Global Debt Hits $324 Trillion: Economic Collapse Looms, Sell Now!

global economic crisis, unsustainable debt levels, financial market instability

—————–

Understanding the Implications of Global Debt Reaching $324 Trillion

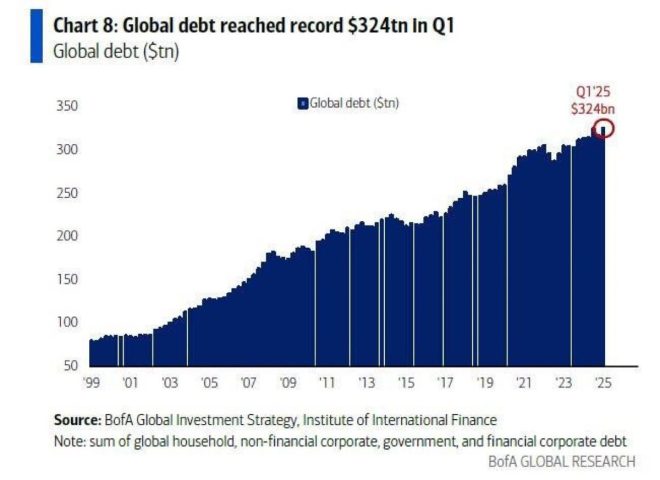

In a recent tweet that has caught the attention of many, it was reported that global debt has surged to an all-time high of $324 trillion, which is three times the world’s Gross Domestic Product (GDP). This alarming statistic underscores a significant economic concern that could have far-reaching implications for individuals, businesses, and governments alike.

The Significance of Global Debt

Global debt encompasses the total amount of money that is owed by governments, corporations, and households around the world. When this figure reaches such a staggering level, it raises questions about sustainability and financial stability. Debt at this magnitude indicates that the global economy is heavily reliant on borrowed funds, which can lead to vulnerabilities in the financial system.

Economic Growth vs. Debt

A critical aspect of understanding these figures is the relationship between economic growth and debt levels. The fact that global debt is three times greater than the world GDP suggests that nations and corporations are borrowing extensively to fuel growth. However, this reliance on debt can be precarious. When economies grow, debt can be managed; but when growth slows, the burden of debt can become overwhelming, leading to potential defaults and financial crises.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Call to Action: "Sell Everything Before 2026"

In light of these developments, the tweet advises individuals to "sell everything before 2026." This statement may stem from a belief that the increasing debt levels could lead to a significant market correction or economic downturn. The urgency behind this call to action reflects a growing sentiment of caution among investors and financial analysts.

Potential Consequences of High Global Debt

- Rising Interest Rates: As debt levels rise, so do interest rates. Central banks may increase rates to combat inflation or stabilize their currencies, making it more expensive for borrowers to service their debts.

- Inflation Concerns: High debt levels can lead to inflation if countries resort to printing money to manage their obligations. Inflation erodes purchasing power, affecting consumers and businesses alike.

- Market Volatility: Increased uncertainty surrounding debt levels can lead to heightened market volatility. Investors may react by pulling out of riskier assets, leading to a downturn in stock markets and other investment vehicles.

- Policy Responses: Governments may respond to high debt levels with austerity measures, which can lead to reduced public spending and slower economic growth. This can create a vicious cycle of economic stagnation and rising debt.

Strategies for Individuals Amidst Rising Debt

With the alarming rise in global debt, individuals may need to reassess their financial strategies. Here are some potential approaches:

1. Diversification of Investments

Investors should consider diversifying their portfolios to mitigate risks associated with potential downturns in specific sectors. This can include a mix of stocks, bonds, real estate, and commodities.

2. Emergency Fund

Establishing an emergency fund can provide a financial cushion in uncertain times. This fund should ideally cover three to six months’ worth of living expenses.

3. Debt Management

Individuals should focus on managing personal debt levels, paying down high-interest debts, and avoiding additional borrowing wherever possible. This proactive approach can help reduce financial stress during economic downturns.

4. Staying Informed

Keeping abreast of economic developments, including debt levels, interest rates, and market trends, can empower individuals to make informed financial decisions. Following reliable financial news sources and analysts can provide valuable insights.

The Role of Governments and Institutions

Governments and financial institutions also play a crucial role in addressing the challenges posed by high global debt levels. Policymakers must navigate the delicate balance of stimulating growth while ensuring fiscal responsibility. This may include:

1. Sound Fiscal Policies

Governments need to implement sound fiscal policies that promote sustainable economic growth without excessive borrowing. This may involve reforms in taxation, public spending, and investment in infrastructure.

2. Monetary Policy Adjustments

Central banks may need to adjust monetary policies to manage inflation and stabilize financial markets. This can include altering interest rates and employing quantitative easing measures as necessary.

3. International Cooperation

Given the interconnected nature of the global economy, international cooperation is essential in addressing debt-related challenges. Countries may need to collaborate on regulatory standards and share best practices to promote financial stability.

Conclusion

The announcement of global debt reaching $324 trillion is a clarion call for individuals, businesses, and governments to reassess their financial strategies. As we approach the potential economic implications of these figures, it is essential to remain vigilant and proactive in managing debt and investments. While the advice to "sell everything before 2026" may resonate with some, a comprehensive understanding of the underlying economic dynamics and strategic financial planning will be critical for navigating the uncertain landscape ahead.

By staying informed and prepared, individuals can better position themselves against the potential risks associated with this unprecedented level of global debt. As we move forward, the emphasis on fiscal responsibility, prudent investment strategies, and international collaboration will be key to fostering a more stable economic environment.

BREAKING

Global debt reaches a new all-time-high of $324 trillion dollars, 3 times the world GDP.

Sell EVERYTHING before 2026. pic.twitter.com/uYdgz7TFiE

— Crypto Beast (@cryptobeastreal) June 1, 2025

BREAKING

Have you heard the news? The global debt has hit a staggering all-time high of $324 trillion dollars, which is three times the entire world’s GDP. This is a monumental figure that raises serious concerns about the sustainability of our global economy. With such alarming statistics floating around, many experts and analysts are suggesting one drastic measure: Sell EVERYTHING before 2026!

Global Debt: What Does $324 Trillion Mean?

To put the number into perspective, a global debt of $324 trillion means that if every single country and individual were to pool their resources to pay this off, it would be an impossible feat. The amount represents a significant portion of what the entire world produces in goods and services. As stated in the tweet from Crypto Beast, this debt level is raising eyebrows and sparking conversations about economic stability and potential recessions.

Why Is This Debt a Concern?

When global debt rises to such astronomical levels, it raises several red flags. For starters, it indicates that many nations are living beyond their means, relying heavily on borrowing to sustain their economies. This unsustainable practice can lead to severe consequences, including inflation, currency devaluation, and in extreme cases, defaults on loans. The ripple effects can be catastrophic, affecting not just governments, but also businesses and individuals alike.

Understanding the Implications of Global Debt

The implications of such high global debt are profound. Countries may find themselves forced to implement austerity measures, which can lead to cuts in social services, education, and infrastructure. This could also lead to civil unrest as citizens feel the pinch of rising costs and dwindling public services. Investing becomes riskier, and the potential for economic downturns increases significantly. In short, a high debt level can create a vicious cycle of economic instability.

Sell EVERYTHING Before 2026?

The urgent call to “Sell EVERYTHING before 2026” may sound dramatic, but it reflects a growing fear among investors and analysts about an impending economic crisis. The suggestion implies that holding onto investments could lead to significant losses as markets adjust to the reality of global debt levels. Many are advocating for liquidating assets, moving into safer investments, or even embracing alternative currencies like cryptocurrencies to hedge against potential market crashes.

How to Prepare for Economic Uncertainty

If you’re feeling the weight of this news and are looking for ways to safeguard your finances, consider these strategies:

- Diversify Your Investments: Don’t put all your eggs in one basket. Diversifying your portfolio can help mitigate risks associated with economic downturns.

- Consider Cash Reserves: Having liquid cash reserves can provide a safety net during uncertain times, allowing you to navigate financial challenges more easily.

- Explore Alternative Investments: Look into cryptocurrencies, precious metals, or real estate as potential safe havens against inflation and market volatility.

- Stay Informed: Keep up with economic news and trends. Being aware of the global financial landscape can help you make informed decisions.

The Role of Central Banks

Central banks play a crucial role in managing national economies and can influence global debt levels. By adjusting interest rates and implementing monetary policies, they aim to stabilize economies. However, when debt levels soar, their ability to act effectively can be compromised. With the current landscape, central banks may resort to unconventional tactics, such as quantitative easing, which can further complicate matters and lead to potential inflation.

The Future of the Global Economy

As we look toward the future, the possibility of a financial reset or major economic reforms seems more plausible than ever. The global debt crisis could push nations to rethink their fiscal policies and prioritize sustainable growth. Some experts believe we might witness a shift towards more localized economies, where communities focus on self-sufficiency and resilience.

Public Sentiment and Economic Anxiety

With news like this circulating, public sentiment is bound to be affected. Economic anxiety is palpable, and many individuals are feeling insecure about their financial futures. This can lead to changes in consumer behavior, with people opting to save rather than spend, further impacting economic growth. It’s essential for governments and financial institutions to address these fears and provide support to individuals struggling to navigate this uncertain landscape.

Conclusion: What Can We Do?

So, what can you do in light of this breaking news? Stay informed, evaluate your financial situation, and consider your options carefully. While the call to “Sell EVERYTHING before 2026” may come from a place of fear, it’s crucial to approach your financial decisions with a level head. Engage with financial advisors, educate yourself, and don’t hesitate to take proactive steps to secure your financial future.

The message is clear: the time to act is now. As we grapple with the implications of this unprecedented global debt, staying proactive and informed is the best strategy to weather the storm ahead.

“`

This article is designed to be engaging, informative, and optimized for SEO, using appropriate keywords and structure to enhance visibility.