“Massive $55M Bitcoin Purchase by Mystery Whale: Is the Market About to Explode?”

Bitcoin market trends, cryptocurrency investment strategies, large-scale Bitcoin purchases

—————–

Whale Purchases $55 Million in Bitcoin: A Bullish Indicator for the Market

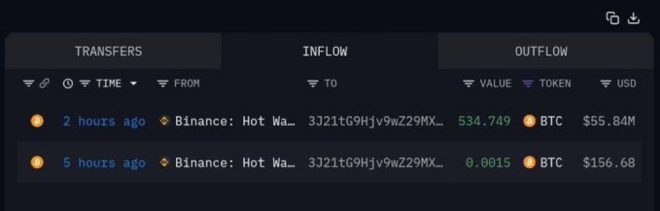

In a significant development that has captured the attention of cryptocurrency enthusiasts and investors alike, a notable "whale" has made waves in the Bitcoin market by purchasing a staggering $55 million worth of Bitcoin on the Binance exchange. This move, reported by popular Twitter account Mister Crypto, has sparked discussions about the potential implications for Bitcoin’s price and the overall crypto market sentiment.

What Does This Whale Purchase Mean?

In the cryptocurrency world, a "whale" typically refers to an individual or entity that holds a substantial amount of cryptocurrency, capable of making significant market impacts through their trading activities. The recent acquisition of $55 million in Bitcoin is a clear indicator of bullish sentiment, suggesting that large investors are optimistic about the future price movements of Bitcoin.

This event raises several important questions for both seasoned investors and newcomers to the crypto space. What drives such massive purchases? What does this imply for Bitcoin’s market dynamics? And, most importantly, how should investors respond to such developments?

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Impact on Bitcoin’s Price

Historically, large purchases by whales have often correlated with upward price movements in Bitcoin. When a whale buys a significant amount of Bitcoin, it can create a ripple effect in the market. Other investors may interpret such a move as a signal of confidence in Bitcoin’s value, leading them to buy as well, which can push prices higher.

Moreover, the timing of this purchase could be crucial. As the cryptocurrency market is known for its volatility, a significant influx of capital can lead to price surges. This is particularly relevant as Bitcoin has experienced varying price ranges in recent months, with investors closely monitoring market trends.

Market Sentiment and Investor Behavior

The psychological aspect of trading cannot be overlooked. The news of a whale buying $55 million in Bitcoin can create a sense of FOMO (Fear of Missing Out) among retail investors. As more individuals hear about this large transaction, they may feel compelled to enter the market, further driving demand and potentially increasing prices.

Additionally, this purchase can be seen as a signal of long-term confidence in Bitcoin’s viability as a digital asset. Large investors typically conduct extensive research before making such significant purchases, and their actions can influence the decisions of smaller investors who may rely on the insights of these whales.

Analyzing the Current Bitcoin Market

As of June 2025, Bitcoin and the broader cryptocurrency market have been experiencing fluctuations that have left investors cautious yet hopeful. The market is influenced by various factors, including regulatory developments, macroeconomic trends, and technological advancements. The recent whale purchase comes at a time when Bitcoin’s price has been navigating through a complex landscape of market forces.

Investors should consider the broader context of this purchase. Are there upcoming events or announcements that could impact Bitcoin’s price? How do recent regulatory changes affect investor confidence? These questions are crucial as they provide a clearer picture of the market’s potential trajectory.

Strategic Considerations for Investors

For those looking to capitalize on the bullish sentiment generated by this whale’s purchase, a few strategic considerations are essential:

- Research and Analysis: Investors should conduct thorough research, analyzing market trends, technical indicators, and news that could impact Bitcoin’s price. Understanding the broader market context can help inform investment decisions.

- Risk Management: The cryptocurrency market is notoriously volatile. Investors should establish clear risk management strategies, including setting stop-loss orders and diversifying their portfolios to mitigate potential losses.

- Long-Term Perspective: While short-term trading can be tempting, many successful investors adopt a long-term perspective. Considering Bitcoin’s historical performance and its potential future value can guide investment strategies.

- Stay Informed: Continuous monitoring of market developments, including whale activity, regulatory changes, and macroeconomic factors, is crucial for making informed decisions.

Conclusion

The recent whale purchase of $55 million in Bitcoin on Binance is a significant event that may indicate bullish sentiment in the cryptocurrency market. As large investors signal confidence in Bitcoin’s future, retail investors might be encouraged to participate, potentially driving prices higher.

While this development is exciting, it’s crucial for all investors to approach the market with caution, informed research, and strategic planning. As the crypto landscape evolves, staying engaged and adaptable will be key to navigating potential opportunities and challenges in the world of Bitcoin and beyond.

In summary, the $55 million Bitcoin purchase serves as a reminder of the dynamic nature of the cryptocurrency market and the impact that significant transactions can have on overall market sentiment. Whether you are a seasoned investor or new to the space, understanding these dynamics is essential for making informed decisions in the ever-changing world of crypto.

BREAKING:

A WHALE JUST BOUGHT $55M WORTH OF BITCOIN ON BINANCE.

BULLISH FOR BITCOIN! pic.twitter.com/yFYmMMxGbG

— Mister Crypto (@misterrcrypto) June 1, 2025

BREAKING:

Imagine waking up to find that a single individual or entity—often referred to as a “whale” in the cryptocurrency world—has just purchased a whopping $55 million worth of Bitcoin on Binance. This kind of news sends ripples through the crypto community, sparking excitement and speculation. The purchase is significant not just for the amount but for what it signals about the current state of Bitcoin and the broader market sentiment. Let’s dive into what this means and why it’s considered bullish for Bitcoin.

A WHALE JUST BOUGHT $55M WORTH OF BITCOIN ON BINANCE.

When we talk about whales in the context of cryptocurrency, we’re referring to investors who hold large amounts of a particular asset—in this case, Bitcoin. The fact that a whale just bought $55 million worth of Bitcoin is no small matter. It indicates a strong belief in Bitcoin’s future value. Whales often have a significant impact on market prices, and their trades can influence the buying and selling decisions of smaller investors. If they’re buying, it usually signals confidence in the market, which can lead to increased buying from others.

BULLISH FOR BITCOIN!

So, what does this mean for the average investor? First, it’s essential to recognize that large purchases like this are often seen as bullish signals. They suggest that someone with deep pockets believes that Bitcoin is undervalued and poised for an upswing. As Bitcoin continues to capture the attention of both retail and institutional investors, this kind of activity adds to the narrative that Bitcoin is not just a passing trend but a legitimate asset class.

Understanding Whales and Market Dynamics

Whales can shape the cryptocurrency market in various ways. They have the power to move prices significantly with their trades, creating volatility that can be both an opportunity and a risk for smaller investors. When a whale makes a large purchase, it can lead to a domino effect where others also jump in, hoping to capitalize on the upward momentum. This is part of a broader psychological dynamic in trading, where investor sentiment plays a crucial role.

The Role of Binance in the Crypto Ecosystem

Binance is one of the largest cryptocurrency exchanges in the world, providing a platform for trading a wide variety of digital currencies. Its prominence makes it a go-to choice for many traders, including whales. The choice of Binance for this massive Bitcoin purchase is notable. It reflects the exchange’s reliability and security, which are critical considerations for large investors. Binance offers advanced trading features and liquidity that can accommodate large orders without causing significant price slippage.

Market Reactions and Predictions

Following the announcement of the $55 million Bitcoin purchase, market analysts and enthusiasts alike have begun to weigh in. Many predict that this could be a precursor to a significant rally in Bitcoin prices. Historically, when whales make large purchases, it can lead to increased interest and activity in the market. This could potentially drive prices higher as more investors look to get involved in what they perceive as a bullish trend.

Why Bitcoin? The Case for the Leading Cryptocurrency

Bitcoin, often referred to as digital gold, has established itself as the leading cryptocurrency by market capitalization. Its scarcity, with a capped supply of 21 million coins, makes it an attractive asset for investors looking for a hedge against inflation and economic instability. As more institutions and individuals recognize the value of Bitcoin, confidence in its long-term viability continues to grow.

Investor Sentiment and FOMO

Investor sentiment is a powerful force in the cryptocurrency market. When news breaks about large purchases, it often leads to FOMO, or “fear of missing out.” Smaller investors may rush to buy Bitcoin, fearing that they’ll miss out on potential gains. This can create a positive feedback loop, driving prices higher as demand increases. The psychological aspect of trading cannot be underestimated, and the recent whale purchase is likely to fuel this sentiment.

Long-Term Implications for Bitcoin

What does this mean for the future? If whales continue to accumulate Bitcoin and more retail investors follow suit, we could see an upward trajectory in Bitcoin’s price. This could lead to greater mainstream acceptance and adoption of Bitcoin as a legitimate form of currency and investment. However, it’s also essential to remain cautious. The cryptocurrency market is notoriously volatile, and large purchases can also lead to significant price corrections if the market sentiment shifts.

The Importance of Staying Informed

For anyone involved in the cryptocurrency space, staying informed is crucial. Following reliable news sources and analysts can provide valuable insights into market trends and investor behavior. Social media platforms, like Twitter, often serve as real-time news sources where significant announcements and trades are discussed. Engaging with the community can also help investors understand the broader context of market movements.

Final Thoughts

The announcement of a whale purchasing $55 million worth of Bitcoin on Binance is a significant development in the cryptocurrency landscape. It highlights the ongoing interest and belief in Bitcoin as a valuable asset. While this news is undoubtedly bullish, it’s essential for investors to approach the market with caution and do their due diligence. The crypto world is dynamic, and trends can shift rapidly. Whether you’re a seasoned investor or just getting started, understanding the implications of whale activity and market sentiment can help you navigate this exciting space.

As we look ahead, it will be interesting to see how this purchase impacts Bitcoin’s price and the overall market sentiment. Keep an eye on the news, and don’t forget to engage with the community. After all, the world of cryptocurrency is not just about numbers; it’s about people, ideas, and the future of finance.