Trump’s Bold Claim: No Social Security Tax—But What’s the Hidden Cost?

Trump Social Security plan, tax deductions for retirees, 2025 fiscal policy changes

—————–

Trump’s Stance on Social Security Taxes: Key Insights

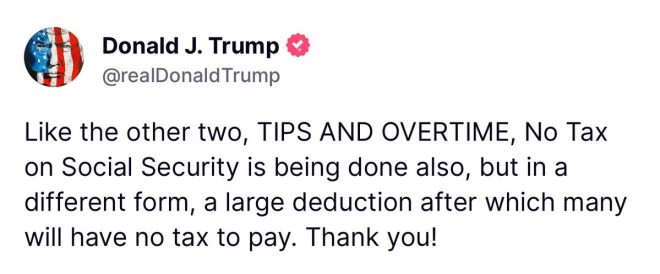

In a recent statement that has caught the attention of many, former President Donald trump declared that there will be no new taxes imposed on Social Security. This announcement has sparked discussions surrounding the implications for American citizens, especially seniors who rely heavily on Social Security benefits for their livelihoods. Trump’s remarks underscore the ongoing debates surrounding taxation and government support programs in the United States.

No New Taxes on Social Security

Trump’s assertion comes at a time when many Americans are concerned about the sustainability of Social Security. With rising living costs and inflation, the potential for tax increases on benefits could significantly impact retirees and those dependent on Social Security. By categorically stating that no tax will be instituted on Social Security, Trump aims to reassure these individuals that their benefits will remain intact.

This stance aligns with Trump’s broader economic philosophy, which emphasizes lower taxes and reduced government intervention. By eliminating the possibility of taxing Social Security, he is not only appealing to seniors but also reinforcing his commitment to conservative economic principles.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Implications of Trump’s Statement

Trump’s comments imply that any discussions regarding the taxation of Social Security will be contentious. He mentioned, “A large deduction after which many will have to tax to pay,” which hints at the complexities surrounding the government’s fiscal policies. This statement raises questions about how the government plans to fund Social Security in the long run.

With the Social Security Trust Fund projected to face shortfalls in the coming years, the sustainability of the program is under scrutiny. Critics argue that without reforms, the program may not be able to provide full benefits to future retirees. Trump’s assurance may provide temporary relief, but it also highlights the urgent need for a long-term solution to ensure that Social Security remains viable for future generations.

The Political Landscape

Trump’s announcement also has significant political implications. As the 2024 elections approach, candidates are eager to address key issues that resonate with voters. Social Security is a critical concern for many, particularly among older voters who make up a substantial portion of the electorate. By taking a firm stance against taxing Social Security, Trump positions himself as a protector of senior citizens’ benefits, a strategy that could bolster his support among this demographic.

However, Trump’s comments are not without controversy. Opponents may argue that his administration’s previous policies did not adequately address the long-term challenges facing the Social Security program. This discourse is likely to intensify as Trump and other candidates vie for public support.

The Future of Social Security

As discussions around taxation and Social Security continue, it is essential for policymakers to consider a balanced approach that addresses both the needs of current beneficiaries and the financial health of the program. While Trump’s statement provides a temporary sense of security for many, it also brings to light the pressing issues that lawmakers must confront.

The future of Social Security will require collaboration across political lines to devise sustainable solutions that protect benefits while ensuring the program’s longevity. This includes exploring potential reforms, such as adjusting the payroll tax cap, increasing the retirement age, or revising benefit calculations.

Conclusion

Trump’s declaration that no new taxes will be levied on Social Security is a significant statement in the current political climate. It addresses the immediate concerns of many Americans while opening the floor for deeper discussions about the future of the program. As the nation navigates complex fiscal challenges, the commitment to safeguarding Social Security will remain a pivotal issue for voters and policymakers alike.

In summary, Trump’s comments highlight the critical need for ongoing dialogue regarding Social Security and taxation. The challenge lies in finding equitable solutions that ensure the program’s stability for current and future generations. With the 2024 elections on the horizon, the discourse surrounding Social Security will undoubtedly influence voter decisions and shape the future of American economic policy.

JUST IN: Trump says no tax on SOCIAL SECURITY is coming, and –

“A large deduction after which many will have to tax to pay.”

— Eric Daugherty (@EricLDaugh) May 31, 2025

JUST IN: Trump says no tax on SOCIAL SECURITY is coming, and –

In a surprising announcement, former President Donald Trump has put to rest fears about potential taxes on Social Security benefits. His declaration, “no tax on SOCIAL SECURITY is coming,” has stirred conversations across the nation. But what does this really mean for millions of Americans who rely on Social Security for their retirement income?

“A large deduction after which many will have to tax to pay.”

Trump’s statement also included a cryptic phrase about “a large deduction after which many will have to tax to pay.” This raises eyebrows and prompts questions about the intricacies of tax policy and retirement planning. Let’s dive into what this could imply for the future of Social Security and the financial landscape for retirees.

The Importance of Social Security

Social Security is a lifeline for many Americans, providing essential financial support to retirees, disabled individuals, and survivors of deceased workers. According to the Social Security Administration, about 65 million people receive Social Security benefits, which is roughly 1 in 6 Americans. Understanding the implications of tax policies on this vital program is crucial for both current beneficiaries and future retirees.

What Does No Tax on Social Security Mean?

When Trump states that there will be “no tax on SOCIAL SECURITY,” he is likely addressing concerns that have been raised over the years regarding the taxation of Social Security benefits. Currently, depending on your income level, up to 85% of your Social Security benefits can be subject to federal income tax. This can be a significant financial burden for many retirees who may already be living on a fixed income.

By assuring that no new taxes will be imposed on these benefits, Trump is attempting to alleviate fears among seniors and those nearing retirement. This reassurance is particularly timely, as many Americans are still reeling from economic uncertainties and rising inflation rates.

The Implications of Deductions

The part of Trump’s statement mentioning “a large deduction after which many will have to tax to pay” is where things get a bit murky. It suggests potential changes to tax deduction policies that might affect how much income retirees can claim without being taxed. Understanding deductions and their implications is crucial.

Deductions can lower your taxable income, which is beneficial for retirees who often rely on multiple income streams, including pensions, savings, and Social Security. If deductions are altered in a way that makes it harder for retirees to offset their incomes, it could lead to higher tax liabilities for some. This could create a situation where, despite the assurance of no additional taxes on Social Security itself, retirees might still face higher overall tax burdens.

Future of Social Security Taxes

While Trump’s statement provides a sense of security for many, the future of Social Security taxes remains a complex issue. The program is funded through payroll taxes, and with the aging population and increasing life expectancy, questions about its sustainability continue to emerge. The Committee for a Responsible Federal Budget has warned that without reform, Social Security could face cuts in benefits as early as 2034.

Considering these factors, it’s essential for current and future retirees to stay informed about potential changes in policy and taxation that could impact their benefits and overall financial security.

Public Reaction to Trump’s Statement

Public reaction to Trump’s announcement has been mixed. Supporters appreciate the reassurance regarding Social Security, while critics question the feasibility of such a promise, especially in light of ongoing discussions about budget deficits and national debt. Some experts argue that while the promise sounds good on paper, without a solid plan to ensure the program’s funding, it might not hold up in the long run.

Moreover, conversations around these topics are vital. Engaging with local representatives and advocating for policies that support retirees is essential. Social Security is a cornerstone of the retirement system in the United States, and its future impacts everyone.

Planning for Retirement with Uncertainty

Given the uncertainties surrounding Social Security, it’s more important than ever for individuals to proactively plan for their retirement. This involves not only understanding Social Security benefits but also exploring other retirement savings options such as IRAs, 401(k)s, and pensions.

Financial advisors often recommend a diversified approach to retirement savings. By not relying solely on Social Security, retirees can create a more robust financial plan that can withstand the ups and downs of economic shifts and policy changes. It’s crucial to stay informed, seek advice, and adjust your plans as necessary.

Resources for Staying Informed

For individuals looking to stay updated on Social Security and tax policies, there are numerous resources available. The Social Security Administration website is an excellent starting point for understanding benefits, eligibility, and potential changes. Additionally, organizations like AARP provide valuable insights and advocacy efforts aimed at protecting the interests of seniors.

Staying connected to news outlets and financial blogs can also help individuals keep track of policy changes and expert opinions on the future of Social Security and taxation. Engaging with community forums and local advocacy groups can further enhance understanding and provide support in navigating retirement planning.

Conclusion

Trump’s recent declaration about Social Security taxes has initiated a wave of discussions about the future of this essential program. While the promise of no new taxes may provide temporary relief, the complexities surrounding deductions and the sustainability of Social Security require ongoing attention and proactive planning. As we move forward, it’s crucial to remain informed and engaged in discussions about the policies that will shape the financial futures of millions of Americans.

“`