Ethereum and Solana Staking ETFs Could Bypass Approval—What’s the Catch?

Ethereum staking opportunities, Solana investment strategies, cryptocurrency ETF approval process

—————–

Ethereum and Solana Staking ETFs Could Be Approved Soon

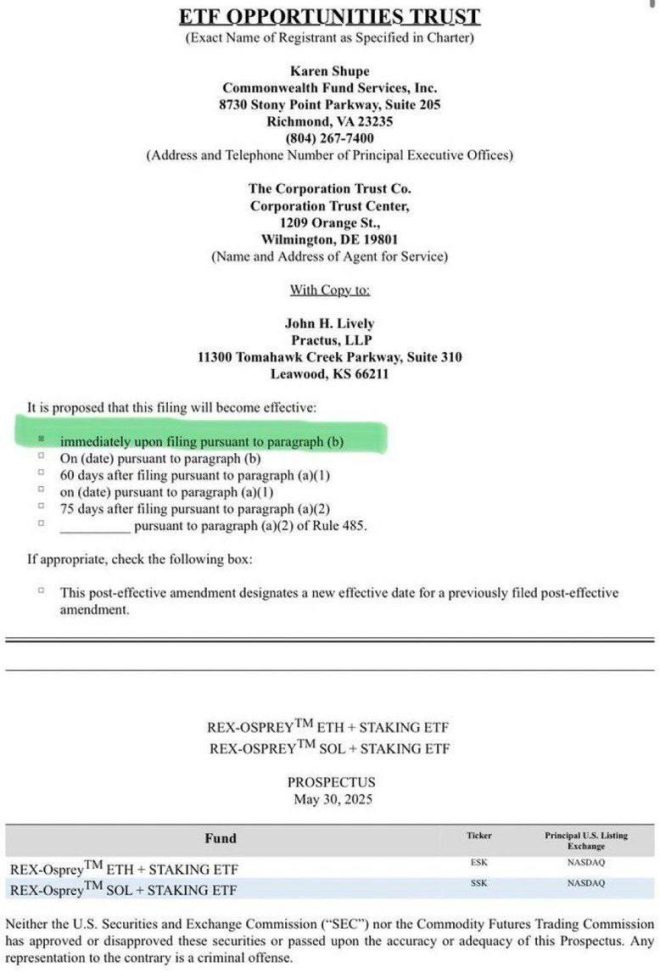

In a groundbreaking development for the cryptocurrency market, it has been reported that Ethereum ($ETH) and Solana ($SOL) staking exchange-traded funds (ETFs) could receive approval as early as June. This news comes from a credible Bloomberg analyst, who suggests that the traditional approval process, which usually involves a lengthy review period under the 19b-4 rule, might be bypassed. Such a scenario could significantly impact the adoption and trading of these two prominent cryptocurrencies.

The Significance of Staking ETFs

Staking ETFs represent a new frontier in the investment world, allowing investors to gain exposure to cryptocurrencies like Ethereum and Solana without directly purchasing or managing the underlying assets. Staking involves locking up a certain amount of cryptocurrency to support the operations of a blockchain network, which in return provides rewards in the form of additional tokens. By offering staking ETFs, the potential for passive income becomes accessible to a broader range of investors, including those who may not be familiar with the technical aspects of cryptocurrency.

For Ethereum, which transitioned to a proof-of-stake (PoS) model with its recent upgrades, this could provide a significant boost in validating its network and increasing its overall value. Similarly, Solana, known for its fast transaction speeds and low fees, stands to benefit from increased institutional interest as more investors seek to diversify their portfolios with innovative financial products.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Market Reactions and Implications

The anticipation surrounding the potential approval of these ETFs has already begun to influence market sentiment. Investors are closely monitoring developments, and if these ETFs are approved, we could see a surge in the prices of both Ethereum and Solana. Increased institutional investment could further solidify the status of these cryptocurrencies as mainstream financial assets.

Moreover, the approval of staking ETFs could pave the way for other cryptocurrencies to explore similar financial products. As the market matures, financial institutions are likely to develop more sophisticated investment vehicles that cater to the growing demand for cryptocurrency exposure.

Regulatory Landscape and Challenges

While the news of a potential expedited approval process is encouraging, it is essential to consider the regulatory landscape surrounding cryptocurrency ETFs. The U.S. Securities and Exchange Commission (SEC) has been cautious in its approach to approving cryptocurrency-related financial products, often citing concerns around market manipulation and investor protection.

However, the growing adoption of cryptocurrencies and the increasing interest in staking could lead to a paradigm shift in how regulatory bodies view these assets. If Ethereum and Solana staking ETFs successfully navigate the approval process, it could set a precedent for more cryptocurrencies to follow suit, ultimately leading to a more robust regulatory framework for the industry.

Benefits of Investing in Staking ETFs

Investing in staking ETFs provides several advantages for investors. First and foremost, it allows individuals to participate in the cryptocurrency market without the complexities of managing wallets, private keys, and the staking process itself. Additionally, staking ETFs can offer diversification, as they may include a basket of different cryptocurrencies, reducing the risk associated with investing in a single asset.

Furthermore, the passive income generated from staking rewards can provide an appealing incentive for investors looking to enhance their returns. As more investors seek opportunities in the digital asset space, staking ETFs could become a popular choice for those looking to balance risk and reward.

Conclusion: A New Era for Crypto Investments

The potential approval of Ethereum and Solana staking ETFs marks a significant milestone in the evolution of cryptocurrency investments. As the market continues to grow and mature, innovative financial products like these ETFs are likely to play a crucial role in attracting institutional and retail investors alike.

With the possibility of expedited approval, stakeholders in the cryptocurrency ecosystem are eager to see how these developments unfold. If successful, Ethereum and Solana staking ETFs could reshape the landscape of digital asset investments, making them more accessible and appealing to a broader audience.

As the crypto space continues to evolve, keeping an eye on regulatory changes and market trends is essential. The future of cryptocurrency investments looks promising, and with the right financial products in place, investors may soon find themselves at the forefront of a new era in finance.

#BREAKING: Ethereum ( $ETH ) and Solana ( $SOL ) staking ETFs could be approved as soon as June.

According to a Bloomberg analyst, they might skip the usual approval process (19b-4) and get approved in just a few weeks. https://t.co/6teGkhrJ0F

BREAKING: Ethereum ( $ETH ) and Solana ( $SOL ) staking ETFs could be approved as soon as June.

In the fast-paced world of cryptocurrency, developments can happen in a blink of an eye. One of the hottest topics right now is the potential approval of Ethereum ($ETH) and Solana ($SOL) staking ETFs. According to a Bloomberg analyst, we might see these investment vehicles hitting the market sooner than expected—possibly as soon as June! This news has sent ripples through the crypto community, fueling excitement and speculation about what this could mean for investors.

Understanding Staking ETFs

Before we dive into the implications of these potential approvals, let’s break down what staking ETFs are. In simple terms, a staking ETF (Exchange-Traded Fund) allows investors to gain exposure to the staking rewards generated by cryptocurrencies like Ethereum and Solana without having to directly hold the digital assets. This is particularly appealing for those who want to benefit from the rewards of staking but may not have the technical know-how or the time to manage it themselves.

Staking involves locking up a certain amount of cryptocurrency to support the operations of a blockchain network. In return, participants earn rewards, usually in the form of additional tokens. With the advent of staking ETFs, investors can enjoy these rewards passively while enjoying the liquidity that comes with trading ETFs on major stock exchanges.

The Approval Process: What’s Happening?

The typical approval process for ETFs is quite rigorous. It usually involves a detailed review under the 19b-4 rule, which outlines the requirements and considerations the Securities and Exchange Commission (SEC) must evaluate. However, the recent insights from Bloomberg suggest that these approvals might skip this lengthy process. This could mean that interested investors won’t have to wait long to get their hands on these promising investment products.

This acceleration in the approval timeline is noteworthy, especially considering the historical hesitance of regulators towards cryptocurrency-based financial products. The fact that Ethereum and Solana, two of the most prominent cryptocurrencies, are at the forefront of this potential shift speaks volumes about their growing acceptance in the financial landscape.

Why Ethereum and Solana?

Ethereum, often dubbed the backbone of decentralized finance (DeFi) and non-fungible tokens (NFTs), has been a leading player in the crypto space for years. Its transition to Ethereum 2.0 has made staking more accessible and appealing. With Ethereum’s robust ecosystem and ongoing developments, it’s no surprise that it’s a primary candidate for staking ETFs.

On the other hand, Solana has rapidly gained traction due to its high throughput and low transaction fees. It’s become a favorite for developers looking to build decentralized applications. The efficiency of Solana’s network makes it an attractive option for staking and, consequently, a prime candidate for ETF inclusion.

Market Implications of the Approval

If the SEC does approve these staking ETFs, the implications could be significant. For one, it could attract a wave of institutional investment into the crypto market. Many institutional investors have been hesitant to dive into cryptocurrencies directly due to regulatory uncertainties and the complexities of managing private keys. Staking ETFs could serve as a bridge, allowing these investors to gain exposure to crypto while adhering to regulatory frameworks.

Moreover, the approval could lead to increased legitimacy for the crypto market as a whole. It would signal to both investors and regulators that cryptocurrencies are becoming an integral part of the mainstream financial system. This could pave the way for more innovative financial products based on digital assets, further solidifying cryptocurrencies’ place in investment portfolios.

What This Means for Retail Investors

For everyday investors, this news could be a game-changer. Many individuals have been looking for ways to participate in the crypto boom without the complexities of direct investment. Staking ETFs offer a more straightforward approach, allowing retail investors to benefit from staking rewards while enjoying the liquidity and accessibility that ETFs provide.

Additionally, the approval of these ETFs might lead to increased price volatility for Ethereum and Solana as new investors enter the market. This could present both opportunities and risks for those looking to capitalize on the potential price movements that often accompany significant news in the crypto space.

Keeping an Eye on Regulatory Developments

As exciting as this news is, it’s essential to remain cautious and stay updated with ongoing regulatory developments. The landscape of cryptocurrency regulation is continually evolving, and decisions made by entities like the SEC can impact the market significantly. While the prospect of Ethereum and Solana staking ETFs seems promising, it’s crucial for potential investors to do their due diligence and stay informed about any changes in regulations.

Moreover, it’s worth noting that while the approval process might be expedited, it’s not a guarantee that these ETFs will indeed be greenlit. The SEC has historically been careful with cryptocurrency-related products, and any unforeseen regulatory hurdles could delay the process.

Potential Challenges Ahead

Despite the optimism surrounding the potential approval of staking ETFs for Ethereum and Solana, there are challenges that could arise. Questions about the security of staking, potential market manipulation, and the overall volatility of cryptocurrency prices are all factors that regulators may consider when determining the approval of these ETFs. Additionally, the technology behind staking needs to be transparent and secure to foster investor confidence.

Investors should also be aware of the risks associated with staking itself. While it can provide rewards, staking carries its own set of risks, including potential losses from slashing (a penalty for validators who fail to perform their duties) and market volatility. All these factors could influence investor sentiment and regulatory decisions moving forward.

Conclusion: The Future Looks Bright

As we wait to see how this situation unfolds, one thing is clear: the potential approval of Ethereum and Solana staking ETFs could be a landmark moment for the cryptocurrency industry. With the possibility of bringing institutional investment into the fold and offering retail investors an accessible way to engage with crypto, the future looks promising.

So, keep your eyes peeled for updates in the coming weeks! Whether you’re a seasoned crypto enthusiast or just starting, the developments surrounding these staking ETFs are worth watching closely. They might just revolutionize how we think about investing in cryptocurrencies.

For more details on this developing story, check out the full article on Bloomberg’s website here.

“`

This article is structured with headings and detailed paragraphs to engage the reader while incorporating SEO-friendly keywords.