Trump Shocks Nation: New Plan Could Change Social Security Tax Forever!

Social Security taxation changes, Trump 2025 tax policy update, implications of Social Security financing

—————–

President trump Confirms No Tax on Social Security: Implications and Insights

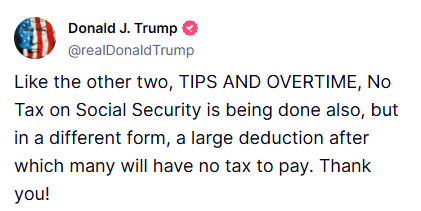

In a recent announcement, former President Donald Trump made headlines by confirming that there will be no new taxes imposed on Social Security benefits. This statement was shared via a tweet from the account "Resist the Mainstream," sparking discussions across various platforms about the future of Social Security and its implications for millions of Americans who rely on these benefits.

Understanding Social Security

Social Security is a crucial program in the United States, providing financial assistance to retirees, disabled individuals, and survivors of deceased workers. Funded through payroll taxes collected under the Federal Insurance Contributions Act (FICA), Social Security is designed to offer a safety net for those who may struggle financially in their later years or due to unforeseen circumstances.

Trump’s Announcement: Key Takeaways

Trump’s assertion that there will be no tax increases on Social Security is significant for several reasons:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Reassurance for Beneficiaries: Millions of Americans depend on Social Security as their primary source of income after retirement. This announcement provides reassurance to current and future beneficiaries that their benefits will remain intact without the burden of new taxes.

- Political Implications: The statement comes at a time when discussions about tax reform and budget allocations are prevalent in political discourse. Trump’s commitment to protecting Social Security could be seen as a strategic move to garner support from senior voters and those concerned about their financial futures.

- Economic Impact: By ensuring that Social Security remains tax-free, Trump aims to bolster consumer confidence among older Americans. This demographic tends to spend a significant portion of their income on essential goods and services, which can positively impact the economy.

Broader Context of Social Security and Taxes

The conversation around Social Security and taxation is complex. In recent years, there have been proposals from various lawmakers to consider altering the tax structure surrounding Social Security, including increasing taxes on benefits for higher-income individuals. Trump’s announcement effectively counters these discussions, emphasizing a commitment to maintaining the status quo.

The Future of Social Security

While Trump’s announcement is a positive development for many, it raises questions about the long-term viability of the Social Security program. Experts warn that without reforms to address the program’s funding challenges, Social Security may face significant financial hurdles in the coming years. Key considerations include:

- Aging Population: As the baby boomer generation continues to retire, the ratio of workers to beneficiaries is declining. This demographic shift puts additional pressure on the Social Security system.

- Funding Shortfalls: Projections suggest that the Social Security Trust Fund will be depleted by the mid-2030s unless reforms are enacted. This scenario raises concerns about the sustainability of benefits for future retirees.

Public Sentiment and Reactions

Reactions to Trump’s announcement have been mixed. Supporters view it as a necessary safeguard for seniors, while critics argue that the lack of proactive reform could lead to more significant issues down the line. Public sentiment largely reflects a desire for stability in Social Security, with many Americans expressing concerns about potential cuts or tax increases.

Conclusion: Navigating the Future of Social Security

As the discourse surrounding Social Security continues, Trump’s confirmation of no new taxes offers a momentary sense of security for millions. However, it is essential to recognize the underlying challenges that the program faces. Policymakers must navigate the delicate balance between protecting beneficiaries and ensuring the program’s long-term sustainability.

In summary, while Trump’s announcement is a positive development for Social Security recipients, the need for comprehensive discussions about the future of the program remains critical. As America moves forward, the focus will undoubtedly shift toward finding solutions that address the financial health of Social Security while prioritizing the needs of its beneficiaries.

Key Takeaways

- President Trump confirmed there will be no new taxes on Social Security.

- This announcement reassures current and future beneficiaries.

- The statement has significant political implications and aims to boost consumer confidence.

- Long-term challenges facing Social Security include an aging population and funding shortfalls.

- Public reaction is mixed, highlighting the need for proactive reform to ensure the program’s sustainability.

By engaging with these critical issues, stakeholders can work towards a solution that preserves the integrity of Social Security for generations to come.

JUST IN: President Trump confirms no tax on Social Security is happening in a new form. pic.twitter.com/YpjNuEz5YO

— Resist the Mainstream (@ResisttheMS) June 1, 2025

JUST IN: President Trump confirms no tax on Social Security is happening in a new form.

In recent news, President Trump made a significant announcement that has captured the attention of many Americans: there will be no tax on Social Security in a new form. This statement, shared via social media, has sparked various reactions and discussions about the future of Social Security and the implications for retirees and those relying on these benefits.

When it comes to Social Security, many people are understandably concerned about how taxes might impact their benefits. After all, Social Security is a critical safety net for millions of Americans, providing essential income in retirement. The prospect of new taxes can cause anxiety for those who depend on these funds to make ends meet. President Trump’s assurance that no new taxes are coming gives a sense of relief to many, but it also raises questions about what this means for the program’s future.

Understanding the Context of the Announcement

To fully grasp the implications of President Trump’s statement, it’s helpful to understand the broader context of Social Security in the United States. Social Security has been a fundamental part of American life since it was established in 1935. The program is financed through payroll taxes collected from workers and their employers, with the funds then distributed to eligible beneficiaries.

Over the years, there have been numerous discussions and proposals regarding changes to Social Security, including potential tax increases. Many lawmakers and economists argue that without adjustments, the program could face financial challenges as the population ages and the ratio of workers to beneficiaries decreases. This is why the president’s announcement is so significant—it addresses concerns about the program’s sustainability and the financial burdens that might fall on future retirees.

The Reactions to Trump’s Announcement

Reactions to the announcement have been mixed. On one hand, many supporters of President Trump praise him for protecting Social Security benefits, arguing that this move aligns with his administration’s commitment to prioritizing the needs of American citizens. Supporters feel reassured that their Social Security benefits will remain intact without the threat of additional taxation.

On the other hand, critics express skepticism regarding the long-term viability of Social Security. They argue that while it’s encouraging to hear that no new taxes will be introduced, this assurance does not address the underlying issues facing the program. The ongoing debate over how to fund Social Security continues to loom large, and some worry that this announcement could be more of a political strategy than a viable solution.

What Does This Mean for Future Policy?

The president’s confirmation of no new taxes on Social Security does bring a sense of stability, but it also opens up further dialogue about the future of the program. Policymakers will need to consider alternative methods for ensuring the long-term viability of Social Security. This could include discussions around reforming the program, increasing the retirement age, or finding new revenue sources that don’t rely on taxing current benefits.

It’s also crucial for citizens to stay informed about how these discussions evolve. Engaging with local representatives, participating in town hall meetings, or following credible news sources can help individuals understand how potential changes might impact their benefits. Knowledge empowers citizens to advocate for their interests effectively.

The Importance of Social Security for Americans

Social Security is not just a financial program; it represents a promise made to millions of Americans. For many retirees, it serves as a critical source of income, often making up a significant portion of their monthly budget. According to the Social Security Administration, nearly 40% of elderly beneficiaries rely on Social Security for 90% or more of their income. With such a heavy reliance on this program, the implications of tax changes are profound.

Moreover, Social Security is not only vital for retirees. It also provides essential support for disabled individuals and survivors of deceased workers. As such, any discussions around taxes or reforms should consider the broader implications for all these groups. The stakes are high, and every decision made can have real-world consequences for families and individuals relying on these benefits.

Engaging in the Social Security Conversation

As citizens, it’s crucial to actively engage in the discussions surrounding Social Security. Whether you’re a retiree, a working individual, or someone who may rely on the program in the future, your voice matters. Staying informed about policy changes and expressing your opinions to your representatives can make a significant difference.

In addition to advocacy, understanding the mechanics of Social Security can help you plan for your future. Familiarize yourself with how benefits are calculated, how to apply for them, and what to expect as you near retirement age. The more you know, the better you can prepare.

Social media platforms, like the one where President Trump’s announcement was made, are excellent tools for staying updated and engaging with others who share your concerns. Following reputable news sources and joining discussions can help you stay informed about the latest developments and understand the implications of policy changes.

Looking Ahead: The Future of Social Security

While President Trump’s announcement has provided some immediate relief regarding taxation, the future of Social Security remains uncertain. Ongoing debates about its funding and sustainability will continue to shape the landscape of American retirement and social support systems.

As we navigate these changes, it’s essential to keep the conversation going. Engaging with your community, advocating for the needs of retirees, and participating in discussions about fiscal policy can help ensure that Social Security remains a robust program for future generations.

In the end, Social Security is more than just a program; it’s a lifeline for many Americans. Whether you’re currently benefiting from it or planning to in the future, understanding the nuances of its structure and the implications of policy changes is vital. And as we’ve seen with President Trump’s recent announcement, staying informed and engaged is the best way to ensure that this crucial program continues to serve the needs of the American people.