dynamics, we can better navigate the complexities of the current financial landscape.

In the coming weeks, be sure to keep an eye on the news for updates regarding the debt ceiling negotiations and economic policies. The outcome of these discussions will shape the future of the US economy and, by extension, the lives of millions of Americans.